How eSports Revenue Models Will Drive the $600B Global Sports Market (Pt. 1)

Brought to you by:

SEED STAGE INVESTMENT OPP ($20k MIN CHECK SIZE): Creator Economy SAAS x Real Estate Startup

Rolla empowers businesses to scale their video content creation, globally.

US businesses will spend $52B on video content in 2022.

With consumers expecting video to be a part of their purchasing experience, businesses are struggling to find ways to produce original, social video content cheaper, faster, and at scale.

Rolla’s mobile technology reduces the friction of hiring local film companies across multiple markets and puts the power of video directly in the hands of contractors, employees and influencers.

Our go-to-market strategy is focused in the real estate industry, where video is in high demand for agents at residential, commercial, and industrial brokerages.

Check out our investor deck.

Outside of real estate, our video-tech is well positioned to disrupt many other industries, including influencer marketing. See our branded campaign demo here.

OUR MISSION IS BIG: What Canva built for design and Squarespace built for websites, Rolla is building for video.

We have opened a $1M SAFE, which will close on 9/15. $20k min check size.

Please reach out to the RockWater team if you’d like to learn more.

———

Part 1: What is happening? What have we been seeing and what are we seeing now?

The $1 billion eSports industry is harnessing demographic and technological shifts and adopting alternative revenue models to vie for market share with traditional sports .

The global sports market makes between $300 billion to $600 billion a year in revenue. In comparison, the global eSports market generates less than one percent of that revenue annually. However, the pace at which it is growing is many times faster than any traditional sport. In 2021, it broke, for the first time ever, the billion dollar mark, generating around $1.08 billion. It continues to surge in terms of revenue and viewership, fueled by 1) demographic changes such that there are more people familiar with eSports, 2) technological changes such that video games and related content are more accessible, and 3) socioeconomic changes that allow gaming and eSports to move away from being just niches and towards being major media verticals.

Source: Sports Business Research Network

As gaming and eSports go through these demographic, technological, and socioeconomic changes, we are seeing quite a few interesting developments, most notably the fact that eSports relies significantly less on cable TV media rights compared to traditional sports and more on many alternative revenue streams. Additionally, the merging of eSports into the creator economy and the heightened investor activity in the eSports and gaming spaces further corroborate that eSports are paving their own way forward and that fans and investors alike are bullish about them.

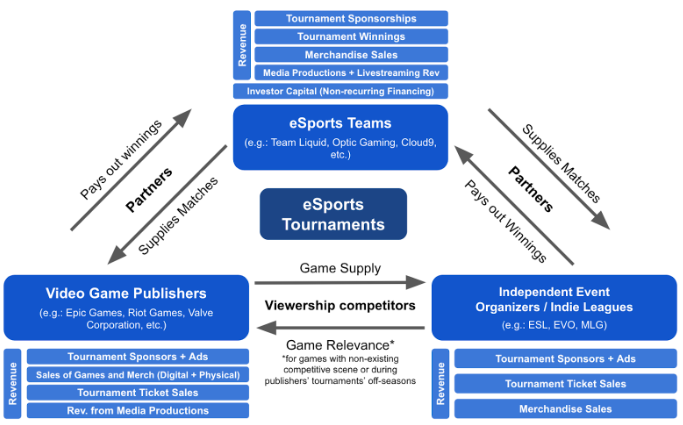

eSports Framework

In the competitive level of traditional sports, there are typically two entities: the league itself and the individual teams. The NBA and the Lakers, the NFL and the Patriots, the NHL and the Lightning. The league itself generates revenue through league-level sponsorships, league-level merchandise sales, league-level licensing deals, national-level media rights, and through taking a cut of all ticket sales for tournaments under the league. On the other hand, teams generate revenue through team-level sponsorships, team-level merchandise sales, team-level licensing deals, regional media rights, and through taking the lion’s share of ticket sales at home games.

By contrast, in eSports there are three major entities: the teams, the game publishers, and the independent leagues. The major difference between traditional sports leagues and eSports leagues is that the game publishers are often the ones who organize the largest tournaments. Think Riot Games and the League of Legends Worlds Series, Valve and Dota 2’s The International, Blizzard and The Overwatch League, Epic Games and the Fortnite World Cup, and much more. Non-publisher leagues like the Evolution Championship Series (EVO), the Electronic Sports League (ESL), and StarLadder also exist, but they are often either 1) the default leagues for games (often smaller) whose publishers do not run tournaments or 2) smaller, off-cycle versions of publisher-run tournaments.

eSports Tournaments Revenue Model

Relationship Between Major Players in eSports

Framework Key Takeaways

- The 3 current major players in eSports are competitive teams, video game publishers, and independent event organizers.

- eSports teams supply matches and therefore viewership and relevance for game publishers’ games and event organizers’ tournaments. In return, they gain followers and fans, brand recognition, and tournament winnings.

- Video game publishers and independent event organizers both organize large tournaments every year, making them competitors in terms of viewership. This competition is often mitigated by splitting the year into mutually exclusive seasons, some of which are run by publishers and others by independent organizers.

- Independent event organizers give off-season relevance to games where publishers organize annual world tournaments. They also add relevance to the competitive scene for titles where publishers refuse to sponsor competitive play. On the other hand, publishers supply the games that independent organizers’ tournaments are based off of.

- All 3 major players rely on non-cable/non-TV and forward-thinking monetization models.

Part 2: eSports Teams Monetization Models

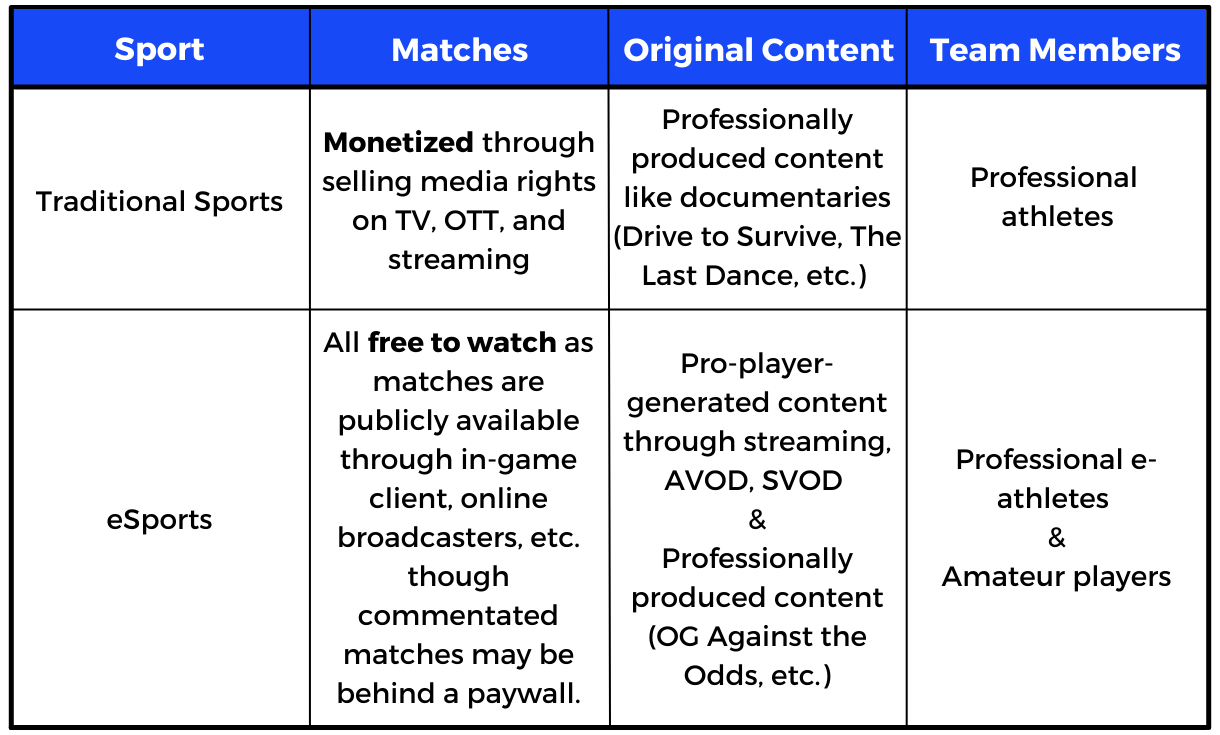

eSports do not rely nearly as much on cable as traditional sports. eSports fans are generally younger and have on average grown up with streaming technology either alongside or instead of television and cable channels. In addition, since eSports as an industry developed alongside live streaming and VOD technologies as well as the rise of the gaming and Let’s Play genres, most eSports broadcasts are found online, either on streaming or VOD platforms. As such, not only are a large proportion of eSports fans and gamers part of the so-called “cord-nevers” generation, the whole eSports industry has essentially skipped the cable phase.

Moreover, unlike traditional sports teams, eSports teams have a non-existent sense of media rights. eSports teams don’t sell the broadcasting rights to their games to any platform – cable, VOD, or streaming. Rather, most games can be found in their entirety online on sites such as YouTube. They can also sometimes be found within the video games themselves* for a more nuanced and feature-rich viewing experience; this further weakens the case for eSports on cable as it completely erases content exclusivity, traditional sports media’s biggest selling point, from the picture.

As a result, eSports has always resorted to alternative forms of monetization. And they have been reaching pretty high valuations at that.

*Games like Dota 2 allow players to access a spectator mode inside the games where they can view live matches including professional tournaments. Watching a match inside the video game gives access to free camera control, the scoreboard and game statistics, and all player perspectives, allowing viewers to customize their own viewing experiences instead of relying on game casters’ perspectives.

Sponsorships and Advertising for eSports Teams

Sponsorships represent around 60% of all eSports revenues, by far the largest source of income for any eSports teams. They include a wide variety of companies and industries and largely work the same way as in traditional sports. Some of the most common sponsor verticals are gaming hardware, food and beverage, betting platforms, and traditional sports teams.

Video game hardware sponsors include gaming chair company Secretlab, gaming peripherals company SteelSeries, and the less niche computer peripherals company Logitech. eSports teams receive a wide selection of high quality gaming accessories and devices to use in both practice and competitive games. In return, eSports teams feature their sponsors on their livestreams, websites, team jerseys, and produced media.

Food and beverage sponsors typically fall within a subset of “gamer culture” snacks and refreshments such as the meme-ified Doritos and Mountain Dew. While there is some truth to the memes (Mountain Dew was recently announced as an official partner for a Call of Duty League Major), some of the more popular sponsors have been mostly energy drink companies, like GFuel, Monster, and Red Bull, who each sponsor multiple teams, sometimes within the same game title, too. Red Bull in particular has also begun branching off into sponsoring entire game leagues like VALORANT’s Champions Tour in EMEA. All that being said, more snacks, fast food, and even food delivery companies are joining the bandwagon, including Totino’s partnership with FaZe Clan, Grubhub’s partnership with the League of Legends’s League Championship Series, and Gen.G Esports’s partnership with McDonald’s Esports League.

Like in traditional sports, sports betting in eSports has been a growing phenomenon. Traditional platforms like DraftKings and BetMGM have been burning a ton of cash trying to secure advertisements and sponsorship with sports leagues, arenas, and even teams as the restrictions against US sports betting are slowly beginning to be lifted, massively increasing their total addressable markets. The same is happening in eSports: DraftKings, for example, announced a partnership with FaZe Clan to be its official sports betting partner. However, it is interesting to note that none of these traditional sports betting platforms offer any type of true eSports betting – the closest they have is fantasy eSports betting, probably because of the sports betting restrictions still in place. The more interesting opportunity, though, lies with non-US betting companies, specifically eSports focused ones like GG.BET, which offers true sports betting for nearly every competitively played eSport title. Based in Cyprus and active in many countries outside of the US, GG.BET does not have the same restrictions as DraftKings and BetMGM. As a result, GG.BET partners with a plethora of different eSports teams across different game titles as well as some entire leagues like the ESL Pro League for Counter Strike: Global Offensive.

Traditional sports teams have also been seeing the potential in eSports and have been eager to either invest in it or sponsor it. One way this has been happening is when a traditional sports team sponsors an eSports team, like in the case of Paris Saint Germain’s partnership with Chinese Dota 2 team LGD. Another way is when a traditional sports team invests in or buys an eSports team like in the case of the Philadelphia Sixers’ purchase of Team Dignitas and Apex Gaming for over $5 million. A third way is when a traditional sports player invests in, buys, or partners with an entire eSports team, like in the case of David Beckham investing in Guild Esports and becoming its co-owner.

eSports sponsors are also beginning to come from traditionally popular verticals like lifestyle and consumer products. For example, Gen.G Esports launched a clothing collaboration with, Southeast Asian organization EVOS Esports engaged in a partnership with Bank Mandiri to launch an EVOS debit card, and the massively successful North American eSports team 100 Thieves launched a partnership with Lexus to rename their content house the Lexus Content House.

With the recent explosion of web3, blockchain, and cryptocurrency technology, companies in these spaces have also joined the race in getting involved with sports. The Staples Center being rebranded as the Crypto.com Arena and Coinbase’s $7 million QR code ad are just some of the most buzzworthy examples. In eSports, these large checks and deals are also widespread. London based team Fnatic, for example, signed Crypto.com’s first eSports deal in late 2021, amounting to $15 million. Also, in early 2022, crypto exchange Bitstamp signed with UK-based Guild Esports in a $6.1 million deal. Going forward, we can probably expect more of these large-sum sponsorships in the eSports space as gamers in large become more comfortable with web3 technologies like NFTs and cryptocurrencies.

Key Takeaways

- The original sponsors in the eSports space have typically been gaming hardware and F&B companies. These continue to be popular, and companies/products that embrace “gamer culture” see the most success

- New waves of sponsors have been emerging, including sports betting companies, traditional sports teams (who are looking to expand into eSports), and web3/cryptocurrency companies

Tournament Winnings

While the majority of eSports teams’ income comes from sponsorships, winnings from tournaments may greatly supplement earnings. Winnings vary greatly depending on three major factors: the game (which dictates # of people/team, # of overall winners, the prize pool amount and structure, etc.), the event organizer (which affects the prize pool, tournament structure, and viewership statistics), and the team’s overall placement in the tournament.

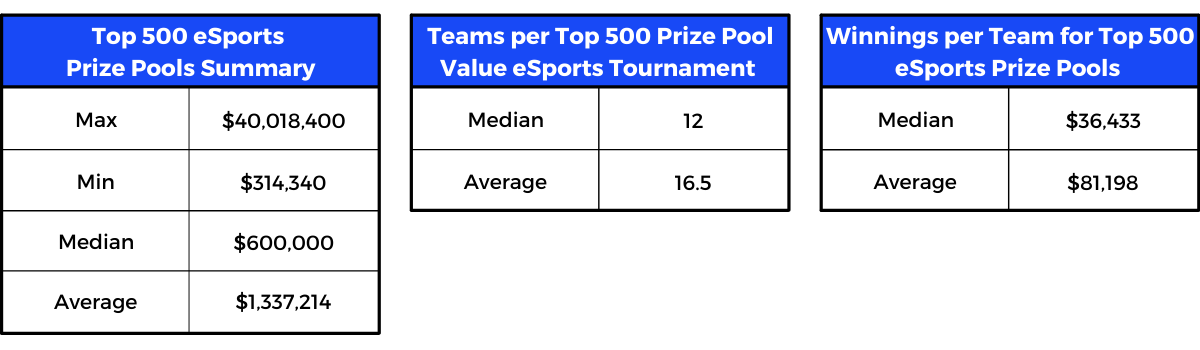

To help with analysis, let’s split eSports prize pools into 3 tiers.

- The bottom tier consists of a large number of smaller, often community organized, tournaments that yield prize pools around $10K to $100K.

- The middle tier consists of fewer tournaments organized either by independent organizers or sometimes the game publishers themselves. Usually branded as “majors”, “minors”, or seasonal championships, prize pools of these events span from $100K to $1M.

- The top tier consists of annual tournaments most often organized by the game publishers (but sometimes also organized by the largest independent organizers, too). These events’ prize pools exceed $1M and can reach $40M.

The largest 500 eSports prize pools span across 62 video game titles ranging from first person shooters like the Call of Duty series and VALORANT to multiplayer online battle arenas (MOBAs) like Dota 2 and Heroes of the Storm to battle royales like Fortnite and PUBG. These pools lie around the mid- to top-tier prize pools, which means that while winnings/event may be high, the events are not as frequent (think once or twice a year). Even so, by doing some quick math, we can see that teams participating in such events can reasonably expect to win between $30K to $80K assuming the prize pools are split evenly* between all participants.

As $30K-$80K is not nearly enough to sustain a team’s annual operations, most teams can only see tournament winnings as supplements to their other income streams. That being said, the top teams of the games with the largest prize pools can walk away with up to $20M (that’s at least several million per player), representing extremely high variance in prize pool winnings.

* While this simplifies calculations, this is almost never the case in reality. Prize pools are usually split such that the winning team gets around 50%, the second place around 20%, the third around 10%, and so on.

Key Takeaways

- While teams’ tournament winnings can get very high, the majority of winnings/tournament for the best teams in the biggest tournaments lie around $30k-$80k or lower (tier 2 and tier 3 winnings are only less), which is to be split among all team members and their company.

- As such, most tournament winnings should be seen as supplemental income, not primary income for eSports teams.

Investor Capital (Heightened Investor Activity)

Source: “The rise of eSports investments”, Deloitte 2019

With the success of video games and heightened investor activity in the space, investors are becoming increasingly interested in the related eSports space.

Between late 2021 and mid 2022, we’ve seen some large deals including a $60 million round for 100 Thieves, a $35 million round for Misfits Gaming Group, and a $12 million round for Ampverse. eSports and lifestyle organization FaZe Clan had also raised a $40 million series A round before recently going public through a SPAC at a $750 million valuation. More recently, Ares Management invested $35 million in aXiomatic Gaming, the parent company of the infamous Team Liquid, which has teams in over a dozen eSports games’ competitive leagues.

Most traditional sports teams have been valued at around $2 billion and have at least 50 years of history under the belt. FaZe going public at $750 million means that a team with a fifth of the Clippers’ history can sell for more than a third of its price. This then raises several follow-up questions: how fast can eSports teams valuations’ grow? What does eSports have that traditional sports doesn’t that contributes to this growth? Could it be that the biggest team in 10 years has not even been founded yet? Only time will tell.

Valuations of teams in traditional sports at sale

It’s interesting to think what these eSports organizations and teams would do with the funds acquired by these investor rounds. Unlike companies in traditional sports, eSports companies do not spend heavily on media rights and content production. Rather, they often seek to invest in alternative business lines to develop a diversified portfolio of revenue streams. These could include anything ranging from merchandise sales to expanding team rosters to new geographical locations to developing/incubating new teams in new eSports titles. Let’s look at some examples:

- aXiomatic Gaming says that it would use the $35 million it just raised to expand into new verticals within sports, media, and entertainment as well as to grow its fan base in fast-growing and popular international markets like Brazil through building new training facilities and developing local content. Based on aXiomatic’s previous investments, we can expect investments in teams of new eSports titles and eSports-related media segments like knowledge bases and video studios.

- 100 Thieves said that it would use the $60 million it raised in its Series C round in December 2021 to invest in gaming hardware (such as its investment in Higround, a gaming keyboard company) and gaming culture, which includes apparel, talent, and content. More recently, 100 Thieves has also announced its very own game, Project X, as well as a digital collectible drop, the 100 Thieves Champion Chain.

- Going back a little earlier to 2018, Cloud9 raised a $50 million Series B round which they said they would use to expand merchandise retailing and build physical facilities. These facilities would be used to both train existing professional players as well as develop youth talent. In the words of Cloud9 president Dan Fiden, “Your 14-year-old daughter loves Overwatch and wants nothing more than to get coached and participate in a league. This could be the place that you take her for practice on Wednesday afternoon every week.” Though it is unclear whether Cloud9 has built this facility, it has since created Training Grounds, an online eSports game coaching and bootcamp platform, which essentially works to achieve the same goal, only virtually.

In addition to these, developing and incubating new teams in new games is the one that largely sets eSports as a genre apart from traditional sports. The lifespan of any given video game is significantly shorter than that of any traditional sport: soccer and basketball are timeless, but popular first person shooter games like CS:GO will inevitably be replaced by another, more modern First Person Shooter like Valorant within decades of release (and that’s being optimistic). That lifespan will only get smaller and smaller as game developers get larger, more experienced, and more numerous in quantity. Because of this longevity issue, eSports teams must continuously innovate by scouting and investing in talent in the next biggest games.

Key Takeaways

- eSports teams are getting significant funding, but so are eSports event coordinators, developers, and media/advertising platforms.

- eSports teams are using this capital for training players in existing games, scouting for and training players in new/upcoming games, developing new training programs, building physical training centers, creating new business lines (i.e. merch lines, media companies, etc.), and expanding internationally, among others.

eSports Teams Merchandise

While the term “merch” in eSports technically encompasses anything from gaming accessories to event passes to clothing lines, it is mainly used to refer to fashion and apparel.

From an eSports team’s perspective, merch sales are often the only income streams that come directly from consumers and fans. In traditional sports, ticket sales in home games also contribute to these direct-to-consumer revenues, but eSports teams rarely have home arenas, let alone home/away game distinctions, removing this as an option.

eSports teams’ merch sales typically fall under two categories: drops and clothing lines.

Drops borrow from hypebeast culture and are often limited quantity, limited edition pieces, which create sporadic high-revenue opportunities. FaZe Clan, for example, did two drops around 2020, one of which brought in $2 million in 24 hours and the other of which generated $500 thousand in just 5 minutes. Drops are also increasingly often in collaboration with well-established fashion brands, suggesting fashion’s slow but steady acceptance of gamer culture. Examples include a Fnatic x Gucci watch, a Mkers x Armani Exchange jersey, a Team Liquid x Tokidoki collection, and a Cloud9 x PUMA collection (85% of PUMA’s male customers are gamers, so such a collaboration was a great idea).

On the other hand, eSport team-branded clothing lines represent a higher-consistency, lower-price revenue opportunity. Most major eSports teams around the world have a clothing line through partnerships with white-label clothing companies and sell directly to their fans through their online stores. Prices of these items are mostly in line with merchandise sold in the creator economy – think social media influencer merch lines and band T-shirts.

Apart from being a direct revenue stream, eSports merch also serves as a marketing tool. More merch sales → more brand representation → higher brand awareness → more team support, better sponsorships, and more future merch sales.

eSports team Immortals, known for their League of Legends and VALORANT teams, takes this marketing approach to the next level by experimenting with its new “zero profit” Essentials line. With items in this collection aimed to be fashionable and accessible (everything under $40), the idea here is to convert potentially anybody, gamer or not, into an Immortals eSports fan through their fashion business. On paper, this might sound like an obvious strategy that any team might adopt; however, the Immortals Essentials model is highly unconventional, the first of its kind in eSports, and met with skepticism as the merch → fan funnel is a very uncommon path for fan economies of any kind.

Key Takeaways

- Merch is often the only way eSports teams can sell directly to their fans

- The vast majority of eSports teams have thier own merch line through partnerships with white label apparel companies.

- Limited edition drops represent high-revenue opportunities and are often done in collaboration with well-known fashion brands. These are becoming more common now.

- Zero-profit pricing models aim to induct anyone, gamer or not, into an eSports team’s fandom through affordable and fashionable apparel.

Alternative eSports Media Rights

As previously mentioned, the majority of eSports fans are either cord-cutters or cord-nevers, and the primary channels of eSports media consumption are streaming (e.g. Twitch), AVOD (e.g. YouTube), and SVOD (e.g. some Twitch and YouTube membership/subscriber-only content).

While Amazon’s Twitch has always been the go-to platform for gamers and eSports culture, Google and Meta through YouTube and Facebook Gaming, respectively, have started to offer very lucrative deals to streamers to move them away from Twitch as they develop their own gaming categories in live streaming. The Streamer Awards streamer of the year Ludwig, for example, signed an exclusivity contract with YouTube valued at an alleged $30 million. These deals have been becoming more attractive as Twitch has been unraveling plans to decrease streamers’ cut of revenues generated from 70%/30% (streamer cut/Twitch cut) to 50%/50%. Some popular streamers besides Ludwig who left Twitch include Sykkuno (2.83 million YT subs), Valkyrae (3.6 million YT subs), and Dr. Disrespect (3.9 million YT subs).

Sports vs. eSports Media Channels

For individual streamers, the fierce competition between Amazon, Google, and Meta means that the price floor for streaming revenues is rising, potentially making streaming a more viable day-to-day income source. However, these revenues do not necessarily translate into eSports teams’ revenues. While many professional eSports players do stream on the side, they almost always stream on their own channels instead of under a team channel, and they do not necessarily explicitly represent their team when doing so. As such, eSports teams must adapt to the unique media ecosystem to collect media rights revenue.

One, perhaps obvious, way of doing so is to put a revenue sharing line in the contract with the team’s members, essentially allowing the team to take a cut of all streaming earnings (which come mainly from tiered subscriptions and donations on streaming platforms like Twitch and YouTube). Though I haven’t seen any hard evidence (i.e. contracts) for these revenue sharing models, movements in the industry highly suggest that this has already been done for a while. For instance, many eSports teams have been recruiting video game streamers, YouTubers, and celebrities to join their teams not as competitors but as content creators. One unexpected and notable case was when rapper Snoop Dogg joined FaZe Clan in March 2022, where he has since been collaborating with other FaZe members in various videos. More on this in Part 4.1.

Another way is for eSports teams to produce their own media or license some aspects of their IP to third-party production companies. Team Liquid, for example, owns its own production studio, 1UP Studios, that produces Team Liquid-related videos in addition to other unrelated content. Legendary Dota 2 team OG took a different approach by partnering with their sponsor, Red Bull’s, in-house production studio, to make a documentary following their journey to win The International for the second time.

Key Takeaways

- eSports media rights are not nearly as well-developed as media rights in traditional sports. Streamer/team revenue sharing and in-house media productions are some ways eSports teams have been exploring the idea of monetizing media rights.

Overall Key Takeaways for eSports Teams

- Overall, sponsorships have been and continue to be eSports teams’ primary source of income. This means that securing high-sum and long-lasting sponsorships is often the #1 business consideration for teams.

- In addition to sponsorships, teams can supplement their income through tournament winnings, external investor capital, merch sales, and by monetizing media rights.

- All this being said, the landscape is always rapidly changing. As more capital flows into the eSports ecosystem through heightened investor interest and overall growing eSports followings from fans and viewers, it is entirely possible for teams to generate the majority of their income internally (as opposed to externally i.e. sponsors, investors, etc.), whether it be through merch lines or media rights. At that point, eSports teams can and should be viewed through a creator economy lens, where an entire team should be viewed as a single creator/creative engine. See Part 4.1 for more discussion on the eSports x Creator Economy.

To Be Continued…

In the next installment of our reports on the eSports market, we’ll break down:

- League and game publisher monetization models

- Creator economy implications

- Web3 opportunities