Hollywood Is Betting on Fear + Savvy Games Acquires Scopely for $4.9 Billion

What We’re Reading

2 articles + RockWater analysis to make you a better investor and operator. Today we discuss the how creators can capitalize on Hollywood’s horror boom, as well as Savvy Games’ $4.9 billion Scopely acquisition.

———

Hollywood Is Betting on Fear

WSJ, 4.06.23

The RockWater Take by Chris Erwin

As horror enters a new boom cycle, producers and distributors of modern horror programming should be aware of the key data and trends shaping the industry.

In 2023, over 30 horror films are set to be released, creating a crowded lineup. The genre’s momentum is building off a big 2022 sleeper hit in Smile, which made $217M on a production budget of $17M. And this year kicked off strong with Blumhouse-produced M3GAN about a murderous doll animated by ai, which did $175M in global box office since its Jan 6 release. Then Scream VI had a franchise-high opening of $45M in March.

These figures have studio executives seeing dollar signs, especially given the typically lower production budgets for horror films. Part of that is driven by the fact that A-list actors typically don’t work as well, since their fame factor makes it harder for audiences to imagine themselves in the same scary situations.

If you’re a content producer, marketer, or distributor, below are some key takeaways for how to setup your horror project for success.

The classic scares work — sadistic murderers, darkly lit hallways, dolls that move on their own, shattered mirrors, etc.

But audiences demand more sophisticated and smarter writing, plot, richly-developed characters, and some connection to the social issues of today. Not the slasher gross-outs of the 1980s like Blood Diner or Slasher Party Massacre. The genre is also growing to appeal to more general-interest moviegoers.

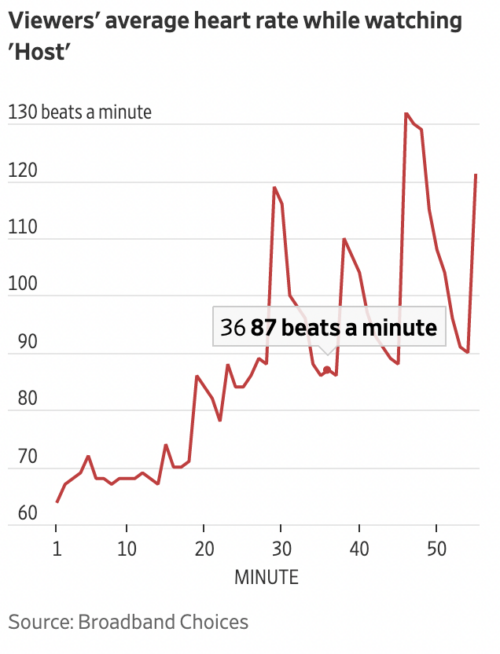

These types of films include Barbarian, about the Airbnb double-booking debacle, which followed a female protagonist. Or Host, which was 100% filmed on Zoom and came out during COVID, and is considered the scariest movie of all time based on audience heartbeat data! Also M3GAN, which included AI themes.

Horror works well on big screens, and audiences like to be spooked in big groups. But most upcoming films won’t get wide release, and at most may get release in just a few hundred screens. If you’re exploring an alternative distribution strategy, consider pop-up screens at festivals and malls, where audiences can come together for a unique shared experience.

Insider tip = do research to understand where target audiences spend their time and money IRL and online. This will inform the high-traffic footfall areas, tourist destinations, permanent and pop-up retail locations, brands, talent, and performer/entertainment experiences that you can piggy back on or partner with to create a fan-delighting experience and better drive attendance.

Avoid “cheese” or “cringe” vibes. If test screenings reveal such issues, consider reshoots, edits, or even scrapping the project. Don’t throw good $$ after bad, cut bait.

Be smart about how the horror genre’s audience demographics have shifted. While once considered male-dominated, recent Comscore data shows a near 50-50 gender split. Additionally, older audiences (25+) have grown significantly, now making up 57% of the market in 2022, up from 41% in 2012, and over-30s went from 28% to 38% over the same period. This presents an opportunity to explore content themes catering to 25+ females, reminiscent of the research behind Magic Mike Live’s launch.

Lastly, don’t underestimate the power of smart marketing. A marketing stunt by Smile included packing the movies’ stars behind home plate of nationally-televised MLB games, wearing their trademark psychotic smiles. The promo campaign went viral on social media, proving that innovative strategies can pay off big BIG in the competitive horror landscape.

Overall, the current horror boom presents both opportunities and challenges for filmmakers and investors. Key advantages include lower production budgets, a diverse and growing audience, and innovation in marketing and distribution strategies. However, risks lie in navigating a crowded market, and ensuring a film resonates with modern audience expectations. By striking the right balance between traditional scares and contemporary themes, and by exploring modern IP business models, creators in the horror space can capitalize on the genre’s resurgence while mitigating potential pitfalls.

Alright, all this horror chat has me amped up to go and find the next opening weekend horror release! Of note, one of my favorite horror movie experiences was watching the remake of It during a snowy night in Sundance back in 2018. Eight of us huddled together on a couch in our Airbnb, and the chatter varied from film connoisseur breakdowns of cinematic storytelling devices and the right amount of on-screen gore, to debates on who was going to have the worst nightmares…it was epic! Shout-out to Chas, Tom, and Ben, such good times 😉

I’d love to hear about your favorite horror movie experiences…DM me with the details!

———

Savvy Games Acquires Scopely for $4.9 Billion

The RockWater Take by Michael Booth

Savvy Games acquired Scopely for $4.9 Billion… a HUGE move for mobile gaming.

Savvy is a subsidiary of Saudi Arabia’s Public Investment Fund, which owns a variety of different eSports and gaming assets.

Whereas Scopely is one of the largest casual mobile game publishers in the world, having produced released titles like: Marvel Strike Force, WWE Champions, Looney Toons World of Mayhem, Scrabble Go and many more.

This deal in particular boosts Saudi’s prowess in the West. All of Scopely’s major titles license IP from major US media co’s (Disney, Warner Bros, Endeavor, etc). Curious to see the terms of those licensing agreements, but I doubt there are easy outs for the licensors. I’ve spoken to licensing execs at multiple major studios in the past few months who said their company policy is to not strike any IP licensing deals with Saudi owned entities. Now those studios have been forced to play ball.

This is the latest in a flurry of media investments that PIF has made. Others that I have documented in past blog posts include:

🎮 Acquired and merged eSports company ESL and gaming platform platform Faceit as part of a combined $1.5 billion deal

🎮 Acquired esports technology company Vindex for an undisclosed sum.

🎮 Increased its ownership of Nintendoto 8.3% (now the largest outside shareholder)

🎮 Increased its ownership of Embracer to 8%

⛳ Investmented $2B into LIV Golf

⚽ Signed a $207M annual deal with Christiano Ronaldo

❌ Attempted a $9B investment into the WWE (lost out to Endeavor)

Saudi has stated that PIF has $38B set aside to invest in more gaming companies over the next decade, $13B of which is earmarked for a flagship game developer. Many more deal announcements to come.

———

If these insights are relevant to projects you’re working on, ping us here. We love talking all things media x commerce!