5 FAQs On Livestream Shopping

Our team at RockWater is consistently approached by investors and operators throughout the livestream shopping space in seek of advisory around key strategic questions.

So, to better serve our community, we’ve compiled 10 of the most frequently asked questions, which we’ll answer over the next two newsletters. This report will break down five questions addressing the current state of the livestream shopping market, and our next report will explore 5 key FAQs about the future of this industry.

PART 1: THE CURRENT STATE OF LIVESTREAM SHOPPING

1. How is the livestream shopping ecosystem currently constructed?

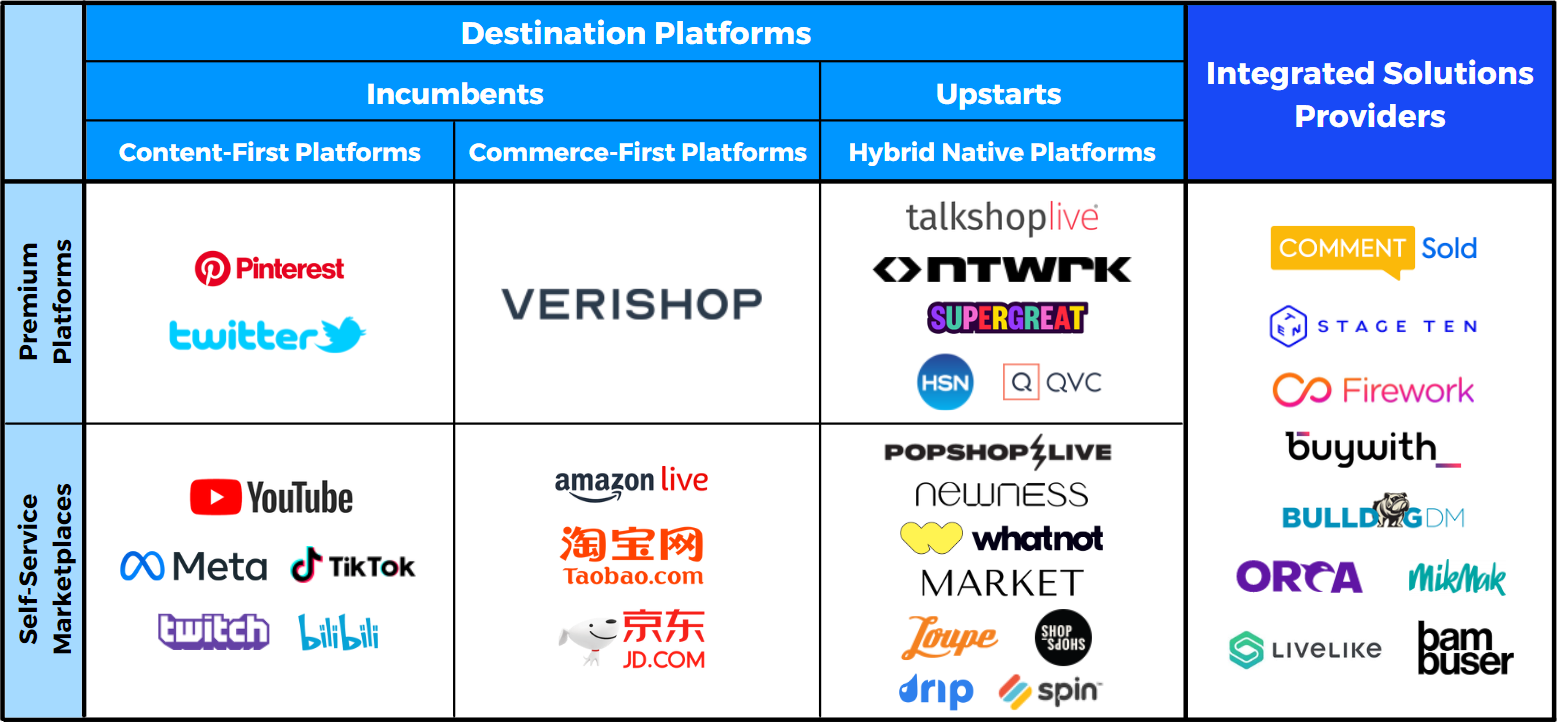

The US livestream shopping ecosystem currently consists of two main company types: “Destination Platforms” and “Integrated Solutions Providers”.

DESTINATION PLATFORMS

Destination Platforms are dedicated platform environments that consumers intently seek out.

These companies have high floors and high ceilings: It’s incredibly difficult to shift existing user behaviors, and migrate consumption from incumbents to new platforms. But if you can establish a critical mass of recurring usership, the potential upside for enterprise value is enormous, due to the enhanced customer proximity.

The universe of destination platforms is broken up into three sub-categories: Content-First platforms, Commerce-First platforms, and Hybrid-Native platforms.

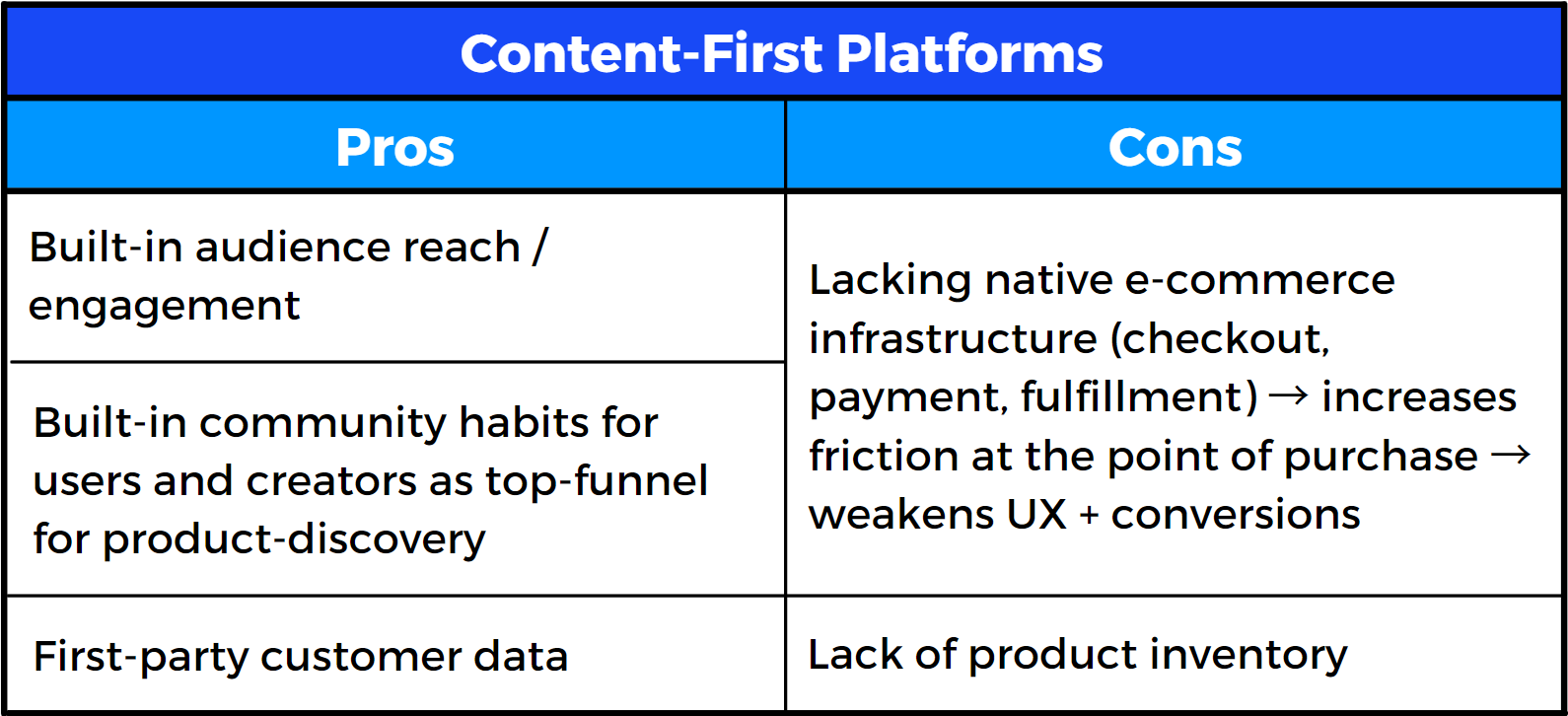

Content-First Platforms: Incumbent social media platforms that are building off the momentum they’ve built — as the go-to social video hubs for creators, brands, and consumers — and supercharging the value and utility of these touchpoints by introducing live commerce functionality. Examples: YouTube, TikTok, Meta, Twitch.

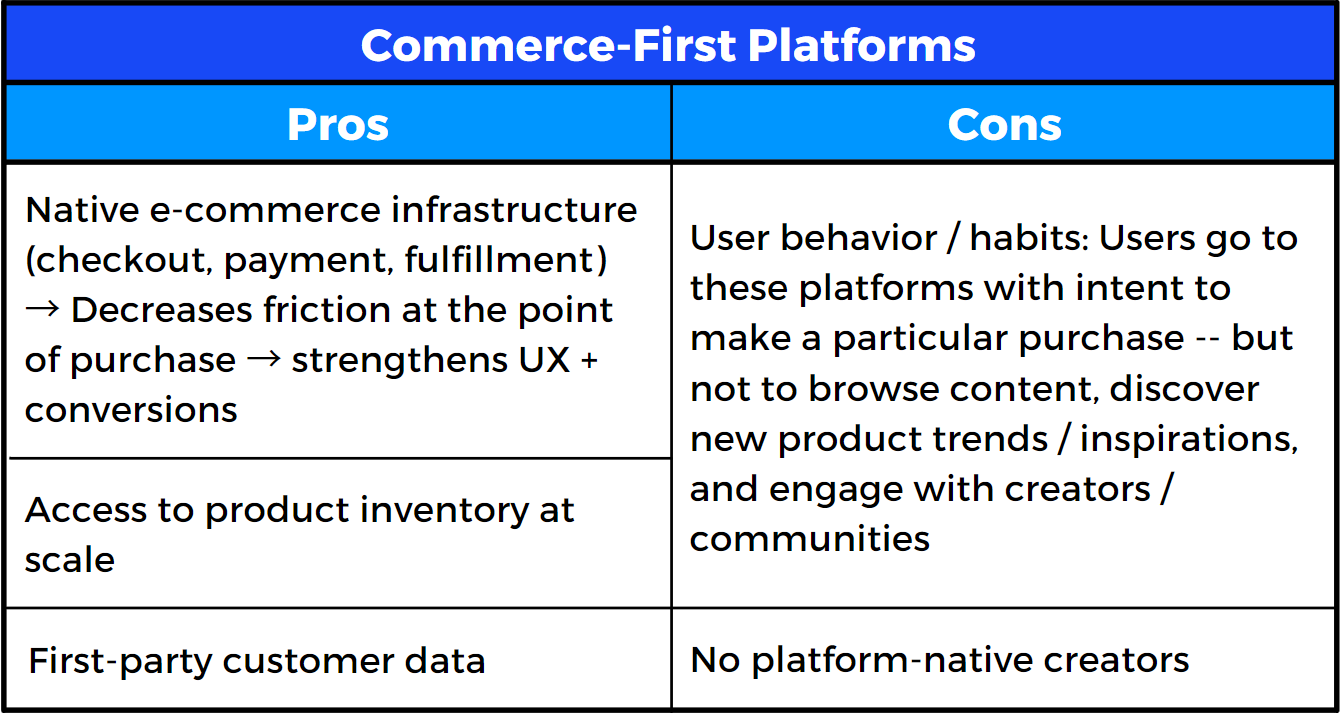

Commerce-First Platforms: E-commerce platforms that are building on the momentum that they’ve built as habitual shopping destinations, and implementing livestream technology to supercharge that user behavior through increased product discovery and conversion. Example: Amazon Live.

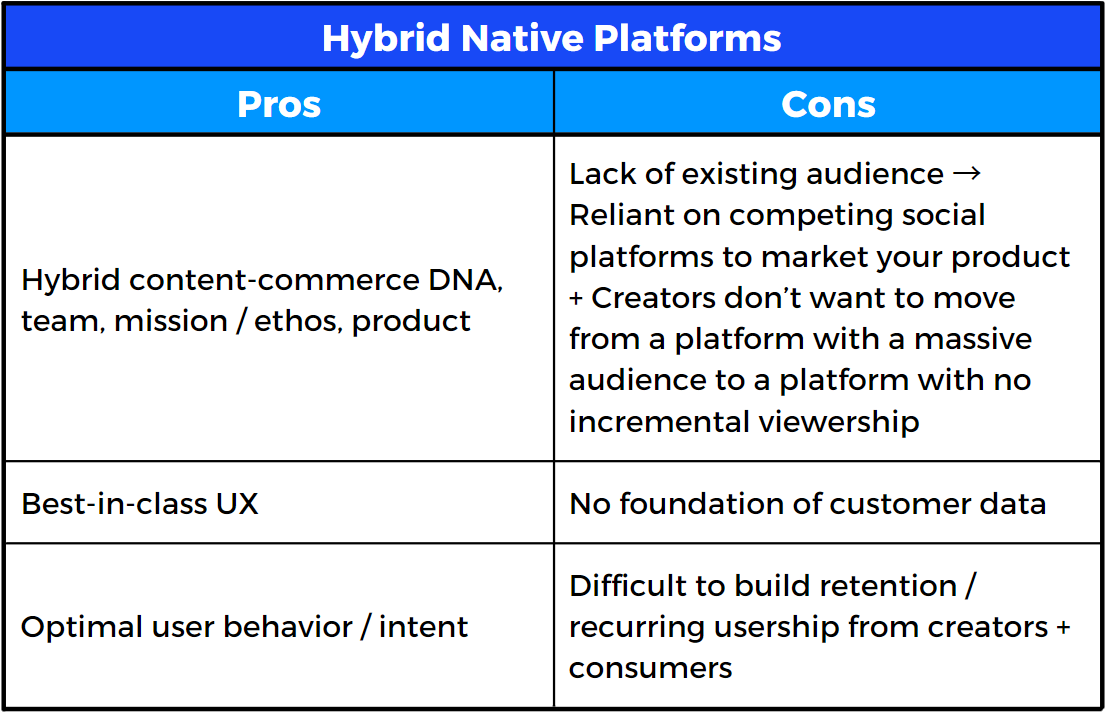

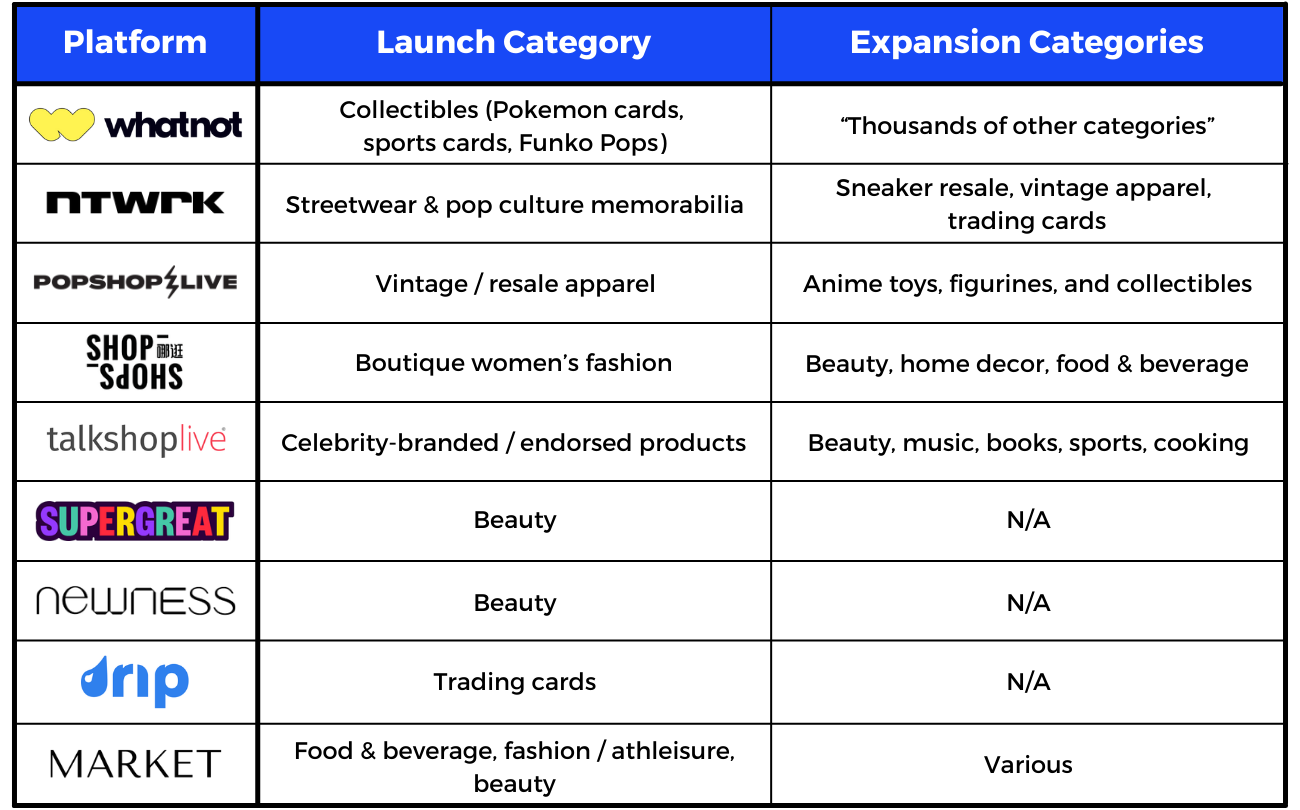

Hybrid Native: Upstart platforms fully dedicated to the livestream shopping experience. Rather than redefine the user experience of existing platforms, these new companies are content + commerce-native. They’re built from the ground up to deliver a more seamless experience for consumers, creators, and retailers, solving for the frictions and latencies inherent to the platform pivots profiled above. Examples: WhatNot, NTWRK, Popshop Live, MARKET.Live.

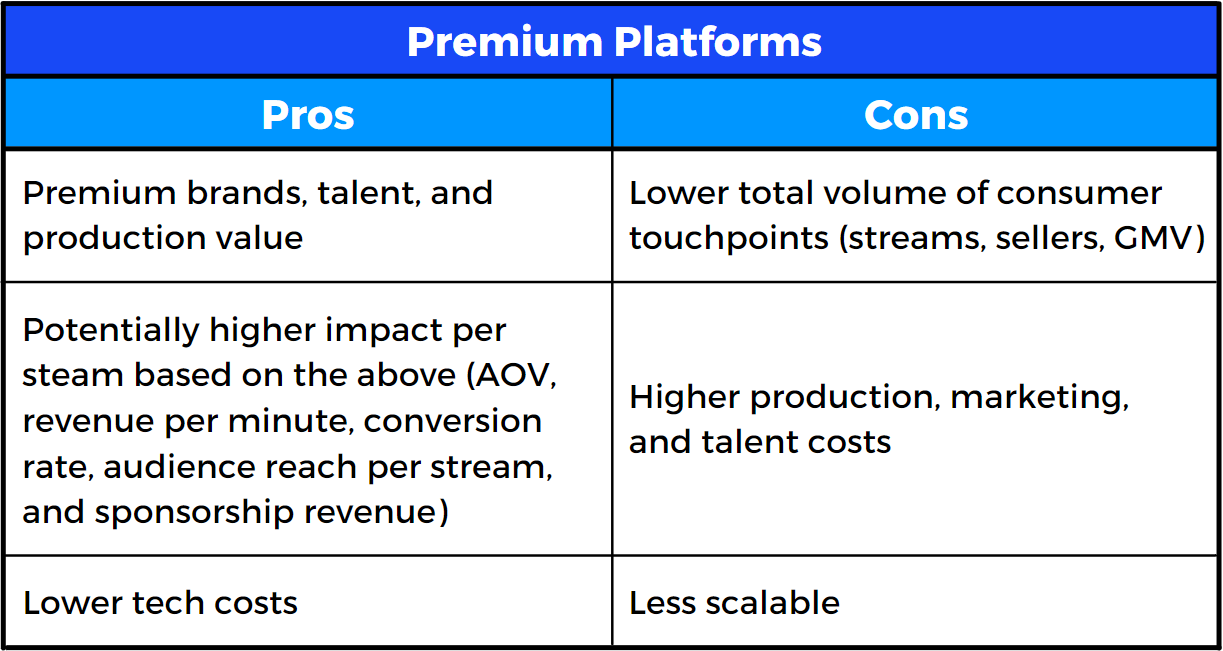

Within the world of destination platforms, there are two types of product environments: Premium Platforms and Self-Service Marketplaces.

Premium Platforms prioritize quality over quantity. All of the content and sales they feature are programmed, planned, and produced by the platform itself. Essentially, it’s more like a TV channel, with original content series — as well as centralized quality and “air traffic” control — than a UGC (user-generated content) marketplace where anyone can host a stream whenever they’d like. This “white glove” approach is executed via human capital, rather than “plug and play” technology. Examples: NTWRK, QVC, TalkShopLive.

Self-Service Marketplaces are more decentralized, tech-enabled, UGC-driven ecosystems that provide independent sellers with “plug and play” tools and distribution to empower them to go live and sell to their communities whenever they want. Examples: WhatNot, Popshop Live, Amazon Live.

However, these lines are sometimes blurred. Self-service marketplaces like WhatNot, Popshop Live, Amazon Live, YouTube, Facebook, and TikTok often supplement their UGC marketplaces with premium, centrally-planned, tentpole events. And some Premium Platforms, like TalkShopLive, also enable independent sellers to activate on the platform, although they are deprioritized on the platform interface.

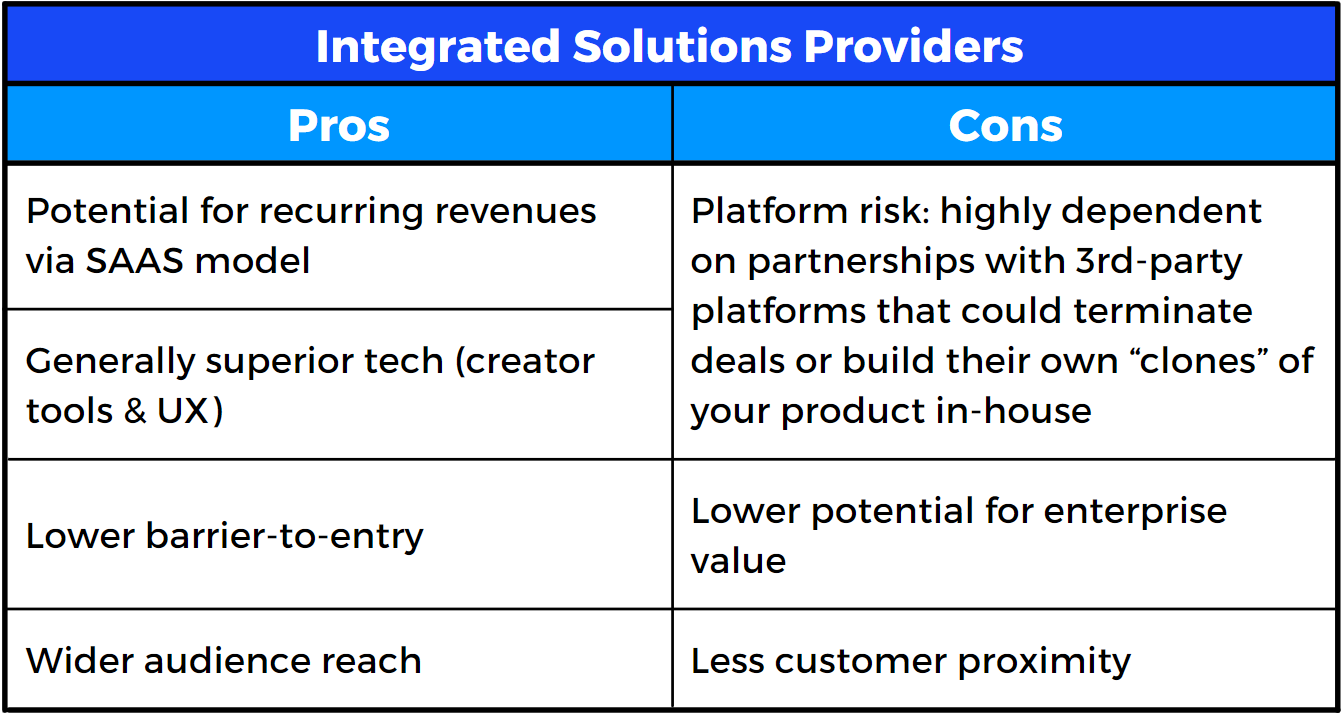

INTEGRATED SOLUTIONS PROVIDERS

“Integrated Solutions Providers” are tech-driven products that help creators and retailers improve their performance within the existing environments they’re already operating in, like incumbent social media platforms, as well as their owned-and-operated websites and apps. These companies provide valuable learnings on how to develop and implement effective creator tools and UX features.

These companies have a lower floor and a lower ceiling. Because they work within the existing ecosystem, rather than attempting to shift user behavior by migrating audiences to a new destination, the barrier-to-entry is far lower for these companies. But, because they don’t own the audience or the transactions, the upside is far less lucrative.

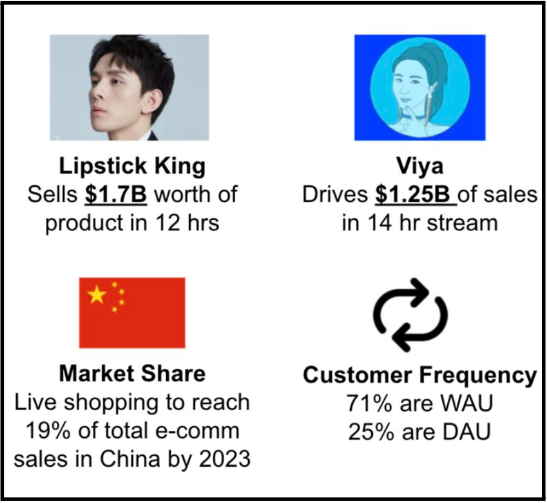

2. How does the US market compare to the Chinese market?

The Chinese livestream commerce market far surpasses that of the US. But the American market is quickly making significant strides (see the chart below).

The reasons for this gap are both structural and cultural.

The Structural Gap: “Super Apps” vs. Platform Fragmentation

In terms of the structural gap, the Chinese “Super App” ecosystem powers a frictionless end-to-end shopping experience (from discovery through checkout) in a way that the US platform ecosystem is not designed to replicate. For example, Alibaba’s infrastructure powers platforms for content distribution (Taobao Live), e-commerce (Taobao and Tmall), e-payments (Alipay), and shipping / returns logistics (Cainiao). It even runs an incubator for influencer talent (Ruhan) to ensure that Taobao Live is always broadcasting premium personalities. As a result, Taobao Live reached $60 billion in 2020 GMV, while another Chinese “Super App”, Douyin (TikTok’s parent company), is projected to generate $240 billion of commerce revenues in 2022.

In short, this vertically integrated infrastructure enables a frictionless user experience that allows live-shopping to thrive in China. It allows consumers to watch, interact, discover and purchase – all without leaving the platform.

Although America’s content and commerce landscape continues to consolidate, it’s significantly more fragmented than China’s. In the US, major content platforms, like Facebook, Instagram, TikTok, and YouTube, are great for product discovery, but insufficient when it comes to point-of-sale transactions and inventory / shipping logistics. You may find a product on YouTube, but to select it for purchase you’ll often have to click out to a third-party portal, and to complete the purchase you probably have to interact with a fourth-party payment processor. Neither of these experiences feel native to the YouTube environment. A new layer of friction is introduced with each step further away from YouTube’s ecosystem, making the would-be shopper less and less likely to follow through with the purchase.

On the other hand, Amazon has perfected e-commerce but struggles to generate the organic influence that powers discovery. Shoppers go to Amazon with intent to purchase. They know what they want before they even log in. Yes, it has successfully leveraged a premium video offering to boost subscriptions to its Prime service, but this experience is different than the type of content engagement on social platforms, which promote organic product discovery and leverages the cultural capital of trusted influencers to drive purchases.

This dynamic explains the race for verticalization and “funnel unification” that we outlined in Question #1 (content-into-commerce and commerce-into-content).

The Cultural Gap

The livestream shopping phenomenon in China is so jaw-dropping that our team at RockWater was curious to investigate to what extent the differences between our markets are purely cultural. Based on these learnings, we could help our clients identify actionable insights based on what’s actually replicable from the Chinese market.

So we conducted a survey of over a thousand Chinese consumers, as well as one-on-one interviews with several Chinese shoppers and platform executives. Here’s some of what stood out in terms of the cultural differences:

Livestream shopping has become a cultural habit in China: Over 45% of our survey respondents say they participate in livestream shopping at least 3 times per week. As a result, livestream shopping currently accounts for 16.5% of all Chinese e-commerce revenues.

When we asked why, we got mixed answers. Although the majority said they tuned into a stream for access to exclusive products or discounts, nearly 23% said they tuned in for the “comedy” of the streams. We spoke to some consumers who watch multiple streams per week purely for the entertainment value, without any intent to purchase. And we spoke to some who tune into multiple streams per week purely for the utility of making routine household purchases, even in the absence of exclusive products or discounts. Chinese consumers use livestreams to buy everything from diapers to luxury jewelry and automobiles. Whereas American consumers turn to livestream shopping for product discovery and inspiration, or for access to limited-edition drops, the majority of our Chinese respondents say that they go to livestreams to purchase products they’re already familiar with, rather than to discover new products.

Despite our ardent belief in the future of the US live shopping market, these user habits reflect a cultural difference that we don’t expect will soon catch on in the states. For US consumers to tune in for the sake of entertainment, existing platforms and creators would either need to seamlessly, and almost passively, integrate organic content opportunities into existing livestreams. Or they’d need to innovate new, engaging, gamified formats (think: HQ Trivia), that “launder” shopping into engaging content experiences. For US shoppers to turn to livestreams with the intent to shop, platforms and sellers will need to leverage the time-sensitive nature of livestreams to provide exclusive access to products or discounts that consumers can’t find anywhere else. They’ll also need to address “the authenticity gap” and the “product gap”, which we’ll elaborate on when we look to the future of livestream shopping in Part 2 of this report.

But although the US market has massive potential, it seems like a stretch to imagine that live shopping will come to replace the everyday e-commerce habits of the American shopper like it has in China. In the US, there will need to be a clear and compelling value proposition to justify turning to a livestream over a static commerce marketplace.

Trust in centralized authority: One cultural difference that stuck out to me during our conversations with Chinese consumers was the pervasive “top-down” mindset when it comes to influence on purchase decisions.

Nearly 60% of respondents said TaoBao Live (owned by Alibaba) is their favorite platform. When we asked one active Chinese consumer why that is, she said ‘Because it’s owned by Jack Ma, who is the richest and most successful person in China, so I trust him’. Can you imagine any US shopper saying that about Jeff Bezos or Mark Zuckerberg?

This logic follows through to their favorite creators. The majority of respondents said that the characteristic that makes a K.O.L (key opinion leader: the Chinese equivalent of an influencer) most trustworthy is that they’re “trusted by the platform”. Most people we talked to said they only tune in for the streams of the top K.O.L’s, who are all groomed in “influencer factories” by the top platforms. The same shopper who told us that she trusts Alibaba because it’s the biggest and most powerful platform, also told us that she only follows the top-tier K.O.L’s because their fame makes them more trustworthy (she said that their fame means they have more to lose, and can therefore be trusted). But she said that even if her favorite K.O.Ls left TaoBao to stream on another platform, she wouldn’t follow them there.

This is a stark contrast to the (comparatively) thriving middle-class of niche micro-influencers in the US, which are highly trusted to influence the purchasing decisions of small but devoted armies of followers. It’s also notable that these K.O.Ls aren’t famous celebrities or creators who are leveraging the built-in trust and engagement of their fandoms to sell products. They are famous for being live sellers. In fact, when US celebrities like Kim Kardashian or Taylor Swift have gone live on Taobao, they need to pay for the right to co-stream with the top Chinese K.O.Ls in order to earn the attention and trust of Chinese shoppers. Although much of RockWater’s market research is based on quantifiable metrics and trends, it’s important to to understand the nuances of cultural differences when seeking to replicate models from one market in another.

3. What is the typical go-to-market playbook for livestream shopping platforms?

The go-to-market playbook differs for upstarts (hybrid-native platforms) and incumbent platforms (content-first and commerce-first).

Hybrid-Native Platforms enter the market by focusing on super-serving a particular category niche. This launch category typically revolves around a passionate fan community that over-indexes on social commerce (aka, the “3 C’s: content, community, commerce). Then, once initial product-market-fit has been validated within this targeted community, companies will typically raise more capital to expand into adjacent verticals that are organic extensions of their core community. Often times, these operators raise capital from strategic investors with strong assets and relationships in their target expansion verticals (we’ll elaborate on that in question #5). Not only is this playbook similar to the one employed by other major content or commerce platforms in the past (like Amazon launching with books or Twitch with gaming), but it’s also the same strategy employed by some of the Chinese behemoths. Like Pinduoduo, which expanded from its initial focus on agricultural products to a broad offering that generated $383 billion of GMV in 2021.

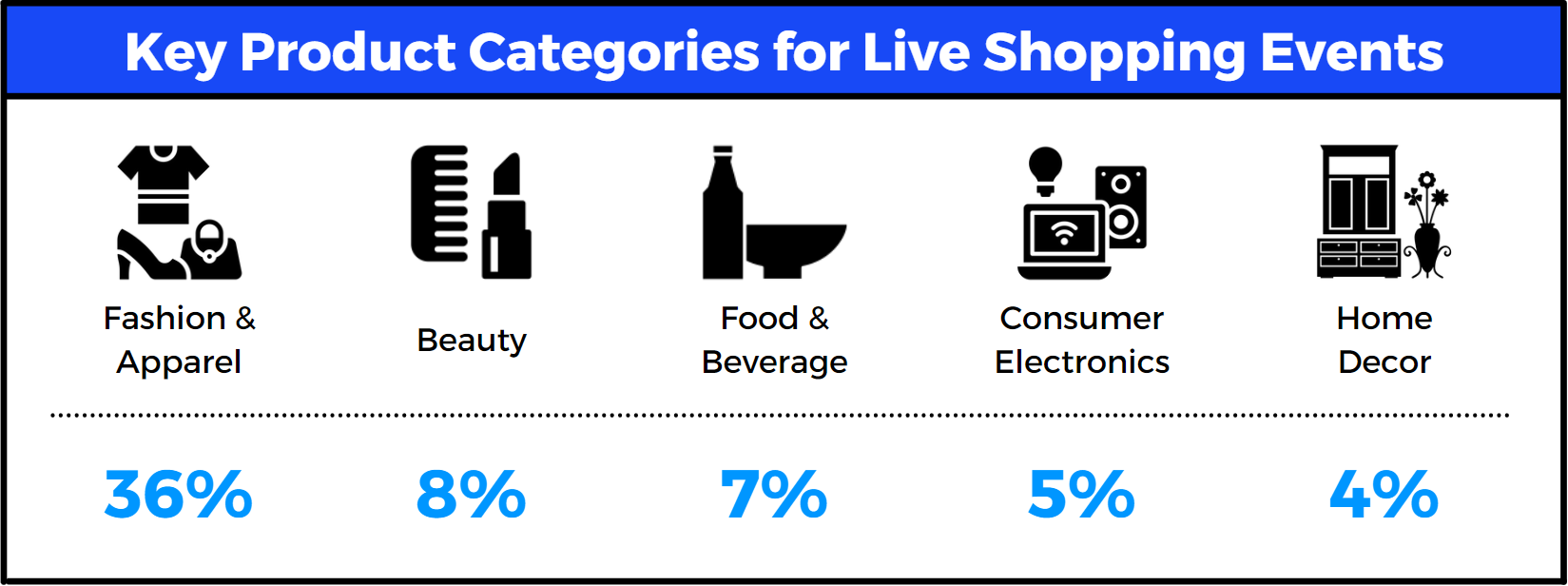

Incumbent platforms, on the other hand, typically leverage their existing scaled communities of users, creators, and brands — across categories — to enter livestream shopping all at once via a category-agnostic approach. Although these platforms don’t specialize around a single category, their activity in livestream shopping mirrors the overall trends of social commerce: meaning that their activations tend to over-index on popular influencer-led categories like fashion and beauty.

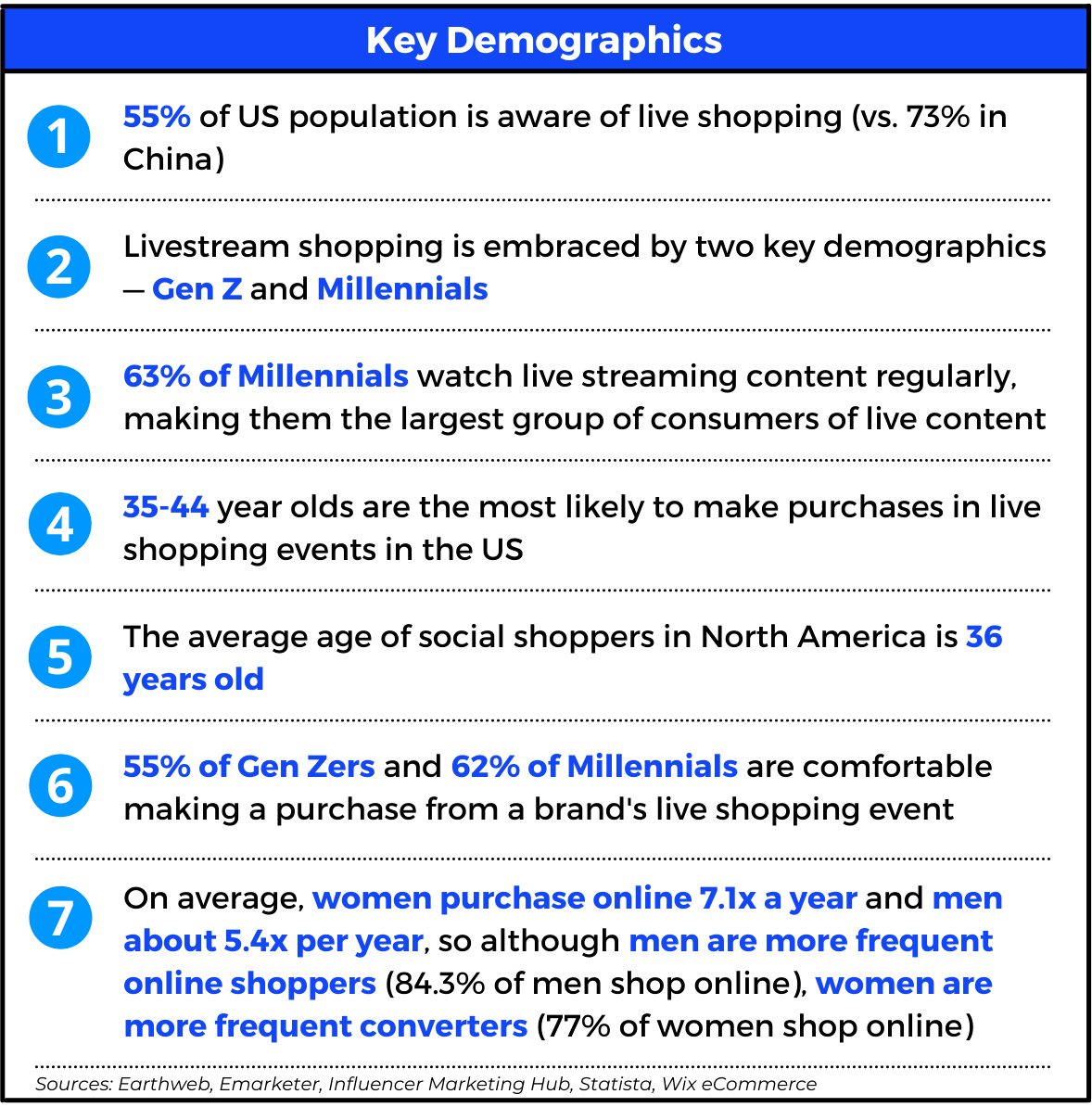

4. What is the primary demographic for livestream shoppers? What are the most popular product categories within livestream commerce?

5. Capital Markets: Who is currently investing in the space? What is the valuation profile for livestream shopping companies? What are the key value-drivers in the capital markets?

The typical profile of the livestream commerce cap table:

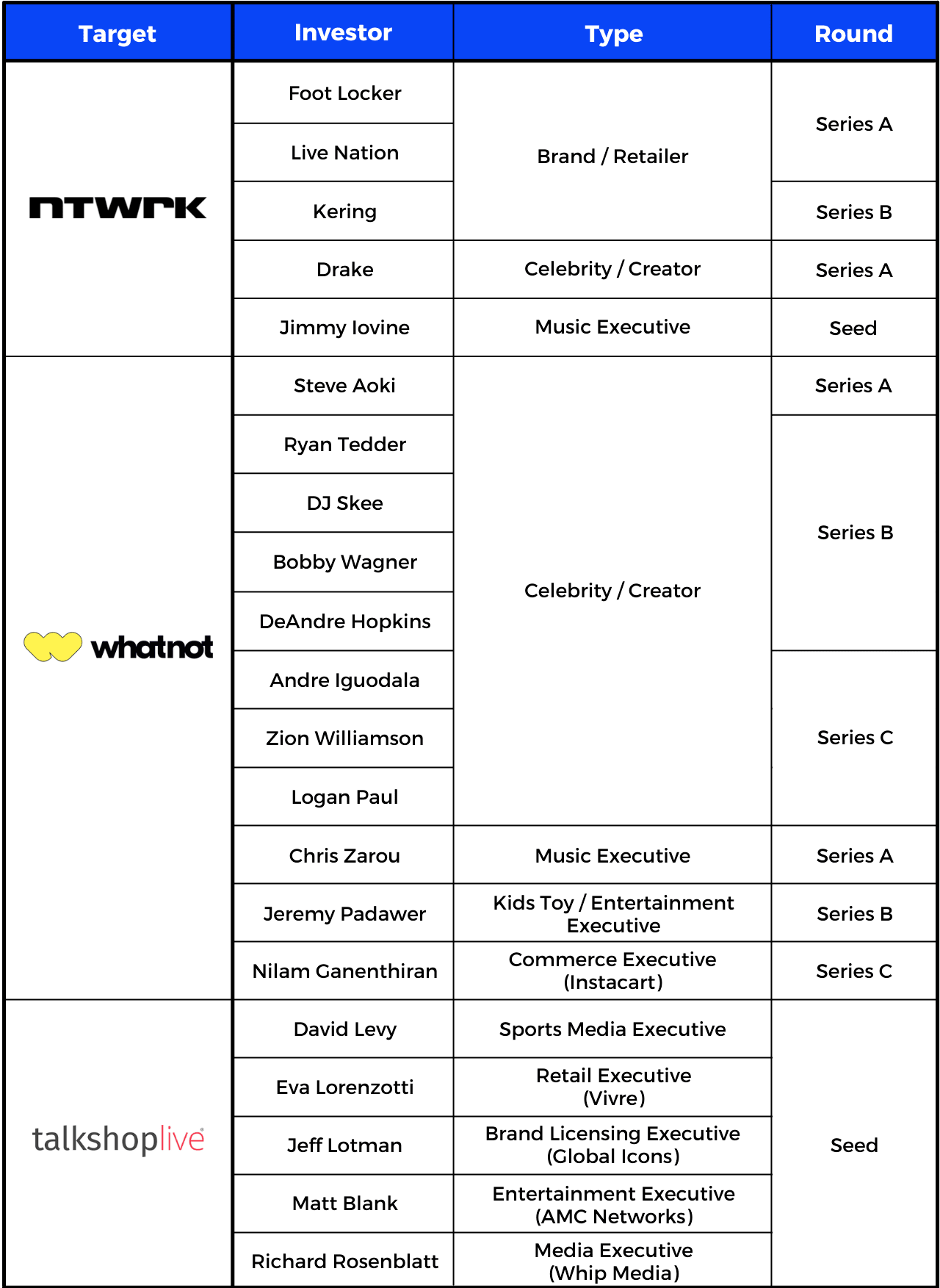

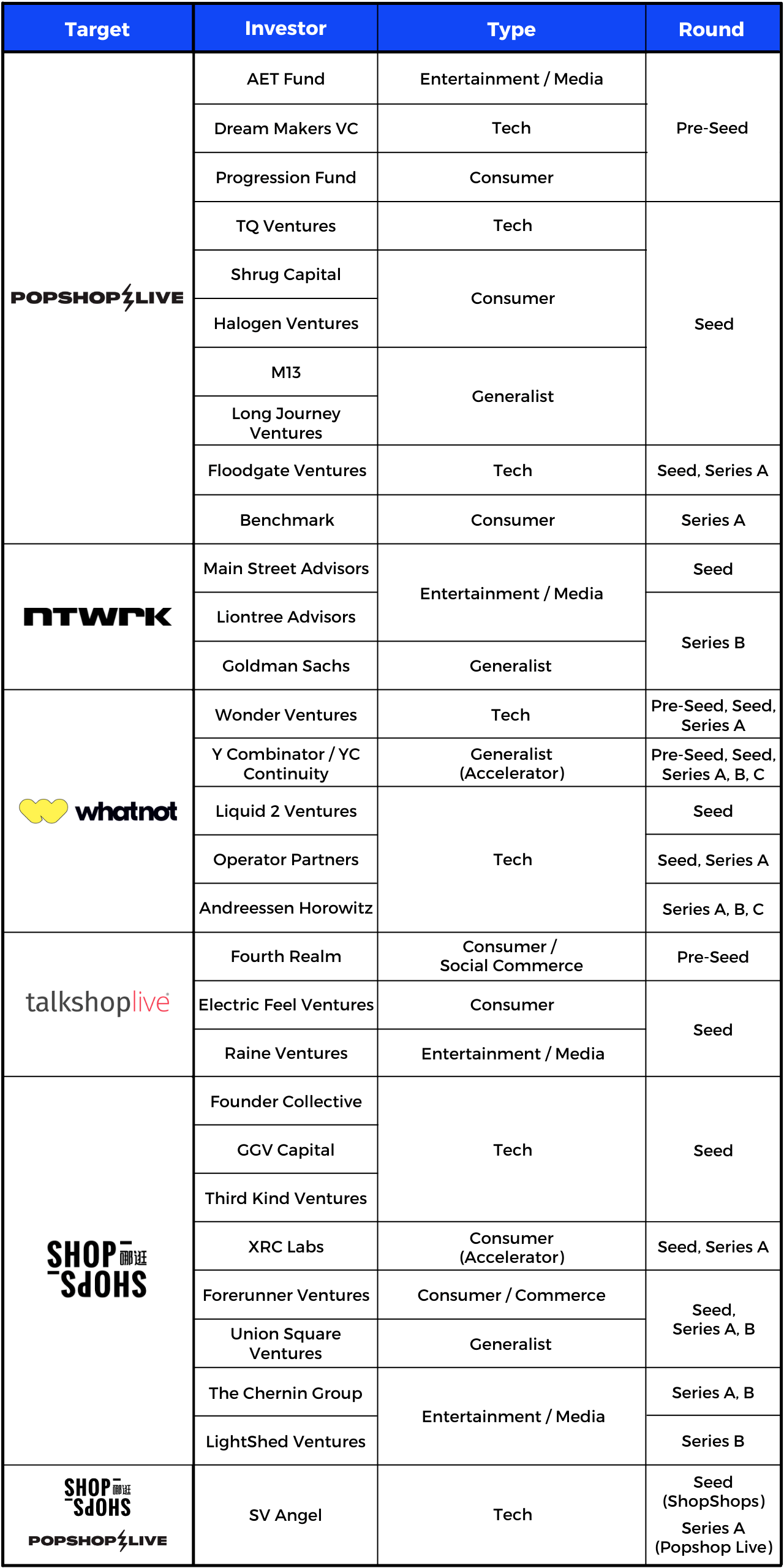

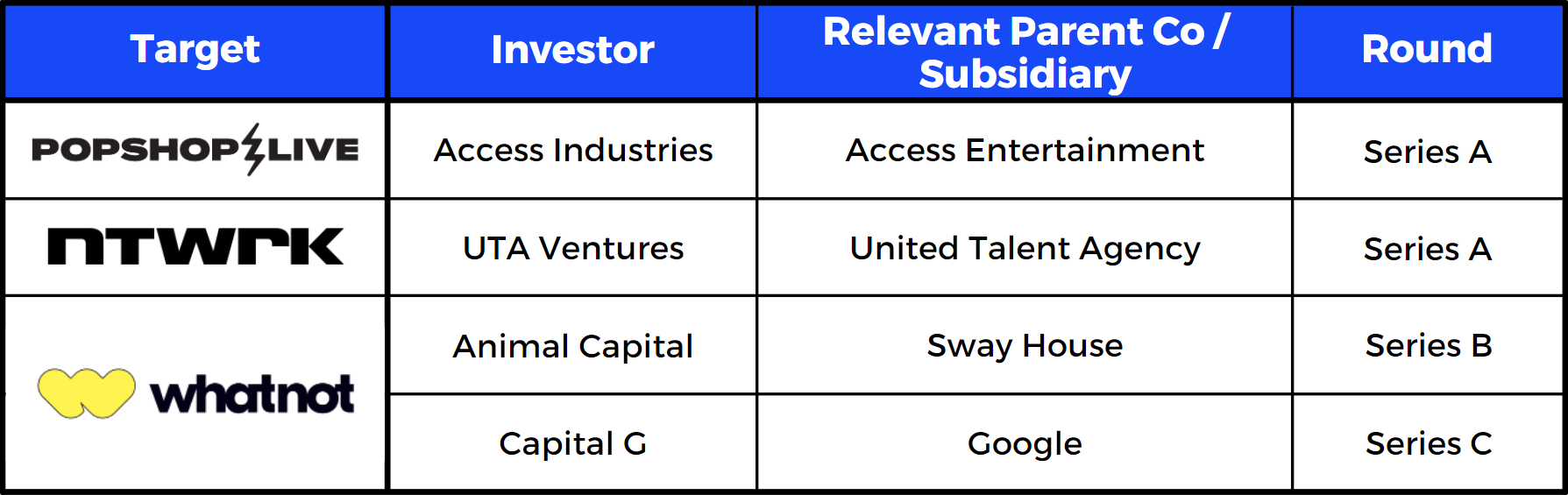

We examined a cross-section of 4 Destination Platforms to get a better sense of the capital flowing into the livestream commerce space.

Early investors in the livestream commerce space generally fall into 3 categories: Strategic angel investors, financial investors, and hybrid investors.

Strategic investors are commerce companies, individual celebrities / creators, or well-connected executives for creative for content or commerce companies. These investors add value to the companies they invest in through opening doors for synergistic relationships. As outlined in Question 2 above, companies often add these strategic relationships to their cap tables to help them expand into certain product verticals (e.g. WhatNot partnering with musicians & music executives, and athletes, to facilitate their expansion into music and sports).

Financial investors in the livestream shopping space are typically venture capital firms that focus on more of the core components that make these platforms successful: technology, consumer products, marketplaces, entertainment & digital media.

Hybrid investors are the official investment funds associated with synergistic stakeholders with strong strategic alignment. They provide a mix of the strategic and financial resources represented by the first two cohorts outlined above.

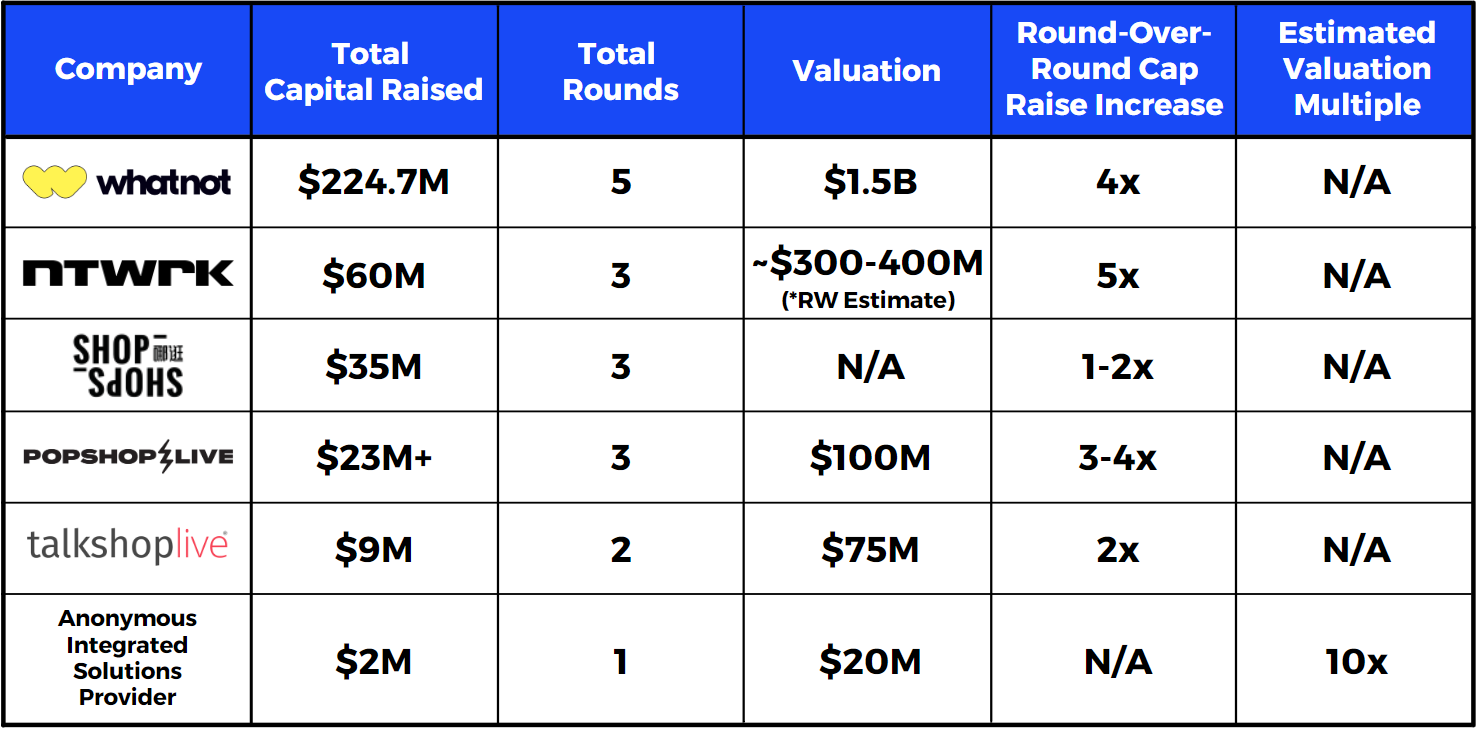

Valuations and fundraising activity:

Key value-drivers:

- Destination Platforms attract much higher valuations than Integrated Solutions Providers.

- Audience proximity and “owning your audience” is very valuable. Owning a centralized niche vertical, across content / community / commerce, has proven more valuable than capturing a small fraction of a massive vertical. For example, specialized platforms like WhatNot, NTWRK, and Popshop Live have much higher valuations than the platforms that are sharing pieces of bigger verticals like fashion or beauty.

- Tech-enabled, scalable marketplaces are most valuable.

- WhatNot and Popshop have much smaller creators and brands than NTWRK, and TalkShopLive. But the activations of these higher-end platforms are much less scalable because they require whiteglove production and brand / creator matchmaking. On the other hand, WhatNot and Popshop have built self-service marketplaces that thousands of sellers can plug into and activate around the clock.

- The top KPI’s driving valuations for livestream shopping products are:

- GMV

- # of Active sellers

- Revenue per minute

- Average Order Volume (AOV on livestream is 150% higher than on traditional e-commerce)

PART 2: THE FUTURE OF LIVESTREAM SHOPPING (Coming Soon..)

In our next Industry Report, we’ll explore the future of the US livestream shopping industry by answering the 5 questions below..

- What is the biggest challenge that needs to be solved to unlock the potential of the US market? What is the biggest “X-Factor” for solving that challenge?

- What can US operators learn from the Chinese market? What elements of the Chinese market are unique to China and inapplicable in the US?

- What do the incumbent platforms need to do to win?

- What do the upstart platforms need to do to win?

- Who will win the US livestream shopping market?

Are there any questions you’d like to see us answer in a future installment? Send them over to Andrew@wearerockwater.com or ping us here.