Why MGM Sold for 28x EBITDA and How Private Equity Will Fund the “Bullet Makers” of the Streaming Wars

What’s Happening?

Over the past 18 months, but increasingly so over the past 6, we’ve seen valuations for IP and production companies soar during an unprecedented buying spree.

M&A / Capital Raises:

2021:

- MGM Studios: Acquired by Amazon for $8.45 billion (27.5x EBITDA)

- Televisa: Acquired by Univision for $4.8 billion

- Crunchyroll: Acquired by Sony for $1.175 billion

- Roald Dahl Story Company: Acquired by Netflix for $686 million acquisition (with a billion-dollar planned production spend behind it)

- Hello Sunshine: Acquired by Blackstone-backed media venture for $900 million

- This Old House Ventures: Acquired by Roku for $98 million

- Spyglass Media: Sold a 20% stake to Lionsgate (financial terms undisclosed)

- Reel One: Sold a 35% stake to A+E Networks (price undisclosed)

- Komixx: Acquired by iGeneration Studios (financial terms undisclosed)

2021: Rumored Deals

- A24: Exploring sale for $3 billion

- Springhill Company (LeBron James): Seeking a sale for $750 million

- Imagine Entertainment: Potential buyers offering $800-825 million → Raised $100+ million from Raine Group in 2016

- Legendary Entertainment: financial terms undisclosed

- Westbrook Media (Will Smith): Exploring sale to the Blackstone venture that acquired Hello Sunshine

2020

- STX Entertainment: Raised $700 million in 2020 → Merged with Eros International later in 2020

- Moonbug Entertainment: Raised $120 million from Goldman Sachs Growth Equity, Fertitta Capital, and The Raine Group

2019

- Entertainment One: Acquired by Hasbro for $3.8 billion

Why Is This Happening?

Production Companies are the “Bullet Makers” for the “Streaming Wars”: Exclusive and Original Content is More Valuable Than Ever Before.

The “Streaming Wars” and the Rising Value of Content

The ways that content is being distributed, consumed, and monetized are transforming rapidly. Although the traditional broadcast TV model is still powerful, the balance of power is rapidly shifting towards streaming.

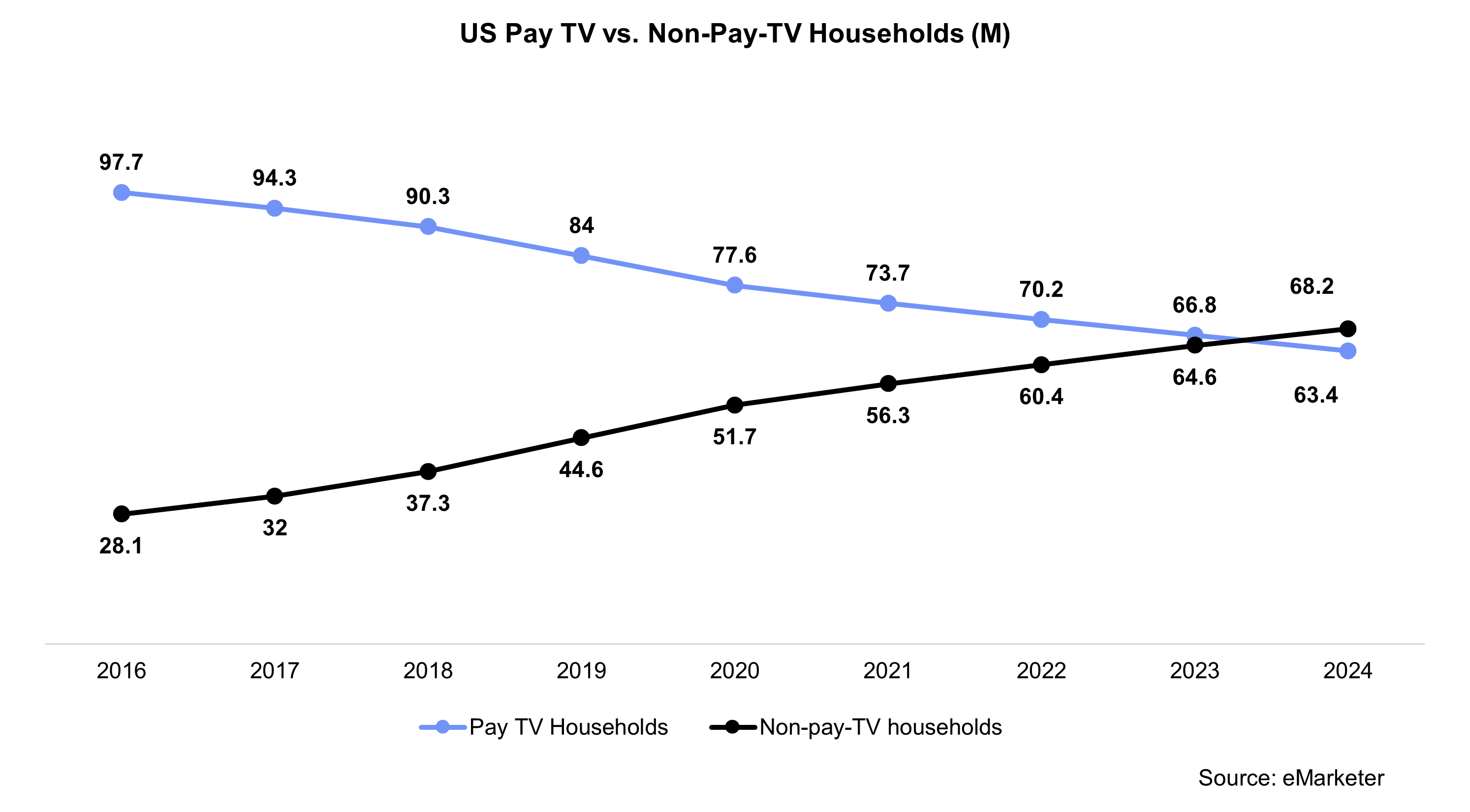

6 million people cut the cord in 2020, leading to an 8% decline in pay-TV subscriptions. Both numbers shattered previous records.

As this trend continues down its irreversible path, the OTT video market is projected to be worth $195 billion by 2025 (a 14% CAGR from 2019). In response, broadcast and streaming companies are all competing to lay claim to the valuable real estate of this “post TV” future.

So, the guiding principle of the “Streaming Wars” is simple: win the land grab.

Spend aggressively to win market share today, while the market is in its formative stages and consumers are developing their routines, in order to become the default streaming destination for generations to come.

This brings us to the value of IP and exclusive content….

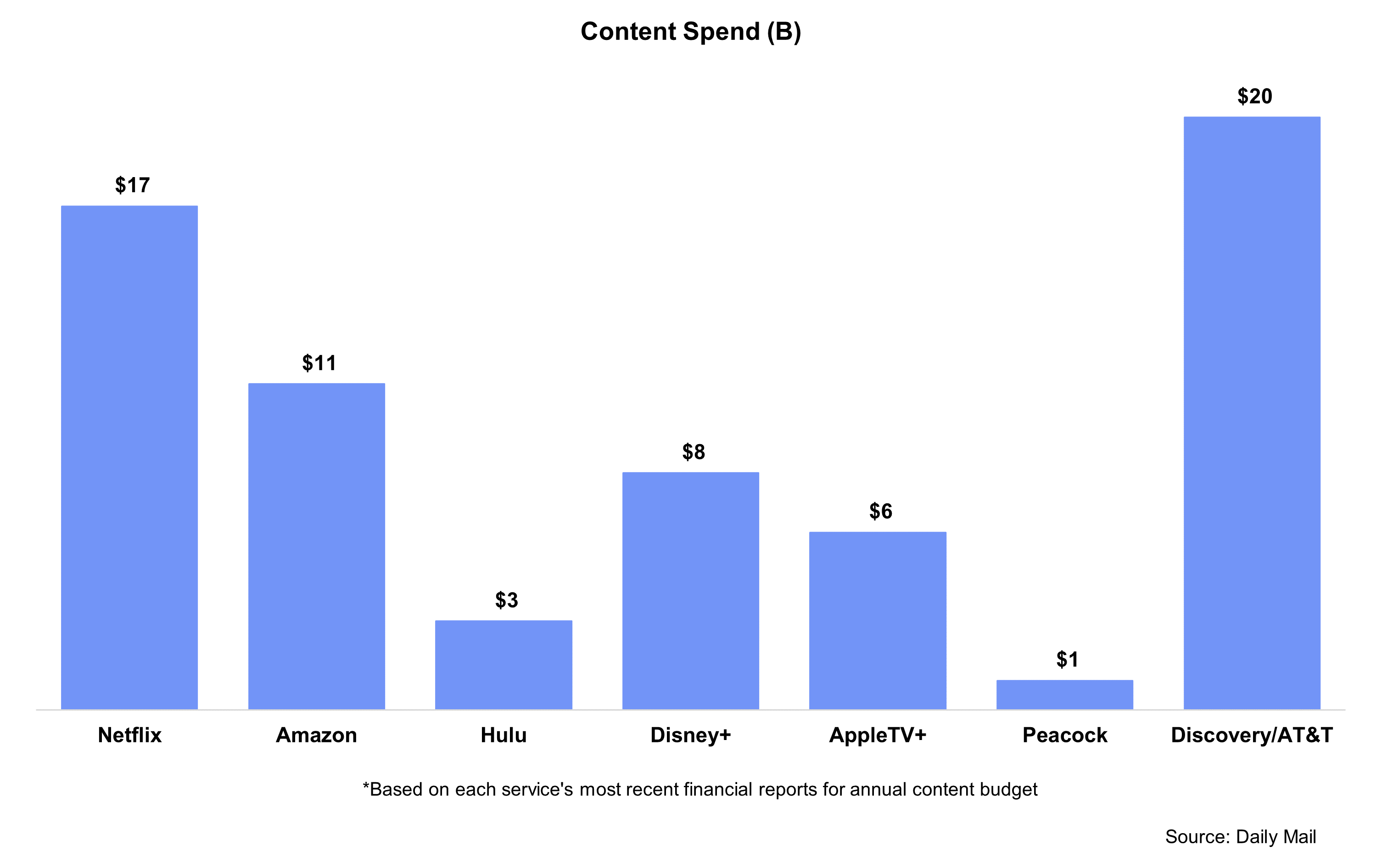

In a world of endless streaming options, content functions as the key differentiator between products, as well as the primary tool for both customer acquisition and retention. Warner / Discovery is comfortable paying $20 billion on content in a single year, because the investment helps them carve out market share in the $200 billion streaming market that’s on the horizon.

More specifically, new tentpole original content drives customer acquisition. And hit library content drives retention.

Even before the streaming era, HBO exemplified the value of tentpole originals on subscriber growth.

If you wanted to be a part of the Monday morning watercooler chat about [insert hit HBO show here], you had to be a subscriber. We’re seeing this same model translate to streaming: whether it’s Stranger Things for Netflix, The Mandalorian for Disney+, or Ted Lasso for AppleTV+, one zeitgeist-y show will drive more subscribers than 10 Super Bowl commercials (that’s probably why Apple just announced they’ll be paying Jason Sudeikis $1 million per episode for season 3 of Ted Lasso).

While tentpole originals bring subscribers onto your platform, reliable favorites is what keeps them there, and cultivates daily habits. That’s why Netflix and NBCU are paying $500 million to put Seinfeld and The Office on their respective platforms for five years.

Because the prices and UX of top streaming services are relatively indistinguishable across the board, the “Streaming Wars” will come down to which platforms offer the most exclusive access to “must see” content.

Put differently: in the context of the “Streaming Wars”, content is the “bullets”…And as the “bullet makers”, production companies are becoming more valuable than ever before.

Ari Emanuel, the CEO of Endeavor, explains the underlying factors driving this trend:

“The investments [into IP and studios] will continue. There’s a finite number of creators and intellectual property to meet the demand, therefore increasing the value…prices are going up in every situation.”

Because of this “arms race” dynamic, today’s content marketplace heavily favors the seller. In their quest to establish a pipeline of exclusive content that will bring users to their platforms and keep them there, streaming services are investing major capital in deals with top filmmakers and studios to lay claim to their future output.

- ViacomCBS / South Park Studios: $900 million (2021)

- Netflix / Shondaland (Shonda Rhimes): $400 million (2021)

- NBC Universal / Exorcist IP Franchise: $400 million (2021)

- Netflix / Ryan Murphy Productions: $300 million (2018)

- WarnerMedia / Bad Robot Productions (J.J. Abrams): $250 million (2019)

- Netflix / David Benioff and Dan Weiss (Game of Thrones creators): $200 million (2019)

- Amazon Prime / Kilter Films (Jonathan Nolan & Lisa Joy): $150 million (2019)

- NBC Universal / Monkey Paw Productions (Jordan Peele – 2021)

- Netflix / Hartbeat Productions (Kevin Hart – 2021)

- Netflix / Amblin Partners (Steven Spielberg – 2021)

- Amazon + IMDBtv / Universal Studios (2021)

Rather than bid for each project on the open market, streaming services are writing nine-figure checks to production companies, sight unseen, to lock down their next several years of creative output. And in the cases of more legacy studios, they’re paying high premiums for the exclusive rights to stream their archives of library content

The Integrated Value of Production + Streaming Companies Are Driving Unprecedented Valuation Multiples

This operating environment, in which the “bullet makers” are more valuable than ever before, is what’s influencing the recent buying spree of production companies — especially among private equity funds. Investors are projecting high ROI’s on production companies, because as the “Streaming Wars” escalate, the price tags for content deals will continue to escalate as well.

Skeptics, who believe these companies are being over-valued, often draw a comparison to the buying spree we saw in the digital video market of the early 2010s, where MCNs like Fullscreen, AwesomenessTV, and Maker Studios were acquired by AT&T, Dreamworks Animation, and Disney, respectively. They say that, like the MCNs, standalone revenues from production companies don’t justify the 9-10 figure deals we’ve been seeing.

However, unlike MCNs and their buyers, production companies are substantially more valuable to streamers than they are on a standalone revenue basis. The integration of these studios and IP-owners is easily worth a premium to top streamers if it helps them win the future of the $200 billion OTT market. The integration logic supporting the MCN acquisitions weren’t nearly as sound, and they failed to drive significant value for their new parent companies.

And even independent of their integrated value, production companies are more reliable assets than MCNs. Betting that A24, Hello Sunshine, or Jordan Peele will continue to make movies and shows that resonate with audiences is a safer proposition than betting on the future of social channels that are so reliant on volatile external factors like platform algorithms, internet trends, and the digital ad market.

In the near-term, we think Private Equity firms will continue to acquire and consolidate production companies to increase the value of their holdings to prospective streaming partners.

And then over the next 2-3 years, we believe that Private Equity companies will sell these assets for an outsized premium when the content buyer-verse expands even further….

How Will This Evolve Going Forward?

The Buyer-verse for IP Production Companies Will Expand

Streaming Platforms Will Acquire Production Companies

Clearly exclusive rights to legacy IP and a pipeline of “must see” content is very valuable to streaming services. That’s why the streamers are constantly bidding with each other for IP and output deals with Hollywood’s most influential creators (as outlined in the list above).

But rather than pay 8-9 figures for a finite claim to a studio’s output, would it be wiser for streamers to spend 9-10 figures for the ability to own that company outright and integrate all of its assets and operations into their platform?

We believe that the economics of such a deal will soon make sense, and become a popular path forward for combatants of the “Streaming Wars”.

By acquiring studios, rather than licensing their content or signing overall deals with them, OTT platforms can better verticalize production and distribution of content. Disney is the perfect example of this: by acquiring Pixar and Marvel, and controlling the content pipeline from development → production → distribution, Disney has maximized the value of its entire flywheel.

So, for example, if Netflix were to acquire Hello Sunshine from its private equity owner, not only would it be able to offer its subscribers access to past seasons of hit shows like Big Little Lies and The Morning Show, but more importantly, it would own the creative pipeline that will produce the next Big Little Lies or The Morning Show. In addition to bringing new subscribers to the platform (like those shows did for HBO and Apple TV+ respectively), controlling a pipeline of premium of IP would also empower Netflix’s growing flywheel strategy — including gaming, audio, live events, immersive experiences, and consumer products (which we explored in our recent report on the growing e-commerce ambitions of top streaming services).

Increased Investments In, and Acquisitions of, Studios That Focus On Underrepresented Communities (Storytellers and Audiences)

By addressing persistent barriers around diversity and representation, it’s projected that the film and TV industry could unlock an additional $10 billion in annual revenue…not to mention, it’s the right thing to do!

As future phases of the “Streaming Wars” unfold, and the consumption preferences of early adopters are all but cemented, high-growth demographics (e.g. BIPOC, LatinX, AAPI) will become increasingly valuable targets for customer acquisition. As a result, streaming services are increasingly focused on providing inclusive storytelling with diverse representation, so that consumers from all backgrounds will have access to enough of their favorite programming to bring them over the paywall and keep them there.

This gap in the market has enabled the emergence of niche streaming platforms like Tyler Perry’s BET+, which reached 1.5 million paid subscribers in its first 18 months, and Univision’s upcoming Spanish-language streaming service, which it’s launching after spending $5 billion to acquire Televisa for its IP library and capabilities (the service will feature 46,000 hours, including 30 original shows, in its first year).

This increased demand is leading to a surge of investments in supply, via new production companies that focus on expanding representation through storytelling. This month, ViacomCBS partnered with Kenya Barris and others to launch BET Studios, which provides equity ownership to Black creators across premium TV and film content. MACRO, a film studio with the stated mission of the voice and perspective of people of color in film and media, recently raised $150 million. In 2020, Lebron James’ Springhill Entertainment raised $100 million to support its mission of creating content that empowers black creators and audiences. And earlier this year, Carmelo Anthony launched a production company focused on “inclusive storytelling”.

As the streaming land grab expands, we expect these production companies to become increasingly valuable. Therefore, we wouldn’t be surprised if private equity companies soon begin acquiring more studios with a specific focus on the demographics that have long been overlooked by Hollywood.

Increased Investments In, and Acquisitions of, Studios Led By Celebrities and Athletes

This year, the top social media platforms have all invested billions in creator funds, because recruiting and retaining top creators means recruiting and retaining their fans.

The same dynamic is true in the “Streaming Wars”; exclusive original content that’s made by and starring celebrity talent will bring their fans to the platform that it’s on.

That’s why we’ve seen streamers ink major deals with production companies owned by celebrities with little to no production experience:

- NBC Universal / Unanimous Media (Steph Curry – 2021)

- Netflix / Nuyorican Productions (Jennifer Lopez – 2021)

- Amazon Studios / Why Not You Productions (Russell Wilson & Ciara – 2021)

- Netflix / Prince Harry & Meghan Markle’s Untitled Production Company ($100 million – 2020)

- Disney Television Studios / Springhill (Lebron James – 2020)

- NBCU / Springhill (Lebron James -2020)

- Netflix / Higher Ground Productions (Barack & Michelle Obama – 2018)

Unlike the output and overall deals listed in the section above (e.g. Viacom paying $900 million to the South Park creators, Netflix paying $400 million to Shonda Rhimes’ company, or WarnerMedia giving $250 million to J.J. Abrams’ company), these deals aren’t based on the prolific resumes of the lead creatives — they’re bets on the power of celebrity fandom to attract and retain subscribers. But, either way, the calculation is the same: production companies that create content which can reliably generate viewership are increasingly valuable assets. The element of celebrity influence is like a “cheat code” that can simulate the value of a long track record of creative success.

That’s why, only one year after its founding, Lebron James’ Springhill Company is reportedly seeking a sale for $750 million. It’s why, only two years after its founding, Will Smith’s Westbrook Media is reportedly in acquisition talks with the same PE fund that bought Hello Sunshine.

And the $900 million dollar acquisition of Reese Witherspoon’s Hello Sunshine is an example of the immense value that’s generated by combining celebrity influence with a proven track record of critical and commercial hits.

Due to their outsized value to the participants of the “Streaming Wars”, we expect to see outsized valuations and acquisitions for production companies led by celebrities and pro athletes.

Podcast Production Studios Will Be Acquired by Private Equity Funds, Film / TV Production Companies, and Streaming Platforms

Film / TV production companies are not the only “bullet makers” capable of generating beloved IP. Increasingly, some of the hottest content franchises are being incubated in audio.

Streaming services and film / TV studios are engaging in multi-million dollar bidding wars for the rights to adapt hot podcast IP to video.

Scott Nemes, Head of Development at NBCU’s subsidiary, Universal Content Productions, explains how the marketplace is heating up for audio-native IP.

“The market is on fire in terms of IP in general. Podcasting is an interesting phenomenon and people are shopping them before they ever air so you have to get ahead of them just like you do with books.”

- NBCU has adapted 16+ podcasts into film/tv

- Pineapple Street Productions expects to have 10-12 original series adapted for film / TV in 2021

- Wondery has 16 different shows that are currently being adapted for TV

- Warner Media is adapting the hit podcasts, “Heaven’s Gate”, “Two Princes”. “2 Dope Queens”, and “Pod Save America” into exclusive video series on HBO Max

- Amazon Studios has adapted hit podcasts like “Homecoming”, “Lore”, and “The Horror of Dolores Roach”

- Netflix adapted music podcast “Song Exploder” into a docuseries and is adapting horror podcast “Archive 81”

- Spotify partnered with Chernin Entertainment on a first-look deal to adapt Spotify original podcasts into film / TV

Not only do top streamers use podcasts to incubate valuable IP franchises, but they also extend their own IP and talent properties into audio formats in order to market and monetize them via spinoffs and companion content.

- Netflix launched a podcast network with a 22 show slate, primarily consisting of companion or promotional content for its hit shows.

- WarnerMedia partnered with iHeartRadio to produce companion content for its HBO Max originals. It also announced that HBO Max will soon feature podcasts within its native app UX.

- Hulu partnered with iHeartRadio to develop companion programming for its exclusive show, “Little Fires Everywhere”

- Apple has announced it plans on producing podcasts to promote its slate of exclusive programming on Apple TV+

This two-way IP pipeline between video<>audio makes podcast production companies an increasingly vital asset in the “Streaming Wars”. This is most likely why Amazon paid $300 million to acquire Wondery. We’ve also tracked nine other acquisitions of podcast studios over the past three years (on our Watchlist linked here).

Bidding wars over audio-native IP will not slow down anytime soon, which means neither will acquisitions. Private equity companies and production companies will roll up podcast production companies to bolster their value for eventual sales to streaming services. And of course, the streamers themselves are also likely to acquire audio studios directly.

Consumer Product Brands Will Acquire Production Studios

Nike has been rumored to be interested in buying Lebron James’ production company, Springhill Entertainment.

The integration logic of an acquisition would make perfect sense.

By owning the next Space Jam or The Shop, Nike could power an expansive flywheel. Not only could it integrate its products and sponsored athletes into the content, but it could also incubate new IP (the equivalent of “Tune Squad” or “Monstar” jerseys / sneakers), which it could manufacture and sell through its existing channels.

Nike would also be able to leverage the creative capabilities of Springhill to produce commercials and other marketing content, limiting its reliance on 3rd-party creative partners.

Other Predictions…

- More private equity buyers will enter the fray. And some will get burned badly when they buy too late on the run-up in content prices, and then mistime the exit window in 2-3 years.

- We’ll see more divestitures of content businesses that are integrated into non-core businesses while prices and investor appetite is strong…like Comcast selling NBCU.

- Top social creators will launch their own production companies.

- There will be a spree of mid to large production companies buying smaller ones in order to bolster their value for future deals.

- More international consolidation.

- Production companies that focus on kids content will be acquired (check out our report on kids content here).

—

Ping us here. We love to hear from our readers.