What New Tech Will Solve the Challenges for US Livestream Shopping?

In our last livestream commerce report, we examined how the emergence of key stakeholders and service providers can help close this $463 billion gap. In this report below, we’ll build on that analysis by outlining how new technologies will complement these stakeholders to accelerate US market growth.

———

Brought to you by:

Today’s article focuses on livestream commerce, which is part of the social commerce revolution. We discuss a few key ways to unlock the potential of the US market, and companies like Orca are part of the solution.

Orca is social commerce made easy. It’s a marketplace that helps creators to build their own online store with products from Orca’s catalog. Creators don’t pay a fee or need their own products.

Brands who place products in Orca’s marketplace can bypass paid media because their products are marketed and sold by the most trusted source: creators who curate the products they genuinely endorse.

Some other Orca highlights:

- Think retailer VS an affiliate tool. Orca strikes wholesale deals with brands, enabling a 20% seller commission; ~10x the average affiliate fee.

- Social first. Sellers can share their store via link-in-bio, create shoppable videos in IG Stories and YouTube, and can even text or WhatsApp their products to friends.

- Their marketplace is growing 100+% month MoM

Learn more about Orca by clicking the link here: orcashop.co

———

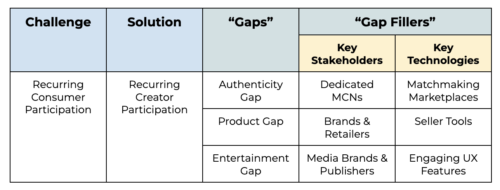

A quick reminder before diving in: The Challenge-Solution Framework for the Livestream Shopping Industry

Our past few articles discussed the various “Gaps” and “Gap Fillers”. Today, we focus on the right side of that chart, the Key Technologies. Let’s get to it…

The Emergence of Creator-Product Livestream Marketplaces

The influx of product inventory into the livestream shopping space, via an influx of brands and retailers, will be a meaningful step in the evolution of the US livestream shopping market. But that alone will not fully close the “product gap”. Nor will it be enough to address the looming “authenticity gap”.

Even when there is enough product volume and diversity to power frequent and consistent habits, one major challenge will still remain:

How will best-fit creators and products find each other?

Let’s look to China again for inspiration.

While China’s top KOL’s like Viya and “The Lipstick King” have large MCN teams around them sourcing hundreds of inbound offers from brands and retailers, they are the exception. According to our Chinese market research partners, China has many more KOL’s than America does influencers, and although the vast majority of these KOL.’s don’t have the resources or the on-platform promotion of their top 1%, many of these “long tail” KOL’s are able to make a living as livestream sellers by going live every night and selling the products that excite them and their followers.

This is made possible, not just because there are 100,000+ brands and retailers pumping product into the ecosystem, but also because Chinese livestream commerce platforms make it easy for KOL’s to access these products. When a KOL logs onto TaoBao Live, Pinduoduo, T-Mall, or Red to plan an upcoming livestream, they can easily search through all of the product inventory that has been uploaded to the platform by brands and retailers, and select products to feature based on what feels authentic to them.

A rudimentary version of this functionality has been rolled out by Amazon Liv — and although these marketplaces are being developed by major social incumbents like TikTok, as well as upstarts like Orca and Buywith — it’s not yet live on any other major US live shopping platforms. For example, on Instagram, even as more and more brands and retailers upload their inventories to the platform’s shopping portal, the products are still siloed from the personalities who can most effectively sell them. Brands and retailers still need to do all of the heavy lifting to create content or find the right content creators to actually drive traffic to their Instagram storefront. And the perfect creator to move the products already available on a brand’s Instagram shopping portal may be engaging a dedicated community every day on the platform, but failing to monetize their influence without any products to sell.

However, we believe this will change in the coming years. We believe that influencer and brand marketplaces, much like the vision for YouTube’s FameBit (though the reality seems to be a more manual matchmaking process), will emerge to connect best-fit products and sellers. As more brands and retailers enter livestream selling, they will need to find the right personalities to maximize their sales. And creators will need to access the products that can allow them to simultaneously delight, service, and monetize their fans.

The right technology will play the role of matchmaker. Perhaps these solutions will be built out by the dominant social platforms. Maybe they will be built by independent solutions providers who partner with, or sell to, the major social platforms. Or perhaps we’ll see these marketplaces built out and perfected by upstart livestream shopping platforms like ShopShops or Popshop Live or NEWNESS, who will join the three key stakeholders in a three-sided marketplace of consumers, creators, and brands / retailers. Meanwhile, dominant commerce platforms like Amazon and Shopify will continue to bridge the product gap from the other side of the spectrum by partnering with, and incubating, influential creators. Even then, these commerce incumbents will need to develop “matchmaking” systems that remove friction for sellers.

Livestream Seller Tools

The independent sellers that are powering the scale of “self-service platforms” like Whatnot and Popshop Live likely won’t have the resources to engage MCNs or creator partners to develop entertaining live programming for their channels and storefronts. In lieu of these personnel-driven service providers, they’ll rely on innovative seller tools that empower them to host entertaining and effective live shopping experiences. These tools will put the functionality of a full studio (editors, producers, etc) in the hands of small teams or even individuals. These features will make it easy to manage both sides of the live commerce equation: live entertainment (e.g. managing pre-stream social promotion, on-screen graphics, audience interaction, real-time production like changing camera / audio feeds, etc) and commerce (e.g. inventory management, frictionless payment / checkout, etc).

These are the tools that “integrated solutions providers” (e.g. CommentSold, BuyWith, Stage Ten, Bambauser, Firework), as well as “self service marketplaces” (e.g. Popshop Live, Whatnot, MARKET) have been investing heavily in. In fact, an executive from one of the top self-service platforms told us that the majority of their tech stack is currently focused on creator and seller tools . Rather than paying big name creators and brands to use their products — and to bring their audiences along with them — they’re investing in cutting-edge tools that sellers aren’t getting on other content x commerce platforms, and getting paid by merchants for access to suites of products that supercharge their digital sales efforts. These products don’t necessarily allow sellers to reach bigger audiences, but they empower them to be more effective with the audience that they do reach. As a result, these companies are able to unlock SAAS business models, which lead to recurring revenues and outsized valuations.

The development of innovative new product suites for creators will unlock a new creator class for livestream selling just like Roblox’s developer tools massively expanded the metaverse creator universe.

———

SPONSORED POSTS

———

Engaging Livestream UX Features

The seller tools described above lessen the need for sellers to invest in MCNs and professional creator partners by empowering them to better engage with and convert their audience Although major brands and retailers will still opt to partner with MCNs to manage their big-budget campaigns, these tools will be essential to onboard independent sellers at scale and optimize their performance. The other side of that equation is innovating user-centric features to enhance the entertainment value of each stream through enhanced interactivity and gamification.

Twitch’s introduction of engaging UX features like emotes, live commenting, and real-time community polls helped the platform become the industry leader in esports livestreaming. Those features have all been adopted in livestream shopping, but just like the content formats we outlined above, a simple “copy / paste” of successful features from other mediums won’t be enough to unlock the mass-market adoption of livestream commerce. It will require unique interactivity and gamification features built specifically for the live shopping experience.

As always, we look to China for inspiration.

The Chinese infrastructure is so developed that sellers can work with the platforms to customize UX tools to drive conversions through new forms of engagement. One Alibaba executive told us that the platform can create any type of user experience that the seller can imagine. For example, users can create digital avatars of themselves, and dress them up in the clothing being featured on the screen. Sometimes they employ demand-driven interaction, like one brand, which announced an upcoming product drop, and only unlocked access to it for each buyer once they hit a certain engagement threshold during a limited time period (likes, comments, shares). Some sellers in China even activate in offline gamification, like when one of the top global jewelry brands enlisted a KOL to host an AR-driven “treasure hunt” around their flagship store in Shanghai.

UX features for buyers and sellers are two sides of the same coin. Sellers will need to be able to toggle and customize their desired feature-sets on the back end, which will translate to unique and engaging user experiences on the front end. Together, these product innovations will offer turn-key solutions to the “entertainment gap”, empowering independent sellers to host engaging streams without the need for professional training, talent, or production support.

In the earlier stages of the US market, it’s likely that smaller sellers will rely on these tools, while bigger brands will use MCNs.

Conclusion

Establishing consistent user habits around livestream shopping will be the biggest key to replicating China’s market. In order for shoppers to interact with these platforms on a daily basis, their favorite creators must also interact daily.

And in order to establish this recurring behavior on both sides of the live commerce marketplace, we must close the “authenticity gap”, the “product gap”, and the “entertainment gap”. Key stakeholders and technologies will emerge to fill these gaps.

It’s already happening. All of the stakeholders needed to make livestream e-commerce successful in America have already arrived (brands, creators, platforms). They’ve begun to experiment with livestream shopping in limited experimental capacities, and as they continue to experience success, the scale of these endeavors will grow.

Some services and technologies have also arrived (e.g. MCNs and seller / buyer UX tools), albeit in nascent and limited capacities. As this infrastructure matures, the key stakeholders will continue to coalesce around these new marketplaces, and the US live commerce industry will continue to gain mainstream prominence.

The US livestream e-commerce market was born in 2020. And over the next five years, we believe it will begin to crawl, then walk, then run.

These developments will enable creators of all sizes to embrace live selling, building frequent habits in the space and inspiring consumers to do the same. Slowly but surely, the paradigm of cultural consumption in the US will continue to shift towards a future where livestream shopping is mainstream.

To Be Continued…

In the next installment of our reports on the US Livestream Commerce market, we’ll break down how the future of the US live commerce market will unfold.

Including:

- What incumbent platforms need to do to win

- What upstarts need to do to win

- How the ecosystem will evolve over the next 3-5 years