How Media Operators Capture the $60 Billion US Sports Betting Market

WHAT’s Happening? Sportsbooks are investing in media assets, and media brands are launching sportsbooks

Below is a sample of recent market activity. Check out our Watch List for more deal points and information on 45+ deals!

-

DraftKings

-

Invests $12.6 million in Meadowlark Media

-

Licenses Dan LeBeaard’s podcast for $50 million over three years

-

Acquires VSIN for a reported $100 million

-

Partnership with NFL

-

Partnership with Turner Sports

-

Partnership with Premier Lacross League

-

Partnership with Sling to launch sports betting channels

-

Partnership with Dish Network

-

Partnership with the Chicago Cubs to launch a retail sportsbook outside of Wrigley Field

-

-

FanDuel partners with:

-

NBA

-

WAVE.tv

-

NFL

-

NHL

-

Turner Sports

-

Pat McAfee

-

Associated Press

-

MSG Network

-

-

Penn National Gaming

-

Acquires majority stake in Barstool Sports at $450 million valuation

-

Barstool Sportsbook partners with social influencers Logan Paul and Nickmercs

-

-

BetMGM

-

$1 billion investment by IAC

-

Partnership with Yahoo Sports / Verizon

-

Partnership with DAZN

-

Partnership with The Athletic

-

Partnership with Audacy

-

-

PointsBet partners with:

-

NBCU ($393M Committed 5 Year Marketing Spend from PointsBet)

-

NHL (NHL received equity in PointsBet)

-

PGA

-

MLB

-

La Liga

-

-

William Hill / Caesar’s partners with:

-

CBS Sports

-

ESPN

-

NHL

-

-

WynnBET

-

Invests $3.5 million in Blue Wire

-

Partnership with NASCAR

-

Partnership with Minute Media

-

-

Bally’s Corporation partners with:

-

Sinclair Media Group

-

NBA

-

NHL

-

-

Media Companies launching sportsbooks:

-

Barstool Sports (owned by PNG) launches Barstool Sportsbook

-

FOX launches FOX Bet

-

theScore launches its own sportsbook

-

FuboTV acquires Vigtory → Launching its own sportsbook in 2021

-

WHY is this Happening?

The legalization of sports betting in the US has unleashed a land grab among sportsbooks seeking to acquire users and establish long-term market dominance.

We outlined the driving factors of the “Sportsbook Wars” in our 2021 Predictions report:

The “Sportsbook Wars” of 2020 and 2021 have been defined by two words: user acquisition. Just like the “Streaming Wars”, “Podcast Wars”, and “Food Delivery Wars”.

The prevailing strategy of the well-capitalized combatants across all of these “Wars” is simple: win the land grab.

Spend aggressively to win market share today, while the market is in its formative stages and consumers are developing their routines, in order to become the default user destination for years to come.

Like OTT video, podcasts, or online food delivery, online sports betting is a nascent yet rapidly growing market with great revenue potential and minimal product differentiation. Specifically, the US online gambling market is expected to realize a 15% CAGR between 2020 and 2025, at which point it’s projected that 75% of all US sports betting revenues will come from bets placed online. And the online gambling market is expected to be $20 billion by 2025, $40 billion by 2030, and it’s long-term potential is valued at $60 billion.

The key metric companies use to evaluate their marketing effectiveness is the customer-level ratio of lifetime value to cost of acquisition.

Much of this customer acquisition spend has been allocated to traditional reach and awareness-driven marketing. From September 1 2020 to March 31 2021, the top sports betting companies accounted for 10.6 billion TV ad impressions, despite the fact that many mainstream sports leagues were inactive during this period due to the pandemic. And since 2018, OOH (out-of-home) advertising for sports betting has increased by 193%.

This advertising blitz is similar to what we saw when daily fantasy apps first burst onto the scene in 2015, when an ad for FanDuel or DraftKings ran on national TV every 90 seconds. And this isn’t a coincidence. As Jason Robins, the CEO of DraftKings, explains, the lesson learned from 2015 is that early-stage customers will have the highest lifetime values, therefore justifying higher acquisition costs:

“[Now] is when you’re going to acquire some of your best customers, so everybody is going to want to be more aggressive. You’re able to justify higher cost per acquisition because those are the customers that have higher lifetime values.

This is what we saw in fantasy. As we went deeper into the market, the LTVs started coming down so we had to take our CPAs down. That will be a natural evolution.”

Sportsbook advertising is becoming so omnipresent, that the NFL is reportedly considering implementing “frequency caps” to limit the amount of advertising inventory they make available to sports betting operators during their telecasts.

However, as we outlined in our 2021 predictions, we believe this approach of pursuing broad reach and user acquisition at all costs must be reevaluated in 2021:

In Q3 2020, DraftKings lost nearly $348 million, after tripling its “sales and marketing costs”. Further, the company’s average revenue per user (“ARPU”) declined.

This performance signals that competitive pressures could be escalating faster than expected. The aggressive “top-of-funnel” marketing approach isn’t sustainable, even for behemoths like DraftKings and FanDuel. And for the challenger brands, it’s clear that they’ll never surpass the market leaders by using their expensive playbook.

In February 2020, Penn National Gaming took a differentiated approach to Customer Acquisition, by acquiring Barstool Sports. Rather than try to compete for brand recognition by “renting” the very fleeting attention of audiences via the oversaturated advertising market, PNG decided to own its own top-of-funnel marketing machine. Unlike traditional reach-based advertising, which goes wide but shallow, leveraging media brands with loyal fans allows sportsbooks to build deep relationships with active and prospective customers. This bet paid off for PNG, as it has managed to achieve much more favorable economics than its competitors. From their annual report, and our last sports betting article:

In its Q3 report, PNG reported a “very limited external marketing spend” that enabled “organic customer acquisition…at a fraction of the cost of the traditional marketing efforts relied upon by many of our competitors”

This approach kept marketing costs down and improved the company’s valuation. Specifically, PNG realized a 2.8x YTD multiple expansion of EV / EBITDA, compared to competitors like MGM, whose EV / EBITDA decreased by 1x over the same period.

Of note, these improved economics didn’t come at the expense of user growth. Only a month after launching in Pennsylvania, the Barstool Sportsbook app achieved 13.4% market share

Although PNG and Barstool was the first major moment of Media x Commerce convergence in the sports betting space, it was far from the last.

In fact, the success of the Barstool Sportsbook likely triggered a media “arms race” by sportsbooks, resulting in exploding valuations that make the Barstool acquisition look like a discount in hindsight. For example, DraftKings recently spent $50 million to license Dan Le Batard’s podcast for three years (for comparison’s sake: Barstool Sports was valued at $450 million when it was acquired by PNG, including full ownership of its podcast network, which features 3 top 10 sports shows, including Pardon My Take, which has a significantly larger audience than the LeBatard show).

This should come as no surprise. The sports betting “turf war” is just beginning, and while the incumbant bohemoths featured on TV ads and billboards are spending up to $500 to acquire each customer, content-first gaming platforms like Playline, which has cultivated a network of 500 influencers and community managers, boasts a CAC of only $25.

HOW will the convergence of Sportsbooks and Sports Media evolve?

Affiliate Model:

The affiliate model isn’t the sexiest. It doesn’t attract the headlines that high profile Media x Commerce acquisitions or partnerships do. But in the sports betting industry, it’s still highly effective.

On average, 10-20% of a given sportsbook’s user base originates through an affiliate relationship. This is why we’ve seen eight sports betting affiliate sites acquired over the past 18 months, culminating most recently in Better Collective’s acquisition of Action Network for an estimated 16x revenue multiple (an exception to the typical 5-7x valuation multiples we’ve observed for sports betting affiliates, likely because of Action Network’s revenue diversification).

However, most sites currently operating affiliate models don’t have the audience reach or engagement needed to drive real value. Betting Hero’s co-founder Jeremy Jakary explained:

“There are only about a dozen impactful affiliates. It’s kind of the 80/20 rule—80% of activations are coming from 20% of the affiliates.”

With eight of those twelve already acquired, we expect to see a buying spree on the next four, likely before football season, which is the peak customer acquisition season for sportsbooks.

Mike Smith, the Head of Advertsing for Sportradar US, explained the power that brands with engaged audiences have to drive affiliate value:

“Choice at the bottom of the funnel is swayed by passion”

We believe that we’ll see more media brands, publishers, and creators with passionate fans begin experimenting with affiliate models for their sports content as a way to generate incremental revenues in the near-term, and showcase their value as customer acquisition tools to sportsbooks, which could help set up premium exits or sponsorships in the long-term.

But the brands with perhaps the most passionate fans, and thus the most untapped potential as affiliate marketing partners, have yet to enter the game: sports teams. Although the five major US sports leagues forbid their teams from taking a cut of betting handle, they all permit clubs to activate performance-based affiliate deals. Recently, the New York Jets and Baltimore Ravens became the first teams to begin exploring that model via deals with Sportradar.

To-date, sports teams have opted for the more risk-averse path of traditional sportsbook sponsorships, which provide more guaranteed upfront capital. But we believe we’ll begin to see more sports teams and passion brands bet on their ability to drive bottom-funnel conversions in an attempt to capture higher revenue upsides.

In-Game Betting:

In Europe, where the sports betting industry is more mature, in-game betting makes up 70-80% of the total betting handle. In the US, it currently accounts for about 20%. Over time, as partnerships between sportsbooks and rights-holders continue to expand, and distribution continues to shift towards OTT platforms, we expect in-game betting to be an equally dominant force in the US.

63% of fans say they pay more attention to sports when legal gambling is permitted, which explains why the NFL is projected to earn $1.9 billion in incremental “fan engagement revenue” as a direct result of increased consumption and engagement with the league’s live broadcasts (a 13.4% increase).

We’re already seeing leagues partner with broadcasters and betting partners to further monetize this heightened engagement via the 2nd-screen experience, such as the PGA + NBCU / PointsBet partnership. Next, we expect the 2nd-screen experience to merge with the primary-screen experience, as more and more OTT distributors will offer the option for betting-centric broadcasts.

We’ve already outlined the growing “e-sportification” of sports broadcasts. The integration of interactive, gamified, and personalized features has proven to make live sports broadcasts more engaging for Gen-Z audiences. These same features can be tailored for bettors.

Made-for-Betting Sporting Events

The heightened engagement that betting, and especially live-betting, brings to live sports broadcasts will soon result in the emergence of “made-for-betting sports events”.

We’ve already seen a recent boom in made-for-social sporting events like Bleacher Report’s “The Match”, Triller’s “Fight Club”, House of Highlights’ series of creator competitions, and Barstool Sports’ upcoming golf match between Dave Portnoy and Brooks Koepka.

Now that these platforms and publishers all have sportsbook affiliations (Bleacher Report / House of Highlights + DraftKings, Triller + DraftKings, Barstool Sports + Barstool Sportsbook), the integration of live-betting will soon become prevalent.

We expect to see live sporting events engineered to not only maximize social virality, but also betting revenues. For example, creator-led competitions in sports that are optimal for betting (e.g. golf, boxing), with compelling storylines and dramatic stakes, fixed-odds betting to sustain fan engagement and narrative tension throughout even the most lopsided events, creative prop-bets integrated into the broadcast (explicitly discussed by the in-game commentators), and even free-to-play games to involve younger audiences.

eSports:

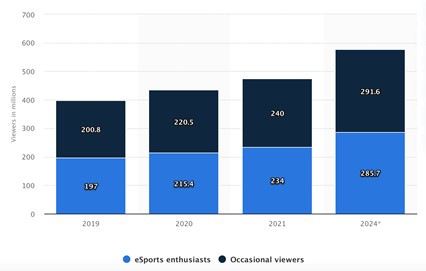

The global eSports audience is exploding. It’s projected to grow by over 140 million over the next four years. However, eSports betting is lagging behind eSports fandom (2020 gross gaming revenue: $250 million, total eSports market size: $1.48 billion). This is partially due to the fact that many eSports fans are below the legal betting age, and partially due to the fact that eSports betting is currently only permitted in eight states.

However, over time, as eSports fans age up and regulation relaxes, we expect eSports betting to catch up to eSports viewership and fandom.

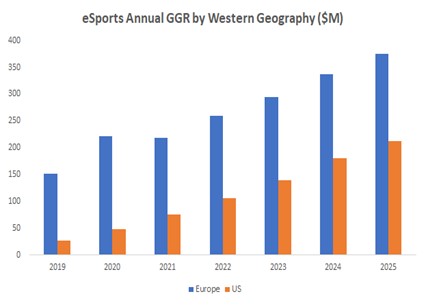

And when that happens, a similar “turf war” will emerge between sportsbooks eager to capture this untapped market.

However, this customer acquisition blitz will require a custom approach. 64% of eSports bettors don’t bet on traditional sports at all, and 54% of them get their eSports news from dedicated sites and forums, rather than generalist sports publications.

With a highly segmented target audience, sportsbooks won’t be able to acquire eSports bettors through their existing media partnerships. Instead, they’ll need to develop dedicated media channels to connect with this elusive, yet increasingly valuable, emergent betting cohort.

Local Sports Media:

Because legalization happens on a state-by-state basis, so does sportsbook customer acquisition. Each state is its own land grab. In Q1 2021, the online gambling industry, primarily sports betting, spent $154 million on local TV advertisements.

A senior strategy executive from one of the top American betting operators told us:

“At this stage of the US market, national advertising doesn’t make sense for us. All of our User Acquisition campaigns right now are hyper-focused on certain states where we’re active. In California you may have never heard of us, but in Indiana you’ll probably see our ads everywhere you look right now.”

As sportsbooks seek to lower customer acquisition costs and develop engaging consumer touchpoints on a highly localized basis, we expect to see these operators increasingly activating regional media brands — via partnerships, acquisitions, and investments. Betting operators are already targeting regional fanbases by partnering with teams and venues. Bally’s even paid Sinclair Broadcast Group $88 million to rebrand 21 of its regional sports networks with the Bally’s brand for the next ten years. And media companies are already investing in building out regional sports brands (e.g. Blue Wire raising at an estimated $30 million valuation, The Athletic raising at an estimated $450 million valuation, Amazon and Twitch are each investing in local sports content).

We believe this asset class will be an attractive partnership category for sportsbooks seeking to convert deeply engaged fandoms on a regional basis.

Underserved Audiences:

As new betting markets across the US are unlocked, sportsbooks will rush to acquire the users with the highest lifetime values, which are the “core” sports bettors. Although white millennial men represent the majority of this audience, considering the overall size of the US sports betting market ($961 million in the first three months of 2021 alone), the more diverse cohorts still represent a lucrative opportunity for media companies and sportsbooks. As the market matures, we expect sportsbooks to more aggressively pursue content that speaks to underrepresented communities.

We’ve done extensive research into the most valuable underserved audiences in this space, which we’ll share in a future report. Stay tuned!

—

Ping us here at anytime. We love to hear from our readers.