19 Influencer M&A Deals Since 2019 + Hasbro Sells eOne for $500M to Lionsgate

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we discuss why influencer representation M&A is heating up, and Hasbro’s new “asset-light” strategy which drove its recent $500M sale of eOne to Lionsgate.

19 Influencer M&A Deals Since 2019

by Chris Erwin

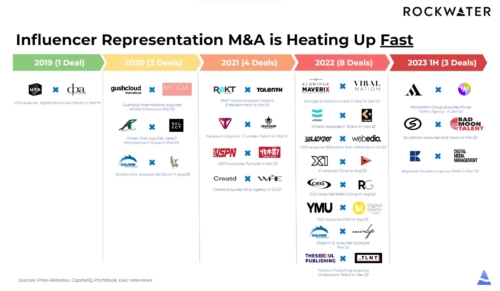

M&A in influencer representation is heating up fast!

We track 19 deals since 2019. Let’s explain why…

IM is table stakes for brands, and is growing quickly.

- $31B in 2023

- 23% CAGR for ‘17 to ‘27

- 53% of co’s are increasing IM spend

So companies are getting more aggressive in IM dealmaking (see chart below).

- ‘19: 1 deal

- ‘20: 3 deals

- ‘21: 4 deals

- ‘22: 8 deals

- ‘23: 3 deals

And there’s an increasing array of buyer-types.

- Influencer talent agencies who want to deepen and diversify their roster

- Traditional talent reps / diversified ad agencies who need to digitize their biz model

- Marketers / prod co’s / leagues / game co’s / trad brands who want to verticalize their supply chain to drive higher margin

- Sovereign wealth / MCNs / IP Rollups / social platforms who want distribution for their IP and alt commercial exploitation

…what buyer-types did we miss?

FYI Our RockWater Industries team enjoys M&A advisory work in this space, and has a lot of deal intelligence. DM me if you want to learn more about how we can help you on the buy or sell-side!

Hasbro Sells eOne for $500M to Lionsgate: Transition to “Asset Light”

by Chris Erwin

Entertainment One just sold for $500M to Lionsgate.

That’s $3.5B less than Hasbro paid for it! But it’s a smart move…

The toy maker is moving to an asset-light model like Mattel. Before breaking that down, let’s understand why Hasbro did the 2019 deal. It wanted…

- Pre-school brands like Peppa Pig and PJ Masks

- To scale up programming based on IP (think Disney)

- More content to drive toy sales

The resulting wins would be new revenue streams from media sales, higher margin through ownership vs licensing, and more IP to make more toys.

But Hasbro quickly learned that media production is expensive, fraught with delays, and carries balance sheet risk. eOne was spending $500+M on production annually, a lot of cash!

Further, eOne has a large media business with NO relationship to toys – it owns IP like Grey’s Anatomy, Naked and Afraid. It also makes fees from scripted and unscripted productions.

Yup, the 2019 integration logic was faulty, and the $4B all-cash price tag was way too high.

So Hasbro will now double down on what it does best, making toys and games! Here’s what I like about the new path forward…

- Studio partnerships to reduce cost and risk (e.g. with Paramount)

- Keeping family IP like Peppa Pig, Dungeons & Dragons

- Keeping branded entertainment capabilities

- Use deal proceeds to pay debt

- Focus on digital gaming, a MUCH faster-growing mkt than film

My recommendation to other media x commerce execs?

Stop throwing good money after bad. Exit bad biz lines, focus on the core. Preserve cash. Some great learnings here.

If these insights are relevant to projects you’re working on, ping us here. We love talking all things media x commerce!