Robinhood Buys its 2nd Financial Newsletter, Chartr

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we discuss Robinhood’s purchase of Chartr, and what we expect to see in the future of financial media.

Robinhood Buys its 2nd Financial Newsletter, Chartr

Financial product companies need a content strategy.

But content businesses are hard to build, so smart operators acquire their content engines.

The Latest:

Robinhood acquired Chartr, a data visualization newsletter. The latest addition to their O&O media suite.

Prior to Chartr:

– Robinhood acquired Market Snacks, a daily stock market newsletter with 8 8-figure weekly readership.

Why does a stock brokerage keep acquiring media companies?

Simple Answer:

lower Customer Acquisition Cost (CAC) and grow customer Lifetime Value (LTV).

The avg LTV for a retail financial products company is around $3k, quite high for B2C. This is why credit cards, trading platforms, banks, etc offer hundreds of incentives for account creation. – “We’ll match $300 on your first deposit”.

$3k LTV / $300 Customer Incentives = 10x LTV / CAC.

While 10x LTV / CAC are winning economics, a company then needs marketing $ to drive awareness of those incentives, which will quickly increase CAC. Say it costs $50 to get in front of the right potential customer → CAC is now $350 → @ $3k LTV then its now 8.5x LTV/CAC. A 15% haircut!

That’s where Chartr adds value – it has 500k newsletter subscribers + 600k social media followers.

M&A rationale is simple: buy content engine → get in front of new audiences → convert into Robinhood customers → preserve 10x LTV/CAC.

Sample economics:

Suppose Chartr has 2M unique weekly views x 0.3% conversion x $2.7k net profit per customer = $162M of enterprise value.

But it gets better, LTV assumes natural churn. Media products are effective at reducing churn because they increase customer touchpoints. Robinhood customers are less likely to churn when they’re listening to the weekly podcast, reading the daily stock market newsletter, engaging with content on social media, etc. So $3k LTV has considerable upside as well.

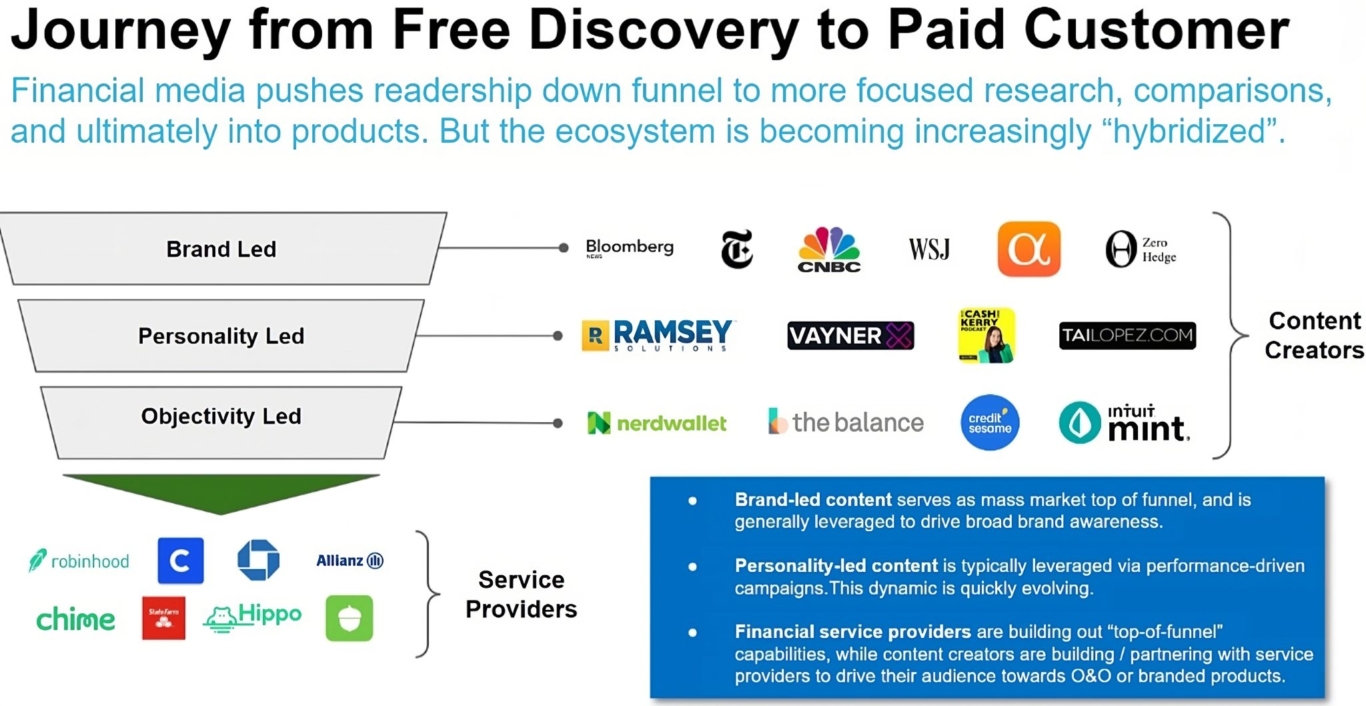

Robinhood isn’t the only one savvy to the customer acquisition game being played. There’s been a steady convergence of both financial media companies launching products and financial products companies launching media outlets.

I’m particularly bullish on financial creators launching their own budgeting apps, retail trading platforms, credit cards, etc. Economics is great and personal finance is a confusing landscape for consumers – making trustworthy creators a value-add.

Below is a graphic I put together that further explains the hybridization of retail finance’s funnel from discovery to paid customers.

Bottom Line:

We’re going to see an increasing number of media-first financial product companies, and resultantly legacy finance service providers acquiring their way into content. A few finance x media cos that I’m watching: Atlas, Ramsey Solutions, Stocktwits, and Barstool Sports.

I’m the founder of RockWater Industries. We do financial and strategy advisory for media, tech, and commerce. From M&A and fundraising to consumer research and go-to-market planning.

DM me on LinkedIn or email me chris @ wearerockwater dot com