How Gambling and ‘Live’ Impact Fandom, the Real Money Maker in Sports Media (Part 1/3)

TV viewership ratings for live sports are steadily decreasing, yet the value of these media rights are steadily increasing. Why?

Media rights are the foundation of sports revenue strategies. However, media fragmentation and shifts in consumer behavior have fundamentally disrupted traditional sports media models, creating both unprecedented challenges and opportunities for sports leagues and rights owners.

Challenges

-

Increased competition for the market share of younger viewers

-

The disruption of traditional media models and the decline in TV ratings for legacy leagues

Opportunities

-

The inflated value of Live

-

The gambling effect

-

An expanded pool of well-capitalized bidders for live rights

—-

BACKGROUND CONTEXT

Traditional sports revenue strategies are based on aggregating reach.

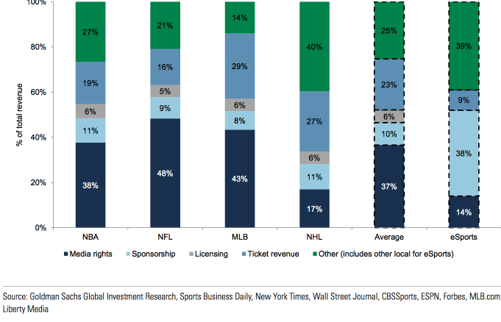

On average, the four largest US pro sports leagues (NFL, NBA, MLB, NHL) generate 37% of their total revenue from media rights.

The traditional model that legacy leagues have employed to monetize these media rights prioritizes maximizing reach above all else.

For decades, this has been a straightforward process; executing exclusive long-term distribution deals with the few broadcasters capable of providing maximum distribution.

“We need to reach everybody…Our entire model is based on reaching as many people for as long as we can. Traditionally, the best way to do that has been broadcast TV.”

– The NFL’s Chief Media and Business Officer, Brian Rolapp

However, as the media landscape fragments and consumption habits shift (especially for younger audiences), acquiring reach has become more challenging and complex…

Today, eyeballs are fragmented across more platforms and devices than ever before. For young audiences especially, there is now unprecedented competition for viewers’ attention, time, passion, and loyalty.

-

Erosion of Pay-TV and Growth of OTT

-

5.5M households abandoned traditional pay-TV in 2019 (8% YoY decline) → OTT-only households have tripled over the last five years.

-

Many believe that the COVID-19 crisis will accelerate cord-cutting. Comcast reports linear TV viewership has been up 6-7% during this period, while OTT viewership is up 38%. Primetime ratings for Adults aged 18-49 from March 15-26 were actually down 3%, despite the entire country sheltering in place.

-

54% of Americans aged 18-29 watch more streaming TV than linear (29% have cut the cord entirely).

-

Between 2007-2017, the median age of primetime viewers on ABC, CBS, NBC, and Fox increased by 8-11 years (the average viewer is now in their 50s or 60s).

-

-

YouTube, Social Video, and Mobile Video

-

YouTube accounts for 12% of all time spent watching video (most-watched video service for adults aged 18-34).

-

59% of Gen-Z’s time spent watching video is on social media (5x compared to linear TV).

-

50% of 12-17 year olds choose a mobile device to “watch something fun” (only 24% choose TV). → 18% of overall consumers identify as “mobile-first” viewers.

-

-

VOD / Time-Shifted Viewing

-

53% of the TV shows consumed by the average viewer are time-shifted (61% for millennials).

-

In his book, The Marketplace of Attention, James Webster posits,

“Although choices seem endless, public attention is not.”

This immutable law of contemporary culture is impacting all IP owners and content creators, in sports and beyond, simultaneously creating complex challenges and exciting opportunities for operators across the entertainment ecosystem. However, for no other content category is this double-edged sword as sharp as it is for sports leagues, which face the parallel potentials for both existential decay and unprecedented revenue achievements.

CHALLENGES

Sports leagues, which are built on aggregating and monetizing the attention of their fans, are now struggling to engage a generation that has more outlets vying for their attention than ever before. Consequently, professional sports leagues are now facing a series of complex challenges.

CHALLENGE #1: Increased Competition for the Next Generation of Sports Fans

In addition to the emerging platforms and consumer trends outlined above, esports and gaming also represent significant forces of disruption and fragmentation. As a hyper-engaging alternative to traditional sports, eSports and gaming are capturing significant market share of young fans from legacy sports leagues, and completely re-routing a sizable portion of the Gen-Z viewing and fan experiences into new entertainment sources that sports leagues have likely underestimated until the past couple years. Additionally, shaped by social media and limitless entertainment options at the tip of their fingers, younger audiences today have a much more fluid approach to fandom, disrupting the process of tradition and geography-based fan development that has made pro sports a multi-generational touchstone.

-

eSports is replacing legacy leagues for many younger fans:

-

79% of eSports viewers are under 35 years old. For comparison, below are the average audience ages for legacy leagues

-

MLB: 57

-

NCAA Basketball and Football: 52

-

NFL: 50

-

-

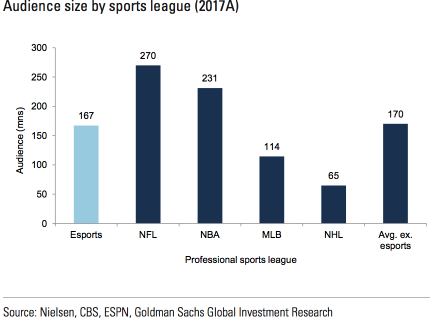

eSports’ global monthly audience in 2018 was 167M (larger than the MLB), and is projected to reach 267M in 2022 (approximately the same size as today’s NFL audience).

-

The 2019 “League of Legends” Championship reached 100M viewers – more than the World Series (38M), NBA Finals (32M), and Stanley Cup (11M).

-

The COVID-19 crisis may further accelerate eSports’ rise. With no traditional sports to compete with, many new fans are being exposed to the eSports experience. 5.4M unique viewers have watched at least one of NASCAR’s recent “virtual races”, including 1M viewers who did not tune in to any of the four previous real life races in 2020 pre COVID.

-

-

Gaming is replacing traditional entertainment for Gen-Z:

-

-

68% of Gen-Z males agree that gaming is an important part of their identity.

-

Twitch and YouTube have larger audiences for gaming alone than the overall audiences of HBO, Netflix, and ESPN combined.

-

-

Younger fans feel less beholden to tradition and locality, both of which have been key drivers of multi-generational fan development

-

Gen-Z fans are more loyal to athletes than teams, favoring athletes over teams by a margin of 2-1 compared to Baby Boomers.

-

Gen-Z is referred to by some industry experts as the first generation of “Fluid Fans”, characterized by a complete openness to adopting new favorite teams, sports, athletes, platforms, and modes of entertainment. These fans have “contextual identities” that are driven by dynamic social groups, influential personalities / trends, personal values, and convenience. Gone are the days of “My father was a Knicks fan, so I’m a Knicks fan too”. Gone are the days of “My team’s owner or star player is immoral or untalented but I’ll support the team anyway because that’s my team”. Gone are the days of “I’ll subscribe to my local sports channel because I want to see my team play”…This generation of fans can not be inherited. Their fandom must be perpetually earned. If it’s not, they will simply turn their attention to one (or several) of the many outlets that will.

-

“We are in a competition with the entertainment industry, with video games, with other leisure activities.”

– Thomas Bach, President of The International Olympic Committee.

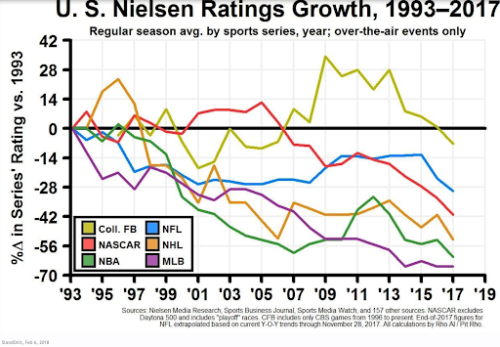

CHALLENGE #2: The Disruption of Traditional Reach-Based Models and the Decline in TV Ratings for Legacy Leagues

As consumption fragments across an ever-expanding ecosystem of platforms and devices, and as linear TV’s monopoly on our collective attention diminishes, reach has become an insufficient metric for success. Not only is the viewership scale achieved during the era of peak TV unattainable in today’s media environment, but viewership scale as an end in itself is also less valuable today.

Marketers, whose TV ad spends power the multi-billion dollar live rights deals, realize that 90% of all sports viewers are now using a second screen while they engage with live sports. The fan sitting at home watching the game is no longer a captive audience. It’s no longer enough to merely reach fans. Value is also now derived from active engagement.

“We’re at an inflection point, and must weigh up the value of reach versus quality of engagement. Just trying to maximize reach is not a viable long-term strategy.”

– Senior Strategy Executive at the European PGA Tour

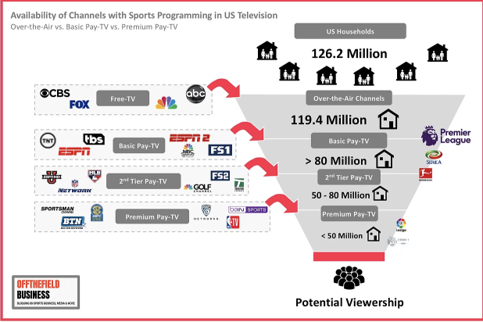

Although broadcast and cable TV still provide the deepest audience penetration relative to emerging platforms, the pay-TV business is in the midst of an irreversible decline. Therefore, legacy sports leagues – whose media models are built on “old world” assumptions that rely on legacy TV networks and the value of broad reach – are suffering steadily declining viewership.

HOWEVER, with unprecedented challenges come unprecedented opportunities…

OPPORTUNITIES

Although media disruption has created complex challenges for rights owners, these same forces have also made their IP assets more valuable than ever before.

OPPORTUNITY #1: The Inflated Value of Live

Although the fragmentation of the media landscape and shift to on-demand viewing has diminished the TV ratings of traditional sports leagues, these same dynamics have also placed an outsized premium on live viewership and engagement.

Live sports are the last mass aggregator of concurrent, culture-defining, live viewership that remains in the post-Netflix world (exceptions like The Bachelor and Game of Thrones are few and far between). Even if viewership numbers aren’t what they used to be, because live sports now play such a unique and differentiated role in our culture, they are more valuable than ever before.

Brian Rolapp, Chief Media and Business Officer for the NFL, explains:

“As the world fragments, we actually become more valuable because we are one of the only things left that can aggregate tens of millions of people in one place at one time.”

“Fortnite” ($1.8B 2019 revenue) similarly benefits from this dynamic, as its recent virtual live concert experience with Travis Scott reached 12.3M concurrent players. The communal component of live viewership is irreplaceable, and the entertainment properties that are built on the unique power of this experience will generate outsized value in an increasingly on-demand world.

-

The Currency of Live: 89% of fans prefer to watch sports live. Live viewership is much more valuable to marketers, and the “DVR-proof” nature of sports make it the last bastion of scaled communal viewership. This is why even as Super Bowl viewership declines, the value of a 30-second commercial during the game continues to increase (from $5M in 2017, to $5.2M in 2019, and $5.6M in 2020).

-

Tallest Tree In A Shrinking Forest: In 2005, 14 out of the top 100 rated broadcasts were live sports events. In 2018, live sports accounted for 88 out of the top 100 broadcasts.

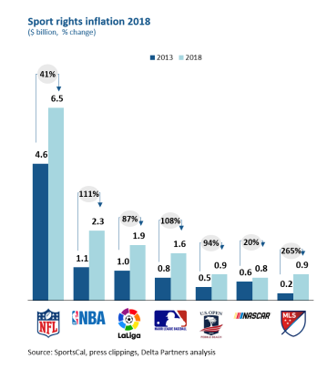

Due to the outsized value of live viewership in an increasingly on-demand world, the value of sports media rights have soared even as ratings have declined.

OPPORTUNITY #2: The Gambling Effect

As sports gambling grows across the US, the biggest financial impact for leagues will come through the subsequent growth of live sports viewership and engagement, thus strengthening the already inflated value of live sports rights.

-

Sports Gambling Directly Increases Live Consumption and Engagement

-

79% of current and potential gamblers say they are ready to watch live sports more often, and 63% say they would pay more attention to games if / when sports betting is legal in their state.

-

Consequently, the NFL is projected to earn $1.75B in incremental “fan engagement revenue” as a direct result of increased consumption and engagement with the league’s content (a 13.4% increase). This includes a projected 18% increase in media rights revenue.

-

“We always saw, and we still see legalized gambling, as a fan engagement opportunity. That’s the holy grail of sports betting; it’s not the short-term gambling revenue.”

– Keith Wachtel, NHL CRO

OPPORTUNITY #3: An Expanded Pool of Well-Capitalized Bidders for Live Rights

In an increasingly crowded and competitive marketplace, where “content is king”, access to sports programming – and the unique reach, engagement, and customer acquisition that comes with it – is seen by many content and social platforms as a key differentiator for their viewers.

-

Traditional Pay-TV Partners Need Sports Rights More Than Ever: 82% of pay-TV subscribers say they would reduce or cut their subscription if they didn’t need it to watch live sports.

-

New Entrants To The Streaming Space Are Vying For The Unique Engagement and User Acquisition That Only Sports Can Provide: OTT content players (Hulu, YouTube, Twitch, Amazon Prime, Disney+, HBOMax), pureplay sports OTT (DAZN, ESPN+, BR Live, FuboTV), and social media platforms (Facebook, Twitter) – have all indicated an intent to invest in live sports content.

-

League-Owned Direct-To-Consumer Platforms: e.g. WWE Network, UFC Fight Pass, et al are further strengthening the leverage that rights owners have over distributors, as the rights owners are now capable of reaching fans directly.

Live sports content has proven to be a “king-maker”. Fox, ESPN, and DirecTV all used live sports rights to grow from insignificant upstarts into behemoths. Tracy Dolgin (EVP of Marketing at Fox Broadcasting), admits:

“If [Murdoch] didn’t make that bet on the NFL…things like Fox News, FX, Nat Geo — the cable empire wouldn’t have been there … All of that is traced back to this bet-the-farm, multibillion-dollar Hail Mary to get NFL rights..”

As “The Streaming Wars” commences with “land grab” strategies by platforms spending billions to acquire landmark IP and content, and who are willing to take massive losses in order to capture early stage market share, we believe these platforms will look to the Fox playbook.

Conversely, for pay-TV networks, live sports are essentially the last thing standing between them and complete extinction.

With an expanded pool of highly motivated and well-capitalized bidders, who all see live sports as their “silver bullet”, the value of live sports rights will continue to inflate.

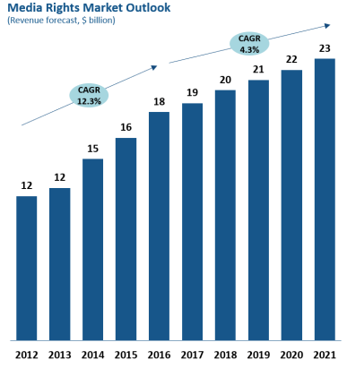

AS A RESULT OF THESE OPPORTUNITIES, sports rights values will continue to rise over the next five years, as the industry hits a major inflection point

Over the next five years, the value of sports media rights will continue to rise while many of the most lucrative existing rights deals will expire.

-

4.5% Five year CAGR projected for traditional sports media rights revenue.

-

67% Five year CAGR projected for eSports media rights revenue.

-

This Five Year Period Will Redefine Media: In 2021 and 2022, as the value of media rights are projected to reach all-time highs, existing media rights deals for several of the most prominent global sports properties are set to expire (NFL, MLB, NHL, FIFA, MLS, UEFA Champions League, La Liga, Bundesliga). Once unburdened by these traditional TV deals, rights owners will be free to capitalize on this unprecedented value by pursuing innovative media models and distribution strategies. Because of how interconnected the greater entertainment ecosystem has become, the ripple effects of these upcoming rights deals will be far-reaching, impacting all corners of the industry.

WHAT’S NEXT FOR SPORTS LEAGUES?

Over the next five years, as the existing rights deals expire for most major leagues, these rights owners will need to transform their media models in order to A) exploit the hot live rights market to maximize near term revenues while simultaneously B) positioning for long-term growth and sustainability by cultivating and engaging the next generation of fans.

How will leagues devise strategies to balance out near-term and long-term priorities?

How will various platforms partner with rights owners to maximize value and accelerate growth?

In our next industry report (to be published on Thursday May 14), we will address these key questions and more, building off of recent deals between NBA/Microsoft and NFL/Amazon, and use case studies from the WWE and others to futurecast and ideate new rights holder and fandom strategies.

—

Ping us here at anytime. We love to hear from our readers.