How Elon Musk’s $8 Blue Checkmark Subscription Strategy is a $9B Opportunity for Twitter

Many from my fellow commentariat are chastising Elon’s decision to make blue checkmarks a paid feature on Twitter. Here’s why I think that’s totally wrong and why it’s actually a $9B opportunity for Twitter.

Twitter has 450M monthly active users (MAUs) that it exclusively monetizes through ad revenue (to the tune of $5B last yr). Net / net that comes out to $11 per MAU per yr…pretty bad. For reference, Facebook is ~$40 per MAU per yr. Twitter never built a sophisticated ad network (like Meta and Google), so they have always been an afterthought for marketers.

Needless to say, Twitter needs to find new ways to make money.

Offering a paid subscription to power users makes total sense. Bundle special product features behind a paywall and sell to its most hardcore fans.

Snap Inc. just launched a $4 per month paid tier in June and saw 1M signups (0.5% of MAUs) in the following 2 months. 1 Million Paid Subscribers x $4 per Month = $48 Million of Annual Recurring Revenue. Not bad.

LinkedIn has been around the block a bit longer – launching the Linkedin Premium paid tier in 2005. Linkedin Premium starts at $40 per month, but can stretch into the low hundreds depending on feature set included. As of 2021, there are an estimated 39M Linkedin Premium users (16% of MAUs). 39 Million Paid Subscribers x $40 per Month = $1.9B in Annual Recurring Revenue. Wow… way to go Linkedin, that is killer.

I find these case studies very encouraging for Twitter.

Linkedin is a particularly good benchmark as it’s a professional social network. Twitter’s power users also tend to be professionals using the platform for work purposes – journalists, politicians, VCs, etc. Professional users will have a higher propensity to spend for premium product features because there is a clear ROI.

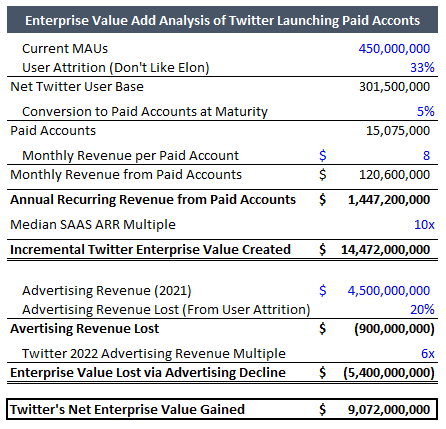

All that being said, I ran some conservative numbers on Twitter’s paid subscription offering to see what some realistic economics could look like (see detailed math in image below).

I discounted their current MAUs to account for 1/3 of users leaving the platform (doesn’t account for new users who like free speech joining) → assumed a 5% conversion to paid accounts at maturity (very reasonable based on Linkedin example) → applied $8 per month to all converted users → then applied a 10x ARR multiple (median of private market SAAS) to calculate $15B of enterprise value for the new business line.

I then subtracted $5.4B of enterprise value, due to advertising revenue lost from user attrition. (Note this also doesn’t assume that Elon improves the ad network, which could accelerate revenue substantially).

Net / net this comes out to $9B in additional enterprise value to Twitter.

Elon bought Twitter for $44B. Paid subscriptions alone would increase that by 20%.

Smart move if you ask me… I’d even raise the price back to $20, I think demand from power users is inelastic 😉

Some Additional Readership Q&A:

Q1: User Experience

CEO of Creator Economy Tech Platform: I understand why this is important from a business perspective, especially considering the debt payment Twitter has to make.

However, there is a ton of competition within social platforms, and the key just about always boils down to the user experience.

Letting anyone pay to be verified will significantly decrease the user experience on Twitter

Michael Booth: Interesting point on UX — why do you think it will get worse?

Twitter has a bot problem that this will help alleviate by amplifying verified accounts. If nothing else, it at least raises the cost of spamming bots at posts.

I could see a world in which there are a critical mass of verified accounts, such that anyone without the blue checkmark is dismissed as a spammer bot. Twitter could also add a feature so that users can only see replies, mentions, etc of verified accounts. Would drastically improve Twitter’s UX.

And while I’m not part of the ‘Cult of Elon’, I do think he has a great instinct on UX, e.g. Tesla.

Q2: Adoption Rate

Jason Zhang (Analyst @ RockWater): Excellent analysis. Only question/concern I have: twitter’s existing $5 twitter blue feature has been abysmal at conversion. Only able to generate $6.4M revenue to date since launched in Jun 2021 – so probably $5M of ARR at most currently.

Perhaps the 5% conversion rate you assumed was a bit too optimistic? Especially considering the further backlash it’s been facing.

As for using LinkedIn as a benchmark, one could argue that Elon’s plan is more of a coercive charge (having to pay to stay verified) for a rather small subset of Twitter users, while LinkedIn premium offers more utility value add (for job search / networking purposes) for a wider subset of users – therefore, this comparison might not be necessarily apples to apples.

What do you think?

Michael Booth: Short answer: Twitter Blue’s feature set is bad — principally it’s just some cosmetics and low utilization backend functionalities.

Per Fortune’s article on Musk’s proposal “Users who pay would get priority in replies, mentions, and searches—which Musk says is essential to defeating “spam/scam” accounts. Users would also be able to post longer forms of audio and video on the service and would see half as many ads.”

Priority discovery / engagement is critical for creators who rely on Twitter for 1. capturing new audience, and 2. engage their existing audience.

Charging for amplified reach is sensible.

Twitter Blue is also not advertised well (different problem).

Lastly, there are large phycological purchase drivers at play with authentication badges that will drive up conversions. Eugene Wei has a foundational thesis on “Status as a Service” with social networks that I’d suggest you check out. It’s a 20 page banger, that I can’t do justice in a comment thread 😀.

To your point on coercion see below from the same Fortune article. I think it’s fair “Musk later added that public figures who don’t pay would still get a secondary tag below their name to identify them as legitimate.”