Why Sticky Habits Will Unlock Billion $$ Potential of US Live Shopping Market

** Your company name and info here! — This month we’re rolling out sponsorships for our blog posts and newsletters. Email hello@wearerockwater.com if you want to reach the most influential execs within the nextgen consumer and creator economies. **

—

Establishing Recurring User Habits is the Key to Catching up with China’s Live Commerce Market

As we outlined in Part 1 of this report, one of the biggest differences between the $17 billion dollar livestream shopping market in the US, and the $480 billion Chinese market, is recurring user habit.

This recurring user behavior is a direct byproduct of recurring creator behaviors. Chinese “Key Opinion Leaders” frequent the medium, so their fans do too.

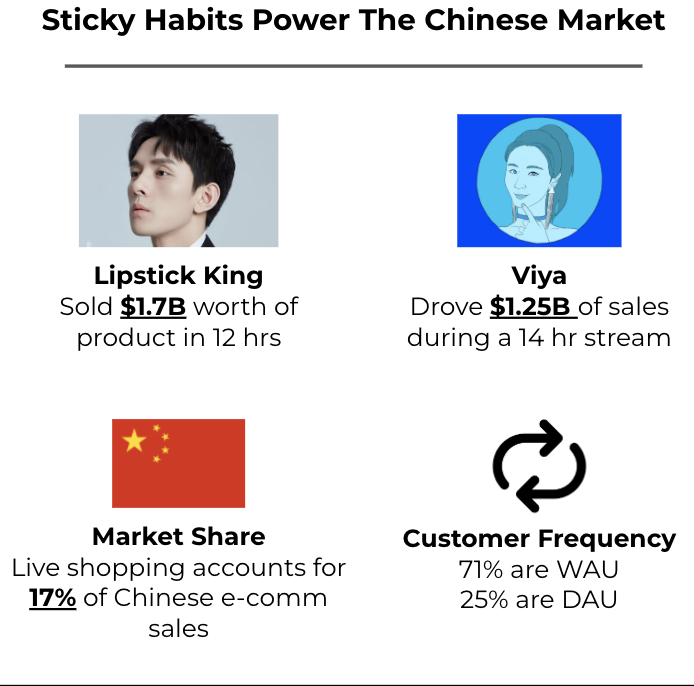

On average, the top-grossing streamers in China go live more than 300 times per year, averaging 8 hours per stream, featuring different items on sale each stream. As a result, 25% of Chinese live shopping consumers are daily active users, while 71% watch a live commerce event at least once per week.

Even in the US, the hands-down leader in shoppable entertainment, Quarte Retail Group (owner of QVC and HSN), has built its empire on the power of sticky user habits. Not only did the company drive $1.4 billion in 2021 revenues (far more than any US livestream shopping platform), but 93% of those sales came from repeat customers. In fact, existing QVC customers make 26 purchases per year, totalling $1,335 spent per year per customer.

But the US live shopping market has not yet succeeded in shaping sticky consumption patterns. So how can the US market shift this consumption behavior? We believe it comes down to closing a few key gaps, through the emergence of key stakeholders and technologies.

Closing the “Authenticity Gap” by Solving the “Product Gap”

In the US, top creators only participate in livestream commerce for infrequent tentpole events. So as a result, most consumers do the same.

We believe this dynamic is a reflection of the current “authenticity gap” in the US livestream shopping market.

Last year, our RockWater team surveyed about 10 prominent digital talent managers, who collectively represent hundreds of clients that influence hundreds of millions of fans, to learn about their initial experiences with livestream selling in the US. And to our surprise, only one manager we spoke with had ever had a client participate in livestream selling. And even then, it was only one client in one campaign.

Given the velocity at which the US livestream market has been moving, and the astronomical revenue figures we’re seeing from Chinese K.O.L’s, we were surprised to hear that livestream selling is barely on the radar of most major US creators, despite the fact that all of the major social and commerce platforms have been developing products and features to make it easy for them to do so.

So, we asked why.

One answer that we heard repeatedly really stuck out: many US creators view livestream selling as an overly commercial venture that will alienate their core fans through its perceived inauthenticity.

One manager told us:

“My clients don’t just want to be a walking, talking billboard…You can only ask your fans to do so many things. Pushing too many things especially when you’re doing a ton of brand deals is not a good long term look.”

We don’t disagree with this sentiment. It’s smart for creators to be cautious with how they balance fan delight and fan monetization. Far too many have sacrificed sustainable long-term growth by pursuing short-term checks that erode the foundation of audience trust that their value is built upon. The problem is that livestream selling is currently framed as choosing direct-to-consumer revenues over fan delight.

But at its best, it’s an opportunity to do both.

So where’s the disconnect? How do we bridge the gap between the indirect influence of social marketing and the direct salesmanship of livestream commerce? Why is influencer marketing ($16.4 billion market size) accepted as organic and livestream shopping is deemed distasteful?

We believe it’s due to a lack of access to sellable product inventory. In other words, the “authenticity gap” is a direct byproduct of the “product gap” in the US livestream shopping ecosystem.

A closer look at the Chinese market highlights this chasm:

Chinese viewers tune in regularly because their favorite K.O.L’s always have cool new products to offer that they authentically endorse. And, Chinese creators are able to stream every night without having to worry about being inauthentic because they have access to enough product inventory to enable them to service and delight their fans by consistently offering discounted access to the products that they genuinely love and personally endorse. Top Chinese K.O.Ls feature about 80 different products over the span of a four hour stream.

This volume of recurring authenticity is possible because brands and retailers are fully invested in the Chinese livestream shopping economy, and have become a vital part of its infrastructure. Over 100,000 brands and retailers participate in the Chinese livestream shopping market. And on “Singles Day” 2021 (Alibaba’s version of “Prime Day”), which generated approximately $34 billion in total livestream sales, over 1,000 brands participated.

By contrast, in the US livestream shopping market, many creators, including those with millions of fans, often don’t have products to sell besides their own merch or products from a brand sponsor. That may be enough to host a few successful livestreams. But in order for a creator to go live on a recurring basis, they need a recurring stream of products that they can authentically and enthusiastically endorse.

But why are US creators so limited in the products they can sell? We’ve consistently heard from talent and their management that even if they were interested in pursuing more direct commerce initiatives — between product sourcing, development, and deal rights management — procuring a wide array of products that fit their brand and audience is a logistical nightmare.

One talent manager told us:

There are “a lot of logistics to get products listed [for sale via social commerce]”, and another told us that their clients prioritize brand deals over direct-to-consumer sales because “product development requires large upfront investment”, even for just a licensing partnership (i.e. time it takes to advise on product and packaging design, pricing, etc).

So despite their ability to influence purchasing, and the high-profile celebrity-led product launches that circulate our LinkedIn feeds, most US creators rarely sell products directly to their fans. Their DTC commerce footprint is usually limited to a few SKUs of branded merch. Therefore, many established US creators are reluctant to pursue livestream selling because they believe that continuously pushing the same few products will alienate their fans and dilute the sense of authenticity and trust that their influence is built upon.

But by only participating in livestream selling when they have a new brand sponsorship or merch line launch, US creators are failing to cultivate the user habits that will drive the US livestream market to scale. On the other hand, most of the US participants in livestream shopping who have a diverse and robust product inventory, which are mostly small boutiques, don’t have the audience influence and reach necessary to fulfill the potential of livestream shopping.

This chasm isn’t just limited to livestream shopping. It permeates social commerce as a whole. The US currently generates only 6.9% of global social commerce revenues.

The US livestream / social commerce market must bridge this gap in order to drive outsized livestream revenues through active and recurring engagement at scale.

The “Entertainment Gap”: Lack of Skilled Livestream Sellers and Engaging Content Experiences

Widespread creator adoption of livestream commerce will undoubtedly lead to widespread consumer adoption. And even before they’re able to generate mainstream consumer adoption, creators will be a valuable tool in generating mainstream consumer awareness of the medium. Despite the fact that live commerce is top-of-mind for social commerce executives around the world, it has yet to penetrate the consumer consciousness.

Rory Cutaia, Founder and CEO of Verb Technologies, which has launched the new live shopping platform MARKET, told us how important consumer awareness is in this formative stage of the US market:

“I believe the key to unlocking the potential of livestream shopping in the US is, in a word, awareness. The value proposition for both sellers and shoppers is inherently so compelling, that greater awareness among both sellers and shoppers is inevitable.”

In order to drive early-stage consumer awareness and adoption, many platforms are paying top creators 6-7 figure checks to host a single 30-60 minute stream.

However, despite the inarguable need for greater consumer awareness, and despite our thesis above in Part 1A — that creators building livestream selling habits will lead to consumers building livestream shopping habits — it’s a common misconception that the biggest creators will be the most valuable livestream sellers.

Live video content requires a different skill set than on-demand video creation (think: Ninja vs. Mr. Beast). And influencer marketing requires a different skill set than direct salesmanship (think: Addison Rae vs. QVC hosts). Effective livestream selling requires direct salesmanship in a live video environment — a skill set completely distinct from the talents required of today’s creator communities across TikTok, YouTube, and Instagram.

Many micro-influencers with small yet fervent followings in niche categories — and even some engaging brick-and-mortar retail salespeople with an intimate knowledge of their products and customers — can outsell many mega-influencers (both in terms of in conversion rates, and sometimes even in aggregate sales).

NTWRK’s CEO, Aaron Levant, elaborated on this dynamic when he spoke to RockWater’s founder on our podcast, The Come Up:

“Sometimes these people that are so big actually don’t move culture in a way that you think they do. They’re propped up stars for consumption and click-bait but they’re not really able to have a meaningful consumer products business…Some celebrities do these things and it’s like an obligation. They go, ‘I got to show up and do this thing and sell this book.’ They pretend like they’re enthusiastic but really they’re not. They do the bare minimum. They’re like, ‘oh, I’m obligated to do one social post, I’m going to do just that and then I’m going to take it down.’ [But the best-fit creator / sales partners] are going to fight to make their things work…They’re enthusiastic and they’re going to go above and beyond tenfold.”

In a recent conversation with a commerce executive at one of the top social platforms, we heard a similar sentiment:

“A local mom and pop store can easily drive more GMV than a blue chip influencer with a $2 million production budget”.

This checks out with what we’ve seen from best-in-class market benchmarks. In 2021, QVC drove $1.4 billion in revenues through its roster of 24 professional hosts — not social influencers. In China, top K.O.L’s like Lipstick King (who sold $1.7 billion worth of product over 12 hours during the last shopping holiday) and Viya ($1.25 billion in 14 hours), are trained to drive direct sales in a livestream environment.

Yet, many platforms are pouring millions of dollars into slick productions with A-list creators, who command six-figure minimum guarantees, in an attempt to drive awareness and adoption.

This premise is flawed for two reasons:

1) As mentioned above, they typically drive less GMV than their fee is worth. Which would be a worthwhile investment if these activations drove long-tail recurring usership. But alas…

2) These events don’t drive sticky user behavior. The creator shows up, cashes their check, and doesn’t return to the medium until the next lucrative minimum guarantee comes their way. As a result, their fans churn just as quickly. So the ROI of pursuing this big-ticket strategy is an unsustainable CAC-LTV ratio.

We’re seeing a similar trend play out in the “Streaming Wars”, where exorbitant investments in big budget vehicles for movie stars has resulted in a never-ending race to the bottom with no clear end in sight.

The flaws of this model reveal a greater challenge facing the whole industry at this moment: A-list influencers reach massive audiences but don’t drive sales or sticky user behavior. Talented live sellers that drive sales and recurring usership don’t attract broad enough audiences to move the needle.

The “Product Gap” and the “Talent Gap” are related in that they’re both inhibiting the type of fluid and engaging, “always on” communal marketplace that it takes to unlock the recurring usership that distinguishes the Chinese market as the envy of the social commerce world.