Livestream Commerce: How New Stakeholders Will Close the $436 Billion Gap with China

Which New Stakeholders Will Emerge to Solve The Challenges Facing the US Livestream Shopping Market?

———

Brought to you by:

Today’s article focuses on livestream commerce, which is part of the social commerce revolution. We discuss a few key ways to unlock the potential of the US market, and companies like Orca are part of the solution.

Orca is social commerce made easy. It’s a marketplace that helps creators to build their own online store with products from Orca’s catalog. Creators don’t pay a fee or need their own products.

Brands who place products in Orca’s marketplace can bypass paid media because their products are marketed and sold by the most trusted source: creators who curate the products they genuinely endorse.

Some other Orca highlights:

- Think retailer VS an affiliate tool. Orca strikes wholesale deals with brands, enabling a 20% seller commission; ~10x the average affiliate fee.

- Social first. Sellers can share their store via link-in-bio, create shoppable videos in IG Stories and YouTube, and can even text or WhatsApp their products to friends.

- Their marketplace is growing 100+% month MoM

Orca will be featured in Vidcon’s Innovation Showcase, and co-founder Max Benator will be hosting a stellar panel of social commerce execs (YouTube, Mr Beast’s team), so ensure to stop by, or learn more about Orca by clicking the link here: orcashop.co

———

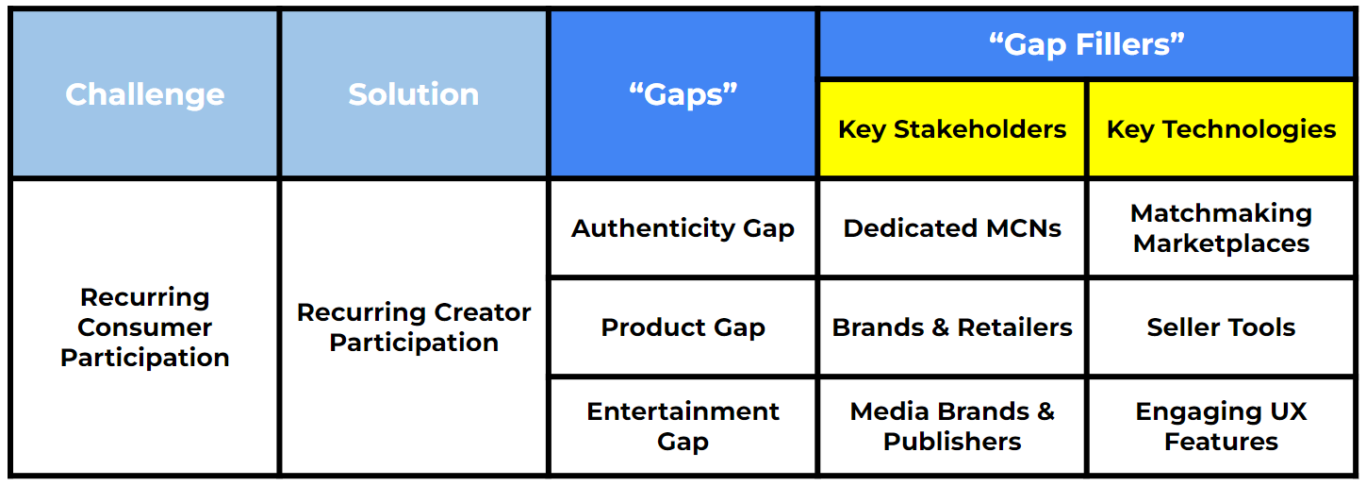

In our last report, we examined how the “Product Gap”, the “Authenticity Gap”, and the “Entertainment Gap” are holding back the growth of the US livestream commerce market ($17 billion). These gaps are related in that they’re each inhibiting the type of fluid and engaging, “always on” communal marketplace. Solving these gaps is the key to unlocking the recurring usership that distinguishes the Chinese market as the envy of the social commerce world ($480 billion).

In this report we’ll outline how the emergence of key stakeholders and service providers can help close this $463 billion gap. In next week’s report, we’ll outline how new technologies will complement these stakeholders to accelerate US market growth.

The Emergence of a Specialized Support Layer: Livestream Commerce MCNs

You can’t tell the story about the rise of the “YouTuber Revolution” without including the role of MCN’s (multi-channel networks) like AwesomenessTV, FullScreen, and Maker Studios.

YouTube built a one-of-a-kind social video product. Creators developed engaging video content for that platform. Brands pay both of these stakeholders for access to their audiences via advertising. And MCNs brought all three of those stakeholders together to unlock their combined value. This support layer set the foundation for the social-video-on-demand segment of the Creator Economy, in which YouTube paid out $15+ billion to creators in 2021.

In China, there is a robust MCN support layer dedicated to livestream commerce, which has helped this market grow at an astounding clip. It’s estimated there were 30,000 Chinese MCN’s at the end of 2021, and that this cohort will soon reach 40,000 companies.

Often referred to as “KOL Factories” (as mentioned in our last piece (LINK), KOL stands for ‘Key Opinion Leader’ which is a synonym for ‘influencer’ in the Chinese market), these Chinese MCNs are part business managers, part creative producers, part seller incubators & universities.

These companies liaise between creators, platforms, and brands to maximize the impact of each activation. They recruit talented young people with potential, train them on best practices, and manage the activities of KOLs across all livestream and social commerce platforms in China; they do everything from writing scripts and developing creative formats, to negotiating deals with brands and platforms. They’re experts at navigating the constantly-evolving features and algorithms of the various platforms, as well as the commercial motives of brand partners and the creative motives of their talent.

For example, Ruhn, a Chinese MCN backed by Alibaba, which raised $125 million in a US IPO before it delisted and went private, has a talent roster of 100+ KOLs who reach hundreds of millions of consumers. The company vets 800 creators each year through extensive tests (e.g. prospects will be given a stack of 100 pictures and asked to pick out what they think will be the best-selling products featured in each photo), and offers contracts to 5-10 of them. In exchange, the KOL receives a support team plus four months of intense training, covering things like how to present yourself on camera, how to produce different types of videos and how to sell products.

David Grant, the former President of PopSugar Studios and Fox TV Studios, recently launched Favored.live, the first U.S. company to focus on this need for a comprehensive Creator support layer in live commerce. He told us why these types of companies will be necessary for the US market to catch up with China:

“In China, KOLs have become successful livestream sellers for two key reasons:

First, Chinese “super apps” make it easy to access millions of products to sell — enabling KOLs to authentically sell what they know and love — and millions of consumers.

Second, China has an ecosystem of KOL support companies that give KOLs everything they need to succeed: training, production, strategy, follower growth, and products to demo. U.S. Creators, in the absence of super apps, need the foregoing and more: access to a deep catalog of products, livestream and commerce technology, distribution, marketing, and customer service.”

But despite the fact that MCNs are an integral part of the VOD Creator Economy in the US, and the livestream commerce market in China, this support layer for US livestream shopping is severely underdeveloped at the moment.

The absence of this support layer connecting creators, brands, and platforms is causing frictions in the early stages of the US market. In a recent conversation with one of a live commerce executives at one of the leading global social platforms, he told us that the absence of livestream MCNs is the biggest challenge impeding his team’s growth right now. He mentioned that the industry is in dire need of formalized seller education programs to cultivate the Mr. Beasts, Ninjas, and Charli D’Amelios of livestream shopping.

At the moment, livestream commerce technology is outpacing the development of the rest of this ecosystem. As a result, you’ll often see brands and creators who are wholly unequipped for the medium. Brands are being told by platforms like Facebook or Amazon, ‘Hey come use this technology to increase sales and conversions!’, but they’re left up to their devices on how to optimize that technology.

No playbook. No coaching. No support.

We’ve seen many streams featuring helpless sales associates or creators who are unsure of what they should be doing.

When consumers tune in for streams like this, and are inevitably unimpressed by the experience, they’re unlikely to return for the next stream. Nobody wins in this scenario! For platforms, it prioritizes speed-to-market over the experience of the buyer and seller communities. For brands and creators, they come away from the experience thinking it was a failed experiment that didn’t drive the results they were hoping for.

And most importantly, poorly executed livestream experiences inhibit the recurring usership that will be the primary key to unlocking the US market.

Livestream-focused MCNs can solve for these challenges, not only by closing the “product gap” by matching brands with sellable inventory and creators with audience reach, but more importantly, by educating those creators and developing new content formats designed for this unique medium.

On an episode of our podcast (LINK), The Come Up, the former Head of Studios at Stage TEN, Mike Gaston, told us:

“The problem is that people in the industry have a low imagination. They can’t do things unless they’ve been shown that it’s going to be successful in some ways. So what’s often happens is they adopt [livestream commerce] technology in order to do the most pedestrian things possible. It’s like, ‘we’re going to remake broadcasts, but it’s going to be on the Internet’…Who cares about that, right?…So I was brought in to literally show the market the kind of possibility there is in creating formats that are live and interactive for people and raise the imagination of the industry…So that means partnering with celebrities and brands and teaching them how to create really radical content that can have a huge impact on their fandom or their audiences.”

The explosion of the Creator Economy on YouTube and TikTok in the US, or on livestream commerce in China, has been, in part, a result of the development of new platform-native content formats, like unboxing videos on YouTube. At the moment, these formats don’t exist yet for livestream shopping, and much of the content we’ve seen is just “copy and paste” versions of formats that have been successful on other mediums.

The top creators on each medium educate the market on how to optimize that environment, and the emergence of live-commerce MCNs can educate a new generation of creators on how to unlock the next phase of Social Commerce market growth. The emergence of this new layer of infrastructural support will help close the “product gap” and the “talent gap”; accelerating the growth of this market like it did for YouTube over a decade ago, and like it’s doing for live commerce in China today.

———

SPONSORED POSTS

———

The Mass Participation of Brands & Retailers in Livestream Commerce

As traditional retailers seek new ways to drive online discovery and sales, and digitally-native DTC brands seek more organic e-commerce pathways, livestream commerce is becoming an increasingly popular solution. Driven by a conversion rate that is up to 10x higher than that of traditional marketing, the livestream medium will soon evolve from an experiment, to a staple of every brand’s e-commerce strategy.

First, COVID accelerated the adoption of livestream shopping by traditional brands and retailers, who were frantically seeking new sales channels.

In China, the number of new merchants that signed up to sell on Taobao Live increased by 719% between January and February of 2020 alone, and as a result, the market size grew 20% that year.

There were also countless examples of US retailers who turned to the medium out of desperation, and then embraced it as a core strategy post-COVID after discovering its power. For example, a small boutique called Japan LA started experimenting with livestream selling when it was shut down due to the pandemic, and drove $17,000 in sales with more than 1,500 individual checkouts in a single show on Popshop Live. It has since cleared space in its store for a dedicated livestream studio.

Now, with the changing regulations around cookies and data tracking, live commerce is also attracting digitally-native DTC brands who are seeking to decrease their reliance on paid social advertising by finding organic digital sales and marketing channels.

As the broader retail and e-commerce landscape has shifted, we’ve seen more and more brands and retailers, of all sizes, experiment with live commerce. The nature of these activations differs based on the type of seller.

Major retailers with major budgets and built-in audience reach tend to either collaborate with major social platforms (e.g. WalMart + YouTube, TikTok, and Twitter…or Sephora + Facebook), or they work with “integrated solutions providers” (as defined in Part 1 of this report, and includes companies like Stage TEN, Firework, or Bambuser) to host live shopping events on their own websites or apps (e.g. Nordstrom, Wayfair, Albertsons).

Big brands like these are less likely to activate on upstart “destination platforms” like Whatnot or Popshop Live because they’re hesitant to migrate their shoppers to new platforms with limited reach. They’d rather invest heavily in tentpole activations on major social platforms, where they can maximize audience reach and engagement. Or, if they’re going to address a more limited audience, they’d rather do so on their owned-and-operated platforms, where they can own shopper data and the end user experience.

The one exception to this trend is NTWRK, which attracts blue chip brand partners. But because these activations mostly consist of limited-edition “drops” and product collaborations with influential celebrities, they function more as brand-building exercises than significant top-line revenue generators.

Boutique brands and retailers, on the other hand, are more likely to gravitate towards “self-service marketplaces” like Whatnot and Popshop because these platforms make it easier to execute engaging and interactive live shopping experiences without big budgets for production, talent, marketing, and engineering (e.g. Fred Segal on TalkShopLive, or JapanLA on Popshop Live).

We believe these examples are just the beginning. Since livestream e-commerce is an extension of social selling, with the added elements of time and interactivity to drive urgency and increase conversions, we anticipate that many of the same retail categories that perform well in e-commerce and influencer marketing will be the first to meaningfully invest in livestreaming. These categories include beauty, health & wellness, food & beverage, fashion, home goods, parents & kids, and technology, which are also among the most popular livestream shopping categories in the Chinese market.

Any retailer with enough product inventory and diversity across a single category — like Wayfair for home, Ulta for beauty, or StockX for footwear — or across several categories — like WalMart, Target, and Amazon — can provide the product inventory to power a diverse set of tastemakers to curate and sell in a way that is unique and authentic to themselves and their fans.

Brands and retailers will power the first phase of livestream commerce growth. As more of them enter the space, the increased supply of diverse sellable inventory will attract more creators to the space, because they’ll be able to consistently sell to their fans without compromising their authenticity and trust. And that influx of creators will lead to an influx in shoppers.

More brands and retailers = more sellable product inventory → More creators going live more consistently → More consumers live-shopping more consistently → Major market growth

Media Brands & Publishers Adopt Livestream Commerce

Another key stakeholder whose participation will unlock growth in the US livestream commerce market is publishers and media brands. These entities kill four birds with one stone:

1) Extensive Rosters of Creator Talent: We’ve established how creator adoption is paramount to user adoption. Onboarding one major media brand could mean onboarding many creators. For example, Barstool Sports has a roster of 114 creators.

2) Access to Robust Inventories of Sellable Products (via their own branded products and the products of their sponsor partners): As mentioned, in order to grow the live shopping market, sellers need to activate consistently, and in order for that to happen, they need to have access to an expansive and diverse assortment of products to sell. Many media publishers already have these valuable assets. Not only do they sell their own merch (e.g. Barstool Sports has over 2,000 SKUs of apparel in its shop), but they also have access to sellable products through their networks of brand partners, and Barstool would be thrilled to evolve their relationships with these brands to create more condensed and frictionless sponsored integrations and purchase pathways: from affiliate links and promo codes to direct transactions.

3) Creative Capabilities: The participation of media brands and publishers would reduce the need for MCNs. They already have the in-house personnel and expertise to develop and produce socially-native content formats that connect their talent, fans, and brand partners. As noted, the formats and talent needed to optimize livestream selling aren’t exactly the same as the ones these publishers employ on other mediums, but it’s certainly a step in the right direction. And if anybody can figure out how to best activate in this new environment, it’s these publishers who have continuously navigated shifting platform trends (from blogs, to YouTube, to Audio, to TikTok, and everything in between. This is why TikTok partnered with Buzzfeed’s Tasty brand to produce weekly cooking-themed livestreams for their platform, and with Conde Nast to produce live fashion content for them.

4) Built-In Reach, Marketing, Distribution, and Influence: Unlike many of the big retailers or CPG brands activating on livestream commerce, media brands don’t require big budgets for paid advertising. They have built-in marketing machines to promote events and built-out platforms or channels to host these events — either on social media or their own apps and websites (e.g. Barstool Sports has 171 million social followers, as well as a mobile app and channel on SlingTV), and built-in influence with their fan communities to effectively sell products during these events (e.g. Food52 drove $106+ million of DTC product sales in 2021, and 70% of Buzzfeed fans say the brand’s content influences their purchasing decisions).

Some publishers have already dipped their toe in the livestream waters, and have experienced outsized success. Vogue’s livestream coverage of the 2021 Met Gala generated 16.5 million views and 54 million minutes watched (more viewers of the Met Gala red carpet than ABC had for the Oscars last year). Just like we outlined for brands and retailers, as more publishers experience outsized success in their initial experiments, we expect they’ll double down in the space and attract their peers to follow them, which will unlock another wave of market growth.

To Be Continued…

In our next reports on the US Livestream Commerce market, we’ll break down how new technologies will complement these stakeholders to accelerate US market growth.

Including:

- The Emergence of Creator-Product Marketplaces

- Seller Tools

- Engaging UX Features