TPG Buys Untitled, Plans New Talent Management Co + Valuation Estimate

RockWater Roundup

RockWater analysis to make you a better investor and operator. Today we discuss TPG’s acquisition of Untitled Entertainment from Boat Rocker, and dive into the deal value prop, key deal terms, Boat Rocker financials, and Untitled’s valuation multiples.

————

Investor TPG bought Hollywood management co Untitled Entertainment.

Yet another PE shop getting into the talent rep game (of note, TPG has benefitted from previous talent representation investments, more on that below).

TPG bought the stake from Boat Rocker, which bought a majority stake from Untitled in 2019.

Let’s break it down…

📌UNTITLED

- Traditional Hollywood talent management co

- Talent focus is film, TV, theater, digital media, and music

- Founded 1999 by Jason Weinberg, Stephanie Simon

- Offices in NY and LA

- 50+ employees

💰UNTITLED FINANCIALS (in CAD)

NOTE: assumes “Representation” is just Untitled in BR segment P&L from public filings. Pob 98% accurate, as there is a bit of outside biz also included

- 1Q 2024 revenue: $8.3M (down 14% YoY)

- 1Q 2023 revenue: $9.6M

- 1Q 2024 profit: $2.9M (down 19% YoY), 35% margin

- 1Q 2023 profit: $3.5M, 37% margin

- 2023 revenue: $29.8M (down 27% YoY)

- 2022 revenue: $40.8M

- 2023 profit: $9.7M (down 43% YoY), 33% margin

- 2022 profit: $17.1M, 42% margin

📌TPG

- Global investment firm

- $224B of AUM

- Founded 1992

- Strategies incl PE, impact, credit, real estate, and market solutions (aka a hedge fund)

- Experience in media / entertainment, talent mgmt, music

- Investment led by TPG Growth, its middle mkt / growth equity platform

📝TPG MEDIA PORTFOLIO

- Calm

- CAA

- DirectTV

- Entertainment Partners

- Fandom

- MusixMatch

- Spotify

- …and now, Untitled

🎥BOAT ROCKER MEDIA

- Global entertainment co

- Creates, produces and distributes scripted and unscripted TV, animation, family content

- Founded 2003 by David Fortier, Ivan Schneeberg

- Went public in 2021 on TSX, raised $170M CAD

- 51% owned by Fairfax Financial (purchased 2015)

- History of growth through M&A

🏅BOAT ROCKER PORTFOLIO

- Mix of acquisitions, investments, and partnerships

- Unscripted: Matador Content, Proper Television, Insight Productions

- Kids & Family: Jam Filled, Industrial Brothers

- First-look deals: TeaTime Pictures, Bay Mills Studios, Jay Barchuel

- Talent and athlete-led startup incubator: Caravan, a JV with CAA

- …and more like Realm (audio), Bustle Digital Group, others

💵BOAT ROCKER FINANCIALS (in CAD)

- $0.97 stock price (down 25% YTD)

- $31.9M mkt cap

- 2024B adj EBITDA: $10M (down 70% YoY, incl impact from sale)

- 1Q 2024 revenue: $51M (down 36% YoY)

- 1Q 2024 adj EBITDA: $3.2M (up from YoY loss)

- 2023 revenue: $475M (up 56% YoY)

- 2023 adj EBITDA: $33M (down 6% YoY)

- Cash position of $75M CAD (post sale)

- No debt

🧐UNTITLED / BOAT ROCKER HISTORY

- Sold stake to Boat Rocker in 2019

- Acquired 51% of Untitled

- Other 49% kept by Untitled founders

- Put-call option on the remaining 49%

- Cash infusion to expand TV, film and digital production

- Untitled got access to BR’s full-service global studio infrastructure

🤝DEAL DETAILS

- Boat Rocker selling its Untitled stake to TPG

- $51.6M CAD ($37.7M USD)

- BR gets 8.8% stake in new TPG talent venture

- Newco CEO Michel Pratte gets 6.5% stake in new TPG venture + cash transaction bonus

- Pratte also gets $4.5M CAD 15-yr term loan to help with tax obligations for equity award

- Untitled founders sold their 49% stake for mix of cash and equity

- TPG will own 100% of Untitled

🤝DEAL VALUE PROP

- Launch new TPG-led talent management company

- Acquire, invest in, and build a diversified global biz centered on talent mgmt, representation, and adjacent verticals

- BR to use deal proceeds for content-first strategy — more owned IP in scripted TV, premium documentaries, animation, and potentially M&A

🤝POST DEAL OPS

- Michael Pratte is CEO (15 yrs of BR leadership roles)

- Eric Taitz is COO (at BR since 2018)

- Untitled and BR will maintain commercial relationship

🤔WHAT I FIND INTERESTING & DEAL INSIGHTS…

I like Boat Rocker’s decision to focus on its TV / content business…

(financial figures in CAD)

BR’s annual adj. EBITDA has been between $32 to $35M since 2018, except for a blip in 2020 when all production shut down due to COVID. Essentially, EBITDA is flatlining, and it’s a signal that leadership needs to do something different to drive profitability growth.

The revenue story is a bit different, growing from $165M in 2018 to $475M in 2023. Of note, 2021 peaked at $580M, which was likely the result of a pull-forward in revenue from the production shut-downs during the COVID onset in 2020.

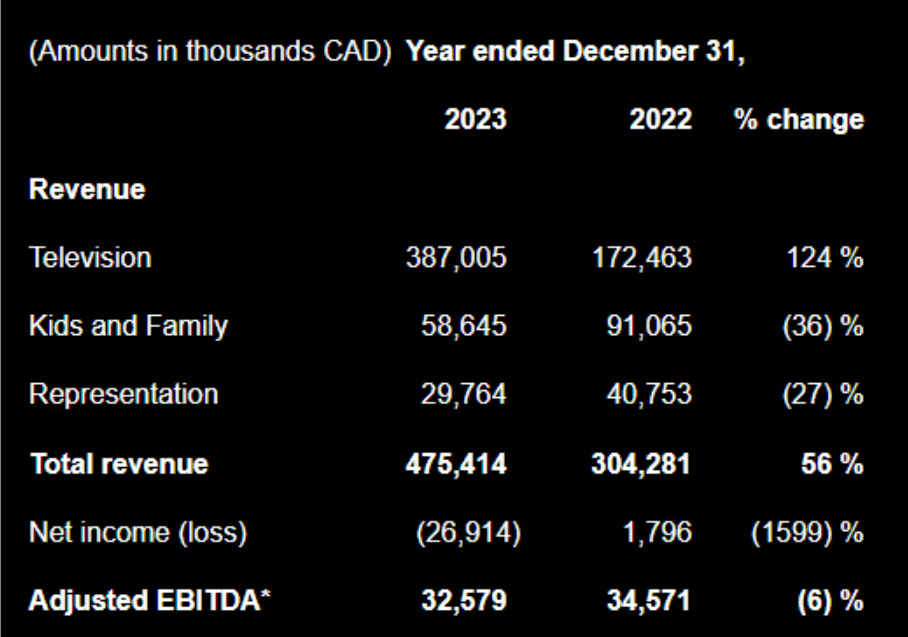

To better understand what’s driving the above revenue and EBITDA trends, let’s look at the biz segment breakdown, where the company breaks out Television, Kids & Family, and Representation…

As seen in the above chart, the TV business is growing quickly at 124% YoY for FY 2023. Further, TV comprised 81% of total revenue, up from 57% in 2022. In contrast, the other 2 business lines of K&F and Representation were each down YoY, at 36% and 27%, respectively.

Looking at BR’s 2023 annual report and MD&A (again, a benefit when public co’s in our industry buy and sell businesses), we can also look at segment profitability for the 2023 and 2022 periods, respectively:

- TV: 20% and 21%

- Kids & Family: 9% and 12%

- Representation: 33% and 42% – NOTE: based on our talent rep advisory experience, this is trending a bit low, where we typically see op margins at 40-50+% of net revenue

While consolidated margin for all of BR is declining, 6.9% in 2023 down from 11.4% in 2022, the TV biz top line revenue is growing, and TV segment margin is essentially flat YoY. Overall, TV is on a much better trajectory than the other two biz lines.

The disparity in performance is due to TBD mix of management not focusing on the other two biz lines, macro challenges, and team performance. Without speculating on all of that, I believe the recommended path forward is simple…

With more of management’s focus on the TV biz, and with freed up capital post sale (a $75M cash position), there’s good upside in the TV / content business. Similar to the note I made in my recent Wheelhouse / Alignment Growth deal analysis, Boat Rocker can now invest in more IP development, and also acquire more prod co businesses to increase output volume and capture more budget share from streamers and series content buyers as that market improves (they hinted at this in the deal press release when they said they “anticipate an improvement of macroeconomic dynamics”). Like my Wheelhouse recommendation, double down on what’s working in the TV and content biz, and remove distractions.

The two other business lines of K&F and Representation increasingly seem to be non-core based on financial performance, and so offloading to a new owner makes sense.

With the growing momentum in talent rep M&A (obvious if you’re a reader of this newsletter), it’s great timing to offload the Representation business, and that’s exactly what Boat Rocker did in selling Untitled. Of note, there was a put-call in the deal when BR acquired the 51% stake of Untitled in 2019, and while BR lacked the capital to exercise the call option in 2024, I wouldn’t have recommended they exercise the call even if they had the financing to do so.

It was time to get out, for all the above reasons.

For the K&F business, I’m unsure what’s next. I know back in 2019 there was talk of Untitled’s talent roster having a mix of kids/family focused opportunities, and a chance to build out more K&F IP and productions, but that takes a lot of capital. And with poor performance of BR stock price since going public, there just wasn’t enough capital to bring those plans to life. Now there’s more cash on the balance sheet post the Untitled sale, but in the spirit of winning through extreme focus, I again don’t think holding on to K&F makes much sense.

Again, just look at the 36% YoY revenue decline, and decline in profitability to 9% from 12% YoY. The answer is to find a new strategic owner for the K&F biz, take the cash proceeds… and double down on TV / series production.

Let’s do a quick valuation estimate on the Untitled representation business…

(all figures in CAD)

What We Know

- Boat Rocker bought 51% of Untitled in 2019

- TPG purchase price incl $51.6M

- Untitled 2023 revenue: $29.8M

- Untitled 2023 profit: $9.7M

- BR gets 8.8% equity in talent newco

- CEO Pratte got 6.5% equity in talent newco

My Assumptions / Valuation Estimate

- The BR “Representation” biz is just Untitled (prob 98% true)

- BR’s 8.8% newco equity is 10% of deal consideration

- Pratte’s 6.5% newco equity is 7.5% of deal consideration

- $51.6M cash was other 82.5% of deal consideration

- Implies Boat Rocker’s 51% stake was valued at $62.5M ($51.6M / 82.5%)

- For simplicity, assume only assets of talent newco are Untitled, nothing else

- Implies the talent newco valuation is $122.5M ($62.5M / 51%)

- With 2023 Untitled revenue of $29.8M, that’s a 4.1x revenue multiple

- With 2023 Untitled segment profit of $9.7M, that’s a 12.6x EBITDA multiple (assume segment profit = EBITDA)

…overall, that’s on higher end for talent rep firms.

Though my Endeavor buyout analysis showed 2.9x LTM revenue, and 14.2X LTM EBITDA.

A few things could be impacting the multiple estimate, so some caveats…

Maybe the 8.8% rollover was a much smaller amount of the deal consideration mix vs 10%. And maybe Pratte’s equity grant of 6.5% was not part of deal consideration, but instead was just a grant to new CEO as part of ESOP allocation. Also, my analysis is based on 2023 LTM, when financial performance was declining. Chance that in 2024, there’s a large revenue pull-forward from the end of the writer and actor strikes in 2023, and thus the most recent time period of June 2024 LTM financial figures are significantly higher, which would make run-rate revenue and EBITDA multiples lower.

Or, TPG could just be very eager to get back into the talent game after their CAA exit success to Artemis, and are willing to pay a premium for a foundational asset to then go and rollup other talent-adjacent businesses.

Overall, there are a lot of open questions here, but this is some educated guessing based on a few hours of research and review of public financial docs (thanks SEDAR!). Overall, it’s a good framework to help eval PE-led media and talent rep deals.

If anyone has more deal term specifics, or sees something I’m missing, feel free to drop me a line! My contact info is below…

————

I’m the founder of RockWater Industries. We do financial and strategy advisory for media, agencies, and creator economy. From M&A and fundraising to consumer research and go-to-market planning.

DM me on LinkedIn or email me chris @ wearerockwater dot com