2021 Predictions: How to Close the $150 Billion Livestream Commerce Gap Between US-China

PREDICTION: In 2021 (and 2022), brands, retailers, and “matchmaking marketplaces” will enter livestream e-commerce, which will help close “the product gap”, and in turn the “authenticity gap”. This will lead creators and fans to begin developing frequent livestreaming habits.

WHAT’s Happening?

There’s currently an “authenticity gap” in the US livestream shopping market, which is preventing creators, and thus consumers, from adopting the medium.

In 2020 it’s estimated that the Chinese livestream shopping market generated nearly $170 billion in revenue (above original forecasts of $129 billion). And despite the fact that the US market is estimated to be less than 5% of that, over the past year, we’ve seen significant investment in this space by US players — both upstarts and incumbents — seeking to replicate the success of China’s livestream shopping market.

So our RockWater team recently surveyed about 10 prominent digital talent managers, who collectively represent hundreds of clients that influence hundreds of millions of fans, to learn about their initial experiences with livestream selling in the US. And to our surprise, only one manager we spoke to had ever had a client participate in livestream selling. And even then, it was only one client in one campaign.

Although the current sales volume in US livestream shopping is low, investor interest is high. In the past two weeks alone, Talkshoplive, NEWNESS, and Maestro raised a combined $21.5 million in early-stage funding. Given the velocity at which the US livestream market has been moving, and the astronomical revenue figures we’re seeing from Chinese K.O.L’s (“key opinion leaders”, the Chinese equivalent of an “influencer”), we were surprised to hear that livestream selling is barely on the radar of most major US creators, despite the fact that all of the major social and commerce platforms have been developing products and features to make it easy for them to do so.

So we asked why.

We received many different answers. All of them complex and nuanced. Too much to properly capture in one article (our full reports are exclusive to our advisory clients). But one answer that we heard a lot, and which really stuck out to us, is that many US creators view livestream selling as an overly commercial venture that will alienate their core fans through its perceived inauthenticity.

One manager told us:

“My clients don’t just want to be a walking, talking billboard…You can only ask your fans to do so many things. Pushing too many things especially when you’re doing a ton of brand deals is not a good long term look.”

And despite the fact that we’re evangelists for US livestream shopping, we don’t entirely disagree. It’s smart for creators — influencers, celebrities, brands, and publishers — to be cautious with how they balance fan delight and fan monetization. Far too many have sacrificed sustainable long-term growth by pursuing short-term checks that erode the foundation of audience trust that their value is built upon. Livestream selling is currently framed as choosing direct-to-consumer revenues over fan delight. But at its best, it’s an opportunity to do both.

Digital creators are already massively influencing purchasing decisions among US consumers. The US influencer marketing industry has grown 50% YoY since 2016, and it’s currently valued at approximately $10 billion. And 44% of Gen-Z purchase decisions in the US are based on recommendations from a social influencer.

So where’s the disconnect? How do we bridge the gap between the indirect influence of social marketing and the direct salesmanship of livestream commerce? Why is one accepted as organic and the other as distasteful?

We believe it’s due to a lack of access to sellable product inventory. In other words, the “authenticity gap” is a direct byproduct of the “product gap” in the US livestream shopping ecosystem.

WHY is there an “authenticity gap”? Because of the “product gap”; Creators don’t have enough products to create genuine livestream selling content on a frequent basis.

On average, the top-grossing streamers in China go live more than 300 times per year, averaging 8 hours per stream, featuring different items on sale each stream. As a result, 25% of Chinese live shopping consumers are daily users, while 71% watch a live commerce event at least once per week. This recurring active engagement is one of the major differences that explains why China’s total live commerce revenues are so much bigger than those of the US.

Chinese viewers tune in regularly because their favorite K.O.L’s always have cool new products to offer that they authentically endorse. Chinese creators are able to stream every night without having to worry about being inauthentic because they have access to enough product inventory to enable them to service and delight their fans by consistently offering discounted access to the products that they genuinely love and personally endorse. This is because brands and retailers are fully invested in the Chinese livestream shopping economy, and have become a vital part of its infrastructure. Over 100,000 brands and retailers participate in the Chinese livestream shopping market. And “Singles Day”, Alibaba’s version of “Prime Day”, generated $75 billion in total livestream sales, and over 1,000 brands participated.

By contrast, in the US livestream shopping market, many creators, including those with millions of fans, often don’t have products to sell besides their own merch or products from a brand sponsor. That may be enough to host a few successful livestreams. But in order for a creator to go live on a recurring basis, they need a recurring stream of products that they can authentically and enthusiastically endorse.

But why are US creators so limited in the products they can sell? We’ve consistently heard from talent and their management that even if they were interested in pursuing more direct commerce initiatives — between product sourcing, development, and deal rights management — procuring a wide array of products that fit their brand and audience is a logistical nightmare.

One talent manager told us there are “a lot of logistics to get products listed [for sale via social commerce]”, and another told us that their clients prioritize brand deals over direct-to-consumer sales because “product development requires large upfront investment”, even for just a licensing partnership (i.e. time it takes to advise on product and packaging design, pricing, etc).

So despite their ability to influence purchasing, and the high-profile celebrity-led product launches that circulate our LinkedIn feeds, most US creators rarely sell products directly to their fans. Their DTC commerce footprint is usually limited to a few SKUs of branded merch. Therefore, many established US creators are reluctant to pursue livestream selling because they believe that continuously pushing the same few products will alienate their fans and dilute the sense of authenticity and trust that their influence is built upon.

But by only participating in livestream selling when they have a new brand sponsorship or merch line launch, US creators are failing to cultivate the user habits that will drive the US livestream market to scale. On the other hand, most of the US participants in livestream shopping who have a diverse and robust product inventory, which are mostly small boutiques like Fred Segal on TalkShop Live, or JapanLA on Popshop Live, don’t have the audience influence and reach, nor the engaging on-camera charisma, necessary to fulfill the potential of livestream shopping.

The US livestream market must bridge this gap in order to drive outsized livestream revenues through active and recurring engagement at scale.

Creators can use the live medium to engage and entertain fans in a personal and interactive format, while also sharing the products they love most. Performing the role of a cool best friend with deep product passion and expertise. That level of authenticity and trust is what powers the livestream shopping experience in China, and the influencer marketing economy in the US.

However, until there is enough product accessibility to enable creators to host consistent streams featuring new products that they actually love, creators will not adopt the medium and neither will their fans.

But we believe this dynamic will begin to change in 2021, when the “product gap” will start to narrow.

HOW to bridge the product gap in the US? Retail adoption and product-creator marketplaces

1. More brands and retailers will turn to livestream e-commerce as a new sales channel, which will increase the volume of sellable product inventory available to creators

In 2020, US brick-and-mortar retail sales declined by 10.5%. Meanwhile, e-commerce revenues grew by 44%.

Therefore, many traditional retailers are having to rapidly redefine their sales and marketing strategies. Google’s paid ad revenues in Q4 2020 increased by 22% YoY, an indication of significantly higher brand marketing spend on Google’s ad network , and in 2021 overall social media ad spends are projected to grow 21%.

As traditional retailers seek new ways to drive online discovery and sales, we believe livestream e-commerce will become an increasingly popular solution, driven by a conversion rate that is 10x higher than that of traditional marketing. In China, the number of new merchants that signed up to sell on Taobao Live increased by 719% between January and February of 2020 alone.

This COVID-induced adoption of livestream selling has begun happening in the US too, albeit at a much smaller scale. For example, a small boutique called Japan LA started experimenting with livestream selling when it was shut down due to the pandemic, and drove $17,000 in sales with more than 1,500 individual checkouts in a single show on Popshop Live.

Although retail adoption of livestream selling in the US accelerated in 2020, it’s still incredibly nascent. Viewed by most, for now, as a niche experiment.

According to a consumer survey we conducted in February 2020, 78% of US consumers have never heard of livestream shopping, and 92% have never participated in it. But we believe that 2021 will be a key tipping point, where a critical mass of smaller scale, ambitious sellers will begin investing in the livestream medium to create a new sales channel. The early seller entrants into this space will be savvy, digitally-native DTC brands, as well as brick & mortar boutiques looking to offset declines from diminishing foot traffic, and their mass-market counterparts will follow by late 2022 / early 2023.

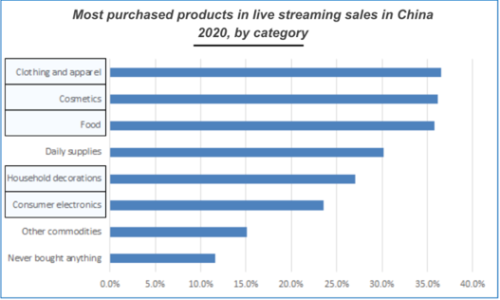

Because livestream e-commerce is an extension of social selling, with the added elements of time and interactivity to drive urgency and increase conversions, we anticipate that many of the same retail categories that perform well in e-commerce and influencer marketing will be the first to meaningfully invest in livestreaming. These retail categories include beauty, health & wellness, food & beverage, fashion, home goods, parents & kids, and technology, which were among the most popular livestream shopping categories in China in 2020 (see chart below).

(Statista, 2021)

Any retailer with enough product inventory and diversity across a single category — like Wayfair for home, Ulta for beauty, or StockX for footwear — can provide the product inventory to power a diverse set of tastemakers to curate and sell in a way that is unique and authentic to themselves and their fans. In December 2020, Walmart collaborated with TikTok and many of the platform’s top influencers to pilot livestream shopping experiences where creators shared their favorite items available at Walmart in an interactive, shoppable format. We believe this is just the beginning. More brands and retailers will enter the space. This will attract creators, and audiences will follow.

2. Marketplaces will emerge to connect creators with products

The influx of product inventory into the livestream shopping space will be a meaningful step in the evolution of the US livestream shopping market. But that alone will not fully close the “product gap”. Nor will it be enough to address the looming “authenticity gap”.

Even when there is enough product volume and diversity to power frequent and consistent habits, one major challenge will still remain:

How will best-fit creators and products find each other?

Let’s look to China again for inspiration.

While China’s top K.O.L’s like Viya and “The Lipstick King” have large teams around them sourcing hundreds of inbound offers from brands and retailers, they are the exception. According to our Chinese market research partners, China has many more K.O.L’s than America does influencers, and although the vast majority of these K.O.L.’s don’t have the resources or the on-platform promotion of their top 1%, many of these “long tail” K.O.L’s are able to make a living as livestream sellers by going live every night and selling the products that excite them and their followers.

This is made possible, not just because there are 100,000+ brands and retailers pumping product into the ecosystem, but also because Chinese livestream commerce platforms make it easy for K.O.L’s to access these products. When a K.O.L logs onto TaoBao Live, Pinduoduo, T-Mall, or Red to plan an upcoming livestream, they can easily search through all of the product inventory that has been uploaded to the platform by brands and retailers, and select products to feature based on what feels authentic to them.

A rudimentary version of this functionality exists on Amazon Live, but nowhere else in the US. But on Instagram, even as more and more brands and retailers upload their inventories to the platform’s shopping portal, the products are still siloed from the personalities who can most effectively sell them. Brands and retailers still need to do all of the heavy lifting to create content or find the right content creators to actually drive traffic to their Instagram storefront. And the perfect creator to move the products already available on a brand’s Instagram shopping portal may be engaging a dedicated community every day on the platform, but failing to monetize their influence without any products to sell.

However, we believe this will change in the coming years. We believe that influencer and brand marketplaces, much like the vision for YouTube’s FameBit (though the reality seems to be a more manual matchmaking process), will emerge to connect best-fit products and sellers. As more brands and retailers enter livestream selling, they will need to find the right personalities to maximize their sales. And creators will need to access the products that can allow them to simultaneously delight, service, and monetize their fans.

The right technology will play the role of matchmaker. Perhaps these solutions will be built out by the dominant social platforms. Maybe they will be built by independent solutions providers who partner with, or sell to, the major social platforms. Or perhaps we’ll see these marketplaces built out, and perfected, by, upstart livestream shopping platforms like ShopShops or Popshop Live or NEWNESS, who will join the three key stakeholders in a three-sided marketplace of consumers, creators, and brands / retailers. Meanwhile, dominant commerce platforms like Amazon and Shopify will continue to bridge the product gap from the other side of the spectrum by partnering with, and incubating, influential creators. Even then, these commerce incumbents will need to develop “matchmaking” systems that remove friction for sellers.

In playing the role of matchmaker between products and creators, it will be crucial for these platforms to understand the true definition of “best fit”.

An incredibly common yet powerful insight that we’ve been hearing throughout our conversations with various livestreaming stakeholders is that the most popular influencers won’t necessarily make the best livestream sellers. Not only does the live medium require a completely distinct skillset from traditional influencer marketing, but also many of the most popular influencers, who command lucrative fees from brands to access their broad audience reach, aren’t actually effective at driving purchases. Many micro-influencers with small yet fervent followings in niche categories can outsell many mega-influencers — in audience conversion ratios, and sometimes even in aggregate sales.

NTWRK’s CEO, Aaron Levant, elaborated on this dynamic when he spoke to RockWater’s founder on our podcast, The Come Up:

“Sometimes these people that are so big actually don’t move culture in a way that you think they do. They’re propped up stars for consumption and click-bait but they’re not really able to have a meaningful consumer products business”

While many mega-influencers will be reluctant to forego brand marketing dollars to pursue a performance-based model like livestream selling, there are many more micro and nano-influencers — in addition to influential brands with dedicated followings like Complex, House of Highlights, and Goop — who will flood to the space once there is easy-to-access product inventory that truly aligns with their brand values.

These “best-fit” sellers will also be more motivated to lean in. To will an early stage venture to success through pure passion and hustle. Many “blue chip” influencers and celebrities may be happy to accept an upfront check from a livestream shopping platform in exchange for fulfilling some baseline obligations. But small businesses, micro influencers, or publishers who have much more to gain by investing in this new medium, will make the best partners because they’re equally invested in the success of each stream.

Levant continues:

“Some people, some celebrities they do these things and it’s like an obligation. They go, “I got to show up and do this thing and sell this book.” They pretend like they’re enthusiastic but really they’re not. They do the bare minimum. They’re like, “oh, I’m obligated to do one social post, I’m going to do just that and then I’m going to take it down.” [But the best-fit creator / sales partners] are going to fight to make their things work…They’re enthusiastic and they’re going to go above and beyond tenfold.”

All of the stakeholders needed to make livestream e-commerce successful in America have already arrived. Now we just need the right platforms, marketplaces, and tools to align them.

The US livestream e-commerce market was born in 2020. Over the next five years, we believe it will begin to crawl, then walk, then run.

In 2021 and 2022, the entry of brands and retailers, and matchmaking marketplaces, will close the “product gap” and thus the “authenticity gap”. These developments will enable creators of all sizes to embrace live selling, building frequent habits in the space and inspiring consumers to do the same. Slowly but surely, the paradigm of cultural consumption in the US will continue to shift towards a future where livestream shopping is mainstream.

—

Ping us here at anytime. We love to hear from our readers.