Who Wins as Layoffs Continue and Economy Worsens? This Week it’s Meme Publishers and Videogame Consoles

What We’re Reading

2 articles + RockWater analysis to make you a better investor and operator. Today we discuss the potential the acquisition of Inverse Cramer Newsletter by Alts.co and why Microsoft is well positioned as the economy worsens

———

Alts.Co to Acquire Inverse Cramer Newsletter

Alts.co, 01.15.2023

The RockWater Take by Chris Erwin

I’m a big fan of the Alts.co investment newsletter. Two weekends ago they announced their purchase of the “Inverse Cramer” newsletter. Three things I found interesting about the transaction…

🕵♂️ Alts uses a tool called Newsletter Spy to acquire newsletters. I just looked up. It offers “insights to performance of over 100,000 newsletters.” Specifically, can use to target sponsor opportunities, cross promo partners, or acquisition targets. Very cool, may add to our RockWater toolkit.

Question: what tools do people use for M&A prospecting of social and meme accounts? I think of SocialBlade and CreatorIQ, but curious what new modern tools are emerging. I see a bigger wave of Overheard / Doing Things Media-type deals coming in 2023.

📊 The Inverse Cramer website ranks well in SEO for Jim Cramer-related searches. Considering JC is a top biz personality with broad distro via his Mad Money show on CNBC, and that watchers likely index higher on income VS other demos, that’s valuable traffic. And now Alts can promote that traffic to its other newsletters and products.

🐤 The (anonymous) seller will still manage the Inverse Cramer Twitter account, which has 175k followers. The newsletter has 6.5k readers, and the owner wants to focus his time on Twitter. So, he actually reached out proactively to the Alts team. This is now Alt’s 5th newsletter investment.

…btw if you haven’t heard of the IC newsletter, go check it out. It’s a parody account that tracks Cramer’s oft-wrong investment picks.

———

Microsoft’s Game Pass Will Reap the Rewards from the Economic Downturn

The RockWater Take by Michael Booth

Microsoft’s recent quarterly financial release showed Xbox gaming revenue declined 13% YoY, but I’m optimistic that they will reap the rewards of the worsening economic downturn, here’s why:

While hardware sales drove the overall decline, platform MAUs are at an all-time high (120M) and Game Pass subscribers are also at an all-time high (exact amount was not disclosed).

Refresher: Game Pass is Xbox’s version of a content bundle — for just $15 a month users get access to many cross platform AAA titles, all Xbox exclusive titles, and more. It’s by far the best deal in gaming.

While Sony and Nintendo do have their own competing subscription services, the quality of offering is nowhere near commensurate with Xbox.

Xbox’s base console is also priced much more affordably than its competition. The Xbox Series S starts at $250 off the shelf VS the PlayStation 5 ($500) and the Nintendo Switch ($300).

❓ Why does this matter?

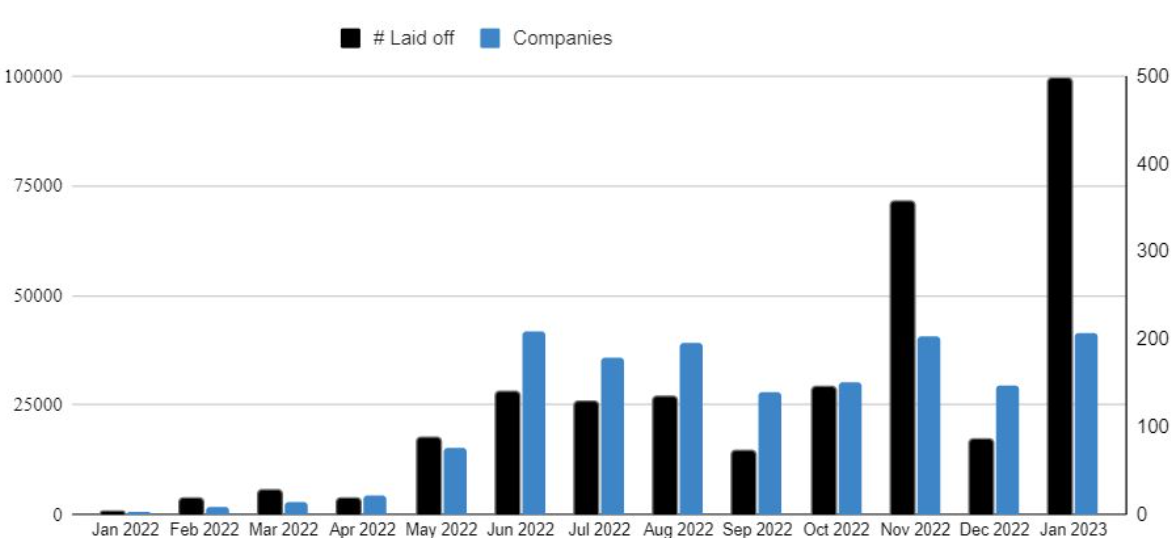

The economy is a bloodbath right now, there are so many mass layoffs announced everyday that it’s hard to keep up.

Amazon: 18,000 employee layoff

Google: 12,000 employee layoff

Microsoft: 10,000 employee layoff

Salesforce: 8,000 employee layoff

Meta: 11,000 employee layoff

Big tech has been anchoring the US stock market post covid, and a contraction in Silicon Valley signals layoffs are going to ripple through the economy. It’s already happening.

❓ What does this all mean?

Consumers en masse are already contracting spending on retail and entertainment. This will continue.

Low cost at home entertainment, like Xbox, will see countercyclical demand tailwinds. IE – when the economy does worse it will see growth. Similar to how movies and fast food do well in bad markets.

The 2023 consumer will want cheap escapism — Xbox Game Pass has a great value prop to do it ($15 a month for unlimited games) and a relatively low hardware entry point ($250 for the console).

I’m bullish.

———

If these insights are relevant to projects you’re working on, ping us here. We love talking all things media / tech / commerce!