The Case for Increased Investment In the Podcast Industry

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we share an “on the ground” podcast industry report published by our client, the CEO of DWNLOAD Media.

The Case for Increased Investment In the Podcast Industry

2023 was a turbulent year for the podcast industry. You all read the headlines of doom and gloom, and many decided that the podcast bubble had finally popped… or had it?

Not even close.

While those headlines drove clicks, let’s first establish some quick facts:

- Podcasts have never been more popular.

- More listeners are spending more time than ever before listening to podcasts.

- While AM/FM still dominates, podcasting continues to grow exponentially, even surpassing SiriusXM consumption.

- Podcast revenue is growing at 10x the rate of radio and faster than most digital mediums.

Podcasts are… well, you get the point. You’d also know all this if you read The Podcast Consumer 2023 by Edison Research , the IAB Podcast Advertising Report, or literally any fact-based reporting. But it seems like many haven’t, so here we are. Like Howard Beale in The Network, “I’m as mad as hell, and I’m not going to take this anymore!”

Welcome to the DWNLOAD REPORT

Some background: I’m Chris Peterson, and I’ve been in the podcast space since 2013. I created the iHeart Media podcast strategy and led the acquisition of HowStuffWorks, which created the largest podcast network in the world. I later served as the President of Kindred Media at LionTree, the merchant bank that sold companies like Wondery, Serial, and Stitcher, as well as invested in companies like Punchbowl News, Pushkin Industries, and QCODE, to name a few.

In 2023, I launched DWNLOAD Media in partnership with Red Seat Ventures. To simplify things, we are a media roll-up focused on taking majority stake positions in podcast content companies, making them profitable, re-investing profits into valuable IP, and creating new business opportunities and revenue off the back of great audio. There’s a little more to it, but you get the gist.

In the last 250-ish days since announcing DWNLOAD Media, I’ve spent my days talking to hundreds of podcast companies. I’ve traveled from the US to Europe to Asia and back, learning about the podcast industry around the globe. With the help of our partners at RockWater Industries, we’ve done due diligence on more than 60 podcast companies, and we’ve completed deep dives on more than a dozen.

We’ve had deals at the finish line, some of which we’re raising capital to close on now and some of which we’ve walked away from. We’ve met with countless VCs, family offices, and Private Equity funds to close capital. With the literal thousands of hours spent living and breathing the podcast space over the last year, we have a better pulse on the podcast industry than most, from the creator and investor perspectives, and I’m here to share my thoughts on where we’re going, as well as why now is the time to invest in the podcast space with us. Let’s go deep.

The History

Long story short, podcasts in the US came from the rib of public radio. There’s a lot more to it, but really, no major media company outside of NPR was really interested in podcasting until 2015 or so, at least in the US. Pandora did a deal with Serial in 2015 that, seemingly, never really amounted to much more than a big payday for This American Life. In August of 2016, with the idea that all media companies—specifically audio companies—needed a podcast strategy—I pitched iHeartMedia on hiring me to lead the way and we were off to the races.

At that time, Spotify, SiriusXM, and Amazon had yet to enter the conversation. But it wasn’t long before the major audio companies, record labels, and others started to dip their toes into podcasting. M&A activity soon followed. Some deals were good! Others were…well, a bit less good. But by 2016 the podcast land grab was in full swing and the market was frothy.

How Stuff Works, Gimlet Media, Pineapple Street Media, Parcast, Cadence13, Wondery, Serial, Conan, Stitcher (a few times), The Ringer, your buddy down the street who podcasts from his closet, and more… they all got acquired. Many of these companies weren’t even profitable and demanded upwards of a 10x revenue multiple. Yeah, like I said… frothy.

I recently looked back at a pitch deck from a couple of years ago and, to be honest, they were all the same: Wondery sold for X, we’re better for [insert reason here], and we’re going to go from under $1m in revenue to $50m in revenue by 2023!

Narrator: They did not reach $50m in revenue by 2023.

Not even close. And yes, that company (and many others) were able to close their funding rounds with millions.

As an industry and investment community, we enabled unrealistic business models and held nobody accountable.

The land grab did result in things getting a bit out of whack. Not only did companies exit on potentially inflated valuations (good on those who cashed in though!), but we also had companies raising money with business models that never made sense. Podcasts were stuck in the growth-at-all-costs mentality, but there was no justification for how they’d achieve this growth or create a sustainable business. Yes, podcast audiences and revenues are growing (more on that later), but stupid money was pouring into the space like a digital ape with sunglasses.

At the same time, we now had companies spending way too much money. They lacked oversight from a board of directors (some companies never even converted seed investments into equity and had no board at all), celebrities and royal family members demanded insane minimum guarantees, production costs kept rising, and a cycle of spending on the belief that hockey stick growth (and investment) would continue… until it didn’t. Time to grow up, Peter Pan.

The Reality

In 2013, about 7% of the US population listened to podcasts weekly. Today, that’s up to 31%, or 89 million people. These listeners are also sticky. In 2015, they consumed 4 hours and 27 minutes of podcasts each week. Not bad, right? In 2023, after quadrupling the audience, weekly podcast listeners spent more than nine hours per week listening to podcasts. Let’s look at this another way: as newsletters grow, their open rate typically decreases, as it’s hard to scale your audience and increase engagement. But podcasts have seen massive growth, and their consumers have become more sticky. Boom.

As for monetization, we all know podcasting took a massive hit in recent years, right? That’s what the headlines say, right?!

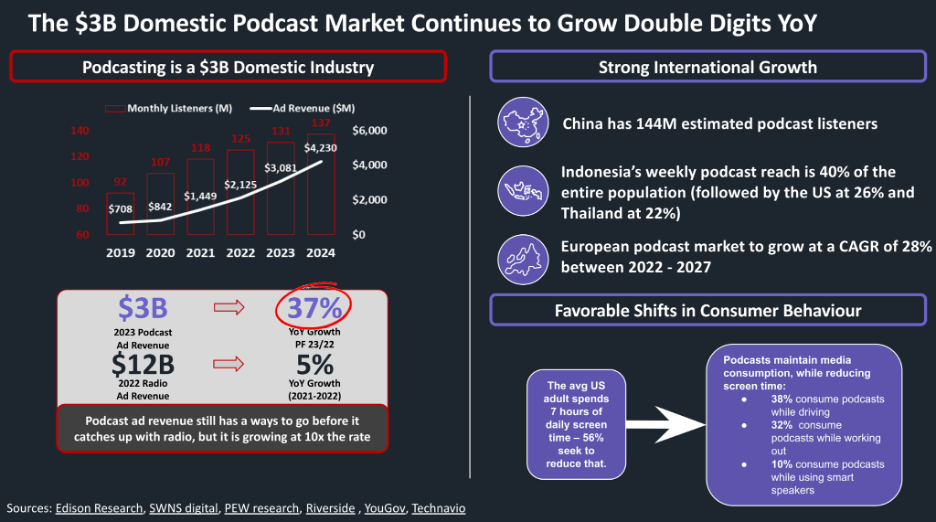

Well, according to the IAB, podcasting ad revenues grew more than twice as fast as total internet ad revenue despite economic headwinds. They also reveal that “podcasting continues to be one of the fastest growing digital channels-posting higher growth rates than social media (4%), paid search (8%), display (12%), digital video (19%), and digital audio (21%)”.

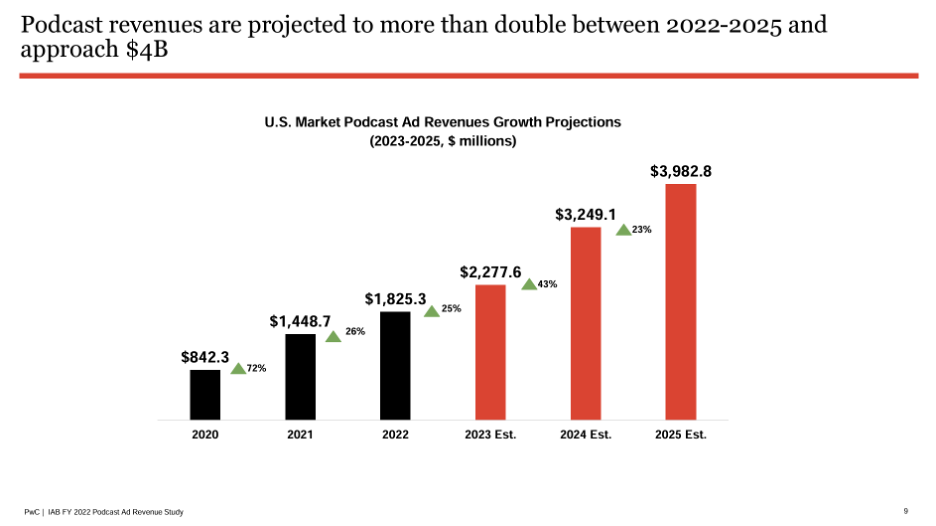

So, the little engine that could (podcasting, that is) went from ≈$100m in US revenue in 2015, grew to ≈$1.5b in 2021, and is expected to balloon to nearly $4b in 2025 (again, IAB) has popped, burst, gone kaput, etc.?

Come on. And, at least so far, we’re only talking about the US here.

Funny how all those articles don’t mention any of this.

At the same time, we had numerous examples of podcasting gone wrong. Spotify, a company that has struggled ever to turn a profit, looked to podcasting as a savior to their inherently bad business model of streaming music. They led the land grab and, as they say, built the plane while in the air.

Some of the deals worked, some did not.

But $1b spent on M&A isn’t that massive on a $40b+ market cap. They have also recently decided to lean into licensing content vs. just buying… And I think that has paid off. From the Joe Rogan Experience to Call Her Daddy, Spotify—like the other major platforms—is realizing just that: It is a platform. They don’t need to own everything. This is ultimately good for high-quality content creators.

So, yes, there are problems. A market correction is happening, which is good for the overall space. It’s painful but necessary. There have been layoffs, but what media sector hasn’t been affected?

The point here is that clickbaity headlines declaring podcasting dead are misleading, if not plain wrong. The data doesn’t lie. Podcasting audience and revenue are growing exponentially, while sectors like gaming are contracting, which is why DWNLOAD Media believes podcasting, while perhaps a bit frothy in the past, is extremely undervalued now.

The Opportunity

Okay, so hopefully, you’re with me that the podcast industry is, at the very least, attractive. Great. What if I were to tell you that we are still in the early innings of growth (or early minutes of a football match for the non-Americans)? Is that something you might be interested in?

So, while podcasting continues to grow in audience and revenue, we also see major tailwinds and opportunities coming to the industry in 2024 and beyond. Here are some of the key inflection points we see in the near term:

New Technology

I cannot overstate how many smart people are coming into the podcast space to create better ad tech and attribution—which, to be frank—is a blue ocean of opportunities. New technologies will undoubtedly increase the ad spend of major brands, increasing the overall ad marketplace globally.

For example, Kal Amin (former Google, Spotify, etc.) and Sounder, an AI-driven insights company, announced last week they would open up their full technology stack to support growing the podcast universe. Expect new products and services to be built on top of their technology that can drive discovery, recommendations, measurements, and audience growth. This is just one of many examples. Watch this space.

Subscription

A handful of singular personalities have been able to create meaningful subscription podcast businesses, but very few networks have, at least in the US. That’s going to change. We’ve seen international markets, which haven’t adopted podcast listening as much as the US, launch successful subscription-based podcast networks. Take Naudio, a Stockholm-based company that creates high-quality audio documentaries and is a successful subscription-only platform in the Nordics. There’s much to learn from companies like this and a massive opportunity for US audio companies. For many high-quality networks, subscriptions will become a significant driver of revenue, if not the majority of revenue, in the next few years. This becomes even more likely with Apple and Spotify supporting (if not aggressively pushing) subscriptions, which is how most podcast networks will utilize subscriptions. However, consider opportunities to own your own ‘plumbing,’ if possible, so you can avoid the app store tax and own the direct relationship with your superfans.

- Note The New York Times launched its audio app, NYT Audio… 👀

Licensing

As mentioned above, platforms have realized they are platforms. And instead of buying everything, they are more inclined to license content. Let’s take a step back… In what other medium do you give away high-quality content? Seinfeld is licensed to Netflix, the New York Times has a paywall (except for The Daily), hell, I even need to subscribe to Apple TV+ to watch a Charlie Brown Christmas! But in podcasting? Nope. Business Wars, Bill Simmons, Crime Junkie, etc. are all free and available “wherever you get your podcasts.”

Now look, I’m not saying the open ecosystem of podcasting and distributing everywhere isn’t good. But I’m also not saying it’s a great thing. Platforms like Spotify and Apple should be expected to compensate high-quality creators for their content, unlocking new revenue streams via licensing or, at least, via marketing. After all, the platforms are building their subscription platforms, outside of podcasting, off the back of content they are getting for free. Seems like it’s time to level the playing field a bit.

International

While the podcast market in the US is growing, there is a massive opportunity internationally, which investors in the US often overlook. Some high-level stats:

- China has 144m estimated podcast listeners.

- Indonesia’s weekly podcast reach is 40% of the entire population and is growing. It is also predicted to have the 4th largest economy in the world by 2045.

- The European podcast market is set to grow at a CAGR of 28% between 2022–2027

These are just a few of the growth opportunities we see, but we see markets that are prime for exponential growth in audience and revenue worldwide. Get your passport ready; we’re going global!

If even two of these four predictions come true, these are seismic inflection points for the entire industry. But, if I were a betting man (I am), I’d bet all four happen. Do any of them sound that unattainable? Again, we’re in the early stages of growth here. As the kids say, to the moon!

The Path

It’s Time to be Real About Production Costs

Podcasts are not episodes of The Sopranos. The P&Ls (mostly losses, few profits) of the last few years are gone. In the same way that signing a celebrity to a seven-figure+ minimum guarantee to make a podcast is likely a bad deal, you cannot expect to make a limited series podcast for hundreds of thousands of dollars and expect to create a successful business, especially when you have no way to market it. It’s unfortunate but true. The rest of the world can create great content with a production budget for a fraction of the cost of the US, which is in line with the realities of the podcast business today; why can’t we?

Well, I have a theory. And it’s likely unpopular. But, as Amplifi Media‘s Steven Goldstein has said, “NPR wrote the playbook.” And, in my opinion, the US market has been playing from the same playbook for too long. Look, this isn’t a knock on NPR. I love the content and people that came out of public radio, many of whom I view as the brightest minds in podcasting. But, as I’ve met companies outside of the US, I realize they aren’t playing from the same set of rules; they aren’t beholden to restrictions of what makes a podcast good or bad. They are giving themselves more opportunities to grow, not only their business but the entire industry. We owe gratitude to NPR and the producers for the path they laid. The rules that work(ed) for public radio still can be sacred to many producers, but as the industry expands, sticking to one playbook isn’t only wrong, it’s irresponsible.

Lowering the cost of production is the most impactful way to increase margins and build a healthy, sustainable business… and industry.

Podcasts, But More

I always tell investors that we are not a podcast company. We are a media company exploiting an undervalued asset, podcasting, in which we find ourselves in a once-in-a-generation time to acquire assets primed for growth and increase in value with the right vision. We aim to find synergies between podcast companies, streamline operations where possible, make the business healthy and profitable, and exploit the IP across various verticals. Live events, publishing, video, merchandising, etc., are all business units that will create new revenue streams, which could become more significant than the actual podcast side of the business. We’ve seen many companies do bits and pieces of this along the way, but it’s incredibly important to have clear strategies in verticals outside of audio, as it not only diversifies your revenue but also allows you to expand into new markets and content verticals.

Think of this: I’ve been bullish on kids’ podcasts becoming a thing for years. But what I hear over and over is that it’s a tough putt for ad dollars. That is true, especially as we haven’t hit the scale needed to generate significant revenue in this vertical but think about what happens when any kids’ IP reaches scale. Why do you think Candle Media bought Moonbug Entertainment, owners of Blippi and Cocomelon, two low-production value YouTube series, for $3b? Not a typo. Billions. Merchandising. Evergreen content that can pass generations. Books. Parents like my wife and I will buy every Bluey toy under the sun and spend hundreds of dollars to see the live show in New York City. I could go on and on…

There are so many opportunities to create an entire juggernaut off the back of kids’ podcasting… you just can’t think of it purely from the old podcast playbook. There’s more to valuable IP than downloads and CPMs. And the growth potential is exponential. Also, lest we forget, every parent is concerned about screen time for the kids—a big opportunity for pods.

Video

YouTube appears to (finally) be getting serious about supporting podcasters. And the question that everyone keeps asking is, does every podcast need a video strategy?

Well, my answer is yes.*

If a podcast is an interview-style show without a heavy edit lift, there is no reason not to use YouTube as one of the spokes in your distribution wheel. But for other projects, the story might be told better via audio, and video could distract from the content (it’d also make budgets insane). So, it’s not a one-size-fits-all solution; each type of content will need its own video strategy.

That being said, YouTube is the 2nd largest search engine in the world with nearly 3 billion users and ignoring it would be akin to not listing your business in Google search. Here is the opportunity: it’s not necessarily about YouTube being the largest platform for your podcast; it’s about exposing your content to a new audience… via a very powerful algorithm. Short clips can be more powerful than full videos on YouTube, so there’s plenty of room to get creative and see what works best for each podcast.

Further, YouTube will be an entryway into podcasts for older audiences and kids. This is a massive opportunity for everyone to increase the already tremendous audience growth for the podcast space.

Then, we have new platforms like Volume.com, which is primarily a live-music streaming platform but has started to partner with music-focused podcasts like Foo Fighters’ Chris Shiflett and Andy Frasco. This is interesting because it’s creating a hub for music fans to find live music and podcasts, connect directly with artists, and more. While the leading platforms like Apple, Spotify, and YouTube will always have the largest share of consumption, I think it’s a huge opportunity to find platforms that cater to a specific community, creating very sticky and engaged consumers… a.k.a. the superfans. [Double Elvis’ Brady Sadler recently dug into this topic, sharing how they view video in their audio-first strategy].

Thinking Global

As mentioned above, the US isn’t the only market experiencing growth. Many markets follow similar trends that the US has already experienced, while some are even outpacing US audience growth, like China and some markets in Southeast Asia. From a revenue perspective, the US is the most mature, which isn’t surprising. While many international markets may never generate the revenue the US does, it’s still incredibly important to consider how a truly global podcast company would have an unfair advantage in the audio ecosystem.

Intellectual Property

The opportunity to share and co-produce content, sharing IP across borders, has yet to be fully explored in the podcast space at scale. There have been many headlines and some examples, but the strategy has yet to be implemented and is a huge opportunity.

- For example, DWNLOAD Media’s investor,Co_Made Sthlm, owns numerous production companies in the Nordics [V66]. This would streamline audio and video production for US IP to Europe while opening a library of proven IP to produce in the US.

In Conclusion

You probably get the feeling that I’m incredibly bullish on the podcast space—and you would be right. However, I’ve got the data on my side, and for the podcast industry, all signs point to continued growth and opportunity. I can tell you with 100% certainty that CEOs are more optimistic now than in 2023… and their financials back them up.

Yes, we will see more rightsizing, and unfortunately, that could come via layoffs or companies folding. There will be increased M&A in 2024 via roll-up strategies (shoutout, DWNLOAD!), similar-sized networks “unifying,” and some acquired lifeline acquisitions. However, it comes, and even if it’s unclear at the time, this is all good for the industry.

If big companies lay off more people, it’s likely more to do with subscriber loss or outside influences (e.g., a platform not hitting subscriber numbers on the overall business vs. a podcast-specific issue). If Joe Rogan leaves Spotify, my guess is because Elon offers him an insane amount of money, or Joe realizes he doesn’t want to work for anyone else. The point is, and I’m talking directly to journalists here, that moves by one or two platforms do not set the course for an entire industry. Look at the data. Or call me.

As I wrote on LinkedIn a few weeks ago, 2024 will be a pivotal year for podcasting. The future is exciting. I genuinely believe that.

For all those who continue to create great content and move this industry forward, let’s keep pushing.

If you’ve ever considered investing in the space, now is the time. As I mentioned, we are in a once-in-a-generation time to acquire assets with incredible upside in the podcast space.

DWNLOAD Media is currently raising capital to do just that.

If you’d like to talk about investing in DWNLOAD Media, let’s chat.

It’s going to be a good year.

I’m the founder of RockWater Industries. We do financial and strategy advisory for media, tech, and commerce. From M&A and fundraising to consumer research and go-to-market planning.

DM me on LinkedIn or email me chris @ wearerockwater dot com