2022 Prediction: Why Was $20B Invested in Sports Leagues and Teams in 2021? And What’s Next For this Soon-To-Be $825B Industry?

Executive Summary

- What’s Happening? ~$20 billion of investment capital has towards sports leagues, teams, and media assets since 2020 — from incumbents to challengers.

- Challenger Leagues

- Traditional Teams, and League Media Assets

- Specialized Sports Investment Funds

- Why is this Happening? The global sports industry is riding the converging tailwinds of macro market trends to soaring valuations. Teams & leagues are the fountainheads of all value creation in this ecosystem.

- Macro Overview: The convergence of four modern market tailwinds

- The Increasing Value of “Passion Brands” That Generate Revenue Diversity

- Cord-Cutting, the “Streaming Wars”, and the Skyrocketing Value of “On-Demand Proof” Live Content

- The Legalization of Sports Betting in the US (and Canada)

- Content Globalization

- Why is investment capital suddenly pouring into incumbent sports leagues and teams?

- Updated League Regulations

- Liquidity

- The Scarcity Principle

- Why is investment capital suddenly pouring into “challenger” leagues?

- “Passion Economy” dynamics are enhancing the viability of “challenger leagues”, while eroding the competitive moat of the incumbents — especially with younger fans

- Capitalizing on modern market tailwinds to achieve ROI at a much lower cost-of-entry

- Macro Overview: The convergence of four modern market tailwinds

- How Will This Trend Evolve in 2022? Predictions for the Future of Investments in Sports Leagues & Teams

- Incumbent Teams & Leagues

- More incumbent leagues will update their bylaws to allow minority acquisitions from institutional investors, and leagues that already allow it will begin to allow majority buy-outs

- Traditional leagues will spin off media assets to raise growth capital by monetizing the soaring valuations of media rights

- Institutional investment capital will flow towards leagues and teams across emerging international markets

- Strategic investors will begin acquiring stakes of teams, leagues, and their media assets to consolidate synergistic assets for scale

- Investors with scaled, diversified portfolios of minority stakes in traditional sports teams and media assets will go public via SPACs and IPOs, or sell them to giant strategic buyers

- Challenger Leagues & Teams

- There will be investments to launch dedicated “Creator Competition” leagues

- Media companies and sportsbooks will acquire and incubate upstart leagues

- Upstart and challenger leagues will embrace the “Ownership Economy” through the blockchain and NFT’s

- The most valuable challenger leagues will be the ones that uniquely leverage modern “passion economy” tailwinds to develop a differentiated value prop that appeals to the next generation of fans

- Incumbent Teams & Leagues

What’s Happening?

~$20 billion of investment capital has towards sports leagues, teams, and media assets since 2020 — from incumbents to challengers.

Challenger Leagues

- WNBA: Valued at $1 billion after recent capital raise (Feb ‘22)

- Super Golf League: Raised $300 million in initial capital with plans to add an additional $2 billion from the Saudi Sovereign Wealth Fund (Feb ‘22)

- XGames: Reportedly being sold at a $50 million valuation (Jan ‘22)

- Fan Controlled Football: $175M valuation (Jan ‘22)

- House of Highlights Creator League: Launched by House of Highlights, a WarnerMedia subsidiary (Dec ‘21)

- USFL (United States Football League): $180 million capital raise (Oct ‘21)

- AEW (All Elite Wrestling): Projected $400 million valuation (Sep ‘21)

- AVP (Association of Volleyball Professionals): Acquired by Bally’s Casino (Jul ‘21)

- Premier Lacrosse League: $140M valuation (Jun ‘21)

- NBA Africa: Valued at $1 billion after recent capital raise (May ‘21)

- Overtime Elite High School Basketball League: Launched by the media company, Overtime, after raising $80 million (Apr ‘21)

- Triller Fight Club: Launched with the acquisition of Fite TV. The league is a significant part of Triller’s plans to go public with a $5 billion valuation (Dec ‘20)

- XFL: Acquired for $15 million (Aug ‘20)

- Drone Racing League: Raised $80M after a Series C capital raise (Jun’ 19)

- Rough N’ Rowdy: Acquired by Barstool Sports (Nov ‘17)

Traditional Teams, and League Media Assets

- Chelsea FC: Owner Roman Abramovich is accepting bids and seeking at least $4 billion in a potential sale (Mar’ 22)

- Denver Broncos: Expected to be sold for roughly $4 billion (Jan ‘22)

- Real Salt Lake (MLS): Acquired by Utah Jazz and Philadelphia 76ers owners for $400 million (Jan ‘22)

- Inter Milan: Nearing $1 billion sale to Saudi Arabia’s sovereign wealth fund (Jan ‘22)

- Leeds United: Sold to San Francisco 49ers’ ownership group for $530 million (Dec ‘21)

- Juventus: Sold an 8.25% stake in the club for €399 million, implying a valuation of €4.84 billion (Dec ‘21)

- Pittsburgh Penguins: Sold a controlling stake to Fenway Sports Group in a deal worth $900 million (Nov ‘21)

- Newcastle United: Sold to Saudi Arabia’s sovereign wealth fund for $409 million (Oct ‘21)

- New York Mets: Acquired by Steven Cohen for $2.475 billion (Sep ‘21)

- Orlando City SC (MLS): Acquired by Wilf family for $400-450 million (Jul ‘21)

- Minnesota Timberwolves & Minnesota Lynx: Sold in a package deal for $1.5 billion to a group led by Alex Rodriguez (May ‘21)

- Utah Jazz: Acquired by Ryan Smith, CEO and co-founder of Qualtrics, for $1.6 billion (Oct ‘20)

- Houston Dynamo (MLS): Sold to Ted Segal for $400 million (May ‘20)

- Brooklyn Nets: Acquired by Joe Tsai, co-founder of Alibaba Group, for $2.35 billion (Aug ‘19)

Specialized Sports Investment Funds

- Arctos Sports Partners: Raised a $3 billion fund “ dedicated to providing growth capital and liquidity solutions to professional sports franchise owners in major North American leagues and European soccer” (Oct ‘21)

- Redbird Capital Partners: Raised $4 billion in funding, with a primary investment thesis focused around sports teams, leagues, and media assets (Aug ‘21, latest round)

- Blue Owl / Dyal Homecourt Partners: Raising $750 million – $2 billion to acquire minority stakes of NBA franchises (May ‘20)

- Galatioto Sports Partners: Raised a $500 million fund dedicated to buying minority stakes of MLB franchises (Oct ‘19)

- MSP Sports Capital: Launched a fund dedicated to investing in sports teams, leagues, and the overall sports ecosystem (c. 2019)

Why is this Happening?

The global sports industry is riding the converging tailwinds of macro market trends to soaring valuations. Teams & leagues are the fountainheads of all value creation in this ecosystem.

The core value pillars of the sports business are perfectly aligned with the value-drivers of the modern consumer economy.

Although there has been a staggering increase in deals and valuations across the sports ecosystem, the surge of deal activity around sports teams and leagues is unique. This is traditionally a more static and scarce asset class. So why have we seen this sudden and dramatic investment boom over the past year?

We believe it comes down to the fact that teams and leagues are uniquely positioned to capitalize on four converging macro market tailwinds:

1) The Increasing Value of “Passion Brands” That Generate Revenue Diversity

The “Attention Economy” is dead. We’re now in the era of the “Passion Economy”.

Disruption is a double-edged sword. The same technologies and platforms that are making it more challenging for brands and content creators to succeed through traditional models, are also empowering them to succeed through a whole new paradigm, which we call “the passion economy”. It’s nearly impossible for most brands, creators, or platforms to reach audiences as widely as they used to, but they can now go deeper with their fans than ever before. The companies that have a deep enough connection with their fans to influence their behavior are becoming more valuable by the day. While those that merely “reach” their audience lose value because of their over-reliance on volatile 3rd-parties (e.g. digital ad market, cable affiliates, B&M retail).

This new ethos is reflected by the investment thesis of Candle Media, the new investment fund led by former Disney execs, which is backed by $6 billion in funding by Blackstone. They’re seeking to invest those funds in companies with IP franchises with the power to grow values through the convergence of “content, commerce, and community”.

The sports industry embodies the power of those “3 C’s”, and have therefore unlocked incredible value in today’s “Passion Economy”. Many consumers define their personal identities by their sports fandoms, and they define their communities through those shared fan identities. They spend their time, money, attention, and emotional energy in support of those fandoms. That’s powerful.

As a result, the entire sports sector is exploding; it’s expected to reach $600 billion by 2025 (9% CAGR from 2020). In 2030 it’s projected to hit $826 billion (11% YoY growth over a 10 year span).

Although the entire sports industry is benefiting from the rising tides of the “Passion Economy”, teams and leagues are the best-positioned to capitalize on this unique market moment. They’re the fountainhead of value, powering growth throughout the ecosystem. A rising tide lifts all ships. And as the origination point for all sports passion, the value of leagues and teams are being substantially lifted by the rising tides of the “Passion Economy”.

In a world where customer proximity is king, teams and leagues wear the crown. And as a result, they have the power to become “kingmakers”.

Just ask Topps and Fanatics. Topps was planning to IPO via SPAC at a $1.3 billion valuation, until Fanatics won exclusive licenses with the NBA, NFL, and MLB (the MLB ended a 70 year relationship with Topps to partner with Fanatics). Months later, Topps sold to Fanatics for just over 33% of its previous valuation. And Fanatics spun off its trading card vertical at a $10.4 billion valuation…before ever selling a single card. The league IP rights alone were enough to warrant an 11-figure valuation.

As stakeholders throughout the modern consumer economy compete for market share, they all need to “pay rent” to the major teams and leagues for access to their IP, and the fandoms that come with it.

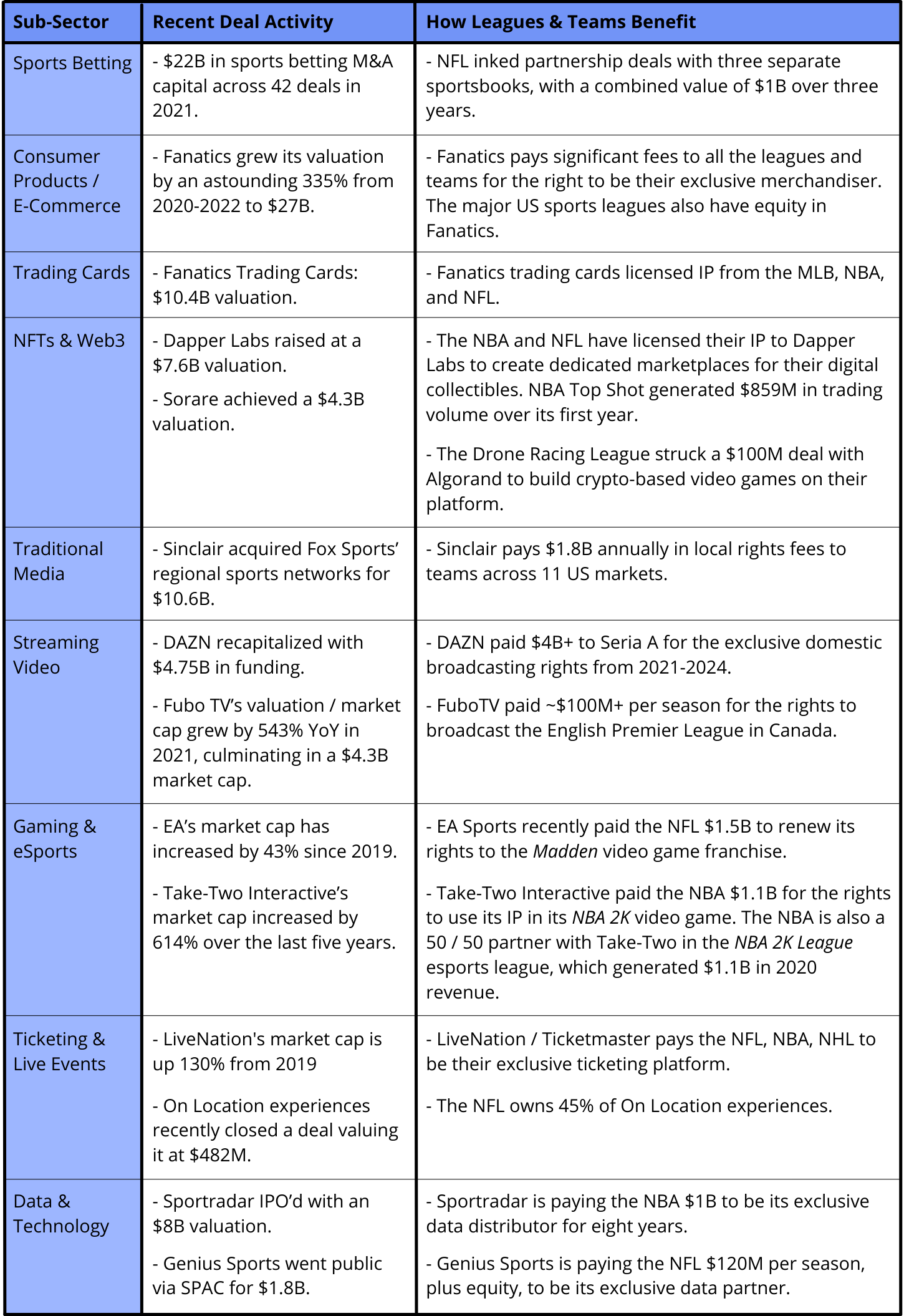

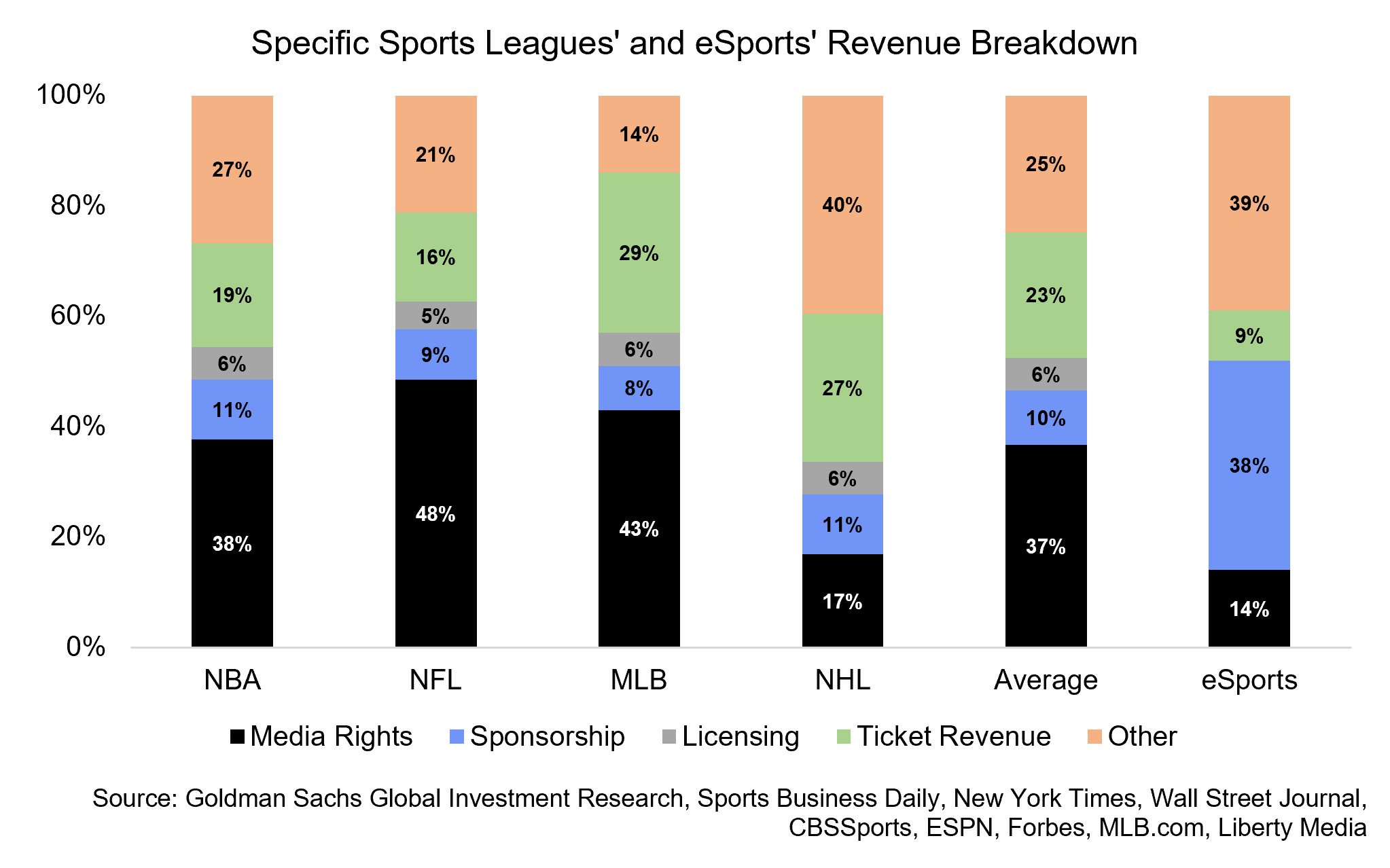

As a result of this unique positioning, leagues and teams generate uniquely diverse revenue profiles. And as the tides of the modern consumer economy continue to rise, so do the values and varieties of revenue streams for leagues and teams.

The increased value of “passion brands” with diverse revenue profiles is one tailwind propelling investments into sports teams and leagues, but three of these revenue streams are particularly inflated due to independent market tailwinds: media rights and gambling.

2) Cord-Cutting, the “Streaming Wars”, and the Skyrocketing Value of “On-Demand Proof” Live Content

Live sports viewership is steadily declining. Yet, the cost of broadcasting those games is steadily increasing. Although the fragmentation of the media landscape and shift to on-demand viewing has diminished the TV ratings of traditional sports leagues, these same dynamics have also placed an outsized premium on live viewership and engagement.

Despite the fact that the majority of consumers — and the vast majority of younger ones — prefer on-demand content, 89% of fans prefer to watch sports live. Live sports are the last mass aggregator of concurrent, culture-defining, live viewership that remains in the post-Netflix world. Even if viewership numbers aren’t what they used to be, as live sports now play such a unique and differentiated role in our culture, they are more valuable than ever. The communal nature of live viewership is irreplaceable, and the entertainment properties that are built on the unique power of this experience generate outsized value in an increasingly on-demand world (we wrote about this trend here).

Brian Rolapp, Chief Media and Business Officer for the NFL, explains:

“As the world fragments, we actually become more valuable because we are one of the only things left that can aggregate tens of millions of people in one place at one time.”

This inflating value is supercharged by the competitive dynamics of the “Streaming Wars”.

Despite their declining revenues, legacy linear broadcasters can’t afford not to pay more for live sports rights, because they’re essentially the glue holding the pay-TV bundle together. 82% of pay-TV subscribers say they would reduce or cut their subscription if they didn’t need it to watch live sports. This is why, even as the viewership for the Super Bowl declined by 17% between 2017 and 2022, the price for a 30-second commercial has increased by 25%. Live sports have become the tallest tree in the shrinking forest of broadcast TV. In 2005, 14 out of the top 100 most-viewed TV broadcasts were live sports events. In 2021, live sports accounted for 43 of the top 50 most-viewed broadcasts.

And on the other side of the spectrum, an expanded field of well-capitalized streamers are engaged in an unprecedented spending spree (in 2021, the total global content spend increased by 14% to $220 billion). As the crown jewel of IP properties with built-in fandoms, live sports rights have become an increasing priority for the combatants of the “Streaming Wars”. 74% of sports fans say they’re more likely to subscribe to a streaming service if it gives them access to their favorite league broadcasts. So, whereas the bidding wars for sports media rights used to be between a few broadcast and cable networks, that pool of competitors has now expanded to include mass-market OTT platforms (Hulu, Amazon Prime, HBOMax, Peacock, Paramount+), pureplay sports OTT (DAZN, ESPN+, FuboTV), and even social media platforms (Facebook, Twitch, YouTube).

That’s why the collective value of live rights between the top four US sports leagues has increased by 400% over the past 10 years.

The NFL has almost one million fewer weekly viewers today than it did in 2010. However, when it renewed its live rights deals with broadcast partners last year, the value of these packages more than doubled, bringing in $113 billion. This trend is consistent throughout the major sports leagues around. The NHL’s viewership is nearly half of what it was in 2010, and it recently doubled the value of its live rights package.

As the market dynamics that are driving these valuations persist, so will the trend of growing media rights fees. Global sports media rights are expected to bring in $85 billion annually by 2025, a 75% increase from 2018.

Considering the fact top leagues make up to 50% of their revenues through live media rights, the sudden doubling of these valuations has led to billions in incremental annual revenues for leagues and teams.

The value of this crucial revenue stream is being even further inflated by the third and final macro market tailwind: legalized US sports betting.

3) The Legalization of Sports Betting in the US (and Canada)

The legalization of sports betting in North America is enhancing the value of teams and leagues both directly and indirectly.

In terms of direct revenues, the expansion of legal sports betting throughout the US has unlocked two massive revenue streams that previously didn’t exist: official sportsbook and data partnerships.

For example, the NFL has three official sportsbook partnerships, which will combine to generate $1+ billion over the next three years. Plus, it is making $1.75 billion from an exclusive data partnership to distribute official league data to sportsbooks. That’s nearly $3 billion in new revenue from a source that didn’t exist two years ago.

The indirect impact of legal sports betting is substantial as well. The NFL is projected to earn $1.75 billion in incremental “fan engagement revenue” as a direct result of increased consumption and engagement with the league’s content (a 13.4% increase). This means that the tailwinds propelling the value of live media rights will be supercharged as increased sports betting means increased consumption and engagement around live broadcasts. And as more people engage with the core product, fandom will grow, which will grow all of the tangential revenue streams outlined above.

These effects are only beginning. Online sports betting is only legal in 19 states at the moment. Only 27% of the US population currently has access to legal online sports betting. But by 2025, 96% of Americans will have legal access to online sports betting, and that market is expected to reach $60 billion by 2026 (a 14% CAGR from 2019). Considering the fact that 79% of current and potential gamblers say they would watch live sports more often if legal betting were available in their state, and 63% say they would pay more attention to games if / when they have legal access to sports betting, as access to legal sports betting grows, the direct and indirect revenue opportunities for leagues and teams will continue to grow as well. Especially for teams, which will be able to reap the rewards when their local markets go live.

4) Content Globalization

In the early days, pro and college sports were regional. Fans only had access to their local teams via local broadcasts and the in-stadium experience. Then, with the birth of cable and ESPN, sports fandoms became national. Now, in today’s era of streaming and social media, entertainment companies — and by extension, sports leagues — are increasingly becoming global enterprises.

Not only are local streaming markets around the world catching up to the US, but these international content markets are becoming interconnected by global platforms.

- 2020 European SVOD Market: $14.6B → 2025 projection: $18B (11% CAGR, compared to a 4.5% CAGR for the US)

- The Indian streaming market is expected to grow by $15 billion over the next decade (25% CAGR)

- The Asian streaming market is expected to grow by 21% year over year between 2020-2030, with a $372 billion market potential

- In 2021, the Latin American streaming market grew by 20% YoY. It’s projected to grow at a CAGR of 18% between 2020-2025.

- In 2021, Netflix, Amazon Prime Video, Disney+, and Discovery+ increased their European subscriber base by 4600% YoY.

- HBO Max will be in 21 markets by the end of the year. SkyShowtime (by Paramount) will be in 60.

As a result of this global streaming boom, leagues that were once only viable in their own nations are now becoming global IP properties. Their addressable audiences are skyrocketing.

European Soccer embodies the value of global content exportation. The 2020 UEFA Cup saw its viewership in India increase by 229% over its previous tournament in 2016. Viewership rose by 42% in China and 32% in the US.

As a result, media rights for the top 5 European soccer leagues rights are expected to balloon from $12.8 billion to $31.9 billion globally in the next five years (149%). And much of that is from international markets like the US (ESPN, NBCU, and Amazon are now paying a collective $8.2 billion to broadcast European soccer in US markets).

Building off this same dynamic, the top Indian cricket league is expected to increase the value of its media rights by 155% to $6 billion.

This tailwind has the potential to add billions of incremental revenue to other leagues in the US and around the world. Despite the fact that 2022 was the first year there was a Super Bowl telecast on a Spanish-language network, the NFL has 28+ million fans in Latin America, and 78% of sports fans in Mexico consider themselves NFL fans. In 2021, NBA viewership increased by an average of 26% YoY across the top five European markets.

Expanding the addressable market of sports leagues and teams can have substantial ripple effects in terms of league valuations. First and foremost, the lucrative live media rights can now be sold at premium values not just domestically, but in local markets across the globe. And increased viewership of that core product will boost all tangential revenue streams — from gaming to consumer products, gambling, and beyond — in each of those markets. Significantly multiplying the value of each league and franchise.

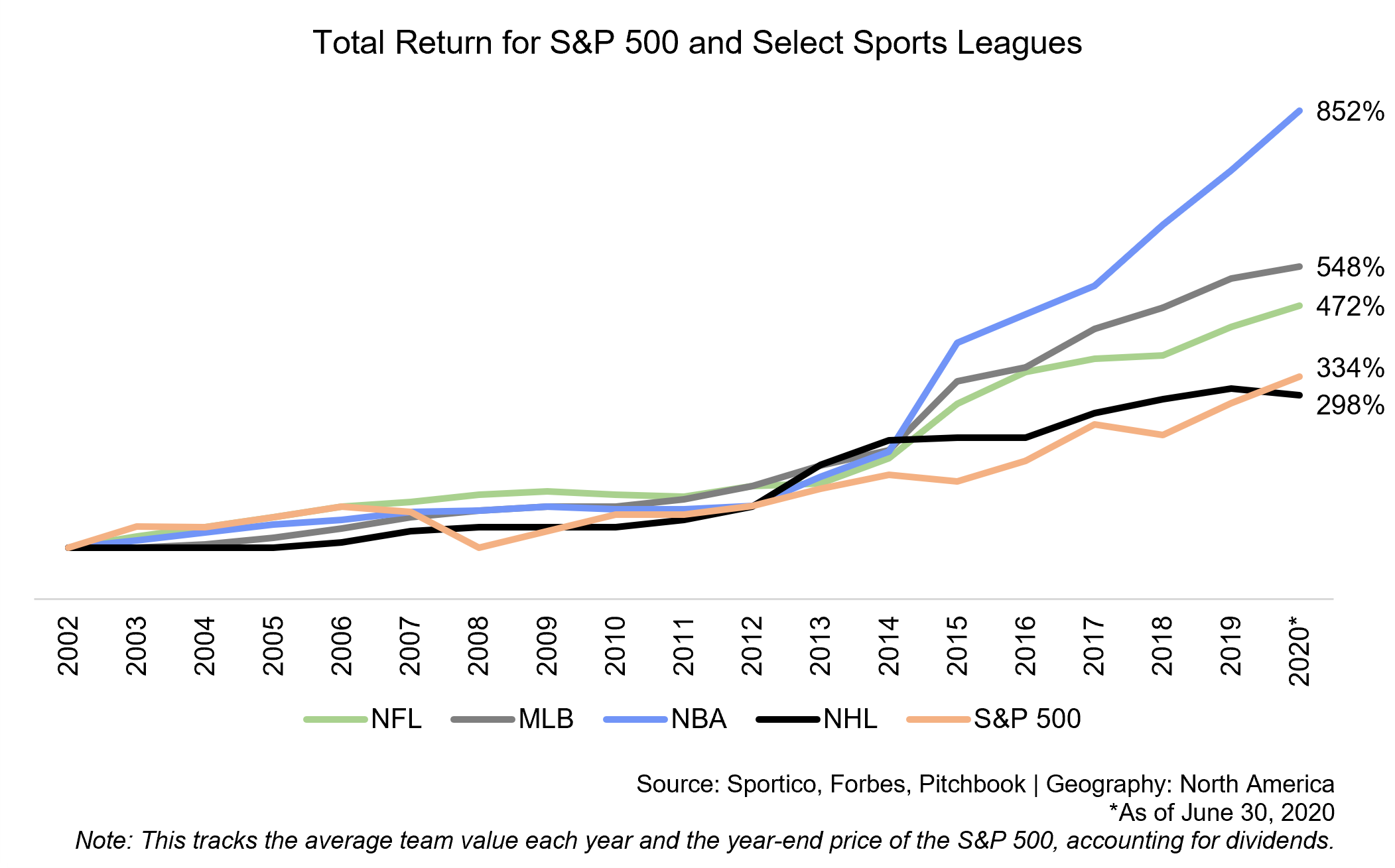

These powerful tailwinds have converged to propel the valuations of sports teams, and therefore the leagues that they encompass, to new heights.

- The average team within the “Big 3” US leagues (NFL, NBA, MLB) has increased its valuation by 400% since 2011.

- In 2021, the average MLB franchise increased its valuation by 18% over the previous year

- In 2021, the average NFL team increased its valuation by 14% year-over-year

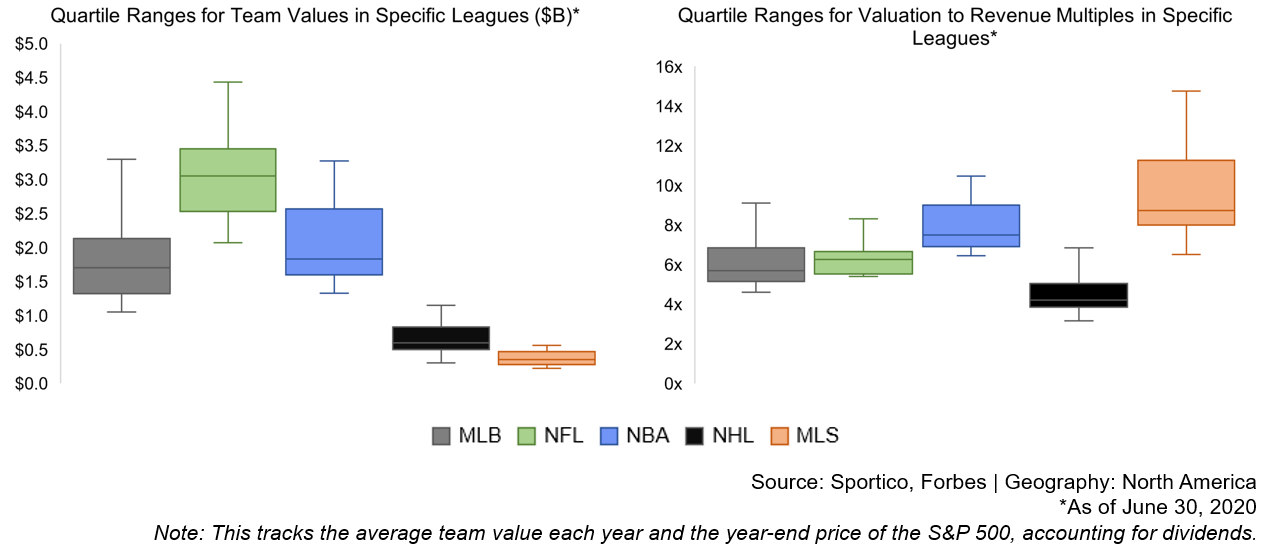

- Valuation multiples for traditional teams range from 4-12x revenue, significantly higher than traditional media companies, which typically trade at 1-5x revenue multiples.

The convergence of these modern market dynamics explains the rising tides that are lifting all the ships of sports teams and leagues. But the reason for the sudden capital influx differs for traditional incumbents and upstart “challenger leagues”. So let’s take a quick look at the specific dynamics for each asset class.

Why is investment capital suddenly pouring into incumbent sports leagues and teams?

1) Updated League Regulations

In 2019, the NBA, MLB, and MLS updated their bylaws to enable minority ownership transactions with institutional investors. This regulatory change essentially created a brand new asset class and opportunity lane for private equity funds to mobilize around.

And mobilize they did. In addition to the five dedicated funds listed at the top of this report, many generalized PE funds like CVC Capital Partners, Silver Lake Partners, and KKR have also been aggressively pursuing this new investment opportunity.

2) Liquidity

Despite the skyrocketing valuations of sports franchises, the owners don’t reap the benefits of year-over-year growth with the immediacy that you might expect. In reality, these assets are more like real estate investments: long-term holds and flips.

These are capital-intensive assets, and the lucrative media rights deals that generate about half of their revenues are typically structured as 10-year deals with built-in escalations, similar to long-term real estate leases.

For owners, this new influx of PE capital is a way to raise growth capital that they can either use to realize ROI during an unprecedented growth period, or to raise growth capital to reinvest in continued empire building.

For investors with war chests big enough to provide capital solutions to team owners seeking to liquidize their assets, the return prospects are compelling due to the tailwinds outlined above. Generally, minority stakes investors target 15% to 20% gross annual returns.

3) The Scarcity Principle

One factor that makes established leagues and teams especially valuable is not a tailwind of the modern market, but rather, it’s a timeless economic principle: Scarcity.

Between the NFL, NBA, MLB, MLS, and NHL, there are only 151 teams. And there are only 98 teams across the top five European soccer leagues. The limited number of teams, mixed with the highly infrequent trading nature (teams often go 30+ years without ownership changes), means that buyers bid the price up when teams come up for sale.

Additionally, these leagues have strict rules around expansion, which means that owners do not have to worry about their value being diluted by new entrants. Owners must vote on expansions and are incented to keep the supply low, and if they do choose to allow expansion, the team owners are rewarded with lucrative expansion fees.

As the demand for sports IP continues to explode, the supply for the most valuable assets remains consistently scarce. This makes it a great bet for investors seeking to de-risk their portfolios.

Why is investment capital suddenly pouring into “challenger” leagues?

1) “Passion Economy” dynamics are enhancing the viability of “challenger leagues”, while eroding the competitive moat of the incumbents — especially with younger fans

Although the fundamental dynamics of the “Passion Economy” have strengthened the traditional leagues, they’ve also breathed new life into their competition (remember, a rising tide lifts ALL ships).

In today’s consumer landscape, micro-communities are positioned to flourish like never before. This is a dramatic paradigm shift. The sports world used to be a zero sum game: there were the “Big 4” leagues, and then there was everyone else. Real estate on TV for live broadcasts was a limited commodity, already saturated by the major leagues. So the ability for non-core leagues to cultivate, grow, and monetize fandoms was extremely limited.

But now, with the proliferation of streaming and social media, “challenger leagues” are empowered to find their fans. And fans of these leagues are empowered to find each other.

This is especially true for younger fans. Previous generations inherited their fandoms through a scarcity of choice. Only the top three leagues, plus the biggest college football and basketball games, were easily accessible via national TV broadcasts. So that’s who we watched and rooted for. But now, especially for digitally-native consumers who are still developing their fandoms, there’s an unlimited abundance of consumer choice.

As a result, younger audiences are beginning to veer away from traditional sports allegiances. Only 53% of Gen Z consumers identify as sports fans. That’s down from 69% of millennials and 63% of adults overall.

This democratized consumer landscape is simultaneously a threat to incumbents and an opportunity for challengers. Esports exploited this dynamic to launch an overnight empire. Esports were born on social platforms like Twitch, YouTube, and Facebook. Intensely passionate communities emerged in these environments, and these fan communities have been supercharged by tangential social platforms like TikTok and Discord.

As a result of this digitally-native fan-first strategy, esports have replaced traditional sports fandoms for many Gen-Z consumers.

- Esports are already more popular among Gen Z than MLB, NASCAR and the NHL. And the total esports audience in the US (84 million) is bigger than the audience for the NBA, MLB, NHL, and MLS.

- 79% of eSports viewers are under 35 years old. For comparison, here are the average audience ages for legacy leagues: MLB = 57, NCAA Basketball and Football = 52, NFL = 50

Now, upstart leagues are recreating the esports playbook. The best example is the Drone Racing League, which has raised $80 million in investment capital. DRL is broadly available, being broadcasted across 15 platforms, plus Twitter. In 2021, it more than doubled its viewership to 250 million. The championship match reached 21 million viewers on Twitter alone (for comparison, the 2021 NBA Finals on ABC only averaged 9.91 million viewers). Additionally, the league has an extremely young and differentiated fanbase. It’s going after the 39% of Gen-Z who says they don’t watch traditional sports at all. 70% of DRL fans don’t engage with the big five sports. In addition its huge live viewership numbers on Twitter, the DRL is constantly engaging with its young community on social media. Its TikTok account grew by 400% in 2021 to 400 million followers, more than both the NHL and MLS, and almost as much as the MLB.

This playbook is replicable for other challenger leagues. And investors are mobilizing to capitalize on this unique market moment.

2) Capitalizing on modern market tailwinds to achieve ROI at a much lower cost-of-entry

The same macro market tailwinds that are converging to propel the valuations of traditional sports leagues are also having the same effects on challenger leagues. These rising tides have equally lifted all ships in the sea of sports leagues.

And although challenger leagues are not expected to achieve the nearly same scale as the incumbents, they offer similar ROI profiles. But at much cheaper entry costs. Investors can spend far less money on far more substantial ownership stakes. And in some cases, the returns on challenger leagues could be even greater. For example, Providence Equity Partners paid $125 million for a 25% stake in the marketing and media arm of the MLS, and sold it five years later for 3x ROI.

There is more than enough consumer passion and investor capital to go around, and as the cups of the incumbents overfloweth, much of it is trickling down to the upstarts and challengers. PE firms are raising multi-billion dollar funds just to buy minority stakes of single teams in traditional leagues. Meanwhile, an investor could buy an entire MLS franchise for the cost of a fractional share of a team in one of the “Big 3” leagues, and the entire XFL was recently purchased for just $15 million.

Investors can even hedge against the increased risk and volatility of upstart leagues by investing across a diversified portfolio of challenger brands. Certain funds, like Arctos and Redbird, are doing both.

How Will This Trend Evolve in 2022? Predictions for the Future of Investments in Sports Leagues & Teams

Incumbent Leagues & Teams

1) More incumbent leagues will update their bylaws to allow minority acquisitions from institutional investors, and leagues that already allow it will begin to allow majority buy-outs.

The most notable league that still forbids minority ownership sales is the NFL. We expect this will change in the near future, as NFL owners will seek to capitalize on the capital influx of private equity partners without selling their teams entirely.

Meanwhile, leagues that already allow minority ownership sales, like the NBA, will increase the stakes that institutional investors are able to purchase. Perhaps they’ll even be allowed to acquire entire franchises.

As valuations continue to skyrocket (the Denver Broncos will reportedly be on the market with an asking price of $4 billion), the pool of private owners who can feasibly purchase a team outright is dwindling. By enabling institutional investors like PE funds, and even other strategic buyers (some examples outline below), leagues can allow franchise valuations to exceed the means of private ownership groups. And at the rate these valuations are currently multiplying, this update may be necessary in the near future.

2) Traditional leagues will spin off media assets to raise growth capital by monetizing the soaring valuations of media rights

As we outline above, due to the dynamics of today’s global content market, media assets have become the most valuable revenue-drivers for leagues across the world.

At the end of 2021, we began to see some major leagues begin to capitalize on this unique market moment by spinning off new entities containing certain media assets, and selling minority stakes of those assets to private equity investors.

- La Liga, Spain’s top soccer league, created a new company to hold its media rights, and sold 8% of that venture to CVC Capital Partners for $2.3 billion. CVC said it expects to sell its stake within 10 years.

- The top two leagues in France have followed in La Liga’s footsteps, and created a new holding company for all of theirmedia assets. This entity is valued at $10 – 14 billion, and private equity funds from around the world (like Ardian and BPI, CVC, Advent, Bain Capital, Apollo, Bridgepoint, EQT, KKR, and Silver Lake) have been bidding on stakes from 10 – 15%. It’s unclear if the league will sell the entire stake to one bidder or sub-divide it between a pool of them.

- The NFL has put its media company — which owns assets like NFL Network, RedZone and NFL.com — on the market. It’s willing to sell up to 49%. So far, bidders have included the traditional private equity players, as well as strategic buyers like Amazon.

Many of the world’s top leagues are now locking into media rights deals that will last up to 10 years. Selling off minority stakes of these assets can be a way to double down on the momentum of today’s market headwinds, while also hedging against any future market volatility over that time horizon. For investors, it’s a way to concentrate their investments around the healthiest and most sustainable league revenue streams, without having to acquire stakes in local teams, whose valuations are based on more unpredictable variables like ticket sales and team success.

We expect other leagues, like the NBA, MLB, and EPL, to dip their toes into the water with similar strategies in 2022 and beyond.

3) Institutional investment capital will flow towards leagues and teams across emerging international markets

As international media markets grow and become increasingly interconnected, live sports rights will become an increasingly valuable tool for local and global broadcasters seeking to onboard new subscribers.

The projected 155% price increase for Indian cricket broadcast rights are driven, in large part, by the fact that Disney, Paramount, and Sony — in addition to local players — are all bidding on these rights as a means of capturing this vital emerging market. In anticipation of these tailwinds, global investment funds like Redbird Capital and CVC Capital Partners have each recently acquired minority stakes of Indian cricket franchises at valuations of $250 million and $736 million respectively. Far cheaper than the cost of traditional American franchises, despite the fact that there are 603 million IPL cricket fans living in India — that’s almost twice as big as the entire US population.

With cheaper entry-costs and larger addressable markets, we believe this attractive investment profile will draw institutional funds to international leagues and teams. We believe more investment capital will flow towards types of assets. Chinese basketball, Mexican soccer, international rugby, and more.

4) Strategic investors will begin acquiring stakes of teams, leagues, and their media assets to consolidate synergistic assets for scale.

Although sports leagues and teams are a new asset class for institutional investors, the private equity playbook is time tested. Acquire and consolidate complementary assets for scale, and flip for big returns via sales or IPOs.

Specialized private equity funds have formed around this new asset class for exactly this purpose. But, as we outline above, sports teams and leagues are not an insular sector. They thrive at the intersection of several growing industries. Therefore, outside of traditional and sports-specific private equity funds, there are many types of strategic investors who can feasibly carry out this strategy by leveraging their existing resources, infrastructure, expertise, and relationships.

For example, Endeavor, the world’s premier talent agency — which has also acquired leagues like the UFC and PBR (Professional Bull Riders league), in addition to other in-house functions like sports media rights sales, production, streaming, sponsorship sales, marketing, licensing, and live events — recently acquired nine minor league baseball teams, which its putting under the management of a newly-formed entity called Diamond Baseball Holdings. The group will oversee ticket sales, sponsorships, naming rights, food and beverage, and media rights for all nine teams.

There have been other recent examples, like Amazon bidding on a 49% ownership stake in NFL Media, or Liberty Media acquiring Formula 1.

We believe this trend will continue in 2022 and beyond, as other strategic buyers enter the pool of bidders for sports teams and leagues. Perhaps Candle Media will acquire meaningful minority stakes of league-owned media assets. Maybe Live Nation will invest in experiential leagues like NASCAR. Or will a hospitality conglomerate invest in leagues like the PGA or Formula 1? (Formula 1 generates $2 billion in annual hospitality revenues surrounding their live events). Perhaps a gaming company like Activision Blizzard or Epic Games will want to invest in a team or league to leverage that IP across gaming, esports, and the metaverse. Or maybe a commerce and collectibles company like Fanatics or Nike would seek to acquire an ownership stake to further verticalize its merchandising efforts. This logic also extends to challenger leagues. Maybe Red Bull will buy the XGames or T-Mobile will purchase the Drone Racing League.

5) Investors with scaled, diversified portfolios of minority stakes in traditional sports teams and media assets will go public via SPACs and IPOs, or sell them to giant strategic buyers

The goal of the private equity playbook is the exit. And because of these perpetually-escalating valuations, the logical conclusion for many of these buyers is an IPO.

However, because the bylaws of most traditional leagues prohibits a single team from IPO’ing, we expect many of these funds themselves to IPO. Or to spin off holding companies for their diversified portfolios of ownership stakes and take them public via SPAC or IPO. Alternatively, PE buyers can sell off assets, or their entire portfolios, to behemoth strategic buyers like the ones listed above, who could build immense value integrating them into their existing assets. This process will begin in 2022 but likely come to fruition a year or two down the road.

Challenger Leagues & Teams

1) There will be investments to launch dedicated “Creator Competition” leagues

Ever since YouTubers Logan Paul and KSI squared off in a boxing match in 2018, we’ve seen a surge in “Creator Competitions” — marquee athletic events between creator personalities (we wrote about this trend here).

Between 2019-2021, we tracked 20+ major Creator Competition events and capital raises, including a boxing match between Logan Paul and Floyd Mayweather, which generated $50 million in pay-per-view revenues. Although Creator Competitions have cashed in on the convergence of powerful trends with some tentpole events that have generated eye-popping viewership and revenue, that’s pretty much all we’ve seen to date. With the exception of Triller’s Fight Club and Verzuz, which was acquired by Triller, so far the Creator Competition trend has been a series of well-executed cash grabs.

However, we believe that we’ll soon see the launch of companies, leagues, and platforms focused on the Creator Competition model launch, pursuing a vision of long-term enterprise value growth.

Will Warner Media spin off House of Highlight’s “Showdown” franchise into a standalone league, with tentpole events airing exclusively on HBO Max?

Or maybe we’ll see a well-connected operator raise capital to launch a dedicated league.

Or perhaps a platform like TikTok or YouTube, which has homegrown talent and is already trying to grow its livestream business, will invest in a standalone league. They can use their viewership data to identify talent, use the league to build their audiences, host exclusive “top-funnel” content on their platform, sell exclusive merch, and ultimately hold the exclusive broadcast rights for the live events.

There are many different paths this model can take. But we’re confident that it won’t stay in its current stage for long. We’ll soon see real business emerge to capture this opportunity, powering all the revenue streams that accompany pro sports leagues: media rights, ticket sales, sponsorships, merchandise, and more.

2) Media companies and sportsbooks will acquire and incubate upstart leagues

As we outlined above, the value of sports content is inextricably linked to the dynamics defining the entire global media market: the “IP Wars”. So it makes sense to look to the world of the “Streaming Wars” for inspiration. In an effort to reduce their increasingly staggering content acquisition costs, many top streamers have turned to verticalization. They’re building out their own production studios, and in many cases, acquiring studios, to create exclusive content in house.

For many top platforms and broadcasters, live sports media rights have become the most expensive content to acquire. The same can even be said for sportsbooks, who are now spending billions of dollars on exclusive content as a means of acquiring and retaining consumers in an increasingly crowded and commodified competitive landscape (we wrote about this trend here).

Although traditional leagues are far too expensive to acquire, challenger leagues could present a compelling opportunity for verticalized sports content. Sportsbooks are especially well-positioned to capitalize on leagues that may not be valuable purely on the basis of reach and audience scale. For example, DraftKings already licenses the live rights for certain international table tennis matches. Dozens of games are streamed live on their mobile betting app, often after midnight when no other US sports are in action. The result? In March 2021, $9 million was wagered on table tennis in the state of Colorado alone. That’s more than the total betting volume for golf and MMA combined during that period.

DraftKings co-founder and CEO Jason Robins explained the phenomenon:

“I think it really fits well with in-game betting with the point-by-point nature. And it doesn’t have to be a lot of money. It can be betting 25 cents and having a great time. That epitomizes what I think our product should be about — giving people enjoyment for not a lot of money.”

There are many small, niche leagues that fit this profile. Having their exclusive broadcast rights on a particular sportsbook would be an effective way to boost retention and customer stickiness. And accumulating a diversified portfolio of niche, owned-and-operated leagues that are broadcasted live around-the-clock would help differentiate a sportsbook from the “sea of sameness” that currently characterizes the landscape. And a sportsbook could acquire several of these leagues for the cost of a minority share of a single traditional team. The revenue-per-user for these leagues would be far greater in this context than on a traditional ad-driven broadcast. For a sportsbook, or even a betting-enabled streamer like FuboTV, the ROI is certainly worth it.

Streaming and social media platforms could also reap the benefits of this verticalized approach. Major OTT and social media platforms could also use upstart leagues with strong Gen-Z fandoms to cultivate market share with younger viewers.

Should Twitter acquire the Drone Racing League outright? Despite its favorable viewership numbers and demographics, it would be a relatively cheap acquisition compared to traditional leagues and teams, considering it has only raised $80 million to date. Or maybe Disney could buy it and make its live broadcasts exclusive to ESPN+? Maybe Twitch will follow a similar path and acquire Fan Controlled Football, its content partner, which recently raised a $40 million Series A. Or perhaps NBCU will acquire the Premier Lacrosse League entirely, rather than simply act as its broadcast partner.

Outside of the acquisition path, we may also see media and betting platforms incubate their own leagues. An analog example of this would be how ESPN created the XGames as a made-for-TV franchise in 1995. What would the modern day equivalent of this be? TikTok, YouTube, or HBO Max (via WarnerMedia’s other subsidiary, House of Highlights) launching its own Creator Competition league? Nickelodeon building off the momentum of its “Slime Cup” and its kid-centric NFL broadcasts to incubate a made-for-kids sports league? Or maybe DraftKings can incubate its own made-for-betting league with competitive formats designed to fit its UX and drive its KPIs.

In 2022 and beyond, we expect Hollywood’s trend of vertical integration to manifest itself in the world of upstart sports leagues.

3) Upstart and challenger leagues will embrace the “Ownership Economy” through the blockchain and NFT’

In 2021, a new subsect of the “Passion Economy” was born: the “Ownership Economy”.

The mass adoption and integration of crypto has allowed creators and brands to drive value beyond merely transacting with their fan communities. Through the implementation of digital scarcity, Web3 is enabling creators to monetize and engage their audiences in revolutionary new ways. Through limited-edition drops and auction models, creators are able to create and monetize new classes of superfans — which can be capitalized upon far beyond the price of a branded hoodie. In these ecosystems, fans transcend the role of mere consumers. They become shareholders and collaborators. Their incentives are completely aligned with those of their favorite creators.

The result is the “Ownership Economy”, which blurs the line between creators and fans into communal ownership. It reveals a glimpse into a possible future where all platforms are built, operated, funded, and owned by their users.

We’ve already seen some upstart leagues embrace this opportunity. The Fan Controlled Football League is handing management responsibilities for four of its eight teams to existing NFT communities: the Bored Ape Yacht Club, the Gutter Cat Gang, Knights of Degen, and 888. Stakeholders of these NFT communities will be co-owners in FCF franchises, and will be able to directly contribute to the on-field playcalling. FCF also plans to sell its own NFTs, allocating 8,888 customizable avatars for each of the four new teams. NFT owners will contribute to the team name and logo design processes for the new expansion clubs, the drafting of players, and playcalling. FCF is also planning some real-world perks.

Similarly, the Premier Lacrosse League has issued one “Owners Pass” NFT for each of its eight teams. These NFT’s aren’t merely digital collectibles. They give you many of the real-world perks associated with actually owning a team: season tickets, mid-season call with the team’s head coach, tickets to the awards ceremony, a call with the league’s co-founders, and a championship ring if your team wins.

Web3 empowers challenger leagues to leverage the tailwinds of the “Passion Economy” by elevating their community from fans to partners. This is a strategy that traditional leagues won’t allow, thus providing challengers with a unique opportunity to make headway in an increasingly “fan first” competitive environment. There is currently a DAO that’s seeking to raise $4 billion to purchase the Denver Broncos. This would symbolize a utopian ideal for sports fans: a franchise by the fans for the fans. But NFL bylaws likely won’t allow this, and even if they did, the fellow owners likely wouldn’t ratify it. Traditional leagues are embracing NFTs via digital collectibles like NBA Topshot, but that’s different than harnessing the power of Web3 to extend ownership stakes to fan communities.

The incumbent’s loss is the challenger’s gain. For young, digitally-native fans who seek deeper connections with their most beloved IP, buying a digital highlight, which only has utility as a collectible, won’t be enough. Challenger leagues will leverage the full potential of the blockchain to reimagine the “Passion Economy” on which sport empires are built.

4) The most valuable challenger leagues will be the ones that uniquely leverage modern “passion economy” tailwinds to develop a differentiated value prop that appeals to the next generation of fans.

Personality-Driven: Turn athletes into influencers. 72% of Gen-Z consumers follow social creators online, which is nearly twice the amount that follow athletes. But Gen-Z fans are still more loyal to athletes than teams, favoring athletes over teams by a margin of 2-1 compared to Baby Boomers. Give players equity (like the PLL). Develop “Creator Funds” (like the PGA and Super Golf League) to reward athletes who best evangelize the league and bring in younger fans. Mic up players on and off the field. Use personality-driven shoulder content on streaming and social media to empower them to engage with fans as the face of the league (e.g. Formula 1 and WWE). Athletes will be your best marketers.

Socially-Interactive and gamified broadcasts: 38% of Gen-Z viewers use a second screen while watching live sports. Social integrations into broadcasts keep young viewers engaged by merging their first screen content and second screen interactions. Customize the broadcast experience by allowing consumers to choose their own audio feeds and graphic overlays. Gamify the broadcast with interactive polls, competitions, and free-to-play betting.

Flexible digital-first content strategy: Find your fans. The challenger leagues that succeed will live on the same platforms as younger fans. That means live broadcasts on free social and streaming media, as well as non-stop, bite-sized, personality-driven content across social networks. Gen-Z won’t adapt their consumption habits to find leagues, so leagues must adapt their content strategies to find Gen-Z. Although this strategy would limit the lucrative fees for exclusive live broadcast rights, it will be an essential component of the sequencing strategy for upstart leagues: first, build scaled and passionate fandom through broad digital distribution, then monetize that community by selling exclusive rights to one or two bidders. That playbook has proved successful for top esports leagues, and we expect other challenger leagues to follow it.

Made-for-betting competitive formats: 79% of sports fans say they watch more sports when they can legally bet on the games, and 63% say they are more engaged in a sporting event when they’re betting on it. Upstart leagues that are being developed in a post-legal-gambling era have the unique opportunity to shape their content strategy and competitive formats to thrive in this consumption context.

Conclusion

As the consumer economy continues to evolve, the sports industry is becoming more valuable. And as the fountainhead of value within the sports ecosystem, teams and leagues are seeing their valuations skyrocket. This dynamic is providing unprecedented growth opportunities to investors and operators alike, across both traditional and “challenger’ leagues.

Through our client work, RockWater has been deeply immersed in this space from all angles. If you’re interested in discussing how to capitalize on this unique market moment, please reach out! You can reach us at andrew@wearerockwater.com or ping us here. We love to exchange strategic insights.