From 9-Figure Cash Grabs to Redefining Sport: The Evolution of Creator Competitions

What’s happening?

“Creator Competitions” are emerging as a new format for culturally relevant, and highly lucrative, tentpole events.

Ever since YouTubers Logan Paul and KSI squared off in a boxing match in 2018, we’ve seen a surge in “Creator Competition” — marquee athletic events between creator personalities. These events have been used to drive subscription revenues, pay-per-view revenues, advertising dollars, and even to raise capital at premium valuations.

- Pay-Per-View Model

- June 12, 2021: YouTube vs. TikTok fight (LiveXLive)

- June 11, 2021: Lamar Odom vs. Aaron Carter (Fite TV / Triller)

- June 6, 2021: Logan Paul vs. Floyd Mayweather (Showtime)

- Generated over 1 million buys on PPV on Showtime (~$50 million in revenue)

- Apr 17, 2021: Jake Paul vs. Ben Askren (Triller)

- February 5, 2021: Jose Canseco vs. “Billy Football” (Rough n’ Rowdy / Barstool Sports)

- November 28, 2020: Jake Paul vs. Nate Robinson (Triller)

- November 9, 2019: Logan Paul vs. KSI 2 (DAZN — *subscription*)

- July 22, 2020: Verzuz rap battle between Snoop Dogg and DMX (Apple Music — *subscription*)

- 600,000+ concurrent viewers and 1.4+ million views (breaking Apple Music records)

- August 25, 2018: Logan Paul vs. KSI (YouTube)

- $11 million in revenue

- Ad-Supported

- June 18, 2021: Showdown Series Pt. 3. Dodgeball tournament featuring internet FaZe Clan, 2HYPE, RDCWorld, and AMP (House of Highlights)

- March 6, 2021: 2-on-2 basketball between 2 Chainz, Quavo, Jack Harlow, and Lil Baby (Bleacher Report)

- March 5, 2021: Showdown Series Pt 2. Knockout competition featuring eight popular YouTubers. (House of Highlights)

- 100 million views across platforms over the first two Showdown events

- October 17, 2020: Mr. Beast’s creator games breaks YouTube record with 1 million concurrent viewers

- November 23, 2018 – July 6, 2021: The Match Celebrity Pro-Am Series (Bleacher Report)

- Capital Raises / M&A / Launches

- June 14, 2021: Triller announces plan to go public at $5 billion valuation

- April 22, 2021: Overtime raises $80 million in support of launching a professional basketball league for high schoolers

- April 14, 2021: Triller acquires combat fight streaming service, Fite TV, to support its Triller Fight Club initiative

- March 9, 2021: Triller acquires Verzuz

- August 12, 2020: Barstool Sports launches the PlayBarstool app, which streams competitions between various Barstool creators and allows fans to win prizes via free-to-play betting

- November 9, 2019: Barstool Sports acquires Rough N’ Rowdy

Why is this happening?

The worlds of traditional sports and digital / social entertainment are merging. Traditional sports are using “top-funnel” storytelling to engage new audiences and drive viewership to live games. And social creators are using sporting events as “bottom-funnel” activations that monetize their social engagement.

Creator Competitions are built on convergence of some powerful trends: growing fandoms around creator personalities, the resultant emergence of the creator economy, the decline in traditional sports fandom among Gen Z, and the booming live sports market.

Traditional sports utilize “top-funnel” content to drive tune-in and fan engagement by amplifying the personalities and storylines surrounding the game.

ABC’s iconic show, Wide World of Sports, opened with the refrain “The thrill of victory, and the agony of defeat: the human drama of athletic competition”…Sports have long been the world’s greatest reality show and soap opera.

We watch the live games to witness the unfolding of this drama. And live games are thus the pillar of every leagues’ revenue strategy — live media rights comprise, on average, 43% of the overall revenues for the top three American sports leagues. But to adequately contextualize the drama unfolding on the field, thus maximizing viewership and revenue potential, it’s paramount for fans to feel invested in the core narrative and the personalities that are driving it.

The WWE has built an empire through its deliberate engineering of this crucial dynamic. For decades, it used its weekly cable broadcasts to develop characters, rivalries, and dramatic storylines, which would culminate in tentpole pay-per-view events. The league has brilliantly translated this “soap opera” model into the digital age.

The WWE has established itself as a social media powerhouse — 1 billion+ social media followers and 28b billion+ annual social video views, accounting for 20% of WWE’s total audience — and uses omnichannel storytelling to promote its athletes amplify their personalities, and empower them to engage with fans directly. By way of example, John Cena is the most followed athlete on Facebook with 54 million followers.

WWE’s supplementary content, across social media generates buzz around its central storylines and visibility of its athletes, which combine to drive viewership to the league’s biggest moneymaker: live events. The result? New linear distribution deals with Fox Sports and USA Network increased the average annual value of WWE’s live rights deals by 3.6x, and TV ratings have increased by 20% YoY. And additionally, in 2021 it sold exclusive streaming rights of its OTT platform to Peacock for over $1 billion.

Although traditional sports leagues are unscripted, they can still implement WWE’s playbook by using supplemental content to heighten the dramatic stakes of live broadcasts.

Formula 1 is the perfect example. After the 2nd season of its hit Netflix docuseries, Drive to Survive, which showcases the personalities and dramatic stakes underlying each race, Formula 1’s ratings in the US are up 36% YoY.

The strategic imperative to transform athletes into “personalities” has been heightened due to the shifting consumption preferences of Gen Z, which now accounts for 20% of the US population. As we’ve discussed in a previous Industry Report, Gen Z’s waning interest in traditional sports is a serious existential threat looming over an otherwise booming sports industry.

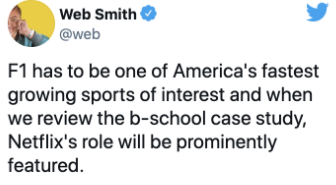

- 53% of Gen Zers identify as sports fans, compared to 63% of all adults and 69% of millennials.

- Gen Zers are half as likely as millennials to watch live sports regularly and twice as likely to never watch.

A significant driver of this decline in traditional sports viewership among Gen Z is that their fandom, and thus their screentime and engagement, is derived through their sense of connection with individual personalities, rather than a sense of traditional allegiance to teams, cities, or leagues.

Gen Z sports fans are therefore more loyal to athletes than teams, favoring athletes over teams by a margin of 2-1 compared to Baby Boomers.

The CMO of the NHL, Heidi Browning, explains:

“You see this shift in sports where kids are following athletes first, then they’re following clubs and then they’re following leagues because they want that one-to-one connection with the athletes, or athletes that they admire..[When asked why the NHL isn’t popular among Gen Z], One of the things [Gen Z fans] shared with us is that hockey athletes are so quiet off the ice…They’re amazing and the best athletes on ice, but when they’re off ice, they’re not present on social media, they’re quiet, fans don’t know much about them. There’s this desire to know everything about their lives: their wives and girlfriends, their dogs, their babies and all that kind of stuff”

This generational emphasis on athletes as creator personalities explains, in part, why eSports are more popular among Gen Z than MLB, NASCAR and the NHL, with 35% identifying as fans.

Zach Leonsis, SVP of strategic initiatives at Monumental Sports & Entertainment (owner of the Washington Wizards and Capitals), explains:

“Esports athletes are streaming for hours on end outside of their typical competition, and when they’re streaming, they’re exposing their personality, they’re interacting with their audience…That authenticity and that accessibility certainly has contributed to esports being a very popular live event category with Gen Z”

Leagues know that in order to cultivate Gen Z fandom, and thus sustain the live viewership that has driven more than 40% growth in the value of American sports media since 2010, it’s essential that they use social media to elevate their athletes into influencers. This strategic imperative explains why the PGA recently launched the “Player Impact Program”, which is a $40M pool distributed to the 10 golfers that generate the most fan and sponsor engagement. It also explains why the NFL launched a youth-oriented social brand called “The Checkdown”, which aims to “taking the helmets off the players” in order to reposition the sport for the digital-native generation.

Social Influencers are best-in-class at generating “top-funnel” fan engagement, especially among Gen Z. Adopting the format of tentpole competitive events from pro sports provides a “bottom-funnel” activation point that enables them to more fully monetize the hype and attention that they’re able to generate.

While professional sports leagues are attempting to reposition their athletes as influencers in order to generate the fan engagement necessary to drive Gen Z viewership to their tentpole broadcasts, social influencers already execute that role to perfection. Now all social influencers need is a tentpole, monetizable event to drive their fans to…

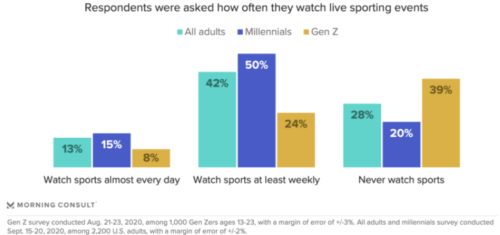

The below table says it all: the most popular social influencers are more recognizable and well-liked among Gen Z than the most popular professional athletes.

When it comes to young fans, social creators generate greater reach, engagement, trust, and loyalty than traditional athletes, teams, and leagues. Not only do 72% of Gen Z and Millennials follow a social influencer — roughly double the amount who follow a pro athlete or sports league — but these creator personalities are also more trusted than traditional athletes and celebrities. On average, 51% of Gen Z and Millennial consumers trust promotional endorsements from a social influencer, while only 41% say the same about traditional athletes and celebrities.

For this reason, the GM of House of Highlights, Doug Bernstein, sees a strong parallel between the connection that younger fans have with social creators with the connection between traditional fans and their favorite teams. He and his team at House of Highlights view this nextgen manifestation of fandom as the basis for a nextgen manifestation of sports:

“It’s not just the Yankees, Red Sox, Cowboys and Lakers anymore; these creator groups are really starting to develop a very similar fandom around them…This is an extension of Turner Sports wanting to be the home of premium live sports and conversation…. We’re taking a similar approach with these creator competitions and saying, ‘Hey, this is still premium sports. It’s just for a younger audience on a different platform’”

For reference, the participants in House of Highlights’ latest “Showdown” event had 70 million combined followers on social media — compared to the ten players in the starting lineup of this year’s NBA finals, who have a combined 38 million social followers.

But despite the fact that top creators command passionate fanbases tantamount to sports teams, they lack the monetization pathways of sports teams, leagues, and athletes. Although the emerging “creator economy” has provided these personalities with a plethora of new revenue streams to supplant their reliance on ad dollars, few (if any) are quite as lucrative as live sporting events.

As we’ve broken down in multiple reports (here, here, and here), the value of tentpole live programming is at an all-time high. It’s why the recent live rights deals for the NFL and NHL nearly doubled in value, even as TV ratings are steadily declining.

Tentpole live events are the perfect “bottom-funnel” activations to mobilize and monetize the outsized hype and fan intrigue that social creators are so adept at generating.

Clearly creators are beginning to see what a big revenue opportunity competition formats could be for them. But will these events continue to be a series of one-off cash grabs? Or will we see creator competitions mature into something greater?

How will the creator competitions business evolve?

1. Standalone companies / leagues catering to this format → Raising capital + creating enterprise value

Although Creator Competitions have cashed in on the convergence of powerful trends with some tentpole events that have generated eye-popping viewership and revenue, that’s pretty much all we’ve seen to date. With the exception of Triller’s Fight Club and Verzuz, which was acquired by Triller, so far the Creator Competition trend has been a series of well-executed cash grabs.

However, we believe that we’ll soon see the launch of companies, leagues, and platforms focused on the Creator Competition model launch, pursuing a vision of long-term enterprise value growth.

Will Warner Media spin off House of Highlight’s “Showdown” franchise into a standalone league, with tentpole events airing exclusively on HBO Max?

Or maybe, following the recent surge of private equity money into professional sports leagues, and the recent flow of venture money into upstart leagues like Overtime and the Players Lacrosse League, we’ll see a well-connected operator raise capital to launch a dedicated league.

Or perhaps a platform like TikTok or YouTube, which has homegrown talent and is already trying to grow its livestream business, will invest in a standalone league. They can use their viewership data to identify talent, use the league to build their audiences, host exclusive “top-funnel” content on their platform, sell exclusive merch, and ultimately hold the exclusive broadcast rights for the live events.

There are many different paths this model can take. But we’re confident that it won’t stay in its current stage for long. We’ll soon see real business emerge to capture this opportunity, powering all the revenue streams that accompany pro sports leagues: media rights, ticket sales, sponsorships, merchandise, and more.

2. Enhancing the competitive stakes

As leagues develop to capitalize on the Creator Competition format, one big challenge they’ll need to address in order to transform this trend into a sustainable long-term business is the lack of true competitive stakes that often dilutes the potency of these events.

As traditional sports and the creator economy merge, it will be easier for sports leagues to create top-funnel storytelling than it will be for creator competitions to replicate the entertainment value of traditional live sporting events. The dramatic stakes and engaging personalities are inherent to pro sports. Leagues just need to find the most effective formats and distribution partners to capture and share these stories with prospective fans. However, the reverse is true for social creators. They’re adept at connecting generating fan interest, however, the competitions they promote often fall flat because they lack true competitive stakes.

The recent fight between Logan Paul and Floyd Mayweather is a perfect example.

Not only was it an exhibition fight with no winner or loser, but the incentives for the participants were structured purely around their performance as promoters rather than performance as boxers. Both were given an upfront fee plus a percentage of the pay-per-view sales. So both of them had “won” before they even entered the ring. There was nothing left to compete for, which takes away from the inherent drama that makes viewers tune into live sports in the first place.

Mayweather even admitted as much after the fight, explaining:

“They say, ‘It’s not all about the money.’ Well, your kids can’t eat legacy…The patches on my trunks [earned me] $30 million alone…When it comes to legalized bank robbing, I’m the best”

We believe that events like these — cash grabs masquerading as sports — have a shelf life. In order to maintain fan trust in the long run, the drama unfolding during the competition itself needs to be as engaging and compelling as the promotional content leading up to it. This is especially true for the pay-per-view model.

As this space matures, event producers will need to innovate creative formats to ensure that the “competition” element of Creator Competitions isn’t lost. This doesn’t just need to be about a financial incentive. It can even include a bet between the participants. The important thing is for viewers to feel like they’re tuning into to an event to watch personalities that they feel invested in compete head-to-head in an event with clear stakes. It’s what drives the entertainment value of everything from movies to the NBA finals.

3. New formats and the redefinition of “sports”

If the core value prop of Creator Competitions is about “leaning in” to watch personalities that have a deep relationship compete in high-stakes events, perhaps we’ll see the very definition of “sports” expand?

Only 25% of Gen Z watch live sports at least once per week, compared to 50% of all millennials. This isn’t just due to their affinity for social creators over traditional athletes, but also due to other consumption habits, such as a preference for dense, short-form content on mobile and interactive social platforms. Creator Competitions can repackage the live sports experience for this generation. Providing them with the personalities they relate to, on the platforms they use, in formats they want to engage with.

House of Highlights’ Doug Bernstein explains:

“If you were to throw out everything you know about creating a sports event, and rethink it from the eye of a 24-year-old, what would it look like? We really wanted something that was relatable, faster-paced, and a shorter window of time…That’s a struggle traditional sports are having, with very long broadcasts and not as much action throughout the whole thing…Creator competition is a new category unto itself, almost akin to eSports”

This means Creator Competitions don’t just have to be regular sports but with influencers instead of athletes. In fact, it might be a more compelling product if it isn’t. Barstool Sports is already streaming cornhole competitions between its personalities on the PlayBarstool app. Mr. Beast broke YouTube’s record for concurrent live viewership with his “Creator Games” event, which featured events like rock-paper-scissors. The Verzuz rap battle format, which became a viral phenomenon before forming a distribution deal with Apple Music and selling Triller, is another prime example.

What’s next?

Maybe a cooking competition between the personalities from Bon Appetit vs. the ones from First We Feast by Complex Networks? Or maybe it’s a fun reinvention of Pro-Am competitions, like the upcoming golf match between Barstool’s Dave Portnoy and PGA star Brooks Koepka, where Koepka will be playing lefty (he’s a righty). Maybe next we’ll see creators playing pro golfers in mini-golf, or MLB players in wiffle ball.

4. Gamification and the integration of gambling

If maintaining stakes is the key to driving live engagement and dramatic tension, then there’s no better way to do that than gambling. As sports betting legalization expands, live-betting functionality is integrated into more platforms, and Gen Z ages into legal gambling status, we expect to see betting infiltrate Creator Competitions just as it’s done with professional sports.

Until then, we expect to see free-to-play gamification integrated into Creator Competitions, allowing viewers to make picks and predictions to win prizes, thus enhancing the “lean-in” nature of the live viewership experience.

—

Ping us here at anytime. We love to hear from our readers.