3 Innovations Social Incumbents Must Pursue to Win the “Livestream Commerce Wars”

Brought to you by:

Today’s article focuses on livestream commerce, which is part of the social commerce revolution. We discuss a few key ways to unlock the potential of the US market, and companies like Orca are part of the solution.

Orca is social commerce made easy. It’s a marketplace that helps creators to build their own online store with products from Orca’s catalog. Creators don’t pay a fee or need their own products.

Brands who place products in Orca’s marketplace can bypass paid media because their products are marketed and sold by the most trusted source: creators who curate the products they genuinely endorse.

Some other Orca highlights:

- Think retailer VS an affiliate tool. Orca strikes wholesale deals with brands, enabling a 20% seller commission; ~10x the average affiliate fee.

- Social first. Sellers can share their store via link-in-bio, create shoppable videos in IG Stories and YouTube, and can even text or WhatsApp their products to friends.

- Their marketplace is growing 100+% month MoM

Learn more about Orca by clicking the link here: orcashop.co

———

3 Innovations Social Incumbents Must Pursue to Win the “Livestream Commerce Wars”

Incumbent platforms have a huge headstart over the upstarts. But that doesn’t guarantee success.

Every day, we hear the same thing from tentpole creators, brands, and media companies who are considering how to best activate in livestream commerce: “Why would we sell on an upstart platform when our entire existing audience, and our entire target audience, already lives on the incumbent platforms?”

They’re not wrong. But superior reach only takes you so far. For the incumbents, live commerce is one of many initiatives they’re focused on. But for the upstarts, it’s the sole mission.

As a result, the upstarts have built superior products that enhance experiences for users and conversions for sellers.

But will it be enough to surpass the built-in creator-fan communities of YouTube and TikTok? Or the built-in commerce infrastructure of Amazon?

Below, we’ll examine the paths to victory for both incumbent and upstart livestream shopping platforms. And we’ll outline our POV on how this ecosystem will develop over the next five years.

What do incumbent platforms need to do to win?

1. Improved Livestream Discovery:

If a tree falls and nobody hears it, does it generate any GMV?

This proverb has a clear answer: No.

Incumbent platforms have a huge advantage that many of them have failed to properly leverage to drive usership of their live commerce products: enormous recurring audiences. Millions of users are going to their platforms every day to interact with creators, brands, and communities (Facebook: 2.9 billion monthly active users, YouTube: 2.3 billion, Instagram: 1.2 billion, TikTok: 1+ billion, Pinterest: 480 million, Twitter: 397 million, Amazon: 310 million). And these consumers are already using incumbent social media platforms to inspire their shopping: 54% of Millennial and Gen-Z say they use social media to influence their purchase decisions.

Yet, even when these major platforms do decide to leverage these assets to host livestream shopping events, they’re often hard to find. Buried in a specific neighborhood within their vast ecosystems. And unless you know they’re going on and are intently seeking them out, they’re hard to find. Despite the fact that millions of shoppers are on their platforms seeking inspiration and interactivity, there aren’t organic pathways for their users to discover live shopping events.

…Even the tentpole events that the platform is investing millions to produce.

During last year’s holiday shopping season, Facebook launched a major live shopping series with major retailers like WalMart, Macy’s, and Ulta Beauty. I knew these events were happening (I read the press release), and still had to spend 20 minutes searching through the platform to find when and where these streams would be broadcasted.

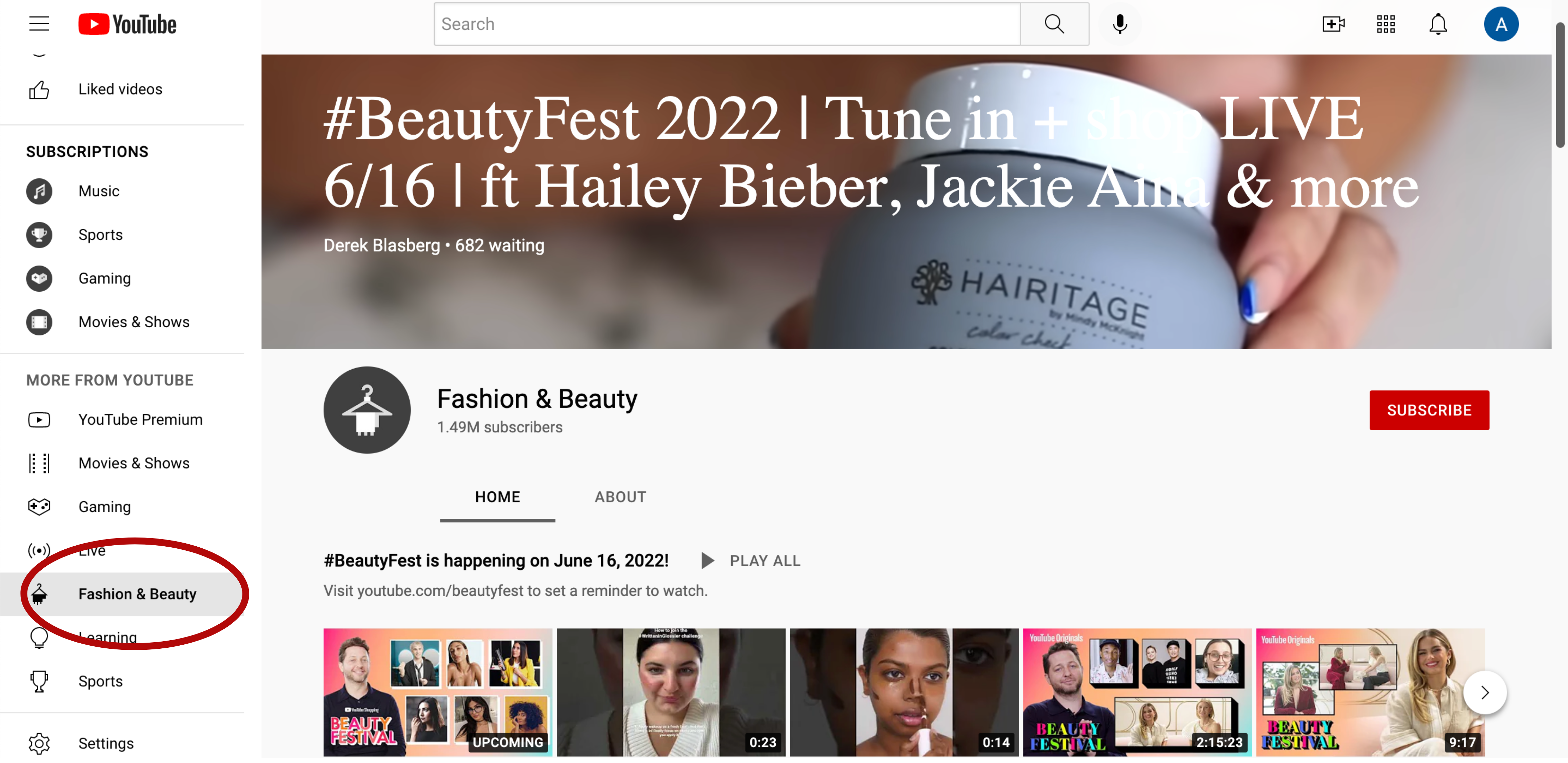

As recently as last week, YouTube’s tentpole “Beauty Fest” was recently announced at last week’s “Brandcast” event to signify their commitment to livestream commerce. Given the premium production value, and the A-list creator lineup (including Hailey Bieber, Gwen Stefani, Tracee Ellis Ross, Winnie Harlow, Ashley Graham, and more), it’s clear that YouTube invested millions in this event. However, when I went to YouTube on the day of the event, there was no promotion for the event on its homepage. I even went to the livestream tab: nothing. Finally, when I went all the way down to the Fashion & Beauty tab, I found promotion up and down the landing page.

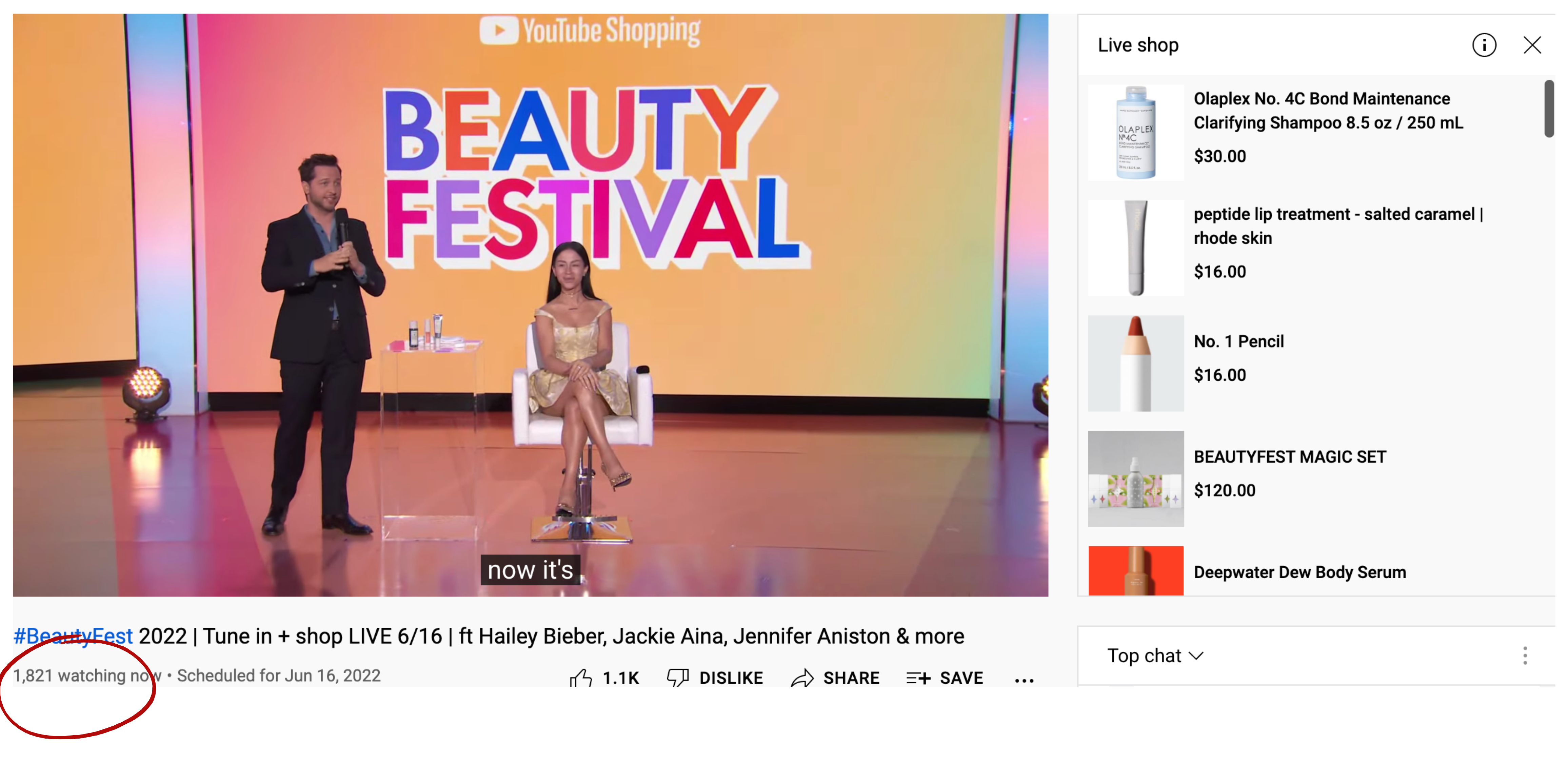

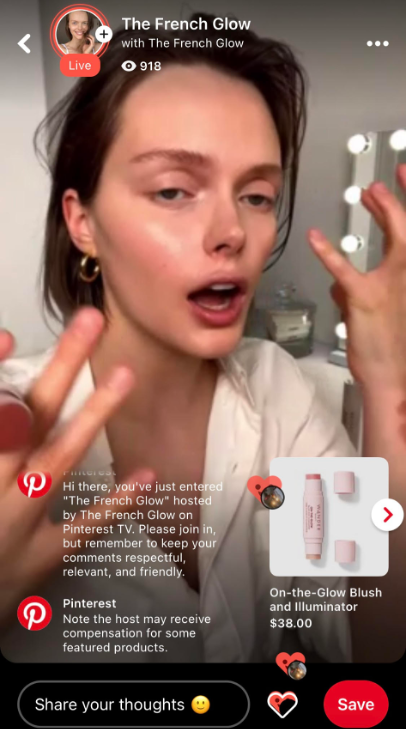

To get a relative sense of scale and contrast, I clicked over to Pinterest TV during the YouTube event to see how many people were watching whatever stream happened to be live on Pinterest at the moment.

Of note, the UI on Pinterest TV heavily emphasizes live shopping discovery. After all, it’s a much bigger priority for Pinterest than it is for YouTube, which generated nearly $7 billion in Q1 ad revenues, and thus is less incentivized to alter its UI for an emergent revenue line.

So what was the concurrent viewership difference between YouTube’s star-studded yet hard-to-find event, and Pinterest’s easily discoverable yet low-cost programming? About 900 people. On a relative basis, Pinterest captured over 10x more of its monthly users than YouTube did (YT: 1,800 concurrents out of 2.3 billion active users. Pinterest: 900 concurrents out of 480 million active users)..

This correlation between discoverability and viewership is consistent with what we’ve seen across this medium and others. TalkShopLive, whose user base is infinitesimal compared to both YouTube and Pinterest, but whose UI is completely dedicated to livestream discovery, generated an average concurrent audience of 2,180 per stream during its recent “Shop Small Business” festival (comparable, if not greater, than YouTube’s peak concurrent viewership for Beauty Fest). When we surveyed Chinese consumers, and asked them how they discover livestream shopping events, 80% of them credited on-platform promotions.

We’ve seen this dynamic at play in other mediums as well. When Spotify decided that podcasts will be a priority revenue-driver, they redesigned their app’s UX to enhance podcast discovery. When Netflix decided that its original content would be a priority for its business, its UI began to promote discovery of that programming.

Even more aptly, let’s look at the “battle of the TikTok clones”. In response to TikTok’s rapid ascension, all of its primary competitors launched their own versions of the short-form video product. In July 2021, YouTube launched “Shorts”, and adapted its UI to reflect this newfound priority. With its new product design, discovering a Short is essentially an inevitability for any user on the platform. The result? 10 months after launching, this product has 1.5 billion monthly viewers (TikTok surpassed the 1 billion monthly viewer mark in September; four years after its launch).

Based on how quickly these platforms mobilized towards short-form video, it’s clear that they can make the necessary innovations to dramatically enhance user discovery. The question is: how badly do they want to? If livestream shopping isn’t going to move the revenue needle for these platforms in the near-future, how motivated will they be to reengineer their UI around it? Meanwhile, the upstart platforms, for whom livestream commerce is the #1 priority, will be aggressively promoting streams and innovating their product design to enable organic user discovery.

To date — despite the well-founded hesitations by brands and creators about activating on a platform with no built-in audience — upstart platforms often aggregate wider audience reach than the incumbents because of their superior commitment to user discovery.

For incumbent platforms, their biggest asset is their built-in audience. But in the race to capture the US live commerce market, this asset means nothing if the platforms aren’t effectively steering their users towards live commerce.

2. Develop Fluid Pipelines Connecting Creators With Products (and Vice Versa):

To succeed in livestream shopping, or any form of social commerce, platforms will need to scale their three-sided marketplaces of creators, consumers, and brands / retailers. One of the biggest advantages that social incumbents have is that they’ve already scaled these ecosystems.

However, when it comes to live shopping, the creators and the brands / retailers are often siloed. In order to unlock their full potential in live stream shopping, these platforms need to develop fluid pipelines that connect creators with products to sell (and vice versa).

In our last two reports we outlined how MCNs and tech-enabled marketplaces can be utilized to close these crucial gaps, and wake up these sleeping giants of social commerce.

———

SPONSORED POSTS

———

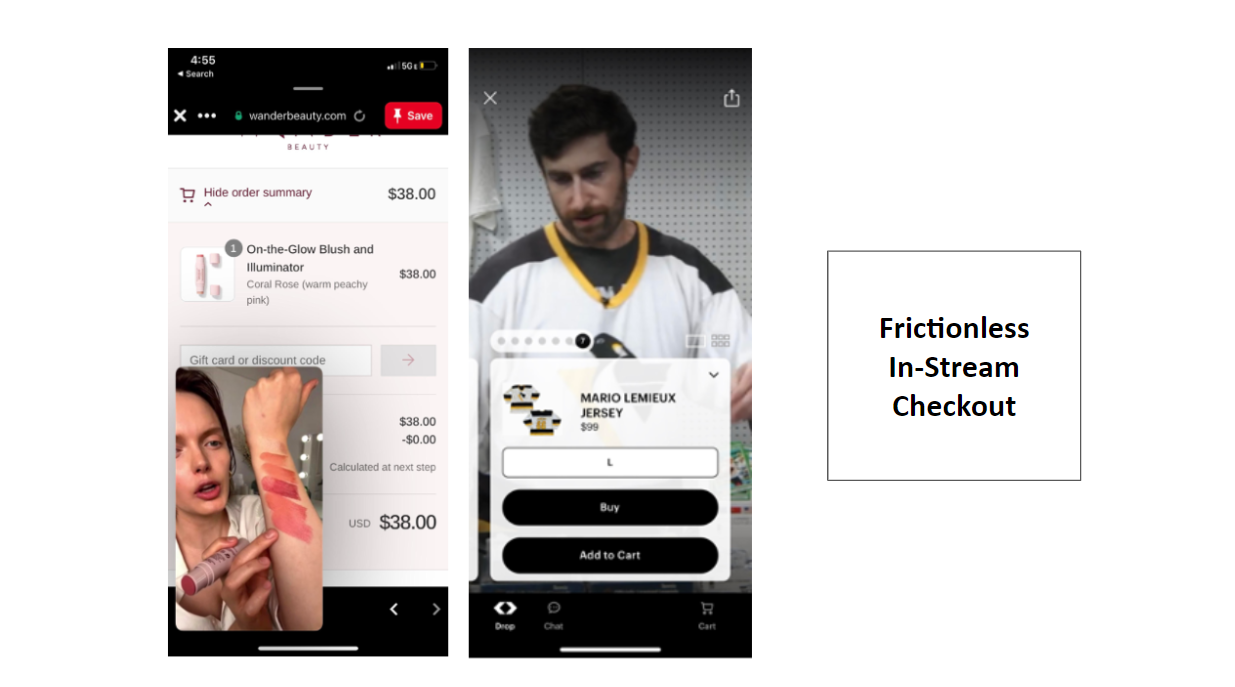

3. More Frictionless Livestream Purchase Journey:

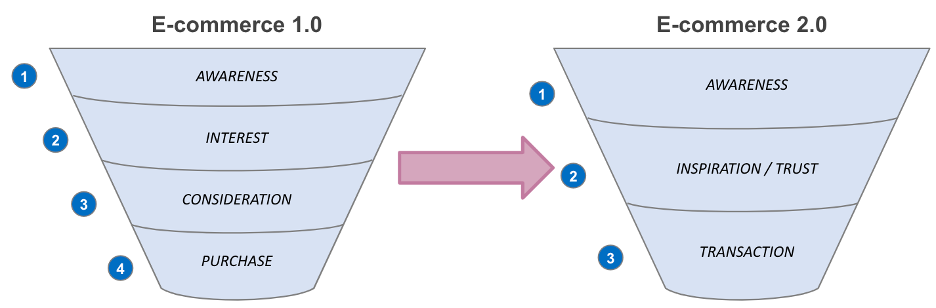

The power of livestream commerce is that it increases conversions by condensing the purchase funnel. It combines the influence of Influencer Marketing with the intimacy and interactivity of brick-and-mortar shopping, and the urgency of flash sale.

A frictionless purchase funnel, enabled by a seamless UX that integrates content and commerce, is essential to executing this model. This means one-click checkouts without leaving the stream. This is a baseline feature of all Chinese platforms and US upstarts.

But few US incumbents have enabled such a frictionless journey in their live shopping events.

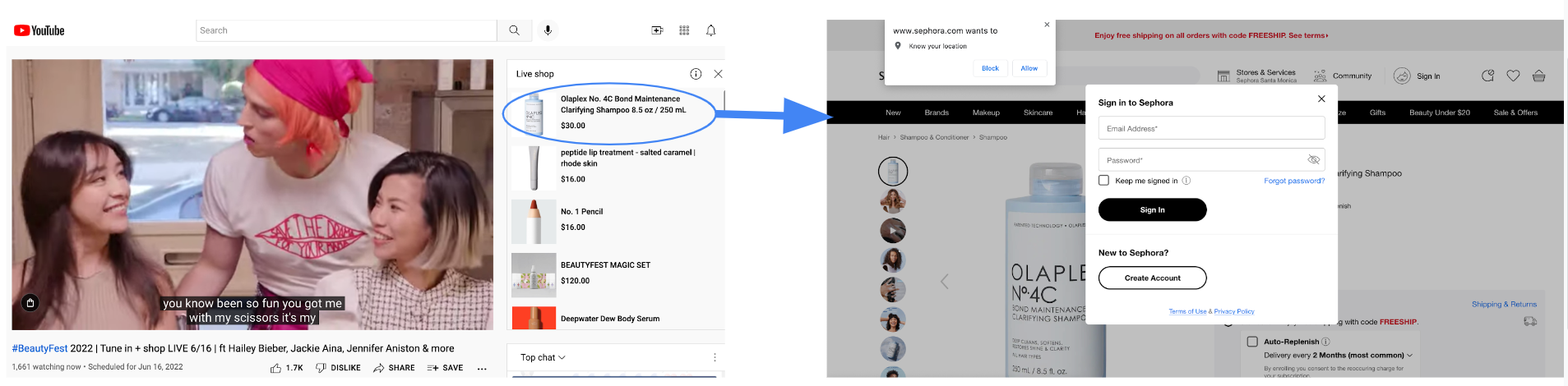

To make a purchase during YouTube’s recent big budget BeautyFest, you had to click off of the stream into the Sephora website, and then continue the journey from there (add to cart >> make an account or add shipping / payment information >> checkout), and then return back to the stream. And the products weren’t discounted, limited edition, or exclusive to viewers of the stream.

This all begs the question: why have a livestream shopping event at all? If you are going to buy standard products at standard prices in a standard e-commerce environment, why not just add static affiliate links to an on-demand YouTube video or Instagram post? Why is this a special experience for the buyer? Why is this worth the investment from the seller?

In order to extract the full value of the medium’s potential, incumbent social platforms need to follow the lead of the big platforms in China, and the emergent players in the US. This means focusing on building a fun and frictionless UX that shrinks the journey from all of the discovery and engagement that’s already happening on their platforms, to the billions of dollars of commerce revenue that’s inspired by those top-funnel interactions.

This is just a brief preview of the playbook for incumbents. Other ideas include:

- Focus on Quality Control: Build community, trust, and organic habits…commerce will follow

- Incentivize Discounts & Exclusive Products

- Use “Creator Funds”, with Transparent Economics, to Incentivize Consistent Creator Activity

- Mint a New Class of “Superstar Creators”…and Market Them

- Improved Feature Set for Users & Sellers

- Lean into Marquee Categories

To Be Continued…

In the next installment of our reports on the US Livestream Commerce market, we’ll look at the future of this market from the other side of the spectrum: breaking down what upstart platforms will need to do to win the “Livestream Commerce Wars”.

Ping us here at anytime. We love to hear from our readers!