Kids Screen Time Explodes, 20+ Deals, and How To Win the Next Generation of Viewers (and Their Parents)

Executive Summary

WHAT’s happening? Media and entertainment companies are rapidly investing in building out kids-focused content verticals — we’ve tracked over 20 major investments, deals, and partnerships around digital kids content over the past two years, and activity is accelerating.

WHY is this happening? Digital content consumption among kids is growing at unprecedented rates — in 2020, for the first time, children younger than eight were watching more videos online than live TV or a streaming service — and so are regulatory restrictions moderating this activity. Publishers and platforms see an opportunity to bolster long-term fan loyalty by capturing the first truly “digital-first-native” generation, but a unique legal landscape requires unique solutions.

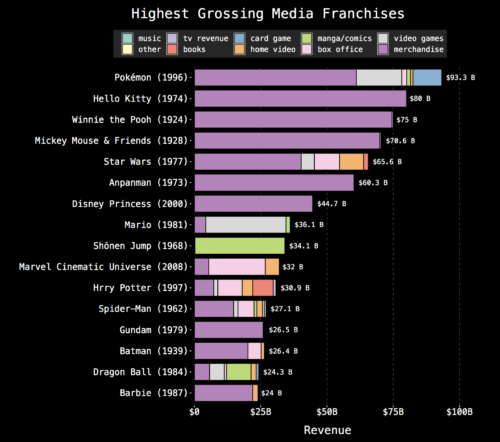

HOW does kids content uniquely drive value? Subscriptions, Advertising, and Derivative Commerce — of note, 13 of the 16 highest grossing media franchises are from kids IP.

WHAT’s happening?

Media and entertainment companies are investing in building out kids-focused content verticals.

Subscription services are investing heavily in kids content, brands, verticals, and products.

-

Apple: teams up with Common Sense Media to provide kid podcast recommendations (Mar 8 2021)

-

WarnerMedia: launches Cartoonito and sets goal to reach 50 original preschool shows (Feb 17 2021)

-

Apple: inks a multi-year deal with John Lassiter’s Skydance Animation (Feb 17 2021)

-

New York Times: begins to test subscription for NYT Kids (Feb 11 2021)

-

Time: Launches a digital subscription app for kids (Oct 19 2020)

-

Amazon: Launches Amazon Kids and Amazon Kids+ (Sep 2020)

-

Spotify: Launches family-friendly “Spotify Kids” app (Mar 2020)

Ad-supported platforms and programmers are investing in growing out their kids-focused inventory.

-

Google TV: adds kids profiles with parental control features (Mar 8 2021)

-

ViacomCBS: makes ad upfronts into a family co-viewing event (Feb 22 2021)

-

NFL: streams wild card game on ViacomCBS owned Nickelodeon (Jan 10 2021)

-

Amazon: Launches Amazon Kids and Amazon Kids+ (Sep 2020)

-

NowThis: Launches ad-supported kids brand (Aug 2020)

-

YouTube: most viewed channel in the world to premiere on Netflix (Jun 2020)

-

Spotify: Launches family-friendly “Spotify Kids” app (Mar 2020)

-

Pocket.Watch: Launches New Kids Focused Agency clock.work To Evolve Its Advertising Offerings And Help Major Brands Navigate The Quickly Changing Kids’ Media Landscape (Feb 2020)

-

Tubi: Launches Tubi Kids (Oct 2019)

-

Roku: launches a Kids & Family section on its ad-supported channel (Aug 2019)

-

Netflix: acquires children media brand StoryBots to create the next Sesame Street (May 9 2019)

Digitally-native kids content brands, platforms, and experiences have been attracting premium partnerships and capital raises.

-

Nastya: Signs Deal With Westbrook Studios for Slate of Animated Projects (Mar 2021)

-

Roblox: Series H brings it to a $29.5B valuation (Jan 7 2021)

-

Genius Brands International: partners with LG to offer Kartoon Chanel! Across all LG Smart TVs (Dec 8 2020)

-

Ryan’s World: launches game in Roblox (Dec 4 2020)

-

Homer: Gets $50M from Lego, Sesame Workshop and Gymboree for its early learning apps (Sep 30 2020)

-

Epic Games: Acquires Kids’ Technology Platform SuperAwesome (Sep 25 2020)

-

OK Play: Raises $11M Series A to launch a kids-focused digital content brand that promises “guilt-free screen time” (Sep 2020)

-

MoonbugEntertainment: raises over $260 million to become the nextgen Nickelodeon and Disney Channel (Jul 30 2020)

WHY is this happening?

As digital content consumption among kids is growing at unprecedented rates, so are regulatory restrictions moderating this activity. Publishers and platforms see an opportunity to bolster long-term fan loyalty by capturing the first truly “digital-first-native” generation. But a unique legal landscape requires unique solutions.

Young kids are spending more time on digital platforms than ever before

Today’s generation of children is the first to grow up spending more time on digital platforms than traditional media. And in 2020 to 2021, as this entire generation has been forced to stay at home and adopt e-learning, this paradigm shift intensified.

Prior to the pandemic, 60% of parents said their children spent no more than three hours on devices. Today, 70% estimate their kids spend at least four hours with screens. A whopping 33% increase in screen time, for 17% more households

And these aren’t the screens their parents grew up on. According to Common Sense’s annual census, in 2020, for the first time, children younger than eight were watching more videos online than live TV or a streaming service. Online videos accounted for nearly 75% of all screen time, while gaming came in second with 16%. In the U.S., kids ages 4 to 15 spend an average of 85 minutes per day watching YouTube and 80 minutes per day on TikTok.

Even prior to the pandemic, this trend had been accelerating rapidly.

The availability of mobile devices and the Internet has been the most significant factor for kids spending increasingly more time consuming online content. In 2013, 63% of young children’s homes had at least one smartphone. In 2020, this figure jumped to 97%. And while Internet access for higher income families roughly stayed the same, for lower income families it grew from 46% in 2013 to 74% in 2020. As a result, 170,000 kids go online for the first time every day. And as of 2018, 40% of new Internet users globally were children.

During the pandemic, many parents turned to screens to entertain and engage their restless children. The screen time limits parents would typically place quickly expanded as computers and tablets became a replacement for school and social interaction.

When the COVID lockdowns started in March, screen time was up 50%. Nearly a year later, that percentage hasn’t budged. Content brands responded to this shift by making what was once considered secondary into a mainstream offering.

For media brands, this massive sea change represents a game-changing opportunity to cultivate their next generation of users and fans while also capturing near-term revenues. Like any meaningful influx of new audiences to new platforms, it’s a “land grab” moment.

Mobilize then monetize.

However, unlike similarly transformative moments of new audience development, the kids market comes with a distinct set of sensitivities and restrictions that makes the process of monetization more complex.

Government regulation and parental concerns, centered on kids screen time, are mounting, making the monetization of this audience particularly challenging.

Despite the immense opportunity posed by this generational digital adoption, the path to monetization isn’t as straightforward as it may appear. Tapping into the digital kids audience is a uniquely challenging endeavor due to the sensitivities and regulations limiting kids advertising, data collection, and screen time.

The Children’s Online Privacy Protection Act (aka COPPA) prevents platforms and advertisers from treating kids as eyeballs to be harnessed and monetized. In 2019, Google and YouTube were forced to pay a record $170 million for violating this law. As laws designed to protect kids who are consuming content online are continuing to develop and expand, it’s estimated that by the end of 2021, 800 million kids will be protected by digital privacy laws (as opposed to only 130 million in 2018).

In addition to regulatory barriers, childrens’ content providers also have to navigate the understandable concerns that parents have about the adverse effects that increased digital screen time may have on their sons and daughters.

Chris Ovitz, Co-founder and President of a new kids content brand called OK Play, which in Sep 2020 raised an $11 million dollar Series A round to support their vision of reimagining screen time for kids, told us the following on an upcoming episode of our podcast, The Come Up:

“There’s so much guilt…and judgement…for parents around screen time. We forget that in our bubbles, in our world, the whole no screens thing is a privilege, and that YouTube as a babysitter is real, and it’s a problem…At the end of the day, balance is key. There’s no reason we can’t reimagine screen time. These devices aren’t going anywhere…and so my partners and I wanted to create something with screen time that wasn’t lean back, that really puts kids at the center of the story, and the creation.”

Although the explosion in digital consumption presents a massive opportunity, the standard “attention economy” playbook won’t apply. Whether through subscription products, “family-native” approaches to ad-driven models, or developing completely reimagined content environments to address this unique moment, brands, platforms, and creators will need to build thoughtfully and differently in order to tap into this growing opportunity.

HOW does kids content uniquely drive value?

Subscriptions, Advertising, and Derivative Commerce.

SUBSCRIPTIONS

The primary strategy that brands and platforms are pursuing to circumvent the regulatory hurdles around monetizing kids screen time is by avoiding ad models entirely in favor of subscription products.

The billions being invested in SVOD and AVOD platforms by legacy studios and TV networks is an investment in the future. Total reach and revenues from traditional mediums still outweigh those coming from digital channels. But this is changing rapidly. As cord-cutting and digital adoption proliferates, companies like Disney, NBCU, ViacomCBS, Warner Media, and others are seeking to reconcile today’s revenue streams with those of tomorrow. Their multi-billion dollar bets on streaming are bets on the next generation of consumption. And the “Streaming Wars” are therefore “turf wars” to establish the best real estate on the future consumer battlegrounds.

Today, as consumption habits are in the process of being redefined en masse, consumer allegiances are still up for grabs. Habits are still malleable. That’s why increasing customer acquisition and retention is the top priority for emerging digital platforms. The top 5 streaming platforms are spending upwards of $4 billion on marketing and $42 billion on content combined, in order to solidify their role as the “go-to” destination for streaming video, at which point they’ll most likely reduce their spend and increase their prices.

So how does kids content fit into this equation? It’s an incredibly effective tool to onboard two generations of subscribers (i.e. customer acquisition) — parents and kids — and develop sticky habits that reduce churn (i.e. customer retention).

Kids content not only drives customer acquisition for subscription services by promoting signups among parents, but it’s also an opportunity to ”skate to where the puck is going” by providing an early-stage onramp to younger audiences who will grow up with these platforms, and develop meaningful user relationships , as these younger audiences begin building habits on the platforms from an early age.

David Perpich, Head of Standalone Products at The New York Times, explained the rationale for the Times’ upcoming subscription app for kids:

“Beyond the subscription revenue itself, it’s also a chance to actually start talking to people earlier in their lives before they might be ready for a New York Times product.”

And once a family has subscribed to a subscription platform with content for the whole family, they’re far less likely to churn.

Brian Robbins, president of ViacomCBS’ Nickelodeon, explains:

“I don’t think it’s any secret that kids drive a big amount of the minutes watched on streaming services… You know as a parent that you’ll go without eating before you take something away from your child that they like. Kids content is an amazing retention tool.”

Kids content is a secret weapon that bolsters LTV for subscription services. No wonder Netflix, Disney+, Apple TV+, Paramount Plus, HBO Max, Spotify, New York Times, Amazon, Time, and others have invested so much in building out this vertical on their subscription platforms.

ADVERTISING

Even without subscription revenues, family viewership is uniquely valuable. For brand marketers, parent-child co-consumption is worth a premium.

-

61% of parents say they are more attentive when watching TV with their kids than they are when watching alone.

-

Parents spend 59% more than non-parents across categories

-

Parents spend 60% more on products when kids are involved

-

Parents are 250% more likely to buy products they see advertised while watching with their kids

-

Parents flip channels during commercials 15% less when watching with their kids as opposed to when they’re watching alone

Between the high-value consumption habits that kids content enables, and the 25% revenue growth of ad-supported digital streaming during 2020 alone, it’s no wonder the kids digital advertising market is projected to grow by over 20% between 2018 to 2021, culminating in $1.7 billion by the end of 2021, which is projected to make up 37% of the total kids advertising spend.

However, privacy laws inhibit the traditional ad-model playbook when it comes to monetizing children’s viewership online. Platforms programming for kids need to abide by a strict set of rules. For example, they can’t link to outbound websites or browsers, they must gate all their content, and social interactivity must be heavily moderated.

To thread the needle between the enormous revenue upside of ad-supported digital kids content, and the complex regulatory challenges that hinder this model, many platforms have launched standalone kids-centric products to provide a family-friendly, legally compliant, and brand-safe environment.

Chris Ovitz explained to us how he’s solving for these complex needs at OK Play:

“At OK Play we took the position of no ads, ever. We want to be the standard for privacy and safety for any parent. No revenue can make up for that peace of mind. We believe plenty of value will be created by surprising and delighting our customers this way.”

As always, execution is key. YouTube Kids, which launched in 2015, has functioned more as a childproofed version of its parent site than as a destination where kids and families prefer to spend time. In fact, young kids use the standard version of YouTube 10% more than they use YouTube Kids. The winning ad-supported kids platforms will succeed by creating “family-native” environments that feel like differentiated destinations that are custom built for specific audiences and use cases, as opposed to watered down versions of their mass-audience predecessors.

DERIVATIVE COMMERCE

Kids IP franchises are the most viable path to the diversified revenue flywheel that all content brands are striving for, best epitomized by the Disney model. As outlined on the chart below, 13 of the 16 highest grossing media franchises are from kids IP. And the vast majority of revenue generated by these franchises comes from merchandise.

Although the dominant distribution mediums for kids IP has changed dramatically since the inception of the above properties, the core business model around monetizing kids content has remained the same. At its best, the direct revenues generated by kids content — either via advertising, subscriptions, syndication / content licensing, or ticket sales — is only just the tip of the iceberg. Kids content has always over-indexed on derivative commerce revenues, and it still does today.

Eyal Baumel, the founder and CEO of Yoola, a prominent MCN that represents Nastya, a top kids creator who recently signed a deal with Will Smith’s Westbrook Studios for a slate of animated originals, told us:

“The most iconic kids IP is traditionally cartoons and animated characters, and that’s why Nastya is in a great position to expand her connection to kids and families in various ways including more than 20 consumer products that we’ll launch later this year at Walmart, Target, and Amazon”

The leading example of this digitally-native kids content flywheel is Pocket.Watch, self-described as a “a digital-first studio building franchises for the next generation of families”. Pocket.Watch’s digital content portfolio has 7.4 billion video views each month, which powers a robust consumer products division comprising well over 100 licensees across categories like games / toys / collectibles, home, apparel & accessories, mobile & video gaming, stationary, sporting goods, health & beauty consumables, and more.

The crown jewel of Pocket.Watch’s portfolio is Ryan’s World, who at 9 years old, is one of the world’s most popular YouTubers. His main channel has 29 million subscribers and generates nearly 1 million hours of video views each day. As a result, Ryan’s World has amassed a $500 million retail empire, with over 100 licensees, selling consumer products everywhere from WalMart to Amazon. In 2020 alone, Ryan’s World consumer products generated more than $250 million in sales. Ryan and his family’s share of those revenues — 60% to 70% — represented over $30 million in annual revenue, which outpaced their YouTube ad revenues for the first time in the history of the franchise.

Perhaps most indicative of the future direction of derivative commerce revenues for kids content brands, Ryan’s World launched its own “virtual world” on Roblox last year, where fans can purchase gems that can be exchanged for virtual goods.

In this generation-wide adoption of digital content, gaming is perhaps the most dominant force.

-

The top “metaverse” platforms each command 1 to 1.5 billion hours of playtime per month

-

Fortnite: 350 million registered users (63% between 18-24 years old)

-

Roblox: 31 million DAUs → 75% of 9-12 year olds in the US are regular users

Social gaming platforms have become the virtual social hub for an entire generation. Especially during COVID, when in-person socialization was prohibited. And while the free-to-play nature of these games broadens their reach, the integration of in-app purchases and “virtual products” provides a whole new medium through which kids brands can drive consumer transactions.

-

82% of free children’s apps (made for ages 5-12) offer in-app purchases

-

$31 billion of in-app purchase revenues were generated in 2020

-

Kim Kardashian’s kid-friendly, free-to-play, mobile game generated $200 million per year, mostly through in-app purchases

-

Game-based learning market projected to be worth $17 billion by 2023

Although in-app transactions provide a new outlet for kids brands to expand their consumer products revenues into the digital realm, once again, brands and platforms must be wary of the unique sensitivities that surround this opportunity. Only 31% of parents approve of their kids spending money on in-app purchases, and 40% parents who do approve, limit their children’s spending on in-app-purchases to $10 per month. Once again, in order to capitalize on the opportunity that kids digital screen time represents, platforms and content brands will need to create environments that kids want to spend time in, and that parents are comfortable with and trusting of.

—

Ping us here at anytime. We love to hear from our readers.