The Duality of Social Audio: How will the landscape unfold?

Many have asked us, “Is Clubhouse a feature or a product?”. But the two aren’t necessarily mutually exclusive.

As we outlined in Part 1 of this report, Social Audio is clearly a feature. But whether or not Clubhouse is truly a “product” will be determined by its ability to cultivate a distinct user experience and platform identity that transcends the singular feature of Social Audio. This evolution will be increasingly crucial as the “feature” of Social Audio becomes further commodified through its replication by incumbent platforms with more deeply-entrenched user bases.

In this report we break down the Social Audio feature VS product dynamic, and then discuss how both upstarts and incumbent platforms can unlock Social Audio success.

Breaking Down the Feature VS Product Dynamic

The best brands and creators function as an extension of a fan’s identity. The best platforms function as habitual and delighting destinations for users to meaningfully engage with the brands, creators, and communities that define a particular extension of their identity.

For the music fan in me, I go to Spotify. When I put on my professional networking hat, I go to LinkedIn. For social networking, Instagram. When I want to be a part of real-time, moment-driven, “watercooler conversation”, I go to Twitter. If I want to tap into my inner super-fan, I’ll check out the appropriate subreddit. Esports? Twitch. Marvel? Disney+. Communicating with colleagues? Slack. The list goes on, but you get the point…In order to be most effective, Social Audio needs to manifest as an organic extension of the ways in which users are already interacting with these platforms.

The takeaway is that Social Audio as a feature is being co-opted by established platforms to deepen engagement and expand their share of total user time on-platform. Because of this widespread initiative, which we explored in Part 1, we don’t see the Social Audio market as a “winner-take-all” race. There won’t be one platform that owns the medium. Instead, we believe the evolution of Social Audio will ultimately be defined by how each platform decides to uniquely integrate Social Audio into its existing user experience.

The most successful platforms are the ones that deeply understand the role they play in connecting their creator communities to audiences, and evolve to deepen that user relationship by super-serving that function. The platforms that falter are often the ones that try to be everything to everybody.

You may recall Spotify’s brief and unsuccessful foray into video in 2015, when the platform launched “Video Capsule”, which allowed users to view licensed clips of popular programming, which were often completely unrelated to music (e.g. highlights from SportsCenter). Ultimately, Spotify decided to refocus its expansion ambitions from video to podcasts, in order to double down on what it does best: audio. Courtney Holt, the Head of Spotify Studios, explained the pivot:

“A giant slate of video is not what people are expecting on the platform.”

However, he noted that expansion into podcasts, which, unlike video, felt native to the audio-first experience that users came to the platform for, effectively boosted user engagement and time on-platform:

“People who consume podcasts on Spotify are consuming more of Spotify — including music. So we found that in increasing our [podcast] catalog and spending more time to make the user experience better, it wasn’t taking away from music, it was enhancing the overall time spent on the platform”

There have been many similar examples of growth initiatives that failed because they felt inorganic to the platform experience. From Facebook’s brief foray into the “Streaming Wars” with multi-billion dollar investments into premium long-form video, to Twitter’s experiment of broadcasting live sporting events. And there have been many examples of successful platform expansions that were the result of integrating new features and content verticals in a way that felt organic to the relationships that users had already developed with the platform: from Spotify’s aforementioned integration of podcasts, to Instagram’s replication of Stories, and YouTube’s expansion into livestreaming.

We believe that Social Audio will evolve along a similar trajectory. Most of the announcements from incumbent platforms outlining their vision for Social Audio echo this sentiment. From Gustav Söderström, Chief Research & Development Officer at Spotify:

“The world already turns to us for music, podcasts, and other unique audio experiences, and this new live audio experience is a powerful complement that will enhance and extend the on-demand experience we provide today.”

This recent user poll that popped up on the Spotify app confirms their commitment to creating a Social Audio experience that aligns with user wants and expectations for the platform.

And from Suzi Owens, spokesperson for LinkedIn:

“[Our goal is] to create a unique audio experience connected to your professional identity. And, we’re looking at how we can bring audio to other parts of LinkedIn such as events and groups, to give our members even more ways to connect to their community…Our members come to LinkedIn to have respectful and constructive conversations with real people and we’re focused on ensuring they have a safe environment to do just that.”

At RockWater, our vision for Social Audio is that it will be incorporated to deepen engagement within platforms that already have a defined role in the lives of their users. Discussions between founders, executives, and investors will take place on Linkedin’s Social Audio feed. Musical artists will host Q&A’s to promote their new album drops on Spotify. Friend-to-friend and influencer-to-fan conversations will happen on Facebook’s Social Audio portal. Journalists will congregate on Twitter Spaces. The gaming community will do so on Discord. Colleagues and vendors / business partners will chat on Slack.

(Yes, this is a simplified breakdown, but you get the point).

So what does this mean for upstart Social Audio platforms like Clubhouse that don’t have defined vertical niches and well-defined consumer relationships?

Upstarts need to define their platform identity before the incumbents define their Social Audio products. Otherwise, their user bases will be siphoned off vertical by vertical.

Death by a thousand paper cuts.

When Clubhouse first launched, it was able to be everything to everyone because it was the only destination for Social Audio. But once this feature is commodified, who is Clubhouse?

Clubhouse needs to ask itself, “Beyond the functionality of Social Audio, what does our platform mean to users? What essential relationships or routines happen on our platform? Who is our super-fan and how do we super-serve him or her?”

In contrast, the founder and CEO of Betty Labs, owner of Locker Room, the sports and culture-focused Social Audio app that was acquired by Spotify to support its ambitions to expand into live audio, articulated a clear product vision with a focused use-case in mind:

“[The goal of Locker Room’s integration into Spotify is] to create the ultimate destination for live conversation around music and culture”

As we’ve seen with platforms like Twitch — which started off by owning the livestream gaming and esports community, and later evolved into livestream music, sports, and socializing — launching with a narrow vertical focus doesn’t prevent a platform’s ability to expand to new verticals over time. But early focus is essential to gain initial traction by cultivating community stickiness, and bolstering user retention and engagement.

Perhaps Clubhouse’s recent partnership with the NFL signals its ambitions of owning the sports vertical. However, given Spotify’s acquisition of Locker Room, the prominence of “NBA Twitter”, Reddit’s built-in community of sports fans who use the platform to engage with fellow fans around tentpole moments, this will be a competitive space.

Or maybe, given its recent rollout of creator monetization tools, or its recent announcement that it’ll be funding 50 new audio show pilots for creators on the platform, Clubhouse is seeking to be the home for professional creators seeking to monetize their fans via Social Audio. But considering the fact that many incumbent platforms have recently rolled out their own suites of creator-monetization tools that replicate the features pioneered by leading “creator economy” platforms like Cameo, Patreon, and OnlyFans, we doubt these tools will be enough to build a moat sufficient to hold off the competition.

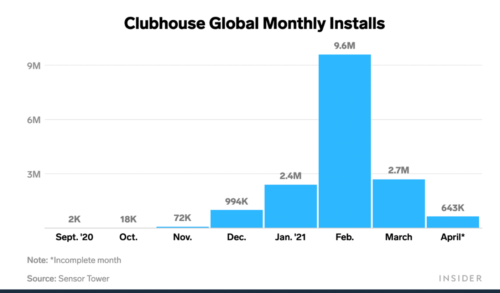

This lack of identity is already translating to a lack of stickiness. In February, the platform peaked with 9.4 million installs. But in May, it had only 643,000.

Whichever route Clubhouse chooses, it needs to start building a platform-native community ASAP. Because a slew of competitors that already have deeply entrenched communities with daily platform habits are already mobilizing. And as the novelty of its core functionality dissipates, Clubhouse’s head start is eroding by the day.

WHAT needs to happen to unlock Social Audio’s full potential?

Personalized discovery and social sharing

Only 23% of monthly spoken-word audio listeners learn about new shows via on-platform recommendations. 54% of them discover new shows by searching the Internet, and 50% say they find new shows from word-of-mouth recommendations. Frictionless discovery and social sharing is a pain point for the podcasting industry, a fast-growing subset of spoken-word audio overall, and due to podcasting’s social and communal nature, Social Audio is well-positioned to solve it.

Like the best “drop-in” social media feeds (e.g. the For You feed on TikTok), the always-on nature of Social Audio could be leveraged to empower a more personalized discovery experience that pairs users with the live shows that they’ll like most. Given the user data that incumbent platforms like Facebook and Spotify already have, they’re well-positioned to build out this functionality, especially compared to upstart Social Audio platforms which are just now beginning to learn about their listener preferences.

With enhanced discovery features, Social Audio also has the potential to function as a powerful top-of-funnel user acquisition tool for creators, especially podcasters. For example, immediately after an NBA playoff game, Bill Simmons can host a live recap show on Spotify / Locker Room (Bill Simmons’ media company The Ringer is already owned by Spotify). Sports fans on the platform could be notified of the event, tune in, develop an affinity for Bill Simmons, and then subscribe to his portfolio of exclusive podcasts on Spotify and become regular listeners. In this situation, the creator, the platform, and the user all win.

Monetization:

Conversely, Social Audio could also be a powerful “bottom-funnel” tool for creators to monetize their super fans. Continuing on the thread of Spotify-owned creators, Joe Rogan could follow up the release of each podcast episode with an intimate and interactive recap show. He could not only paywall the event, but also sell custom emotes and badges that would enable listeners to stand out in the chat and interact with Joe directly through highlighted questions or comments.

For podcast studios with built-out ad teams, Social Audio programming represents new inventory to sell. Host-read ad spots on Social Audio shows may become the new norm for established creators looking to leverage the medium.

On-Demand Recording and Listening, and RSS Distribution:

As we outlined in Part 1, flexibility is paramount to audio’s appeal. The “drop-in” nature of Social Audio makes it a highly accessible medium, however the lack of on-demand optionality makes it less flexible, and thus less fan-friendly.

One of the (many) learnings from the Quibi experiment is that platforms need to enable a broad multitude of consumer touchpoints. For Quibi, mobile consumption was its key company-defined use case, but the fact that it didn’t allow for smart TV viewership, nor easy social sharing, were major misses. Twitch, on the other hand, is a livestream platform, but it also enables on-demand viewership, clipping, and sharing after the stream has ended.

Case in point, I missed the now-famous Elon Musk appearance on Clubhouse. While the fleeting immediacy of that event made it more engaging and special for those in attendance, and undoubtedly contributed to the buzz surrounding Clubhouse, it ultimately robbed creators and fans of the long-tail value of that content. If the Musk interview were published as a podcast the next day, it would most likely have topped the podcast charts, creating incremental revenue for the creators and exposing more fans to their content.

Live and On-Demand Production / Editing Tools:

Although the ease of production is one of the main draws of Social Audio for creators, we also believe that the development of creator tools that provide a professional polish will be an important next step. The raw nature of Social Audio is a double-edged-sword. As much as the raw authenticity of the medium may sometimes add to the listener experience, there’s a reason why podcasters and radio shows employ teams of editors and producers — a high quality podcast stands out.

Like Stage Ten has built for professional livestreamers, and like Instagram and TikTok have built for UGC photographers and video creators, we expect to see platforms build out tools that enable, with minimal effort and expertise needed, the ability to produce live audio shows with added effects like music cues and live audience polls, as well as the ability to edit past live audio streams into well-produced podcasts before publishing them on an RSS feed for on-demand consumption.

Audio “Watch Parties”

Building off of Clubhouse’s recent partnership with the NFL to distribute shoulder programming to promote the 2021 Draft, and the “Watch Party” trend, where most of the major streaming platforms launched interactive features to enable communal viewership during COVID, perhaps we’ll see Social Audio platforms partner with video platforms or media companies to develop voice-enabled “Watch Parties” to wrap around their live broadcasts.

For example, ViacomCBS could partner with Clubhouse to enable alternative, community-driven, commentary feeds for its live broadcasts. The hosts from their hit podcast All The Smoke could host a live watch party for their March Madness coverage, Nickelodeon characters could host a kids-focused watch party for CBS’s NFL broadcasts, and Daily Show correspondents can lead a watch party to accompany CBS News’ election night coverage.

Audio-Native Livestream Commerce

The unique captivity of live audiences can be powerfully harnessed to drive e-commerce sales. As we detailed in a previous report, “livestream shopping” combines the interactivity of Twitch with the “FOMO factor” of time-constricted commerce “drops”. As a result, livestream e-commerce converts viewers to buyers at a significantly higher rate than traditional marketing (30% VS 3%). China has embraced this model, building a livestream shopping sector that’s estimated to have generated over $180 billion in 2020.

Due to its enhanced intimacy, podcast advertising has already been proven to be highly effective at driving conversions. Could we see the power of audio advertising merge with the livestream shopping trend to form audio-native livestream shopping experiences?

With the rapid rise of smart speaker ownership (21% increase YoY), the convergence of audio and commerce has never been more feasible.

Facebook has already begun to experiment with livestream video shopping. Perhaps it could leverage its new Social Audio features to expand its livestream shopping program for creator and brand partners. Spotify is already selling artist merch and concert tickets through its platform. Could it integrate exclusive merch or discounted ticket access to the listeners of a livestream?

There’s an untenable currency to “I was there” moments. It’s why the NFT of Jake Paul’s knockout of Nate Robinson sold for $10 million. It’s why limited edition, moment-driven merch for events like concerts or sports championships are so lucrative. Could platforms enable the sale of commemorative memorabilia to the live participants of a Social Audio stream?

Audio-Native Livestream Concerts

Although COVID triggered the livestream concert boom, the trend will far outlast the pandemic. Just this week, there were two major capital raises by livestream concert platforms, Wave and Dreamstage. Livestream concerts use social interactivity to bring the shared communal experience of a concert into the home. And although in many cases, there may be a high-budget visual production value to these productions, oftentimes, the visual component of the artist on stage is the least engaging part of the stream. For those moments, Social Audio could be the answer. For example, if a DJ is spinning a live mix, it might not be the most captivating thing to watch. But it makes for great background programming that you could take on the go with you. And because it’s happening live, the real-time communal consumption experience makes it more special. You could interact with fellow audience members, and maybe even make requests directly to the DJ.

Social Audio provides another level of optionality for creators to ensure that the right content is going on the right medium. If video doesn’t enhance the experience, it becomes cumbersome. As livestream concerts become the norm, Social Audio could play an important role for many of these communal audio experiences.

Conclusion

Social Audio will come to represent another tool in the toolbox of creators and publishers. Another complementary touchpoint to engage fans and reach new audiences. So how should creators, publishers, and brands best leverage this new medium in a coordinated strategy to reach new users, engage existing audiences, and drive more enterprise value? By developing new Social Audio-native programming and monetization strategies?

Perhaps we’ll outline our strategy in a future report. But in the meantime, feel free to reach out at hello@wearerockwater.com if you’d like to discuss. And you can also learn more by listening to our Rise of Social Audio episode on the RockWater Roundup podcast.

—

Ping us here at anytime. We love to hear from our readers.