The US-China $295 Billion Livestream Gap

The RockWater Roundup: Podcast Episode Notes and Listener Links

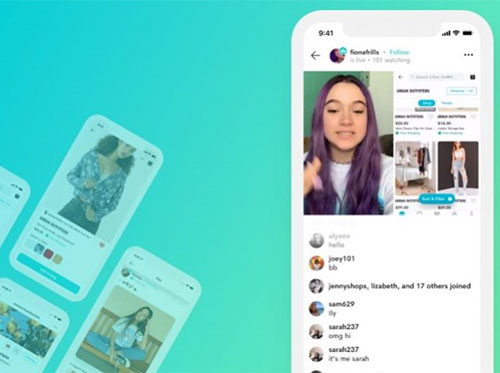

Livestream shopping festivals in the US are ramping up during the holiday season. From Facebook and YouTube to even Twitter. And our RockWater team has been participating in all of them. Yet livestream commerce sales forecasts of $5 billion in the US still significantly lag China’s sales forecast of $300 billion. Chris and Andrew therefore analyze the key market drivers explaining the revenue gap.

Subscribe to our newsletter. We explore the intersection of media, technology, and commerce: sign-up link

Learn more about our market research and executive advisory: RockWater website

Email us: rounduppod@wearerockwater.com

You can listen, subscribe, and follow our show on:

Our ask: wherever you listen, and particularly on Apple Podcasts, please give us a rating and write a short review. And forward to a friend. Doing so will help others discover the RockWater Roundup.

EPISODE TRANSCRIPT:

Chris Erwin:

So Andrew, over the past few weeks, our team has been tracking some interesting activity in the livestream shopping space. So we’ve seen some holiday livestream shopping specials from social incumbents, like YouTube, like Facebook, and even Twitter. You and the rest of the team have really been digging into some of these case studies to learn more.

Andrew Cohen:

Yeah. No, we’ve been having a good time going through watching all of these big, new launches from all the major social incumbents for livestream shopping. And they’re all have varying degrees of qualities, all are doing some things right, something’s not as right. All in all it’s been a big kind of improvement for the US livestream shopping ecosystem. But all of them still remind me of actually a 2021 prediction article that maybe we got right, maybe we didn’t get right because the problem that we called out in that article really still seems to be persisting. That’s the common theme that I’m seeing across all these streams. That problem is what we’re calling the product gap.

Chris Erwin:

The product and the authenticity gap is part of that.

Andrew Cohen:

Exactly.

Chris Erwin:

So let’s dive into that. Listeners, if you’re familiar with our writings and some of our forecast dating back around 12 to 18 months ago, you’ve probably heard us talk about this before, but we’re going to go through this observation that we cited dating back nearly a year ago. Talk about how it’s evolved and then how we think things are going to change in solving this product gap going into 2022. So let’s dive in.

Chris Erwin:

There’s currently an authenticity gap in the US livestream shopping market, and it’s preventing creators and thus consumers from really adopting the medium. And although the current sales volume in US livestream shopping is low. I think we’re looking at some numbers of around 5 billion. The investor interest is quite high at, I think around 220 billion of investments that we’ve been tracking. So we surveyed around 10 prominent digital talent managers over the past year who represent hundreds of clients that influence hundreds of millions of fans. And the goal is to learn about their initial experiences with livestream selling in the US. And Andrew, I think to our surprise, there’s only one manager we spoke to who ever had a client actually participate in livestream selling. And even then it was only one client in one campaign.

Chris Erwin:

We were surprised to hear that livestream selling is barely on the radar of most major US creators. Despite the fact that all the major social and commerce platforms have been developing products and features to make it easy for them to host livestream shopping experiences. So we asked them why and Andrew, one of the answers that we heard a lot was, and it really stuck out to us is many US creators view livestream selling as an overly commercial venture that will alienate their core fans through perceived in authenticity. And to quote, one manager told us specifically, “My clients don’t want to be a walking, talking billboard. You can only ask your fans to do so many things. Pushing too many things, especially when you’re doing a ton of brand deals is not a good long term look.”

Andrew Cohen:

Seems like right now, amongst traders livestream selling is kind of being framed as a choice. Choosing either direct to consumer revenues or fan delight, but really at its best, we believe that it’s an opportunity to do both. And I was surprised by the sentiment because digital creators are already massively influencing purchasing decisions. The US influencer marketing industry has grown about 50% year over a year since 2016. I think it’s currently valued around 14 billion, 44% of gen Z consumers say that their purchasing decisions are based on recommendations from a social influencer. So, and made us ponder, where is this disconnect? How do we bridge this gap between the indirect influence of social marketing and this kind of direct salesmanship of livestream to commerce? And how come one is accepted as organic and natural and is part of our kind of everyday commerce experience and the other one is more distasteful? And I believe and we believe that it’s due to a lack of access to sellable product inventory. Basically in other words, it’s the authenticity gap, which is a direct byproduct of the product gap in the US livestream shopping ecosystem.

Chris Erwin:

Before diving into explaining the authenticity gap. Also just want a note, Andrew, so estimating the influencer marketing ecosystem around 14 billion, and I think just another number to add on to that, which you had actually wrote about the creator economy just over the past few weeks that that’s estimated at over 104 billion. And that creator economy intersects in a very strong way with livestream shopping. So I think it just reinforces just how big the opportunity is here. But on your last note, I think as you’re talking about the authenticity gap, I think we want to better understand why does that exist? Can you give us a little bit more color?

Andrew Cohen:

Really we think that the authenticity gap, this idea that creators feel that they’re being inauthentic by pursuing livestream shopping is really because of this product gap, which is that creators don’t have enough products to create genuine livestream selling content on a frequent basis. So it’s always, let’s look to China for an example. So on average, the top grossing streamers in China go live more than 300 times a year. They average about eight hours per stream, featuring all sorts of different items in each stream. And as a result, 25% of livestream shopping consumers in China are daily active users. And 71% consume it at least once per week. So this recurring active engagement is one of the major differences that explains why China’s total livestream revenues are so much bigger than those in the US. I think China is running 300 billion today because Chinese viewers, they tune in on a regular basis because their favorite KOLs stands for key opinion leaders, basically their word for creators or influencers, but they always have cool new products to offer that they can authentically endorse.

Andrew Cohen:

So Chinese creators are able to stream every night without having to worry about being inauthentic because they have enough access to product inventory to enable them to service and delight their fans by consistently offering discounted access to the products that they genuinely love and personally endorse, which just makes for a much more engaging experience. And this is because brands and retailers in China are fully invested in this livestream shopping economy and it’s become a vital part of its infrastructure. So over 100,000 brands and retailers participate in the Chinese livestream shopping market. On Singles Day, for example, Alibaba’s version of Prime Day, it generated 75 billion last year in total livestream sales and over a thousand different brands participated.

Chris Erwin:

Yeah, the numbers from China are eye popping and particularly when you compare it to the current situation in the US. So let’s talk about that. So by contrast in the US livestream shopping market, many creators, including those with millions of fans, they often don’t have products to sell besides their own merch or products from a brand sponsor. Right. Now that may be enough to host a few successful live streams, but in order for a creator to go live on a recurring basis, like you were just talking about in China, they need a recurring stream of products that they can authentic and enthusiastically endorse. So then the question arises, why are US creators so limited in the products they can sell? Again, going back to our talent manager and talent rep survey, we’ve heard from their reps that even if they were interested in pursuing more direct commerce initiatives between product sourcing, development, and deal rights management, that procuring a wide array of products that fit their brand in audience is a logistical nightmare, right? A ton of work.

Chris Erwin:

So despite the creator’s ability to influence purchasing and the high profile celebrity led product launches that circulate across all of our LinkedIn feeds and on social media, the reality is that most US creators rarely sell products directly to their fans. Their D2C commerce footprint is usually limited to just a few skews of brand and merch. So as a result, many established US creators are reluctant to pursue live stream selling because they believe that continuously pushing the same few products is actually going to alienate their fans and really dilute the sense of authenticity and trust that their influence is built upon.

Andrew Cohen:

But then the flip side of this is by only participating in livestream selling when they have a new brand sponsorship or merch line to launch, US creators are failing to kind of cultivate the user habits, the recurring long term usership that will drive the US livestream shopping market to the scale of China. And on the other hand, most of the US participants in livestream shopping who do have a diverse and robust product inventory, they’re mostly, small boutiques or even national retailers like Fred Segal, who’s on talkshoplive, Walmart who just did something with Twitter, but they don’t necessarily have the audience influence or the reach or the engaging on camera charisma that’s necessary to fulfill the potential of livestream shopping. So really the US livestream shopping market has to bridge this gap in order to drive those outside revenues that come through active and recurring engagement at scale.

Andrew Cohen:

And creators can use the live medium to engage and entertain fans in a personal and interactive format while also sharing the products that they love most. They’re kind of performing the role of like the cool best friend with the deep product passion and expertise. And that level of authenticity and trust is going to be what powers the livestream shopping experience in the US, just like it has in China. However, until there is enough product accessibility to enable creators to host on a consistent basis, creators are not going to adopt the medium and neither will their fans. And I think it’s going to kind of stay in this in between zone until we cross that gap.

Chris Erwin:

And I think that’s just an interesting note is you gave some of the examples of Fred Segal on talkshoplive, or Walmart or JapanLA on Popshop. That consideration is a lot of these retailers, they were originally brick and mortar. And then during the eCommerce migration and digital transformation, they went online and they created web and mobile based storefronts. But it’s completely different to think about putting your product in a livestream shopping environment where users are used to having a personality, right, in a livestream situation.

Chris Erwin:

And I think a lot of these brands got a lot of work to do, to think about how do they attach the right personality, the right influencer, whether it’s someone that they incubate in house or that they find on social media accounts that already have an affinity for their brand. There’s a lot to do there, but when they do it right, it’s really powerful. So, okay, Andrew, so with your last point, a big question arises is how do we bridge the product gap in the US? How do we drive retail adoption and these product creator marketplaces that you’re describing? What do you think?

Andrew Cohen:

So far we’ve seen, especially the major social incumbents, the ones who have launched recently, Twitter, Facebook, YouTube, they’ve attempted to solve it three different ways. I don’t think either of them have quite hit the mark. One is using brands and retailers as the primary sellers. So rather than hosting it on a creator’s feed, just letting a, like, for example, be Vuori hosted one on Facebook and they could use their own talent to sell, but that’s one attempt. The second is using creators with their own product lines. Again, it’s tough to do on an occurring basis, but YouTube, when they do work with creators, it’s creators that have their own merch to sell. And then number three is sponsored streams. So these will pair a creator with a retail sponsor with inventory that they want to promote and sell directly. So these are all attempts. However, this doesn’t really sufficiently bridge that divide and we believe that there needs to be more done. And we think that more will be done. We highlighted two. Chris, what do you think?

Chris Erwin:

So I think diving into one of them it’s that more brands and retailers will turn to livestream eCommerce as a new sales channel, which will in turn increase the volume of sellable product inventory that is available to creators. So just to give some background numbers here in 2020, US brick and mortar retail sales declined by 10 and a half percent, right, primarily driven by COVID. But meanwhile, eCommerce revenues grew by 44%, right? We saw a massive pull forward migration into eCommerce purchases. Because livestream eCommerce is an extension of social selling, with the added elements of time and interactivity to drive urgency and increased conversions, our team actually anticipates that many of the same retail categories that perform well in eCommerce and influencer marketing will likely be the first to meaningfully invest in live streaming.

Chris Erwin:

So in particular, these retail categories include beauty, health and wellness, food and beverage, fashion, home goods, parents and kids, and technology, which are actually among the most popular livestream shopping categories in China last year in 2020. Andrew, the influx of product inventory into the livestream shopping space will be a meaningful step in the evolution of the US livestream shopping market. But that alone will not fully close the product gap, nor will it be enough to address the looming authenticity gap. Even when there is enough product volume and diversity to power frequent and consistent habits, one major challenge will still remain, how will best fit creators and products actually find each other? I think you has some interesting ideas here.

Andrew Cohen:

I think what really is going to need to happen to close that gap is that tech enabled marketplaces are going to emerge that connect creators with best fit products and vice versa. So again, let’s look to China for some inspiration. So not only are there 100,000 plus brands and retailers that are pumping product into this ecosystem, but almost more importantly, Chinese livestream commerce platforms make it really easy for KOLs to access these products. So when a KOL logs on to Taobao Live, Pinduoduo, Tmall or [inaudible 00:13:30] to plan an upcoming livestream, they can easily search through all of the product inventory that has been uploaded onto the platform by brands and retailers and select the products to feature based on what kind of feels authentic to them and their audience and what they can speak to and sell.

Andrew Cohen:

So actually a rudimentary version of this does exist on Amazon Live today, but really nowhere else that we’ve seen in the US. On Instagram, even as more and more brands and retailers are uploading their inventories to the platform shopping portal, the products are still siloed from the personalities who might be most effective at selling them. So brands and retailers still need to do all of the heavy lifting to create the content or to find the right content creators to actually drive traffic to their Instagram storefront. Meanwhile, the perfect creator who’s out there who’s most well positioned to move the products that are on that brand’s Instagram shopping portal is over on their page engaging a dedicated community every day on the platform, but likely failing to monetize their influence because they don’t have any products to sell.

Andrew Cohen:

So that’s really the product gap, which flows downstream of this authenticity gap, which flows downstream of just a lack of recurring user ship for livestream stopping in the US, which is really one of the biggest differences between the 300 billion that’s happening in China and the five billion that’s happening in the US. However, we do believe that this is going to change in the coming years. We believe that influencer and brand marketplaces kind of like what was originally the vision for YouTube’s FameBit, that they’re going to emerge to connect best fit products and sellers. And that really ultimately the right technology will play the role of matchmaker. And perhaps these solutions will be built out by a dominant social platform, or by a dominant commerce platform, maybe by one of the incumbents like whatnot or network. Excited to find out though.

Chris Erwin:

And I think on a closing note that our team is actually doing some interesting advisory work for some of those companies, which is fun. All right, Andrew, I think we’re out of time. So as always, till next time.

Andrew Cohen:

See you then.

—

Ping us here at anytime. We love to hear from our readers.