How to “Follow Your Fans” – Lessons from Fortnite, NFL, WWE (Part 2/3)

In Part One of this industry report, we explored the disruptive effects of media fragmentation and shifting consumption habits on the traditional media models of legacy sports leagues. For the leagues, these have led to both challenges (declining viewership, losing the next generation of fans) and opportunities (inflating value of sports media rights).

As current rights deals expire, leagues will need to transform their media strategies in order to A) capitalize on increases in the sports rights market to maximize near-term revenue and B) cultivate a sustainable long-term future by engaging digitally native fans.

In Part Two of our industry report below, we extract key learnings from best-in-class industry innovators. We use these key learnings to formulate RockWater’s playbook for winning in the next generation of sports media. We will publish our playbook (Part 3) next Thursday, May 21.

Learnings from the eSports playbook: How to win over the next generation of fans

As a form of digitally native entertainment built for a digitally native audience (and one of the leading causes of traditional sports “defection” among Gen-Z fans), eSports provides a blueprint for traditional leagues to reach and engage new fans in a new era.

-

A new paradigm for distribution: More than 80% of eSports fans watch online, while traditional sports viewership is 80% linear. eSports quickly scaled a global audience by lowering the barrier to entry for “Fluid Fans” through mostly free digital access across devices. Traditional sports audiences may also want to watch live games digitally, however, a rapid switch from a linear-first to an OTT-first model is complicated by the outsized economic role of TV rights fees (40% of the average league’s revenue). As pay-TV continues to decline and digital consumption continues to grow, this model may represent the future of video distribution.

-

Nextgen content experience: eSports has captured the passion, attention, and loyalty of the “Fluid Fan” generation by providing an engaging viewing experience that’s highly personalized (e.g. customize preferred video and audio feeds), gamified (e.g. competing against fellow streamers to win prizes by answering trivia questions and predicting gameplay….“who will score the next goal” in FIFA), and socially interactive (e.g. live chat window and expressive Emotes).

-

Nextgen monetization strategies: eSports leagues and platforms have monetization techniques, such as in-stream transactions (sale of physical and virtual items like upgraded “Skins” and “Emotes”). Given the size of the eSports audience (495M global viewers), even a mere 1-3% conversion rate could ultimately generate more revenue than advertising.

-

Nextgen community building via “The Metaverse”: Video Games like Fortnite, Roblox, and Minecraft (each generate 1-1.5B hours of playtime per month) have evolved into “virtual town squares”, where teens gather to interact and connect over shared passions. Because of this immersive social function, Matthew Ball explains “Fortnite is rapidly becoming a medium through which other brands, IP, and stories express themselves”. This hub for nextgen experiences and community building has already been activated by performers (e.g. Travis Scott, Marshmello), and IP owners (Star Wars, Nike). Whether it’s getting together to watch the game or talking about it on social media, sports have always been one of our culture’s most powerful community mobilizers. As communities shift from “IRL”, to social media, to “The Metaverse”, and with such consumer behavior accelerated by COVID-19, these platforms represent an exciting opportunity for sports IP owners to further engage youth audiences.

Learnings from the NFL playbook: Increasing total value by segmenting live rights

The NFL utilized their enhanced negotiating power (outlined in Part One) to break the traditional restraint of exclusive distribution deals with a single TV network. Now, rights packages are beginning to be carved up amongst the plethora of new distribution players, redefining the conventional notion of “exclusivity” that has traditionally shaped sports media models.

In anticipation of renegotiating their expiring live-rights deals, the NFL has used Thursday Night Football (“TNF”) as a testing ground to explore alternative, “post-exclusivity”, distribution models (e.g. digital distribution deals with Yahoo and Twitter). TNF games can now be viewed on broadcast TV (FOX), cable TV (NFL Network), OTT (Amazon + Twitch), and mobile (via a partnership with Verizon).

Content Distribution

-

Platform-agnostic distribution is not cannibalistic, it’s the key to maximizing reach AND monetization in a fragmented mediascape: The NFL still operates under a mandate to prioritize reach. However, by redefining the notion of “exclusivity”, the NFL has redefined the means available to achieve that end. With its TNF experiment, the NFL proved that supplemental broadcast partnerships can be purely additive; increasing total viewership without diminishing value for legacy TV partners. This simulcast model resulted in increased viewership across ALL platforms (65% YoY increase in mobile viewership, 43% YoY increase for OTT, and even a 4% YoY increase for broadcast TV). As multi-platform distribution becomes more prevalent, leagues will lower barriers-to-entry, empowering fans to dictate their own consumption; the value of linear and digital rights will be redefined accordingly.

-

The slices are smaller, but the pie is bigger: Segmented rights packages can generate incremental revenue while maximizing reach and engagement. By creating multiple packages for the same game, the NFL increased the value of their TNF product by 30%, thus proving that 1 + 1 can equal 3.

Content Experience

-

Different content experiences for different fans on different platforms: For TNF broadcasts on Twitch, the platform applied popular eSports features to engage younger audiences (e.g. personalized audio commentary, interactive graphical overlays, social interactivity, and shopping integrations), resulting in 1M viewers per game in 2019. Segmenting live rights packages creates the opportunity to customize the content experience for each platform, and demographic. For example, a father can watch a traditional broadcast on Fox while his 25 year old son watches on The Redzone Network, his 17 year old watches on Twitch, and his 15 year old watches on her iPhone…and neither’s preferred experience precludes the other from enjoying their own.

Learnings from the WWE playbook: A holistic approach to omnichannel programming (including DTC)

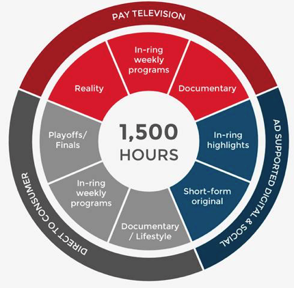

WWE successfully employs the entire platform ecosystem to cultivate and monetize a passionate fan base.

WWE has always epitomized the value of A) combining sports and storytelling, and B) building a passionate fan base. Over the past decade, as many traditional leagues have had their core media models disrupted by the rise of social media and OTT, WWE has embraced these emerging platforms to enhance their core strengths.

WWE established itself as a social media powerhouse (1B+ social media followers and 28B+ annual social video views, accounting for 20% of WWE’s total audience), and launched an owned-and-operated subscription OTT platform in 2015 (“WWE Network”). As the first major sports league to offer a DTC option independent of the pay-TV bundle, WWE became the first sports league to test whether or not a DTC service would cannibalize value from its pay-TV partners. Considering the outsized value of pay-TV rights fees for traditional sports leagues, this question is of paramount importance.

-

Leverage the power of each platform to create an “Ecosystem of Fandom”: WWE expertly employs digital and social content to build top-funnel awareness and engage the next generation of fans. WWE develops and distributes digitally native original programming across social media, using each platform to engage young fans and keep them in its ecosystem. This “snackable”, mobile content only complements and enhances the live matches.

-

Generate and harness “Star Power”: WWE uses omnichannel storytelling to promote its athletes, amplify their personalities, and let fans engage with them (John Cena is the most followed athlete on Facebook with 45M followers). WWE’s supplementary content, across both linear and digital channels, generates buzz around its athletes, which enhances viewership of live events. As the pioneer of “Sports Entertainment”, WWE has always been built on compelling characters and storylines. However, just because traditional leagues are unscripted, it doesn’t mean they can’t learn from WWE by using supplemental content to heighten the dramatic stakes of live broadcasts.

-

Use direct-to-consumer to complement, not cannibalize: WWE Network proved that DTC can be a purely additive, and extremely valuable, component of a league’s overall distribution strategy. WWE uses its OTT platform to optimize the value of premium and long-tail content, and monetize its most devoted fans. With 1.4M paid subscribers, WWE Network accounts for roughly 23% of total WWE revenue. Additionally, much like we saw with the NFL, pay-TV revenues and consumption have only risen since the introduction of a DTC option. These rising linear rights fees are largely a product of the broader market forces outlined in Part One. However, the fact that this inflation was not curbed by the introduction of a duplicative distributor represents a significant breakthrough. New distribution deals with Fox Sports and USA Network (signed after the launch of WWE Network) increased the average annual value of WWE’s live rights deals by 3.6x, and TV ratings have increased by 20% YoY, (which still accounts for 75% of WWE’s total viewership). Additionally, WWE strategically utilizes its enhanced access to direct fan data collected through its DTC platform to optimize adjacent revenue streams (e.g. ticket sales, consumer products), and power international expansion (5-year CAGR of 11% for international revenue).

WWE utilized the entire distribution ecosystem to earn record revenues in 2019 ($960M). While other leagues have been damaged by the emergence of alternative entertainment options, WWE has strategically embraced new platforms to reach new heights.

The lesson: follow your fans.

Next week on Thursday May 21, we’ll publish Part 3 of this 3-part series. It will outline RockWater’s “playbook” for nextgen media innovation, including execution ideation around emerging trends like gambling, augmented reality, micro-subscriptions, and more.

—

Ping us here at anytime. We love to hear from our readers.