Why Creators are Launching Investment Funds and Why Savvy Founders are Watching

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we discuss various announcements of creators launching their own VC funds and explore the factors driving this trend.

Creators are the new strategic investors that founders covet.

Why: creators are the tastemakers who drive purchasing decisions.

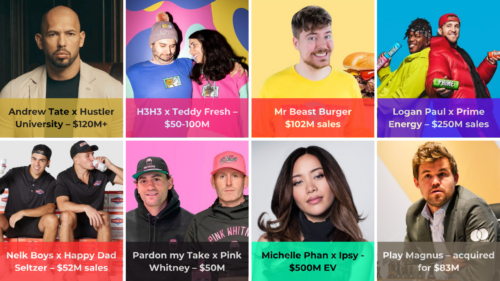

Skeptical? Here’s a small sampling of creator product releases:

📖 Andrew Tate x Hustler University – $120M+ ARR

👕 H3H3 x Teddy Fresh – $50-100M Run Rate Revenue

♟️ Magnus Carlson x Play Magnus – acquired for $83M

🍹 Nelk Boys x Happy Dad Seltzer – $52M sales

⚡ Logan Paul x Prime Energy – $250M sales

🍸 Pardon my Take x Pink Whitney – $50M 2022 revenue

🍔 Mr Beast Burger – $102M sales

💄 Michelle Phan x Ipsy – $500M EV

Good news for founders – much like the celebrities that preceded them, creators are now opening their own investment funds.

The rationale is simple – the top 1% of creators are cash-rich and seek to diversify revenue streams. The most compelling methods of revenue diversification are those where creators leverage their strengths to uniquely add value→ IE – it’s more worthwhile for creators to invest in early-stage CPG brands that they can amplify with their content for VS making passive investments into index funds.

Some creator VC funds that I’ve been watching:

– 444 Capital – D’Amelio family office launched in 2022. Primarily invests in e-commerce brands and marketplaces.

– Upside VC – VC fund by 2 guys from The Sidemen YouTube group. Just exited stealth last month, currently raising capital from LPs.

– Creator Ventures – $20M fund launched by YouTuber Casper Lee and former private equity investor Sasha Kaletsky. Invests primarily in ecom brands, creator tools, SaaS, and Gen AI.

– CreatorLed Ventures – launched by Blake Michael (OG YouTube) in 2022 to invest directly into creator businesses. Limited investments announced to date.

– Animal Capital – $15M VC fund launched by TikTokers Josh Richards, Noah Beck, and Griffin Johnson in 2021. Invests across a wide range of industries.

Looking forward to seeing more top creators launch their investment funds and play an important role in the start-up ecosystem.

💡Bonus business idea: build a platform that enables smaller creators to create investment syndicates (think Angel’s List for Creators). Said platform would democratize access to VC deal flow to more than just the top 1% of creators. Instead of having one big creator back a band, cobble together 1k micro creators.

—

We’re RockWater Industries. We do financial and strategy advisory for media, tech, and commerce. From M&A and fundraising to consumer research and go-to-market planning.

DM our founder on LinkedIn or email him at chris @ wearerockwater dot com