RockWater Q4 Market Update + How to Prep for 2024

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we provide some macro market insights, and how to best prepare for 2024.

🗻 We Are RockWater 🌊

Hi readers,

Chris, founder of RockWater here.

I celebrated a new birthday over the weekend. It included many well wishes for the year ahead. It also made me think of our community of builders and investors across media, tech, commerce.

I learned over the weekend just how supported I am by friends, family, and industry peers. I want to pass along that feeling to all of you. Therefore, below is a quick market update, and an overview of our services for how we’re currently helping clients prepare for 2024. I want you all to feel supported as you continue building and deploying capital — this is a challenging market environment, and there are serious pitfalls to avoid. But there are also incredible areas of opportunity.

If we can be helpful to you or an industry peer, DM me.

You can also just read our content.

Onward.

MARKET INSIGHTS

Last week the Fed’s decision to leave the target federal funds rate unchanged at 5.25 – 5.50% was well received by investors, with all major US market indices having record gains last week. As of yesterday (Monday) morning, the S&P 500 was up 4.6% over the last 5 days.

Further, we just had a GDP print of 4.9% QoQ growth. Consumers are still spending. That’s higher than I was expecting. Yet the 10-year treasury yield is near 5%, and equities have had a 3 month pullback of around 9%.

That means there’s clearly a disconnect between Wall Street and Main Street. Eventually they’ll converge. I believe the takeaway is that investors and capital allocators are hesitant, believing we’re on a bit of shaky ground, and thus want more market signals to indicate exactly where we stand. With more certainty, they can best deploy capital.

Within RockWater’s focus areas of media-tech-commerce, I continue to see market corrections. There’s consolidation in video and social commerce, the podcast market is going through an adjustment, and esports is facing a reckoning.

But there’s also great opportunity.

Smart investors and operators are deploying capital to key growth areas. Talent representation M&A is on fire (read here, here, and here), profitable media companies are getting good exit multiples, video aggregators like Electrify are raising lots of capital, and podcasts have a new growth playbook.

Further, the creator economy was recently estimated to be a $250 billion market by the Washington Post (though industry insiders say the realistic target is closer to $50 to 70 billion), ad agency rollup platforms are raising capital and rapidly doing M&A of MarCom businesses, AI startups continue to raise billions of capital, and sports x media continues to draw incredible amounts of investment and consumer engagement.

For builders and investors within our community, the takeaways vary based on the status of your business. But overall, I see 3 main themes…

-

Continue focusing on fundamentals like unit economics and profitability. Build resilience VS relying on 3rd party capital

-

Be opportunistic in making growth bets or raising capital, yet do so on a data-based understanding of market opportunity. And be targeted in your investor outreach. But Buffett’s old adage holds true, “be greedy when others are fearful”

-

If you’re profitable and in a high-value segment of media, tech, commerce, there’s an opportunity to explore M&A exit opportunities

We’ll continue to write about those opportunities on our blog, in this newsletter (sign up link), and on LinkedIn. And we have some 2024 predictions brewing.

ROCKWATER HIGHLIGHTS

Below are some highlights from our client services. Of note, we’re doing a lot more transaction-related work across buy and sell-side M&A, and fundraising:

-

🏈 Sell-Side M&A: Acting as the exclusive financial advisor for a 360 talent representation business focused on sports x gaming x pop culture. RockWater did a company audit, performed a valuation exercise, designed a 2-step auction process to match market demand, created the investor marketing materials and management presentations, and is supporting all confirmatory diligence to work towards close.

-

🎙 Buy-Side M&A: Acting as the exclusive financial advisor for a podcast rollup platform. RockWater services range from creating target M&A criteria and target outreach, to diligence, fundraising, and deal negotiations.

-

💵 Fundraising: Advising a video generative AI business on its capital raise. RockWater is helping to create the company vision, investor marketing materials, financial forecast, target investors lists, including advising the board and current investors on future planning.

-

💪🏼 Strategy Advisory: We advised one of the largest children’s toy retailers building direct-to-consumer content x commerce flywheels. We mapped their competitors in the space, analyzed their internal capabilities, and built a go-to-market strategy.

-

🤝🏼 Business Development: A leading 3PL logistics agency that needed to revamp its sales funnel for 2023. RockWater built new target customer pitch decks, and then identified the target companies and key decision makers at those companies for direct outreach campaigns. We also provided similar services for an award-winning branded content company; RockWater analyzed current and past clients, as well as clients of its peers, and created lookalike client profiles to create a large yet actionable new client target list.

Check out our service offerings below. DM me if you or someone you know is in need of support 👇🏼👇🏼. We’d be excited to pay referral fees.

Onward,

Chris, founder of RockWater

👷♀️ What we do 👷♂️

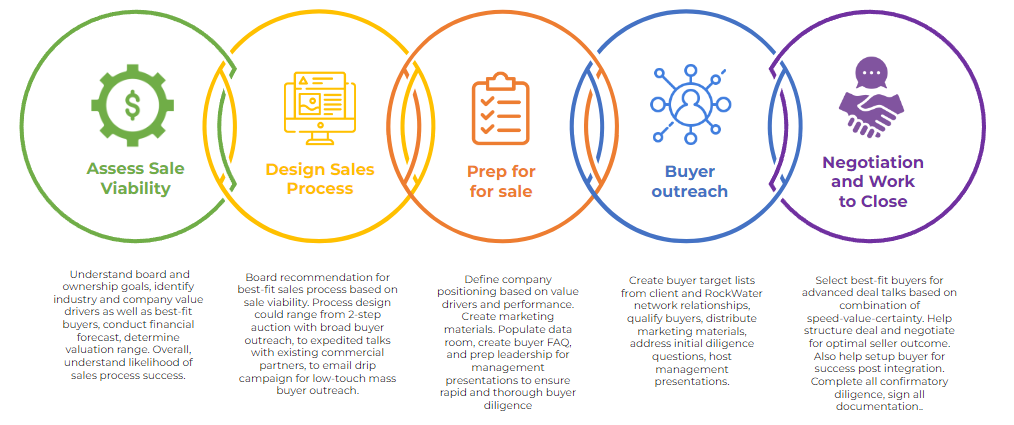

🏈 Sell-Side M&A: RockWater is an expert in Media x Tech x Commerce M&A. We have extensive deal, market, and buyer knowledge. We work tirelessly to get you the best outcome, and free up your time to focus on running the business.

Acting as the exclusive financial advisor for a 360 talent representation business focused on sports x gaming x pop culture. RockWater did a company audit, performed a valuation exercise, designed a 2-step auction process to match market demand, created the investor marketing materials and management presentations, and is supporting all confirmatory diligence to work towards close.

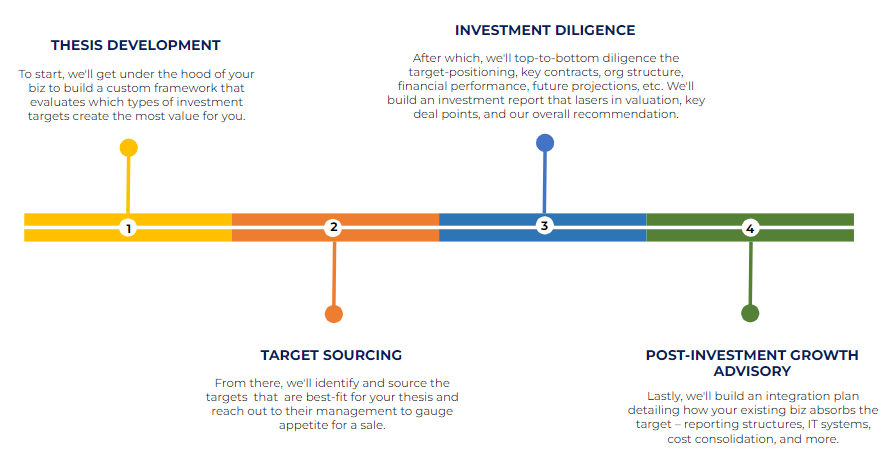

🎙 Buy-Side M&A: We empower business owners and investors to make savvy acquisitions.

Acting as the exclusive financial advisor for a podcast rollup platform. RockWater services range from creating target M&A criteria and target outreach, to diligence, fundraising, and deal negotiations.

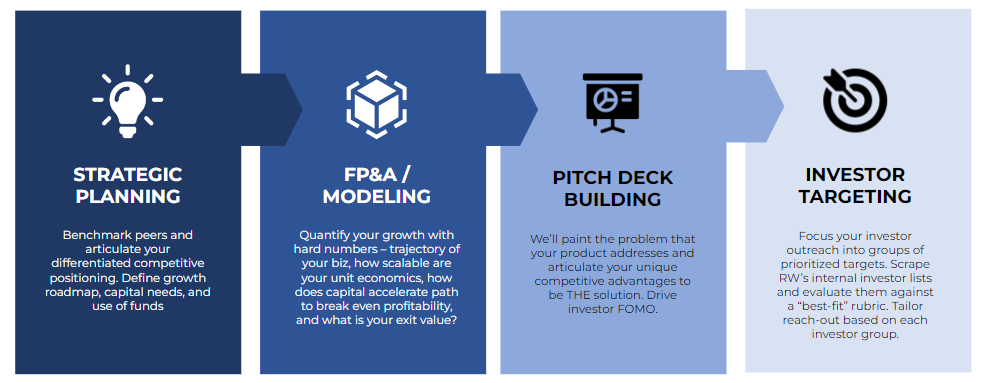

💵 Fundraising: We’ll build a compelling story for you to fundraise against, and target best-fit investors for you to speak with.

Advising a video generative AI business on its capital raise. RockWater is helping to create the company vision, investor marketing materials, financial forecast, target investors lists, including advising the board and current investors on future planning.

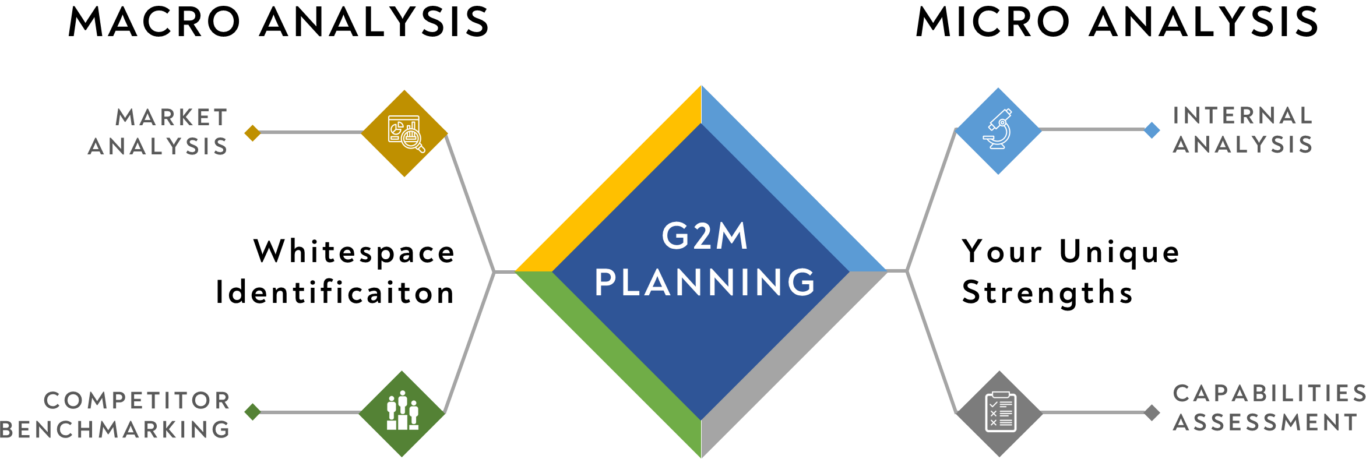

⚙️ Strategy is at the core of everything we do. We’ll build a foundational understanding of your market, benchmark your competitors, assess your internal capabilities, and find your edge. We’ll use these findings to create your unique go-to-market business plan, operating budget, and target milestones.

We advised one of the largest children’s toy retailers building direct-to-consumer content x commerce flywheels. We mapped their competitors in the space, analyzed their internal capabilities, and built a go-to-market strategy.

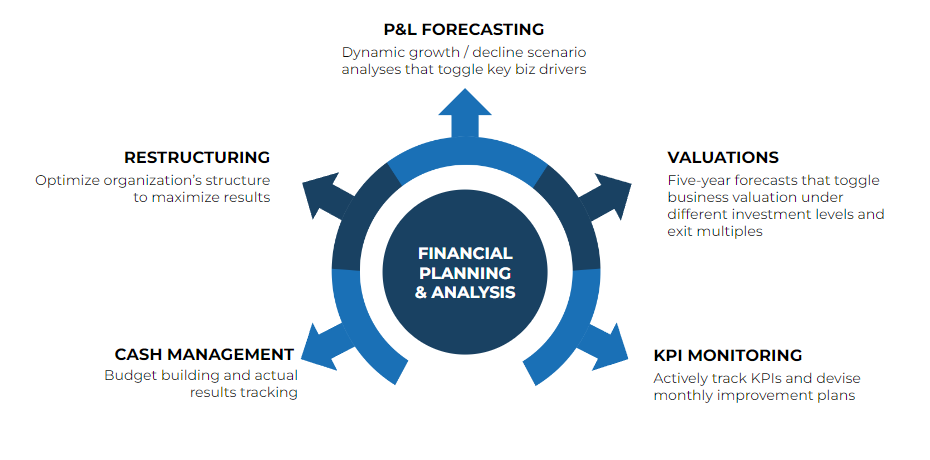

💲 Financial Planning & Analysis is table stakes for any startup in 2023; investors need to see sustainable unit economics. With the current economic outlook, we recommend that clients have enough capital to survive for at least 2.5 yrs. We’ll ensure that you are ready to weather the storm.

We formulated a bottoms-up 8 figure marketing budget for an OTT streaming service. Budget promptly approved by CEO and parent company owner.

📈 A structured Business Development approach is critical for driving revenue. RockWater will give you an expansive hit list of target leads, create marketable pitch decks to get you meetings, and help you structure the economics when it’s time to close. We make deals happen.

We built a compensation structure for a new sales department of a large audio distributor, with incentive alignment for company-wide success.

ROCKWATER TLDR

RockWater provides financial and strategy advisory for execs in media, tech, commerce. We help our clients make faster, data-based decisions. With the goal of creating enterprise value, launching new businesses, and growing revenue.

Who Hires Us:

-

Founders with lots to do but have lean teams and budgets

-

C Suites and VPs who seek data-based decisions and modernization

-

Investors whose portfolio companies need experts to parachute in, or require specialized investment diligence

And… we LOVE to pay referral fees (5-15% of engagement size).