Whatnot’s 90% Market Share, MGA’s $500M+ Content Initiative, Discord Monetization

What We’re Reading

3 articles + RockWater analysis to make you a better investor and operator. Today we discuss Whatnot’s US Live Shopping Dominance, MGA’s $500M+ Content Initiative, and Discord’s First Creator Monetization Feature

———

📹 MGA Acquires Pixel Zoo and Launches MGA Studios

Kidscreen, 11.14.22

The RockWater Take by Chris Erwin

🤷♂️ What’s the best content x commerce model for toy mfgrs?

👇 2 conflicting datapoints from MGA and Hasbro…

In Nov ’22 MGA Entertainment, the co behind LOL Surprise, announced $500 million content studio and acquired Pixel Zoo Animation. Signaled deeper investment in digital consumer experiences.

Of note, MGA has gone deeper than most in digital, such as their Roblox metaverse dance halls, and how they brought toy personalities to life on TikTok.

But in Oct ’22 Hasbro, one of the world’s largest toy mfgrs, announced plans to sell Entertainment One. Hasbro will retain rights to family content division incl IP like Peppa Pig / My Little Pony, but use 3rd party prod cos for new content creation.

Reminder that Hasbro bought eOne for $4 billion in 2019 and quickly regretted it. So after recent Wall Street pressures, leadership now believes easier to outsource content creation VS owning media co.

…so does the MGA new studio announcement make sense?

3 considerations for why the MGA deal could work…

🔸 eOne deal was pricey and brought a lot of IP not relevant to core Hasbro kids toy biz. In contrast…

🔸 $500M is total commitment to MGA studio investment, not just price tag for Pixel Zoo. If MGA starts spending $$ and doesn’t see ROI, they could cull investment and mitigate downside

🔸 MGA studio incl both build + buy strategy VS Hasbro’s buy-only strategy. Perhaps better approach to custom-fit against MGA biz needs, as integrations between 2 large co’s with very different DNA is never easy…and it seems MGA has more digital / content experience than Hasbro did prior to eOne deal

…what do you all think?

———

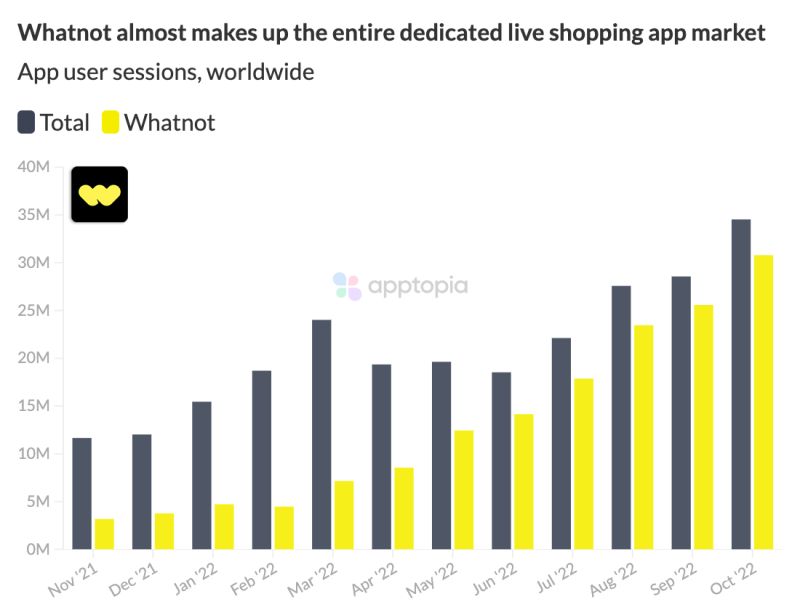

🛒 Whatnot’s US Live Shopping Dominance

The RockWater Take by Michael Booth

Whatnot accounts for 90% of user sessions of the top 8 US based livestream shopping apps. Wow!

The key to success as a destination livestream shopping platform is building recurrent user behavior.

Anyone can pay for downloads, but retaining users, building community, and purchase conversion is where the winners get set apart.

Whatnot has raised $500M in venture funding, the last round was a $260M Series D in July.

The highest amount raised by their competitors is NTWRK at $60M.

Unclear if Whatnot’s superior user capture is due to a much higher customer acquisition spend, a better user retention mouse trap, or some combination of the two.

Also curious to see how well Whatnot’s success in user capture translates into purchase conversion.

Source: Apptopia Inc.

Some community input:

Jesse Guglielmo, CEO @ 1-800-NUMBER: Instead of chasing TikTok’s tail around the last few years and checking the box to play feature catch up, socials should’ve doubled down on this long ago and provided communities with creator x consumer tools…one click shopping, high quality mobile production, creative/collabs, etc.

No brainer (and no excuses) considering the data-driven validation overseas.

Max Benator, CEO @ Orca: I believe Whatnot’s success is primarily the team and the product, which is live auctions. Collectors are deeply passionate, have high AOVs and collectibles by their nature have scarcity — the perfect ingredients for a successful consumer app. If eBay’s success served as a pre-cursor to Amazon’s success, I think live shopping will go in the same direction. Using that historical, with auctions ‘proven’, the next area of growth is everyday livestream shopping.

Kyle Udelson, Sr. Partner Dev Manager – Creators @ Shopify: What Max Benator said; Whatnot isn’t focused on holding new product that later will end up in retailers or DTC/other social commerce channels. Their focus on collectibles, hard to find and one of a kind products via auction and targeting fan communities is an entirely different product offering than others. Consumption behavior from a fanatic audience is entirely different than the QVC model other livestream commerce producers are taking IMHO

Benjamin Grubbs, Founder @ Next 10 Ventures: Whatnot built a product authentication service for collectibles, so you know you’re buying a legit Funko Pop, Pokemon card, or Topps card (similar to how GOAT added this offering for sneakers). They also secured API access to eBay, so they could growth hack their listing volume by carrying eBay listings alongside their app. Live video on Whatnot added the engaging auction buying experience. Together they offered sellers a compelling sales conversion story.

I’ve seen marketplaces grow in markets in different ways. In some, when you get the sellers, the buyers follow. In others, you bring the buyers first and the sellers follow.

Whatnot has power sellers now, just as eBay has power sellers. I’ve heard some are driving over $100m in annual GMV on Whatnot. Those sellers are surely bringing new buyers to Whatnot, or making the Whatnot digital marketing more efficient since they can drive from the click to a variety of live auctions.

I just had a look at some eBay data. $564M in sales Jan-Oct on eBay.com for Topps items. $259M in that same period for Pokemon. ~250k sellers for each product. Provided Whatnot’s API feed still works, they have a great market to pull from and provide value added services.

———

🤑 Discord’s First Creator Monetization Feature is Live

Variety, 12.1.22

The RockWater Take by Alex Zirin

Creator monetization on Discord is officially live. After nearly one year of testing, the platform’s newest update has rolled out “Server Subscriptions” to all eligible discord servers with owners based in the US.

Similar to options like those offered on Patreon, YouTube, Twitch and more, Server Subscriptions will allow creators to offer exclusive content to paid subscribers, or paywall a server all together.

From a cost perspective, Discord is charging a 10% revenue fee on all subscriptions. In comparison, Patreon’s fees range from 5-12%, depending on the chosen plan. Twitch, in an effort to push creators towards running more ads, charges between 30-50%, depending on the creator.

While Discord is among the last dominoes to fall in this respect, I believe that it will be among the most impactful. No other platform is as well suited to engagement and two-way interaction.

For one-to-many content, platforms like those mentioned above do very well. But, when it comes to building lasting fan relationships, especially those that can convert to revenue, Discord’s format is significantly better optimized.

So, what does this mean?

In the immediate, very little. Onboarding, ramp up, and familiarity will take time to gain momentum. However, I anticipate in the mid / long-term, we will see a sizable emigration away from the more “Web2-style” paid-subscription platforms.

Creators and businesses that are looking to optimize their fan engagement for the future are already building communities on Discord, and it won’t be long before second-movers, now with additional incentive, begin to follow.

———

If these insights are relevant to projects you are thinking through, ping us here. We’re always excited to riff through ideas!