Netflix Shop and 4 Ways Streamer-Led Commerce Will Evolve

What’s Happening?

Streaming services are increasingly looking to increase revenue diversification through consumer products with direct-to-consumer (“DTC”) commerce as top priority. Want the world to know you’re a Lupin fan? Netflix does too, and they want you to buy something to prove it:

- June 2021: Netflix launched its first foray into DTC commerce, Netflix Shop: The Official Netflix Merch Shop, featuring exclusive merchandise based on IP from hit Netflix shows. Unique product offerings range from a $30 Hypland x Yasuke logo tee to a $55 Lupin side table to a $250 statue of the main character in The Witcher.

The market has taken note and peers are moving quickly — here’s a timeline of recent studio and streaming service consumer product team hirings and restructurings:

- July 2021: Disney Streaming Division Hires Ex-Netflix Exec Ajay Arora to Lead Commerce, Experimentation Team

- June 2021: ViacomCBS Consumer Products Promotes Three as Key Franchises Spur Growth

- April 2021: Skydance Taps Longtime Disney Exec Luis Fernandez for Key Role as Head of Consumer Products

- Feb 2021: Riot Games Taps Ryan Crosby, Former Hulu, Netflix Exec, To Lead Marketing, Consumer Products at New Entertainment Division

- October 2020: Archer Gray adds Jim Fielding as Partner; Fox and Disney Vet will Launch Consumer Products and Merchandising Unit

- Feb 2020: Netflix hires VP of Consumer Products from Nike

- March 2019: MGM Names Robert Marick EVP Consumer Products

Why Is This Happening?

Streamers are working to capture more revenue from their costly IP investments. The recent surge in capital flows to production companies proves the increasing value of IP in the streaming age:

- August 2021: Reese Witherspoon’s Hello Sunshine sells for $900 million

- July 2021: ‘Dune’ producer Legendary Entertainment considers acquisition suitors

- July 2021: Ron Howard and Brian Grazer’s Imagine Entertainment piques investor interest with a valuation near $800 million

- July 2021: Lebron James’ SpringHill Company explores a sale, is valued near $750 million

- July 2021: A24 acquisition rumors swirl with an asking price of $2.5 – $3 billion

- May 2021: Amazon reaches an agreement to acquire MGM for nearly $8.5 billion

Aside from acquisitions, total spend on original content in search of the next big tentpole franchise has reached another record high. Recent predictions suggest streamers will likely shell out over $250 billion by the end of 2021.

Streaming services have an incredible amount of audience data and a desire to leverage some of the most beloved global IP franchises beyond simply driving subscriptions. With the goal of increasing their lifetimve value VS customer acquisition ratio (LTV / CAC), streamers are making a push into DTC commerce to exploit key IP and once again meet their Millennial and Gen-Z audiences where they already are engaging with content they love online.

Now instead of simply watching, the goal is to convert viewers and subscribers to buyers of physical products.

How Will the Market Change?

The streaming wars are rapidly approaching a boiling point, but the commerce x streaming wars are just starting to heat up as competitors find unique ways to compete with the runaway market leader and master of the commerce flywheel: Disney.

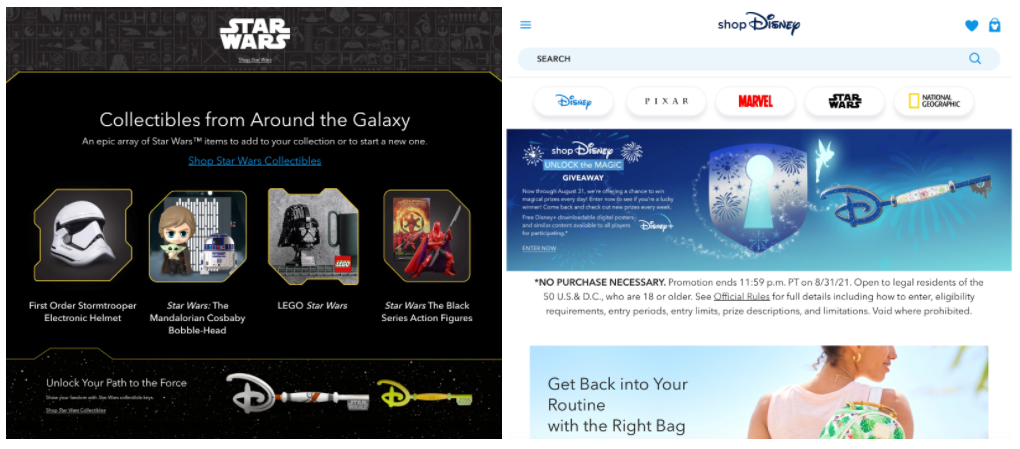

In 2019, total sales of licensed products tied to film and TV characters brought the House of Mouse nearly $55 billion globally. Compared to Disney, everyone else is leaving hundreds of millions, if not billions, on the table. But Disney’s strategy is changing: in March 2021, the company revealed plans to “focus on its ecommerce business and significantly reduce its brick-and-mortar footprint” in order to provide a more “seamless, personalized and franchise-focused ecommerce experience through its shopDisney platform.” Disney is prioritizing personalized DTC offerings to give fans the full Disney experience as they shop from their devices at home — and all the newly revitalized competitor consumer products divisions have taken note.

How #1: Innovation and Expansion in Licensing Agreements

Historically, streaming services have leveraged their IP through various licensing agreements. Over time these agreements have become increasingly innovative and expansive:

- To All the Boys I’ve Loved Before line at Sephora created around the Netflix hit show IP

- A Disney ‘Shop in Shop’ partnership in various Target stores and online

- Space Jam: A New Legacy from Warner Brothers had an exhaustive list of exclusive product lines in each of the following retailers:

- Nike ($120 jersey, sneakers ranging from $180 – $235)

- Flight Club (exclusive $235 sneakers)

- Old Navy ($12 gender neutral graphic tee for kids)

- Zara ($26 athletic shorts)

- Macy’s ($149 Tommy Hilfiger x Space Jam overalls)

- Build-A-Bear ($29 Buggs Bunny plush)

- Additional list of products here

Warner Bros was sure to meet fans where they are with products from Space Jam: A New Legacy. The movie was released in theaters and on HBOMax on the same day in a push to drive new subscriptions for the streaming service. An expansive release of exclusive products across price levels served as both an additional revenue source and as a marketing push.

For now, licensing agreements with major retailers like Target and Walmart are here to stay. They’ll continue to expand in scope and creativity since big box retailers provide a wide reaching, tried and true brick & mortar distribution channel. As DTC shops from streamers continue to improve, exclusive deals between IP owners and retailers could emerge. For example, if a show or film is in the NBCUniversal family, then apparel and any products from NBCU IP will only be available at one retailer like Walmart. Imagine if Disney made a deal with Target — all Star Wars products are only available at Target, on Target.com, in Disney stores and online at Shop Disney — think of this like overall deals between streamers or studios and retailers.

In the land grab for exclusive access to hot IP, anything is possible.

How #2: Growth of DTC “Drop” Models

While some streamers are going wide with their product offerings, others are going deep and DTC. Take Netflix Shop, as a case study:

Netflix introduced their new shop as “A new way for fans to connect with their favorite stories.” The design and user interface of Netflix Shop is reminiscent of online shops from indie darlings Elara Pictures or A24. Each product line is carefully curated and features apparel collabs with buzzy young designers like Nathalie Nguyen or homeware décor from the Louvre museum with designs from the show Lupin. Price points are mid to high and it’s clear that this merch is for superfans who understand the inside jokes and style of characters from each show.

But the really interesting element of Netflix’s strategy is how specifically it meets its largest audience by catering to a shopping trend well known to Millennials and Gen-Z…

“Drop” culture.

In a May 2020 survey, 78% of Gen-Z respondents said they had access to a Netflix account. And Netflix is serving this fanbase merch they want by bringing together their favorite Netflix IP and fashion brands and delivering it through their favorite e-commerce model.

Current Netflix merch offerings stem from anime and genre shows like Eden, Lupin, and The Witcher — each with a strong fanbase. Apparel is predominantly unisex and objects only have a limited number for pre-sale with additional limited releases coming in 3-5 months. The shopping experience is reminiscent of streetwear mainstays like Stussy or Aime Leon Dore: a limited quantity with unlimited potential for collabs.

This new DTC offering from Netflix is a far cry from its original forays into consumer products and licensing which featured partnerships based on Netflix IP with a range of retailers. Josh Simon, VP of Consumer Products at Netflix, explained that Netflix Shop is “an exciting new destination combining curated products and rich storytelling in a uniquely Netflix shopping experience.” Providing Netflix’s core Millennial and Gen-Z fanbase with a shopping experience catered to their preferences and drop culture allows the streamer to leverage consumer products around their one-off hit shows. Netflix knows that their IP does not have the generational stickiness of Disney characters for two reasons:

- Netflix’s rapid IP consumption cycle and ‘popular in X territory’ ranking system churns out hits at the rate of the attention economy

- While Netflix has been nominated for many awards, their original series are still uniquely ‘Netflix’ instead of ‘prestige’ in tone

Netflix knows what their strengths are and who their audience is. They’re making decisions informed by data to continue to meet their Millennial and Gen-Z audiences where they are and give them more of their favorite content.

How #3: Revamp of Digital E-commerce Touchpoints

Streamers and studios will continue to find new ways of bringing the stories they sell on screen into the homes and lives of their audience through unique, authentic, and experiential DTC commerce experiences.

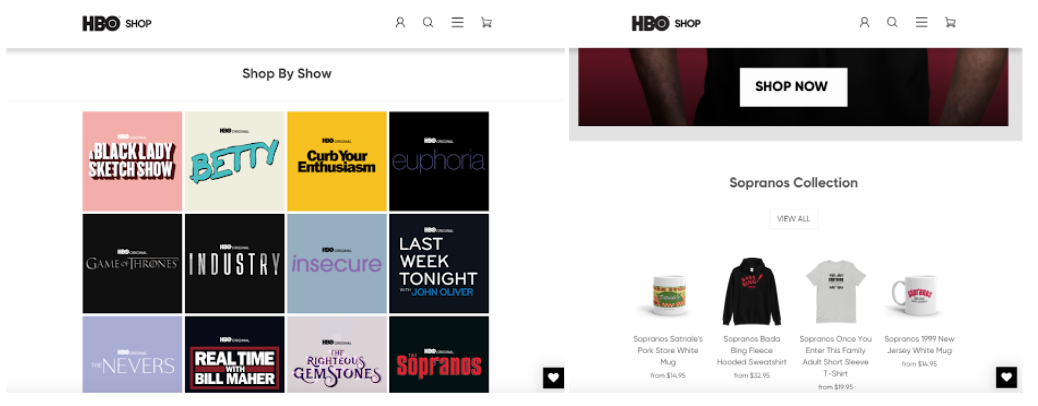

Today, The HBO Store is a typical shopify website organized by IP — each show like Game of Thrones and Succession have show-themed merch, but the customer experience and overall website is severely lacking in design and personality. HBO and HBO Max shows are leading total Emmy nominations this year, but there’s barely any mention of which shows are exclusive streamer offerings or even of HBO Max itself on the website. After a rocky launch, this legacy cable leader is finding its stride with its DTC content offering, but it will soon also need to define its DTC commerce experience.

The HBO Shop homepage features a few products from various shows — customers have to navigate to ‘HBO Originals’ in the search function before having the option to shop by show. Even then, show homepages are a collection of products, some more innovative than others. It’s clear the experience was not designed to maximize customer delight.

In contrast, the Shop Disney homepage features all of Disney’s IP lines including Marvel and Star Wars. Each IP landing page is unique and follows the IP theme giving customers a fun and unique online shopping experience.

Investments will be made to create shopping experiences that delight audiences who are also consumers, utilizing native content elements like a guided experience or video reviews. Every touchpoint counts in the current messy omnichannel commerce web. A best in class example would be an experiential, online world of HBO: fans would enter a website and navigate through different online worlds with interactive games or AR versions of their favorite shows. Imagine clicking on Curb Your Enthusiasm and entering the online version of Latte Larry’s coffee shop with click to buy merch right on the shelves. A virtual Larry can sit in the corner by the window complaining about a wobbly table as fans click through a ‘coffee with Larry’ game.

There are plenty of opportunities for streamers to leverage their IP to create fun shoppable experiences that delight audiences hungry for opportunities to engage with the characters they love.

How #4: “X-Ray” Powered Amazon May Get There First

Amazon will be an early mover in giving audiences the opportunity to purchase directly from content. The streamer currently utilizes a feature called ‘X-Ray’ while audiences are watching a show or movie on the platform to tell them who exactly each actor is in a given scene. It’s likely that Amazon will soon utilize a similar feature to provide audiences with a direct link to purchase the sweater an actress is wearing, the loveseat in the room behind her, and the rug under the loveseat in whatever Amazon original show they’re watching. Click-outs will go directly to where the item is for sale on Amazon.com, making the conversion and purchase journey, from viewer to buyer, incredibly short.

The current purpose of Amazon Prime video is to drive subscriptions for Amazon Prime: for $119 per year a customer gets free shipping on many items on Amazon.com, discounts at Whole Foods, access to grocery delivery, the entire library that is Amazon Prime Video, and more. The purpose of Amazon’s original content offerings may soon shift from driving subs to converting views to purchases. With years of user data, Amazon will have the unique advantage of controlling the entire purchase journey, and also understanding what viewers are looking for by comparing their viewing and historical shopping habits.

However, while this may seem to be in the not-so-distant future, tracking viewership data may not be as easy as it seems. Despite attempted crackdowns and new password prompts, large families or groups of people can all share one Amazon Prime account making it difficult to sift through who is watching and buying what. Assumptions can be made, but in order for Amazon to extract the most value out of their data they’ll need a better way to profile their Prime users.

Conclusion

Overall, the RockWater team expects to see a rapid evolution in the way streamers think about commerce.

As streamers increase their content spend, they’ll seek to maximize ROI by diversifying their revenue streams. And as these platforms pursue new ways to extract as much value from their IP portfolios as possible, we expect consumer products to be their top priority.

Keeping the purchase journey fun and frictionless will be key in the days of shoppable film and TV, which are likely closer than we think.

—

Ping us here at anytime. We love to hear from our readers.