Winning in Livestream Shopping: The RockWater Playbook (Part 2/2)

In Part One of our Industry Report on livestream shopping, we broke down why this trend has taken off in China, why we believe it can take off in the US, and what factors will limit its US growth.

Now, given all of the US market dynamics that are shaping livestream shopping’s evolution, what do we think livestream shopping will look like in the US? Who will be the big winners?

We break it all down below…

How Livestream Shopping Will Evolve in the US, and What Creators and Companies Must Do to Win

To replicate the seamless user experience that powers the Chinese live commerce boom – including the $63B in revenue – American platforms must build frictionless continuity throughout the customer journey.

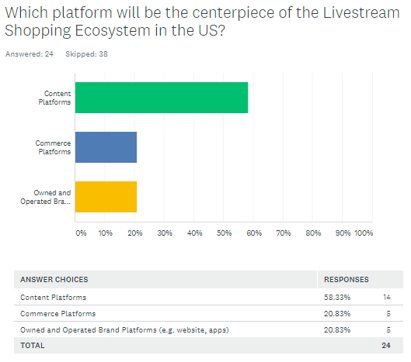

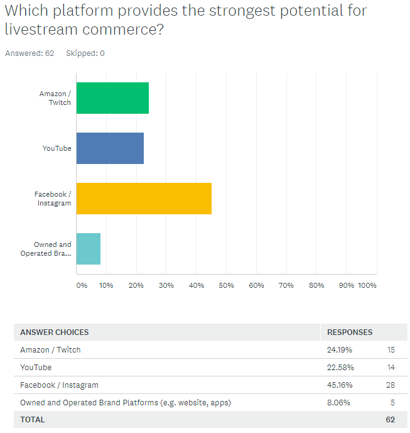

The race to owning livestream shopping in the US will thus be a race from one side of the funnel to the other. Can a live-enabled content platform like YouTube perfect the native shopping experience before a commerce platform like Amazon can establish itself as a destination for live, personality-driven content?

Creators

The key to livestream shopping is trust and influence. Making on-air talent paramount in this ecosystem. Influential personalities will lead audiences to the platforms and products they’re using. And commerce will follow.

Due to the enormous revenue opportunity that livestream shopping represents, platforms will compete to become the preeminent destination for this emerging form of commerce. And influential talent will be the asset that they stockpile and mobilize to win this war. It’s no different than other media forms, where tentpole talent and IP are keys to victory due to their ability to aggregate and engage audiences in today’s increasingly fragmented “attention economy” (e.g. “The Streaming Wars”, “The Podcast Wars”, or the “Battle for Live Sports Rights”). The platform that eventually owns livestream shopping will do so through cultivating user habits, which will be impossible to achieve without “lighthouse” personalities leading the way.

Content Platforms (Facebook / Instagram, YouTube, Fortnite)

Pop culture’s most influential personalities engage audiences on socially interactive content platforms. Making these platforms well-positioned to own the livestream commerce revolution. Consumers already go to these platforms to interact with friends and tastemakers. This habit is powerful.

These platforms must capitalize on this head start by investing in best-in-class ecommerce and payment solutions that cleanly integrate into existing live content offerings. They need to leverage existing live-viewership behavior to begin cultivating the habit of livestream shopping within these environments (e.g. IG Live, YouTube Live), where the habit will feel most organic. And they should recruit, train, and incentivize A-list personalities to pursue livestream commerce programming, which will cultivate and normalize the habit of live shopping among their fans.

For example, Fortnite can partner with Kylie Jenner to launch a pop-up shop on “Party Royale” featuring a limited supply of exclusive items. Facebook / Instagram and YouTube can work with their most popular creators and advertisers to incubate new livestream shopping formats, partnering with them to popularize this emerging commercial trend.

Even more traditional platforms, which are already broadcasting popular live events, can begin to incubate live commerce programming. For example, Disney broadcasts some of the most-watched live events in the US – from NFL and NBA games, to the Oscars. What if, using in-house talent and production, Disney produced original live shopping segments interspersed into the live broadcasts in lieu of a few ad spots? Disney could further monetize these segments by selling in-stream product placement to brand sponsors (similar to NBCU’s rollout of shoppable ads).

Commerce Platforms (Amazon / Twitch)

Amazon can aggregate enough live viewership within its ecosystem to win the race to livestream shopping in the US. Commerce platforms are not yet a natural destination for engaging content and product discovery. But, through shrewd partnerships and acquisitions, Amazon can generate the live viewership necessary to own the livestream shopping space.

Alibaba is a great case study here. Although Taobao and Tmall are the biggest ecommerce destinations in China, Alibaba does not dominate social media. However, Alibaba was able to create a consumer habit of livestreaming on Taobao Live by leveraging premium on-air personalities. Not only has it recruited major celebrities from the west to host Taobao streams (e.g. Kim Kardashian), but Alibaba also owns a company called Ruhnn. Often described as an “influencer factory”, Ruhnn incubates, and trains promising young personalities to be effective social sellers.

Similarly, Amazon is closing the gap between commerce and content, and redefining the way consumers interact with its platform. Like the content platforms, Amazon needs to build on the momentum of the live-consumption habits that already exist on its platform. And it also needs to develop new consumer behavior through investing in premium talent partnerships, which can attract and activate new audiences.

Through its acquisition of Twitch and live NFL broadcast rights, and the recent rumors that it may be adding live TV to its Prime Video package, Amazon is becoming a go-to destination for premium live content. The company needs to work with the top streamers on Twitch to develop and promote live shopping segments on the platform. It should integrate live shopping segments into its live NFL broadcasts. And it should invest in exclusive partnerships with A+ influencers to host live shopping streams on Twitch and Amazon Live.

Brands

Brands will benefit from US adoption of livestream selling, but not to the extent that creators and platforms will. On Taobao Live, recommended brands don’t reap any long-term benefits from an influencer’s endorsement. Further, brands have to provide significant discounts to be featured. And less than 10% of customers who purchase a brand’s item through a livestream become repeat buyers, compared to 40% of customers who buy directly through a brand’s Tmall store.

Livestream consumers follow the influencer. And when the influencer’s attention moves away from a brand’s product, he or she takes their audience with them. Roger Huang, China CEO for Saville & Quinn, a U.K. skincare company explains:

“It’s just one wave, and then it’s over. They’re Viya’s fans and they follow her call. Livestreaming is very effective, but we can’t get addicted”.

To address this, brands like Procter & Gamble launched their own O&O live shopping channels on TaoBao Live, and retailers like H&M and Wayfair have even broadcasted livestreams on their US websites to coincide with big sales or product launches. However, we don’t believe that branded live shopping shows can have the mass-appeal of a brand-agnostic channel.

Much of the popularity of livestream shopping in China, and influencer marketing in the US, is based on the perceived authenticity of a trusted influencer giving his or her audience the inside scoop on their favorite products. This element is diminished in the context of a brand-owned live shopping channel.

However, brands can use popular personalities to host livestreams, and simulcast them across both the brand’s and influencer’s channels. This will allow brands to reach new audiences who will tune in to engage with their favorite personality. It’s an evolution of the traditional celebrity spokesperson model.

Although these channels may not be as effective at reaching new audiences, we do believe that brand-owned livestream shopping channels could be a great way to super-serve a brand’s super-fans. For example, if Nike launched a nightly live shopping show hosted by Nike-endorsed athletes that featured exclusive discounts and products, it wouldn’t necessarily expand the brand’s audience. But the show would more deeply monetize Nike’s most loyal fans, who would tune in every night in search of (1) exclusive offerings from their favorite sports apparel brand and (2) entertaining content from a beloved personality.

3rd-Party Platforms (NTWRK, Verishop, Popshop Live)

There’s an alternative to the paradigm of content platforms integrating commerce vis-a-vis commerce platforms integrating content. It is new platforms that elegantly blend the two functions from the onset, like NTWRK, Verishop, and Popshop Live. Rather than redefine the user experience of existing platforms, these new companies are content / commerce-native.

They’re built from the ground up to deliver a more seamless experience for consumers, creators, and retailers, solving for the frictions and latencies inherent to the platform pivots profiled above. For example, Popshop Live, which recently raised a $3M seed round, is a two-sided livestream marketplace that makes it easy for individual sellers and established brands to host their own live shopping shows. Popshop provides sellers with a playbook to train them on the best practices of hosting a shoppable livestream, Shopify integrations to help them manage inventory and POS during the show, as well as access to gamification features, show templates, and real-time metrics reporting.

However, a seamless experience for consumers and creators / retailers is meaningless if you can’t drive audience engagement to the platform. Compared to the major platforms, this is a significant disadvantage. However, a 3rd-party platform can drive traffic by providing access to tentpole talent and / or exclusive products and prices. NTWRK embodies this approach. NTWRK, which closed a $10M series A with high profile investors like Drake, LiveNation, Lebron James, Warner Bros, Jimmy Iovine, Arnold Schwarzenegger, Foot Locker and more, collaborates with A-list personalities to promote exclusive time-sensitive product “drops” on its platform.

For example Drake dropped a NTWRK-exclusive merch collection, DJ Khaled dropped a limited-edition version of Beats by Dre headphones, and streetwear designer Jeff Staple dropped an exclusive new colorway of his signature Nike shoes (the stream had 90k viewers and the shoes sold out immediately).

We believe 3rd-party platforms can be winners in the livestream shopping space, but the bar is high and the margin for error is low. They need to not only provide consumers, creators, and retailers with a more frictionless experience, but they also must provide users with products, prices, and personality-driven content that can’t be found anywhere else.

Conclusion

Livestream shopping has enormous potential in the US. It builds on powerful American consumer trends that we’ve been tracking closely.

At RockWater, we always take a “fan first” approach, and we believe that capturing the massive livestream shopping opportunity requires a “fan first” solution.

For content platforms, this means building an end-to-end user experience that seamlessly integrates content and commerce.

For commerce platforms, it means investing in the personalities and programming that delight consumers and make them come to your platform not just to buy products, but to be entertained and engaged.

Based on the $229B live commerce economy that’s developing in China, the reward for successfully unifying the purchase funnel by achieving end-to-end customer delight will be extraordinary.

What’s next? Shoppable product drops during the Super Bowl? Peer-to-peer lives selling, like a cross between eBay and QVC? Flash sales integrated into the daily audio briefings on Amazon Alexa devices? We’re excited to see how the introduction of Live will shape and accelerate the continued merger of content and commerce.

—

Ping us here at anytime. We love to hear from our readers.